Texas Jobs decline at historic pace from impact of COVID-19

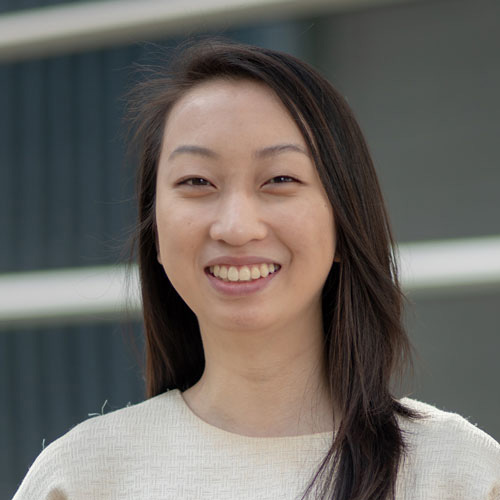

Payroll employment in Texas contracted at a historic nonannualized rate of 9.6 percent, or 1.25 million jobs, in the two months ended in April. The sharp contraction from employment levels in February, prior to the impact of the COVID-19 pandemic, was widespread across all industries. However, job losses in Texas were less severe than in the nation (Chart 1).

The leisure and hospitality sector posted the largest decline in the state over the two-month period at 37.2 percent, or 530,000 jobs, while financial activities was least affected but still down 1.4 percent, or 11,200 jobs.

The decrease affected all major metro areas, with the steepest drops coming in El Paso, Fort Worth and Austin, followed closely by Houston, San Antonio and Dallas.

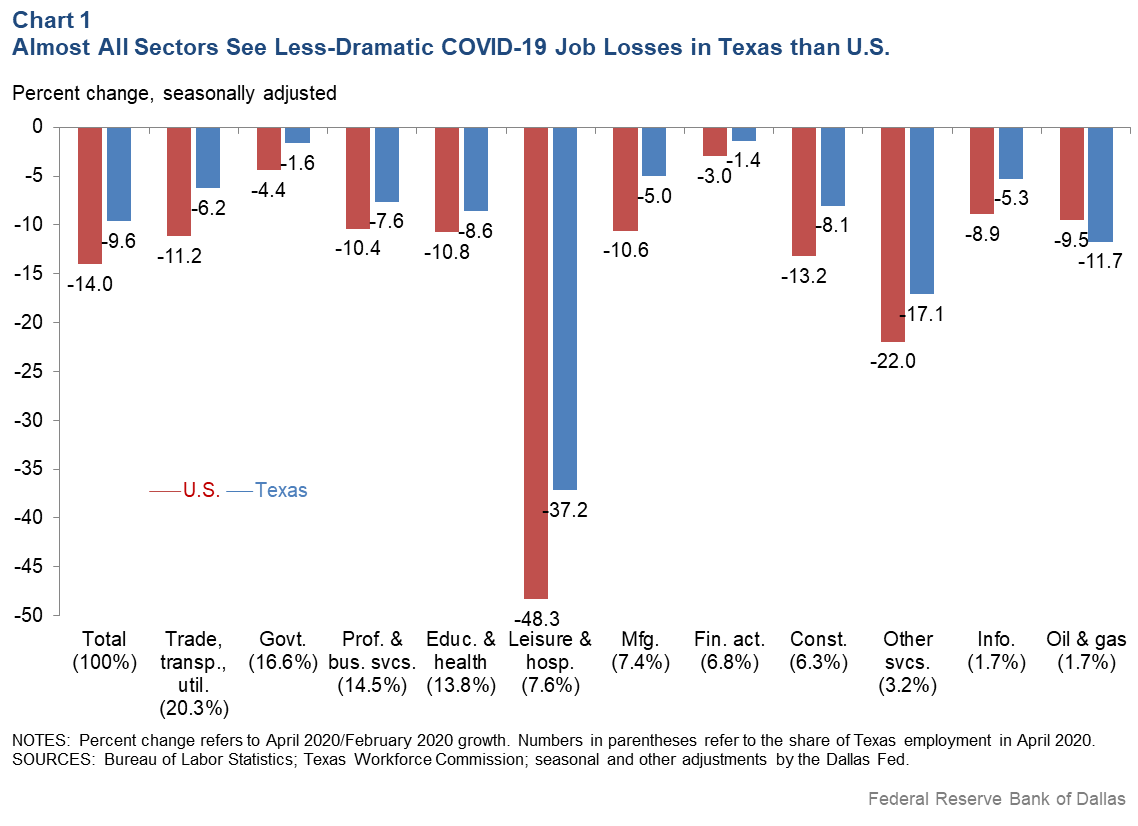

Although the Texas unemployment rate rose to 12.8 percent in April from 3.5 percent in February, it was lower than the U.S. jobless rate of 14.7 percent.

More recent unemployment insurance claims data for the week ended June 6 show that the number of initial claims filed under regular state unemployment insurance programs fell to nearly 81,000—30 percent lower than in the prior week.

Despite recent declines in weekly initial claims, 1.25 million Texans received regular state jobless benefits at the end of May, suggesting that the unemployment rate will remain elevated.

Factoring in the latest employment numbers and other recent data, the Federal Reserve Bank of Dallas estimates that the unemployment rate will finish the year at 8.9 percent and that overall employment will be down 3.8 percent in December 2020 relative to December 2019.

Unemployment Rise Varies Widely Across U.S.

Texas saw a relatively smaller spike in the unemployment rate than the U.S. because the labor force participation rate fell 4.8 percentage points in April to 58.3 percent, compared with a 2.5 percentage-point drop to 60.2 percent nationally.

The jobless rate in April varied widely across states (Chart 2). The change in the jobless rate from pre-COVID-19 levels in February varied widely as well. Texas’ 9.3 percentage-point unemployment rate increase over the two-month period ranked in the bottom half of states.

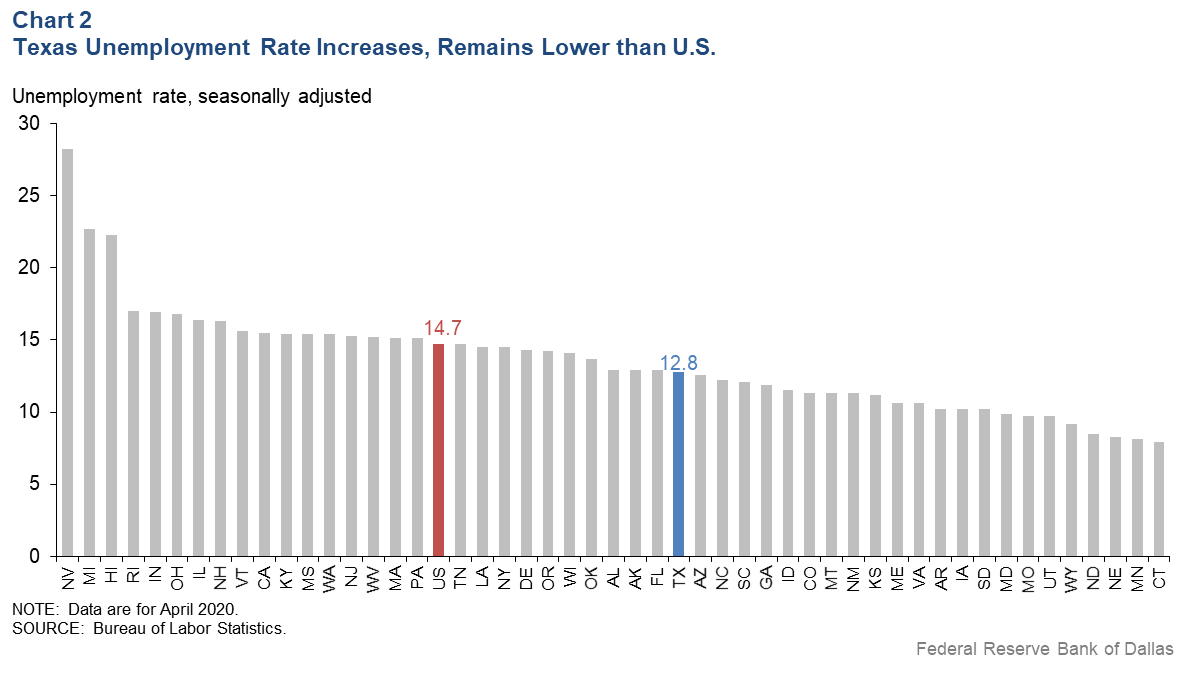

Not surprisingly, the unemployment rate in April increased less in states with relatively larger shares of jobs that could be done remotely.

Another important explanation for the wide variation in the unemployment rate increase across states was the remarkable decline in mobility and engagement attributable to measures taken to slow the spread of COVID-19. States experiencing greater declines in mobility also experienced larger spikes in the unemployment rate (Chart 3). Moreover, decreases in mobility and engagement and employment share in the most at-risk industries—such as leisure and hospitality—were the key drivers of comparative state unemployment.

Manufacturing, Service and Retail Declines Slow

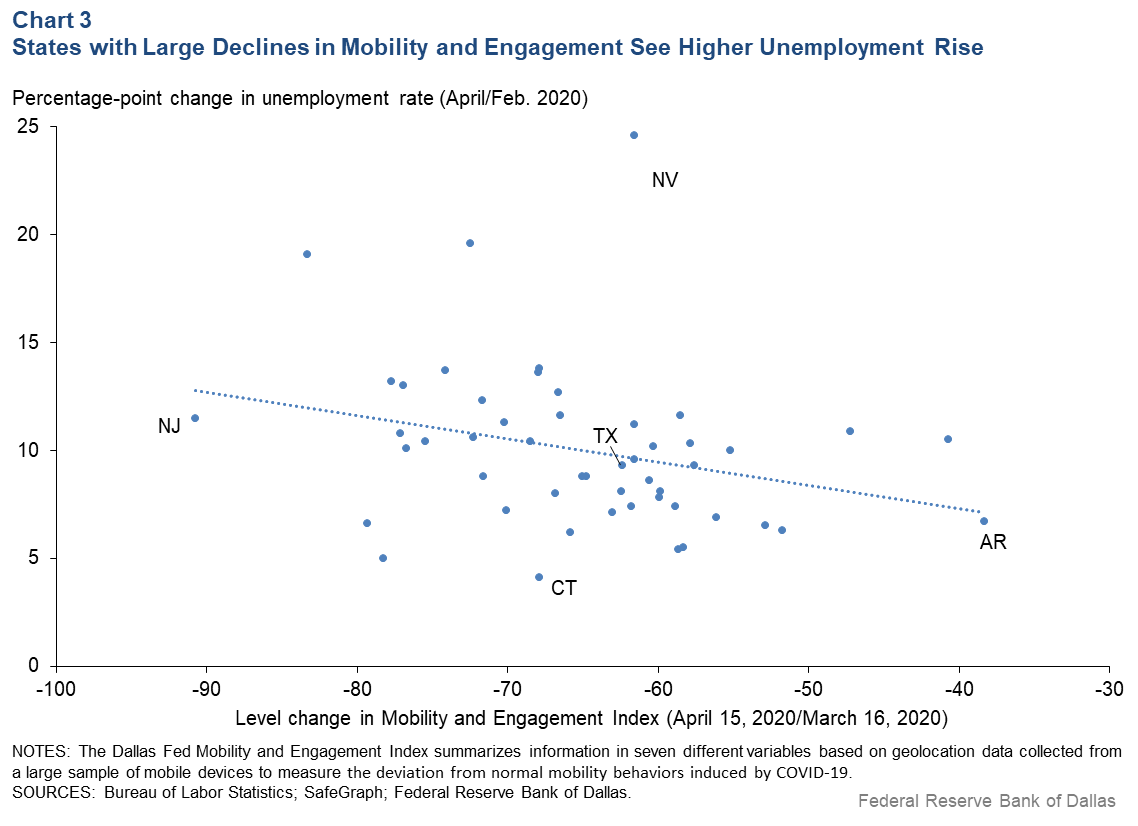

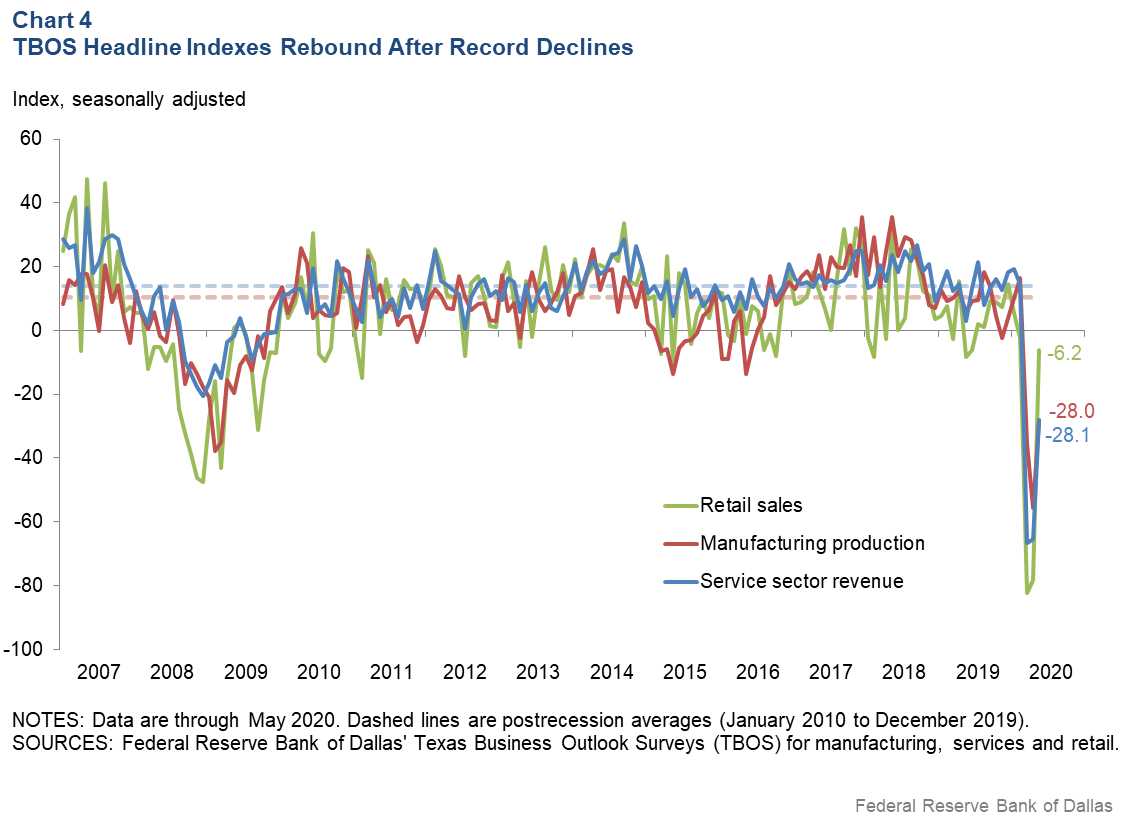

Overall business activity in Texas declined further in May, though at a significantly slower pace relative to a record drop in April, according to the Texas Business Outlook Surveys (TBOS) (Chart 4). The production index, the headline indicator for manufacturing activity in Texas, remained negative but the contraction slowed from -55.6 to -28.0, a sign that the decline in output had eased since April. A reading below zero indicates ongoing contraction; a reading greater than zero indicates expansion.

Indexes of new orders and growth rates of orders remained negative but improved markedly in May. Other indicators of manufacturing activity also suggest a less-severe contraction in May, and perceptions of overall business conditions turned notably less pessimistic.

The service sector index similarly turned up. The drastic decline in activity in March and April began to abate as the revenue index, the headline index for service sector conditions, retreated from -65.3 to -28.1 in May. Other indicators of broader business conditions remained pessimistic, but the degree of perceived weakness subsided.

Signs of an emerging recovery appeared in the state’s retail environment, according to the headline sales index and other broader indicators for retail sales. Indexes of future activity rebounded into positive territory across all three surveys.

COVID-19 Affects Business Revenue, Employment

TBOS participants were asked a set of special questions about the impact of COVID-19. A large proportion of respondents indicated COVID-19’s impact on business revenue and labor was prominent in May.

Concerning changes in revenue, 81 percent of TBOS respondents said they were negatively affected by COVID-19, and the average drop within that group was 40 percent relative to a typical May. About 10 percent of respondents said they experienced higher revenues relative to a typical May.

Responding to the question, “If current revenue levels were to continue, how long could your firm survive?” 59.2 percent of 387 executives said their businesses could last more than a year, while nearly a quarter indicated they could continue for no more than six months.

Responses to survey questions also indicated important changes in work arrangements. Among 389 respondents, nearly 69 percent reported that more employees were working from home in response to COVID-19, while 43.2 percent cited reduced work hours and 38.3 percent said they had resorted to furloughs and/or layoffs. Nearly one-third of respondents said they had reduced or suspended bonuses, and 16.7 percent reduced wages.

Among firms that furloughed, laid off or reduced work hours, about one-third had attempted to recall workers or increase their hours, though the companies said they faced challenges. Sixty percent cited workers’ fear of infection, while 46.7 percent noted child care concerns and 43.4 percent reported worker reluctance to return to work because of generous unemployment benefits.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.