Mexico’s economy shows early signs of slowing

| February 2024 economic report | |||

| GDP, real Q4 '23 |

Employment, formal February '24 |

CPI February '24 |

Peso/dollar March '24 |

| 0.3% q/q | 56,078 jobs m/m | 4.4% y/y | 16.8 |

Mexico’s economy grew an annualized 0.3 percent in fourth quarter 2023 following a 4.3 percent increase in the third quarter. Mexico’s GDP rose 2.5 percent in 2023 (fourth quarter, year over year), below the 3.0 percent median forecast. The Mexican economy is expected to moderate in 2024, following the trend of the U.S. economy. As job growth slows and unemployment ticks up in the U.S., this could affect the flow of remittances, curtailing consumption growth in Mexico. In addition, trade flows between U.S. and Mexico could be impacted, as demand for intermediate goods declines, causing manufacturing production and exports to decelerate. Nevertheless, the consensus forecast for 2024 GDP growth (fourth quarter, year over year) compiled by Banco de México was up slightly to 2.1 percent in March (Table 1).

| Table 1 Consensus forecasts for 2024 Mexico growth, inflation and exchange rate |

|||

| February | March | ||

| Real GDP growth in Q4, year over year | 2.0 | 2.1 | |

| Real GDP growth in 2024 | 2.4 | 2.4 | |

| CPI December 2024, year over year | 4.1 | 4.1 | |

| Peso/dollar exchange rate at end of year | 18.31 | 18.10 | |

| NOTE: CPI refers to the consumer price index. The survey period was March 15–27.

SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Marzo de 2024 (communiqué on economic expectations, Banco de México, March 2024). |

|||

The latest data available show industrial production fell while employment and exports rose in February; retail sales declined in January. Inflation fell, and the peso gained ground against the dollar in March.

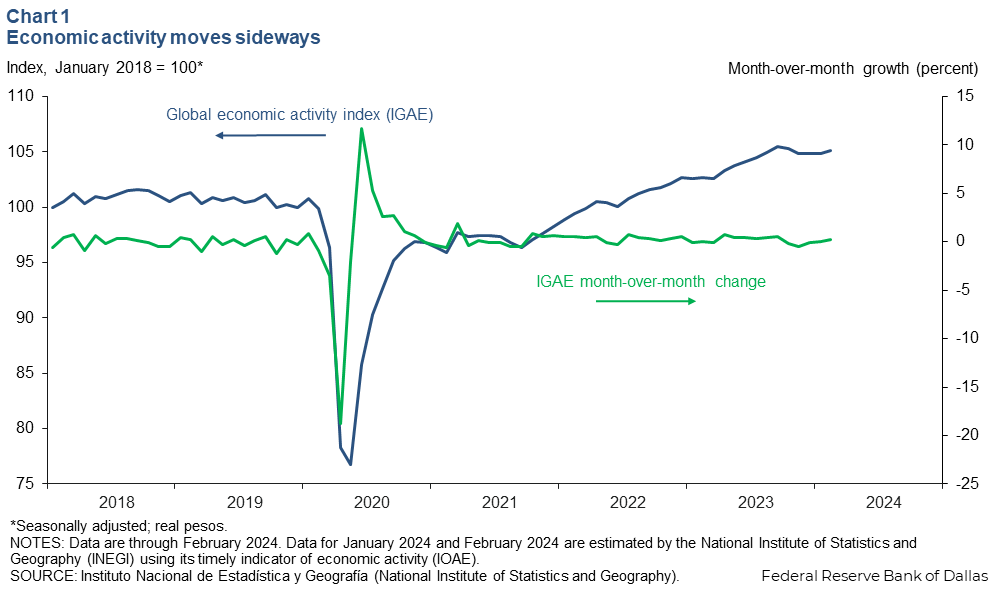

Economic activity flat

The global economic activity index (IGAE)—the monthly proxy for GDP growth—grew a mere 0.3 percent month over month in February after flattening in January (Chart 1). Both the goods-producing sector (including manufacturing, construction and utilities) and the service-related activities (including trade and transportation) increased 0.3 percent in February. The IGAE rose 2.4 percent year over year.

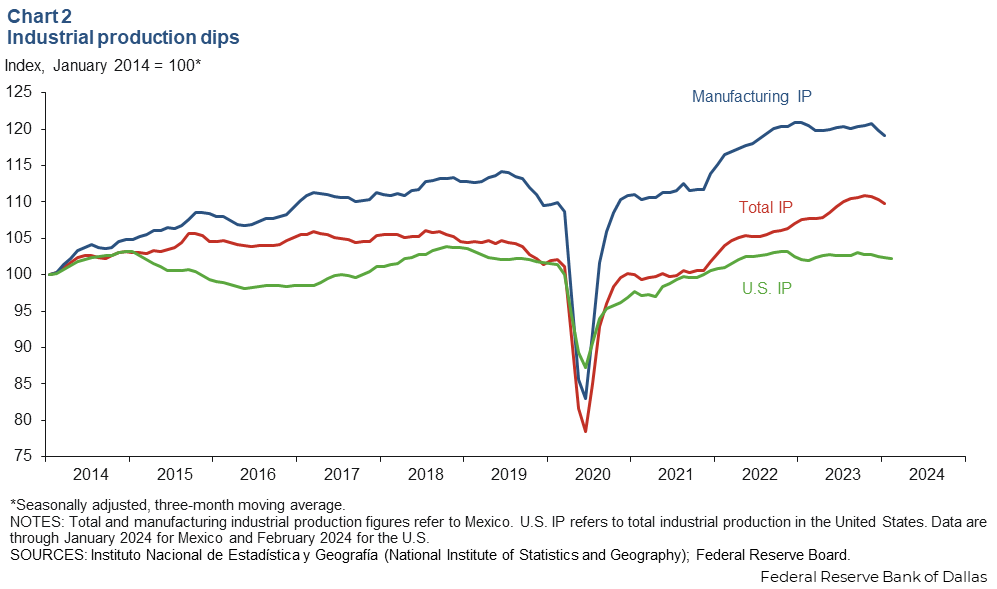

Industrial production declines

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—fell 0.5 percent in January from December—its third consecutive decline (Chart 2). Manufacturing IP also edged down 0.5 percent. North of the border, the three-month moving average of U.S. IP dipped 0.2 percent in February. With the rise of intra-industry trade between the U.S. and Mexico since the early 1990s, the correlation between Mexican and U.S. IP has increased considerably. Slowing U.S. manufacturing activity appears to be impacting Mexico’s manufacturing sector.

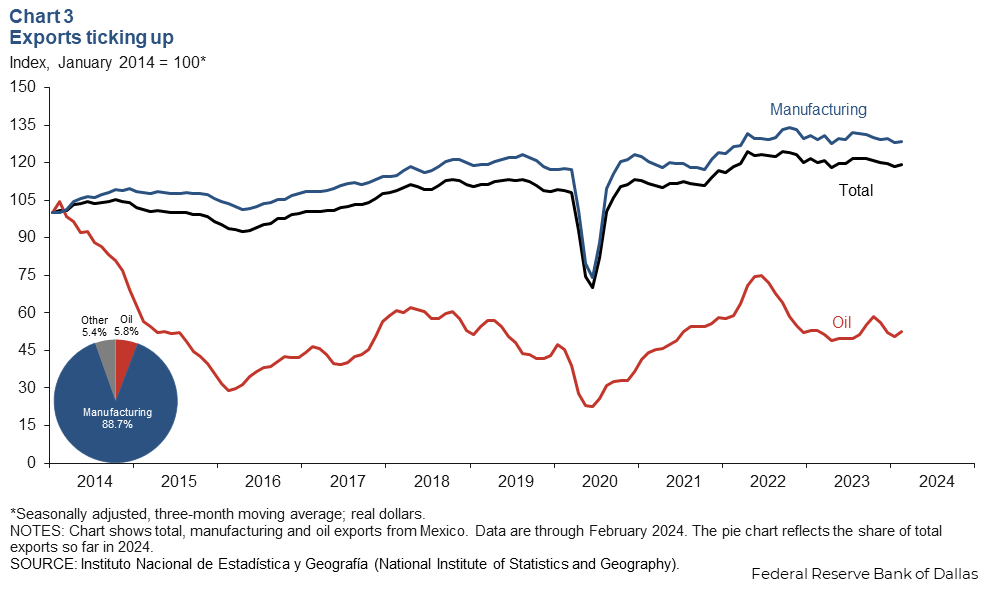

Exports slightly up in February

The three-month moving average of total Mexico exports ticked up 0.7 percent in February while oil exports grew 4.1 percent, and the much-larger manufacturing sector edged up 0.3 percent (Chart 3). Year over year, total exports fell 0.8 percent, with oil exports down 0.6 percent and manufacturing down 0.7 percent.

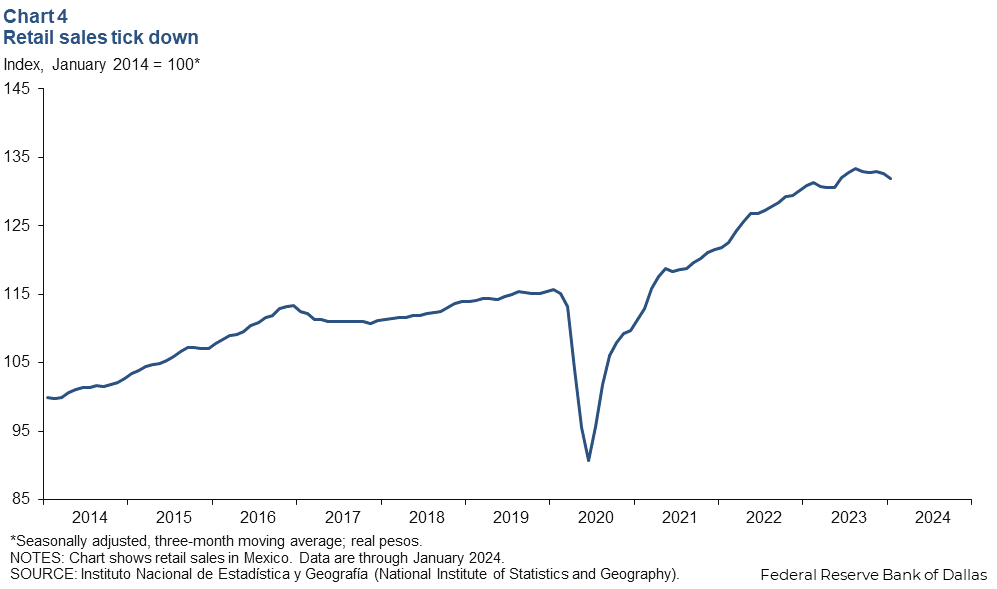

Retail sales fall slightly

The latest data available for real retail sales indicate a downward trend for four of the past five months—declining 0.5 percent in January (Chart 4). Year over year, however, the smoothed retail sales index was up 0.8 percent. Consumption was one of the key engines of economic growth in Mexico last year.

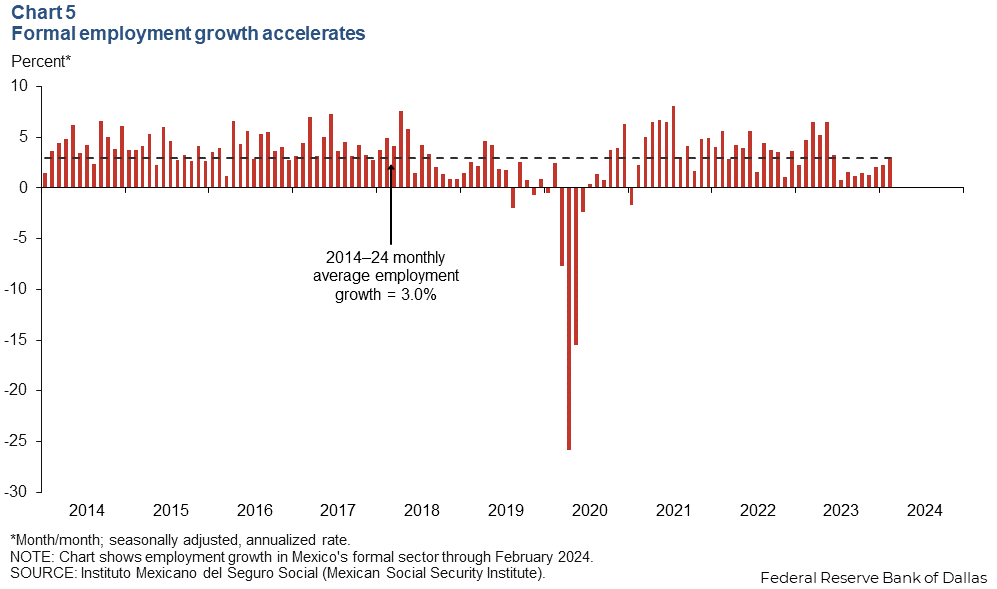

Job gains solid

Formal sector employment—jobs with government benefits and pensions—grew an annualized 3.1 percent (56,000 jobs) in February (Chart 5). Total employment, representing 59.4 million workers and including informal sector jobs, was up 1.8 percent year over year, and total formal employment was up 2.9 percent. The unemployment rate held steady at 2.8 percent in January.

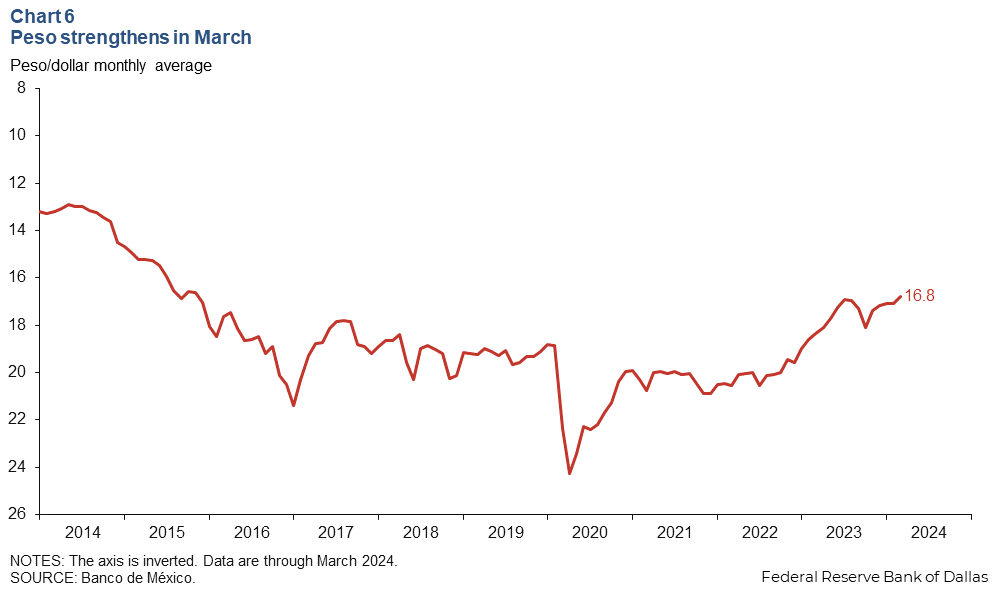

Peso opens the year strong

The Mexican currency averaged 16.8 pesos per dollar in March, stronger than the previous two months’ average of 17.1 pesos per dollar (Chart 6). Mexico’s solid macroeconomic framework, fiscal discipline and prospects for nearshoring investment likely have contributed to peso appreciation and stability.

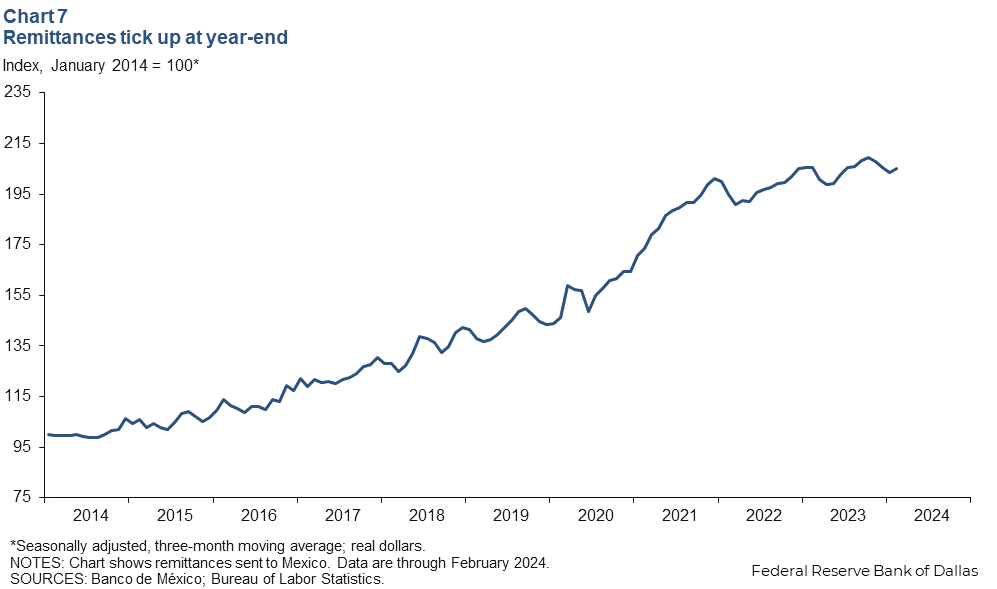

Remittances edge up

The three-month moving average of real remittances to Mexico edged up 0.8 percent in February after a 1.0 percent decrease in January (Chart 7). Remittances are near record highs. The U.S. economy is expected to experience weaker employment growth this year, which may further impact the capacity of Mexicans working abroad to send money back home.

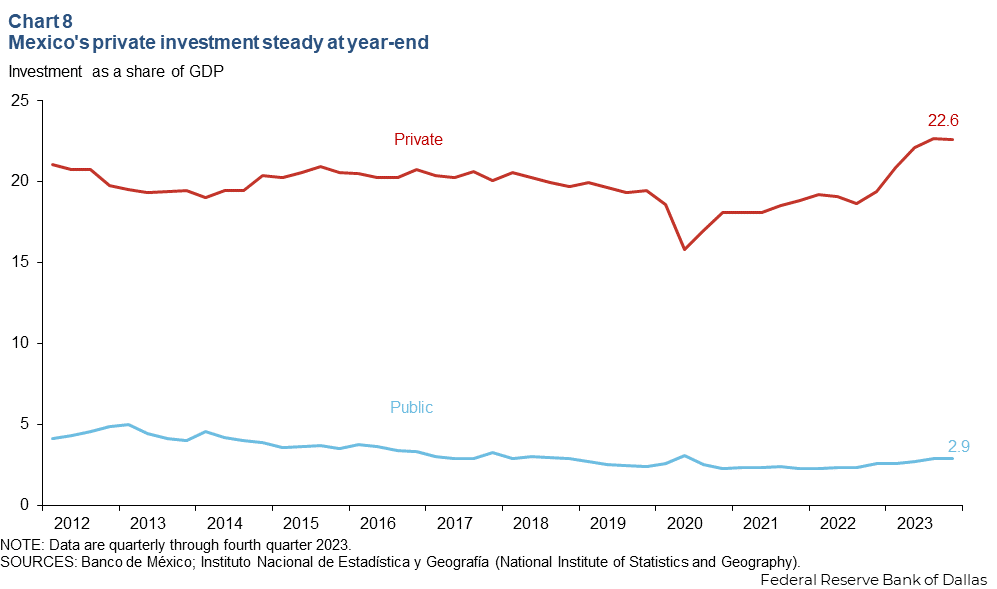

Domestic investment stable at year-end

Private investment has been on an upward trend since the end of the pandemic, reaching prepandemic levels in third quarter 2021. Private investment held steady in fourth quarter 2023 at 22.6 percent of GDP, above the 18.6 percent figure in first quarter 2020 (Chart 8). The elevated level of private investment is due to investment catching up after many projects were suspended during the pandemic and in preparation for nearshoring projects, according to multiple sources. A strong peso also makes imports of machinery and equipment less expensive, and companies are taking this opportunity to replace dated equipment. Meanwhile, public investment rose to 2.9 percent of GDP in the fourth quarter, buoyed by major public projects underway like the Maya train and the Dos Bocas refinery.

Inflation slows in February

Mexico’s consumer price index (CPI) decreased to 4.4 percent in February—turning down after three consecutive months of increases (Chart 9). Moreover, CPI core inflation, which excludes food and energy, continued slowing but grew 4.6 percent. In March, Mexico’s central bank lowered its benchmark interest rate by 25 basis points to 11.0 percent. This marks the start of an easing cycle after the bank kept its policy rate unchanged for seven consecutive meetings. Nevertheless, the central bank still believes inflation will converge to its long-term target of 3.0 percent by second quarter 2025.

About the authors