Texas exports reach new record despite strong dollar

Texas remains the nation’s top exporter, setting records each month despite the recent appreciation of the dollar. A strong dollar can be bad for business because it makes U.S. goods more expensive overseas.

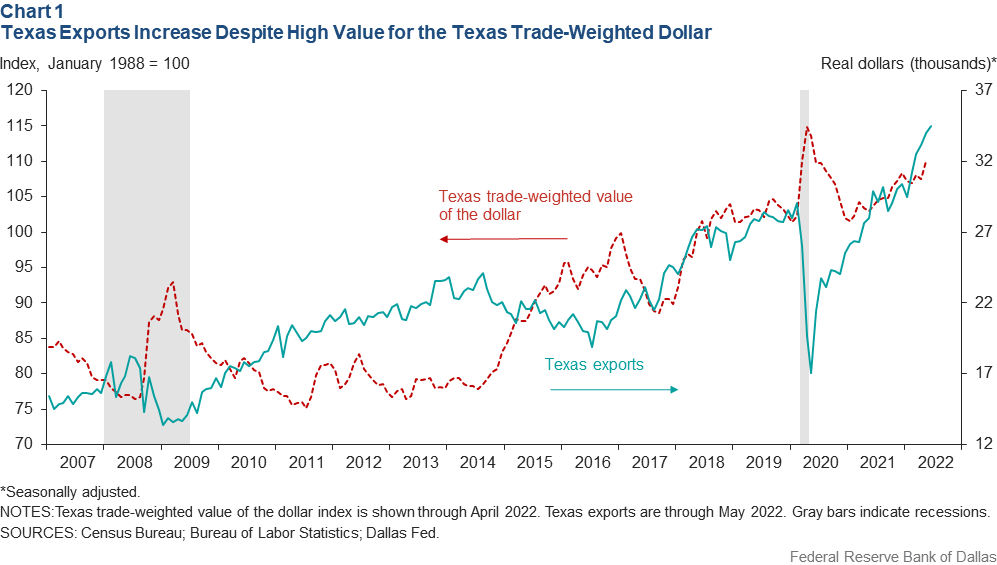

The Texas trade-weighted value of the dollar provides a measure of the exchange rate helpful to understanding the state’s trade activity. The index captures changes in the exchange rates that most affect Texas’ exports. It weights the U.S. dollar exchange rate with various countries based on Texas’ share of exports to them. It is a “real” measure because it also adjusts the exchange rate for different rates of inflation among Texas’ trading partners.

Strong Dollar Impact

An increase in the index represents an appreciation of the currency, causing Texas exports to be costlier relative to its major trade partners. An index decrease reflects a depreciation of the currency and causes Texas exports to be less expensive and, holding other things constant, increases the demand for Texas exports (Chart 1).

Exchange rates are affected by interest rate differentials between locations, in this case, Texas and the countries where it exports; current economic conditions; growth prospects and inflation. These factors impact the flow of capital between countries and the demand and supply of domestic currency relative to foreign currency.

The dollar’s current strength and that of the Texas trade-weighted value of the dollar is likely a function of rising interest rates to fight inflation; global investors moving assets to the perceived safety of the U.S. in the face of uncertainty created by the Ukraine–Russia conflict; and strong global demand for oil and gas.

Texas Trade Grows

The Texas trade-weighted value of the dollar has risen 1.6 percent this year after gaining 6.3 percent in 2021. By comparison, a similarly weighted index of the U.S. dollar has climbed 7.3 percent in 2022.

Texas has been the top exporter among U.S. states since 2002, with exports rising 9.3 percent per year in real (inflation-adjusted) terms to $342 billion in 2021. During the first half of 2022, Texas exported $195 billion in goods, close to three times as much as California, the second-highest exporting state.

In 2021, the top five Texas exports were oil and gas (28.6 percent); petroleum products (14.7 percent); chemicals (13.7 percent); computer and electronics products (13.4 percent); and transportation equipment (6.2 percent).

Texas exports 55 percent of its goods to its top five trading partners: Mexico (32.7 percent), Canada (7.7 percent), China (5.7 percent), South Korea (5 percent) and Brazil (3.8 percent).

The Dallas Fed produces a trade-weighted value of the dollar for every state.[1] The index is adjusted for each country’s inflation rate to best represent the purchasing power of the dollar relative to the foreign country.

Note

- Real Trade-Weighted Value of the Dollar by U.S. State, Federal Reserve Bank of Dallas.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.