A new view of the relationship between oil prices, gasoline prices and inflation expectations

It has been considered self-evident until recently that oil prices drive inflation expectations, but new evidence calls into question this conclusion.

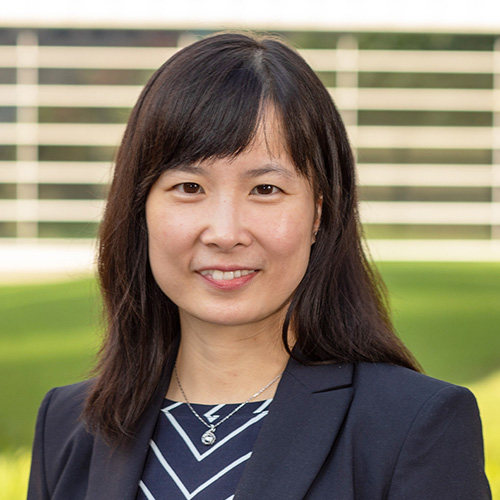

Conventional wisdom within macroeconomics is that U.S. inflation expectations respond to the level of the price of oil (or the price of gasoline). This view is based on coefficients of regressions of inflation expectations on the price of oil. Researchers such as Olivier Coibion and Yuriy Gorodnichenko have argued that the correlation between these variables reached 74 percent during first quarter 2000 to first quarter 2013. But, when taking a longer perspective, the existence of such a relationship is less than obvious (Chart 1).

Conventional wisdom called into question

Our recent Dallas Fed working paper questions the conventional view. It highlights a number of concerns about the specification of the regressions reported in the literature that each reduces the strength of this relationship in the data. These concerns include the fact that standard statistical tests of this relationship are spurious.

When these problems are collectively addressed, the regression evidence does not support the conventional wisdom that inflation expectations rise with the price of oil (or gasoline). Similarly, it can be shown that estimates of the correlation between inflation expectations and the price of oil (or gasoline) tend to be erratic in small samples and unstable over time, given that these prices are not mean reverting. In short, these statistics provide no empirical support for the conventional wisdom. This does not necessarily mean that the conventional wisdom is wrong, but rather that its empirical foundations must be established by other means.

New evidence provided by structural models

We make the case that a dynamic structural model with multiple shocks is a more promising approach to analyzing this question. Our study uses monthly data beginning in July 1981 to model jointly the inflation-adjusted price of gasoline, headline inflation in the Consumer Price Index (CPI), and one-year-ahead inflation expectations in the University of Michigan Surveys of Consumers.

The model allows for three types of economic shocks: a shock to the nominal price of gasoline, a shock to the core CPI (defined as consumer prices excluding the gasoline price) and an idiosyncratic shock to household inflation expectations unrelated to changes in actual consumer prices.

In the model, a positive shock to nominal gasoline prices raises the inflation-adjusted price of gasoline on impact because the nominal price of gasoline responds more quickly than the CPI. It also raises household inflation expectations, consistent with evidence from household surveys.

A positive shock to the core CPI raises headline inflation and inflation expectations on impact. It also lowers the inflation-adjusted price of gasoline. This assumption follows from evidence that the nominal gasoline price does not respond within the month to inflation shocks.

Finally, a positive idiosyncratic shock to household inflation expectations leaves the inflation-adjusted price of gasoline and headline inflation unaffected on impact. This assumption follows from the fact that expectations shocks that move actual consumer prices are already captured by the other two shocks in the model.

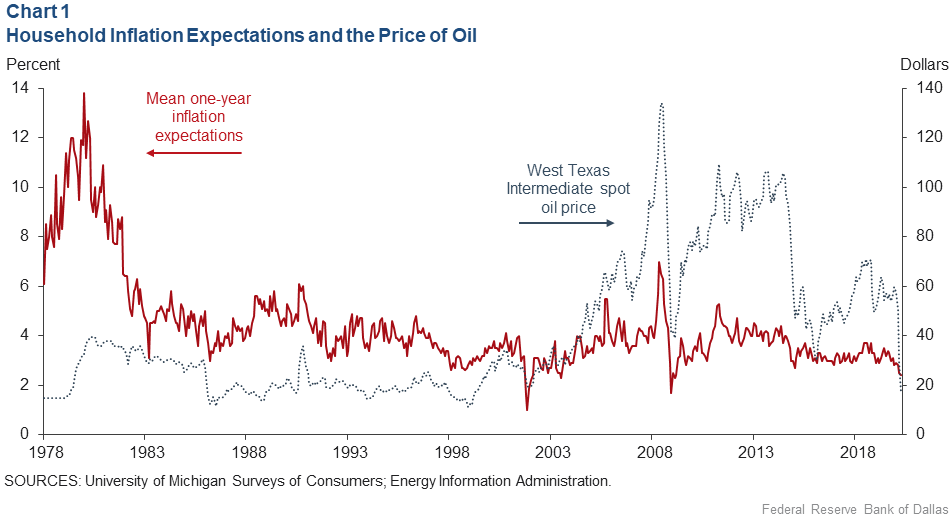

These assumptions allow us to quantify the response of the three model variables to a surprise increase in the price of gasoline at the pump. Chart 2 implies that an unexpected increase in the retail price of gasoline by 1 percent boosts inflation expectations by 0.05 percentage points in the same month. After accounting for estimation uncertainty, this estimate may be as low as 0.04 and as high as 0.08 percentage points, greater than would be expected based on consumers’ average expenditure share for gasoline of 3 percent.

Are gasoline price shocks an important determinant of inflation expectations?

The evidence in Chart 2 speaks directly to the response of inflation expectations to a one-time nominal gasoline price shock but does not tell us how much of the historical evolution of inflation expectations must be attributed to nominal gasoline price shocks.

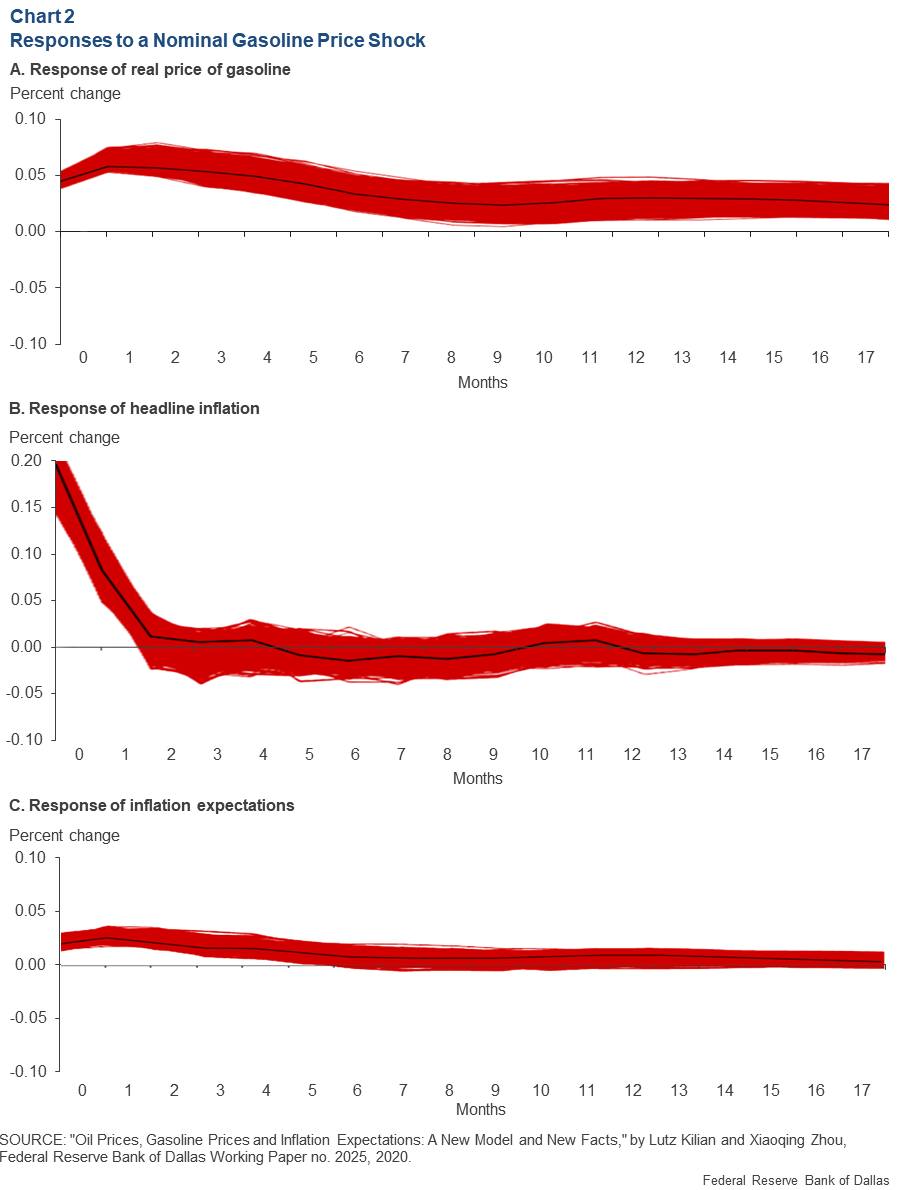

Chart 3 depicts an alternative way of presenting the model estimates. It shows that on many occasions, one-year household inflation expectations have risen or fallen for periods lasting more than one year at a time when confronted with large and persistent gasoline price movements. In each case, however, these discrepancies ultimately vanish.

The potential importance of gasoline price shocks is best illustrated by the episode from January 2009 to March 2013, when the U.S. economy recovered from the financial crisis. Inflation expectations during this episode increased by 1.5 percentage points (on an annualized basis). Chart 3 shows that in the absence of nominal gasoline price shocks, household inflation expectations would have cumulatively increased by only 0.1 percentage points. In other words, the observed increase in inflation expectations during this episode is almost entirely explained by gasoline price shocks.

Other examples of episodes when inflation expectations were elevated by the cumulative effect of nominal gasoline price shocks include 1990, when Iraq invaded Kuwait, and the period of surging oil prices from 2004 to mid-2008. In contrast, from late 2014 to late 2017, following a sharp fall in oil prices, and in the late 1990s, during the Asian financial crisis, falling gasoline prices masked rising inflation expectations.

The evidence in Chart 3 provides the first credible support for the conventional wisdom that inflation expectations respond to gasoline prices. This is not to say that gasoline price shocks are the most important or the only determinant of inflation expectations. In fact, on average over the entire estimation period, gasoline price shocks account for only 39 percent of the variation in household inflation expectations. The most important determinant on average is idiosyncratic shocks to household inflation expectations, which account for 54 percent of the variation. Shocks to the core CPI explain 7 percent.

Origins of the excess sensitivity of household inflation expectations to gasoline price shocks

Our evidence shows that households tend to associate rising gasoline prices with increasing prices of other consumer goods. This behavioral relationship is consistent with households employing simple rules of thumb based on the collective experience of the 1970s and 1980s, when high oil and gasoline prices coincided with persistently high inflation.

This interpretation is supported by microeconomic evidence found in the work of Carola Binder and Christos Makridis (“Stuck in the Seventies: Gas Prices and Consumer Sentiment”) that survey participants old enough to have experienced the 1970s and ’80s tend to be more responsive to gasoline price shocks.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.