Average inflation over the pandemic avoids 'base-effect' distortions

Since the start of the COVID-19 pandemic early last year, the nation has seen enormous swings in consumer prices, with extraordinary declines last spring giving way to similarly eye-popping increases as the economy has reopened.

These large swings have whipsawed our standard 12-month measures of inflation and made it difficult to disentangle recent trends from the impact of prior declines. In this post, we discuss a measure that provides useful context to recent movements in inflation.

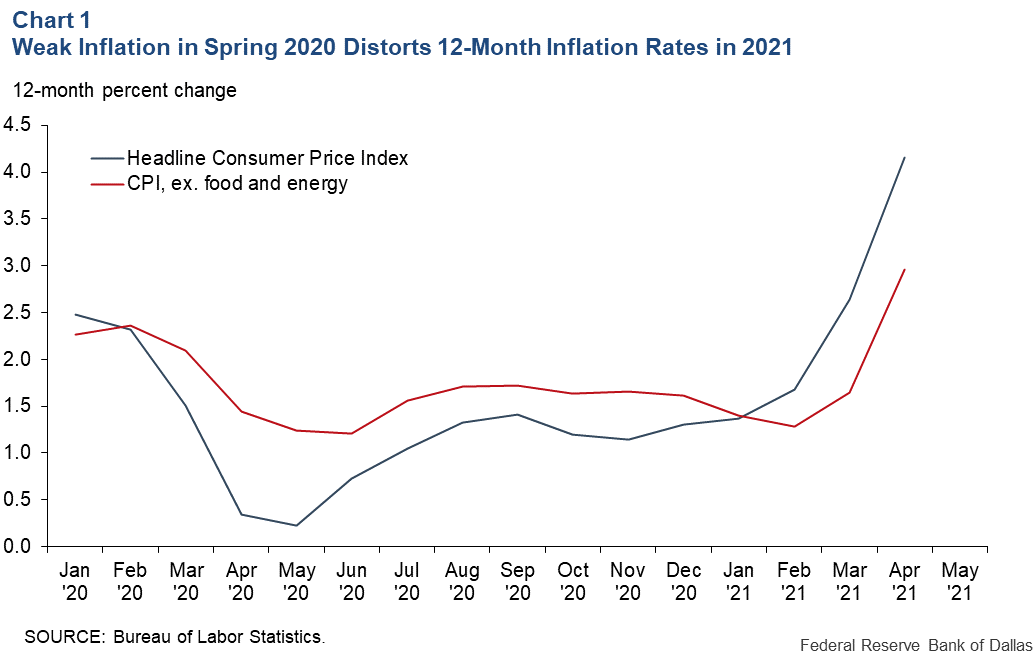

Consumer Price Index (CPI) data for April, released May 12, showed robust increases in both the all-items index (“headline” CPI) and the index for all items, excluding food and energy (“core” CPI). The 12-month headline inflation rate was 4.2 percent in April, its highest level since 2008.

Given that the 12-month rate through March had been 2.6 percent, this would seem to indicate a sizable surge in CPI inflation. Twelve-month core inflation likewise jumped, to 3.0 percent from 1.6 percent a month earlier (Chart 1).

‘Base-month effects’ frame change over past year

Complicating an interpretation of the movements shown in Chart 1 are so-called “base-month effects”—changes in 12-month inflation rates always reflect a combination of what’s happening with inflation today and what happened 12 months ago.

While the base-month problem is always present, current circumstances have greatly amplified its impact because month-to-month headline and core CPI inflation rates were deeply negative last spring as demand plunged in many sectors of the economy. As time passes and those spring 2020 lows fall out of our 12-month viewing window, inflation measured on a 12-month basis mechanically picks up, though that effect eventually dissipates.

Considering average inflation as a measure

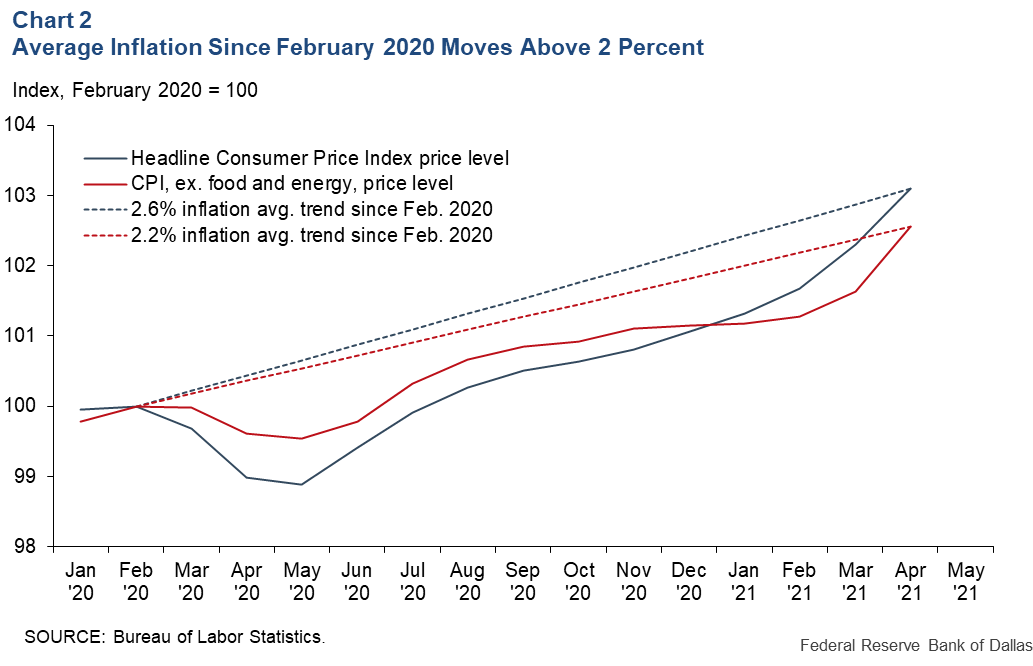

Rather than try to tease out base-month effects from recent trends, an alternative approach is to look at average inflation since the onset of the pandemic in early 2020. This calculation captures the effects of last spring’s price declines, the increases as economic activity has recovered and the recent jumps that reflect a combination of reopening, supply bottlenecks and rising input costs.

It treats the period since the pandemic began as a single episode and doesn’t mechanically accelerate with the passage of time.

Chart 2 illustrates our approach. The chart shows the levels of the headline and core CPIs along with trend lines indicating their average rates of increase since February 2020.

By these calculations, headline CPI inflation has averaged 2.6 percent on an annualized basis since the onset of the pandemic, and core CPI has averaged 2.2 percent.

Inflation based on the personal consumption expenditures (PCE) price index—which typically runs 0.2–0.3 percentage points below CPI inflation—averaged 1.9 percent from the start of the pandemic through March 2021, while core PCE inflation averaged 1.6 percent. Based on April’s CPI report, average core PCE inflation likely moved to near 2.0 percent in April, while average headline PCE inflation likely moved above 2.0 percent.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.