What’s up (or not up) with wages?

Recent commentary has suggested that slack may remain in the labor market because of restrained wage growth. Our analysis suggests that recent wage gains are, instead, consistent with what we view as a tight labor market.

We estimate a wage-inflation Phillips curve model—this Phillips curve depicts the inverse relationship between unemployment and wage growth rates—to understand wage growth over the business cycle. In particular, this model relates nominal wage growth to long-term inflation expectations and the “unemployment gap.”

The unemployment gap is the difference between the actual unemployment rate and the natural rate of unemployment and is used to capture cyclical factors affecting wage growth. The natural rate is the unemployment rate that would prevail in a “neutral” labor market, one without the highs and lows of the business cycle.

A negative unemployment gap (when the unemployment rate is below the natural rate) is expected to exert upward pressure on wage growth and vice-versa. We convert nominal wage growth into real (inflation-adjusted) wage growth by subtracting a measure of long-run inflation expectations—10-year personal consumption expenditures (PCE) inflation expectations.

Measuring real wage growth

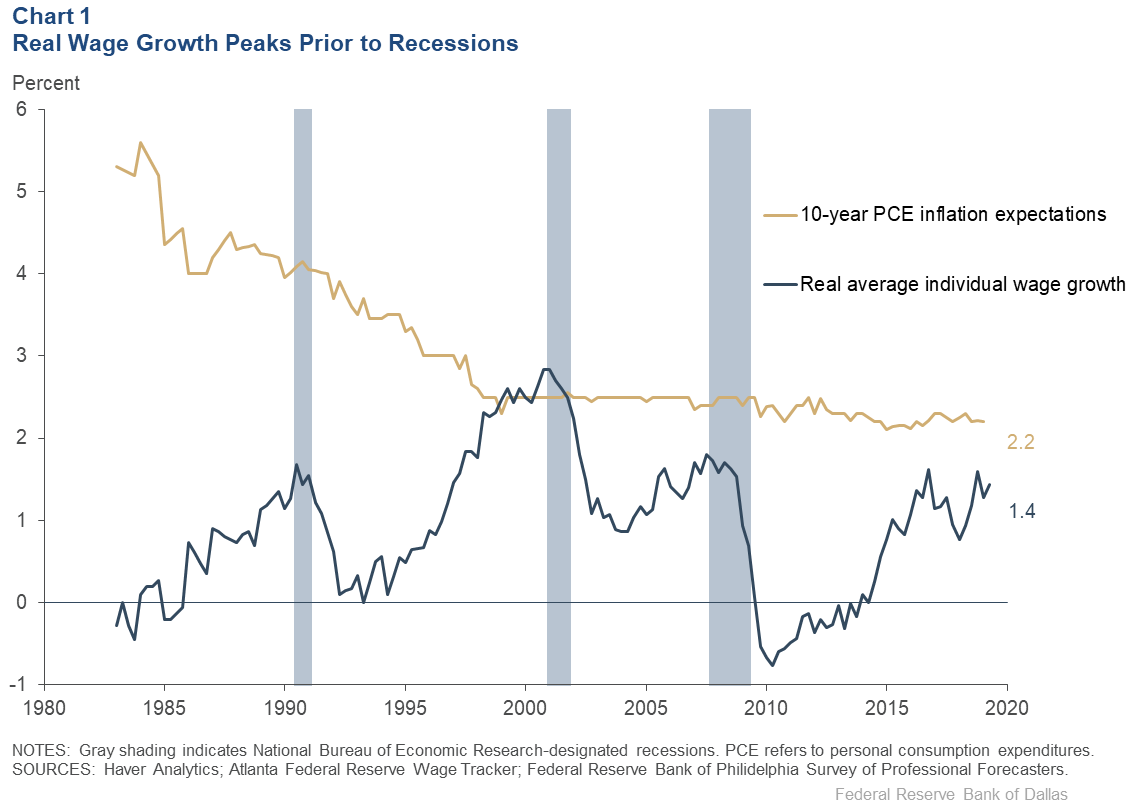

We use the average individual wage growth taken from the monthly Current Population Survey to gauge the wage growth experienced by workers. Chart 1 shows real wage growth and inflation expectations from the 1980s to present.

Inflation expectations eventually declined over the 1980s, resulting from Federal Reserve efforts to reduce inflation from its high level during the 1970s. Since the late 1990s, inflation expectations have varied only slightly. Real wage growth increases over an economic expansion, peaks just before a recession and then declines over the recession and early in an economic recovery.

Unemployment gap effects on wages

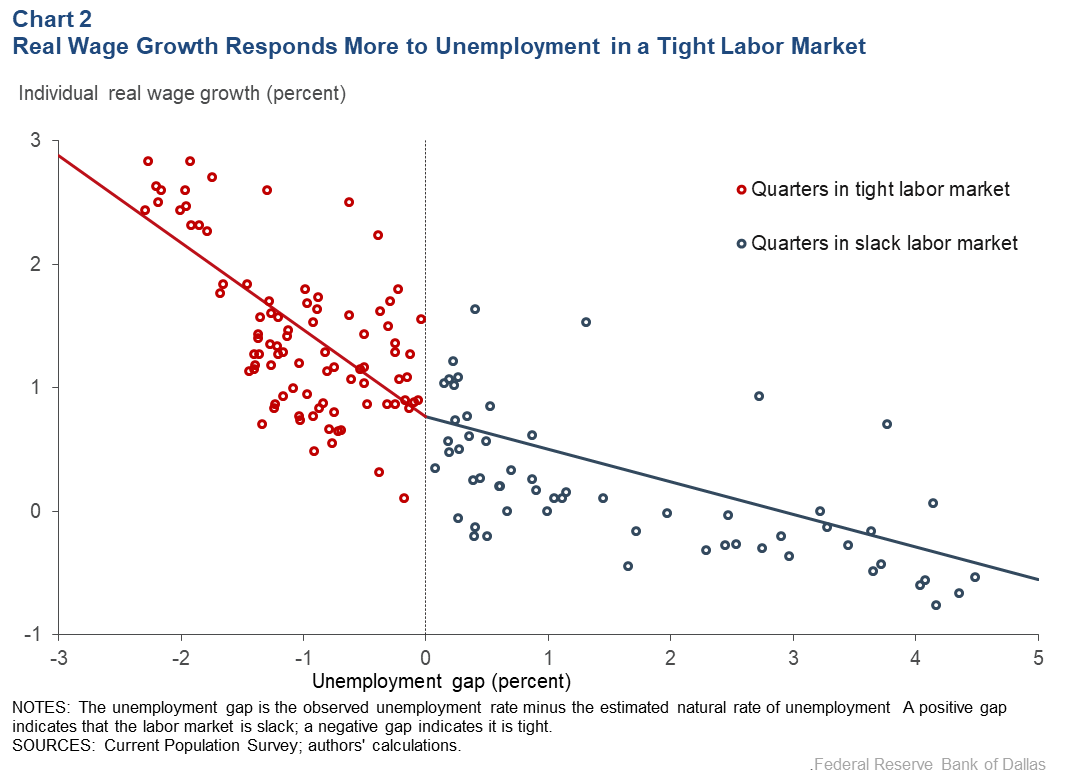

Chart 2 shows the relationship between the unemployment gap and real wage growth. Previously, we showed how a cohort analysis drawn from the Current Population Survey, covering 35 million individuals age 16 and older from 1976 to 2018, can be used to develop a measure of the natural rate of unemployment.

When the actual unemployment rate exceeds the natural unemployment rate, there is “slack” in the labor market (shown in blue). In contrast, when the actual unemployment rate is below the natural rate of unemployment, conditions in the labor market are “tight” (shown in red). The difference, positive or negative, is the unemployment gap.

Declining (rising) unemployment generates upward (downward) pressure on real wage growth. However, the extent depends on labor market conditions and may not be the same when labor markets reflect tight versus slack conditions.

Regression analysis indicates that a percentage-point decline in the unemployment gap in a slack labor market is associated with a rise in real wage growth of 0.29 percent points. Conversely, a percentage-point decline in the unemployment gap in a tight labor market is associated with a much larger rise in real wage growth of 0.89 percentage points. That is, upward pressure on real wage growth from a declining unemployment rate is much stronger in a tight labor market.

Applying our wage-inflation Phillips curve model

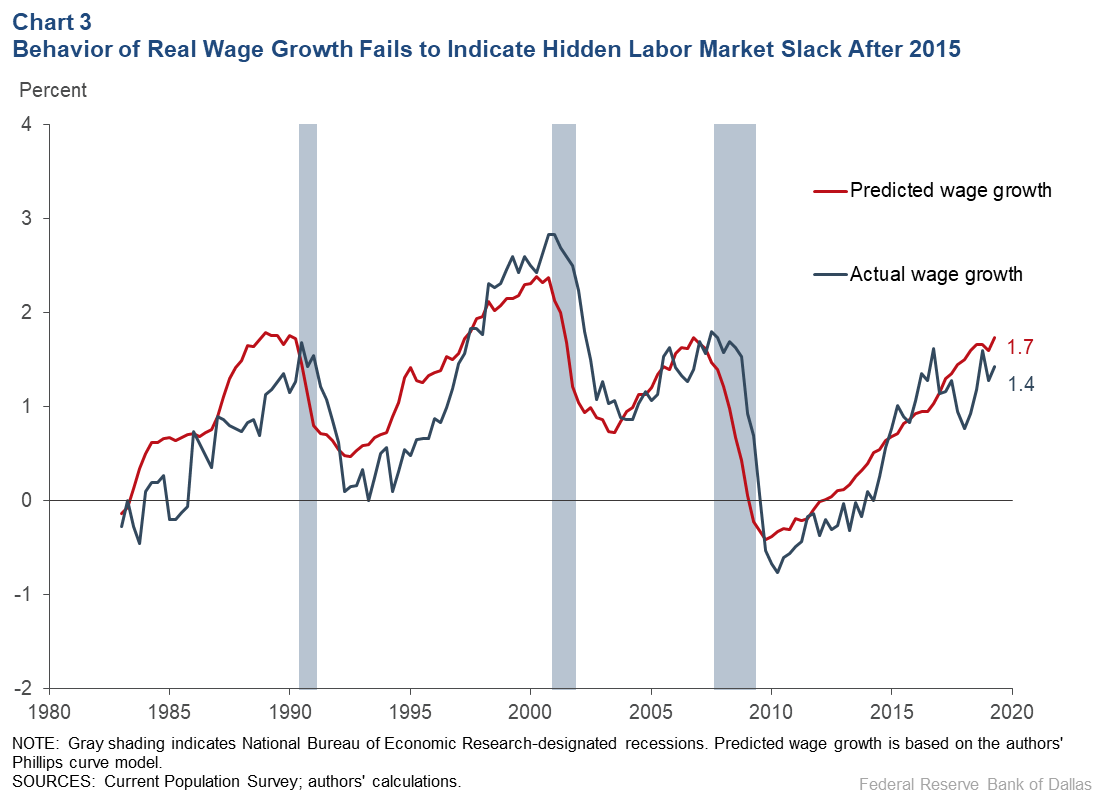

What does our estimated wage-inflation Phillips curve model indicate for recent wage behavior? Chart 3 shows actual real wage growth and the predicted real wage growth based on our estimated wage-inflation Phillips curve model. The model does a good job of fitting the movement of real wage growth across economic expansions and recessions.

Importantly, over the post-2015 period when actual unemployment fell below what we previously estimated as the natural rate of unemployment, actual real wage growth has roughly equaled predicted real wage growth. If “hidden slack” existed in the labor market, as some commentators have argued, we would expect to see actual real wage growth consistently below predicted real wage growth.

Our cohort-based natural rate of unemployment indicates that the slack in the labor market created from the Great Recession was eliminated by mid-2015. The unemployment gap is also an important determinant of average individual wage growth, exerting stronger upward pressure in tight labor markets than downward pressure in slack labor markets. Recent real wage growth does not indicate that hidden slack remains in the U.S. labor market.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.