Has the Beige Book become disconnected from economic data?

Studies have shown that the Federal Reserve System’s anecdotal report of U.S. economic conditions by Federal Reserve district, the Beige Book, has traditionally correlated with economic data and is a useful tool to detect U.S. business cycle turning points.

But in the postpandemic period, observers note Beige Book economic characterizations were often weaker than what hard data such as employment and the gross domestic product (GDP) indicated, prompting questions about whether the Beige Book has diverged from official statistics. And, if so, why?

The Beige Book (so named for the color of its cover when it was a hard copy) is released eight times per year, before each Federal Open Market Committee meeting when officials set monetary policy. The information is collected by the 12 individual Reserve Banks through surveys, interviews and roundtables with business and community leaders and banking executives. The Beige Book also includes reports from business, higher education and nonprofit leaders serving on reserve bank and branch advisory councils and boards of directors. Contacts are asked about changes in demand, employment, prices and outlooks, among other topics.

Data series constructed from Beige Book shows postpandemic weakness

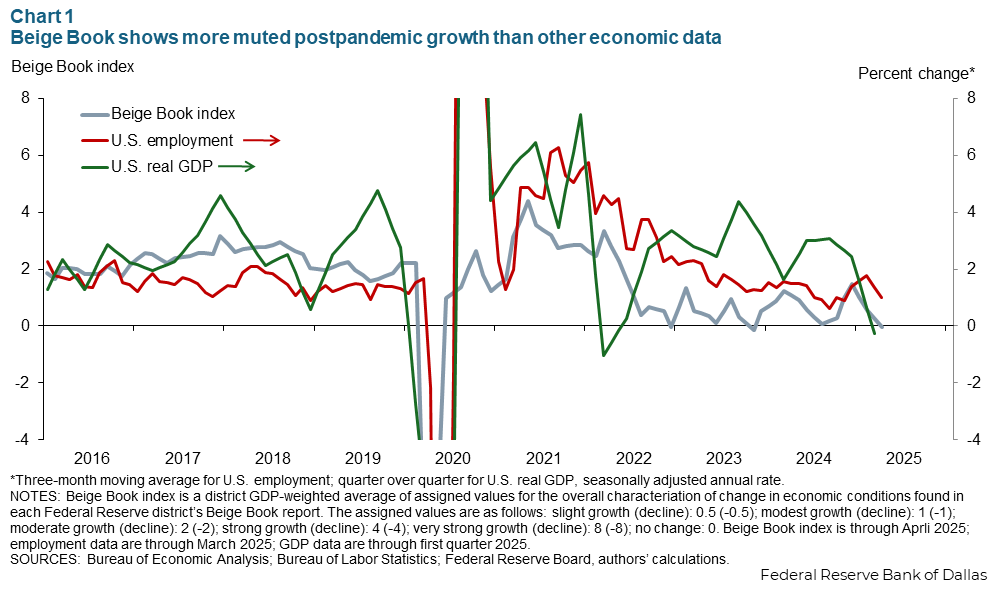

Each district’s report features an opening line characterizing the change within the region over the reporting period, such as economic activity “rose moderately,” “was flat” or “declined slightly.” Although the Beige Book is a qualitative summary, for this analysis we constructed a data series by assigning a value to each characterization. For example, we assigned moderate growth a value of 2 and moderate decline a value of -2. We then took an average of these values weighted by each district’s share of national GDP. The resulting Beige Book index covers January 2016 to April 2025.

The pace of economic growth indicated by this index closely tracked U.S. employment and GDP growth leading up to the pandemic. However, this summary measure of the Beige Book has since suggested a slower pace of growth relative to the hard data (Chart 1).

Postpandemic growth concentrated in sectors not prominent in Beige Book

Since 2022, growth has been concentrated in sectors less sensitive to business cycles, a possible reason for the Beige Book and hard data disconnect. These sectors don’t receive much coverage in the Beige Book.

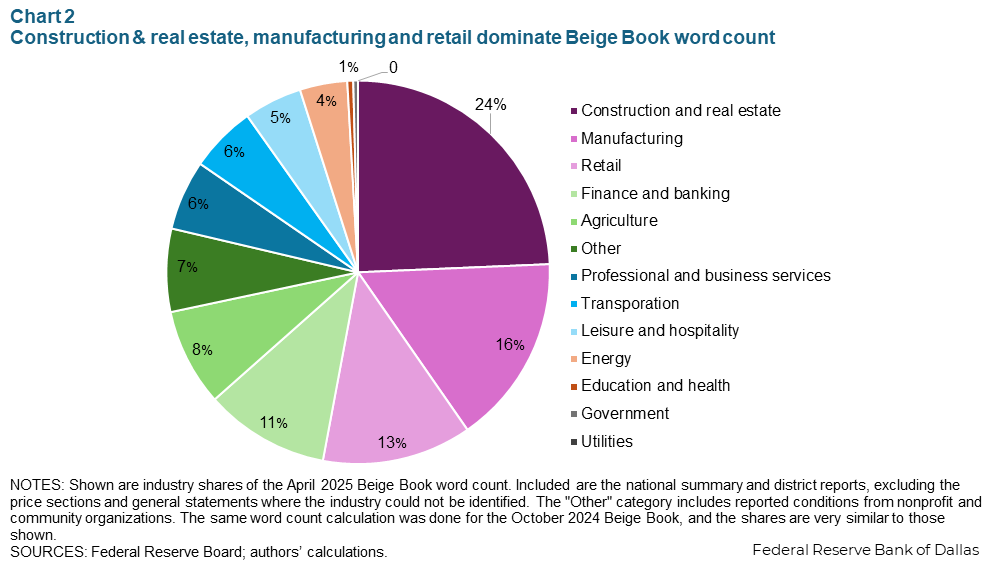

The Beige Book was devised to catch turning points in the business cycle before they appear in the hard data. Thus, the Beige Book focuses on cyclical sectors that typically signal a downturn before it happens. For example, a word-count analysis of the April 2025 Beige Book, including the national summary and district reports, shows that construction and real estate, manufacturing and retail—all among the more cyclical sectors—dominate (Chart 2).

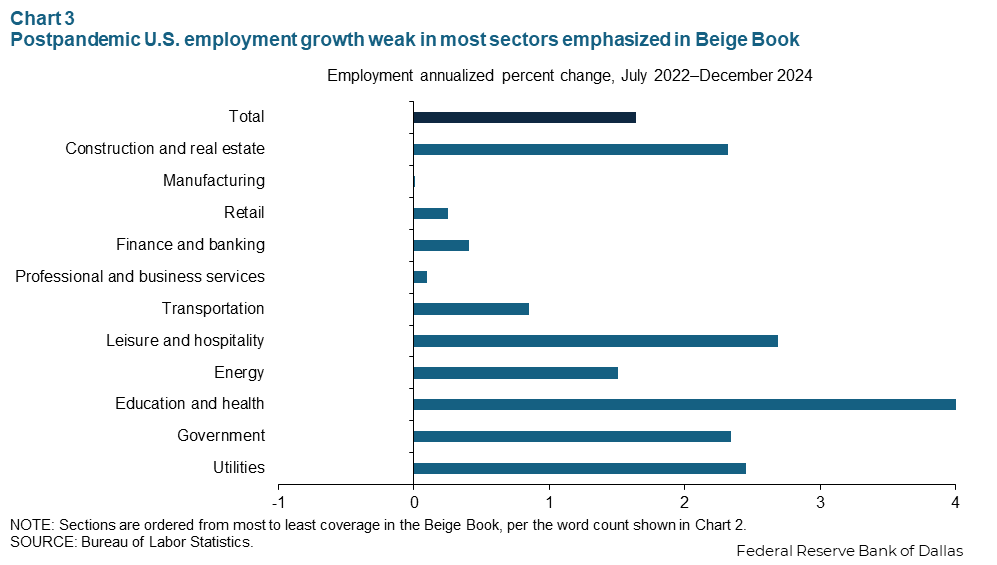

The industry representation can drive a divergence between the Beige Book and other measures of U.S. economic growth when growth is concentrated in sectors with no or little Beige Book coverage. This has been the case since mid-2022, when large increases in health care and education as well as government and utilities dominated employment gains (Chart 3). With the exception of construction and real estate, sectors heavily emphasized in the Beige Book—manufacturing, retail, and finance and banking—exhibited weak or no growth from mid-2022 to December 2024.

Negative perceptions in business sentiment likely play a role

Negative perceptions in business sentiment during the postpandemic period likely also factor into Beige Book-hard data divergence. Pessimism could have been due to elevated inflation levels in 2021 and 2022 and the high interest rates that followed.

Further, while U.S. consumption data showed resiliency in 2022–24, many retailers and other businesses reported that promotions and discounts were required to motivate consumer spending. Thus, among store owners, there was a sense of weakness and squeezed margins. Acceleration of the shift to e-commerce spurred by pandemic disruption of traditional in-store shopping also played a role. Sales increased among online retailers such as Amazon, while brick-and-mortar retailers struggled.

High-income households accounted for much of the consumption growth since mid-2021. Thus, activity has been uneven across the diverse mix of business contacts providing insights for the Beige Book.

Finally, once COVID restrictions on travel and business operating capacity were lifted and people became less pandemic focused, consumption growth became particularly strong in leisure and hospitality, which has a relatively small footprint in the Beige Book.

Thus, anecdotal findings on consumer spending reported in the Beige Book may be more languid than headline consumption data.

Economic data and Beige Book converge again

Beige Books released in 2025 indicate growth nationwide has retreated since year-end 2024. The April 2025 report signaled flat economic activity in the U.S., with a handful of Fed districts noting slight declines. This is in line with the latest GDP data, which showed no output growth in the first quarter. Job growth remains resilient, and the Beige Book continues to report slight employment gains on net.

Looking ahead, the Beige Book highlights the extent to which uncertainty about tariffs and trade policy is weighing on prospects. Several districts, including the Dallas Fed, said growth slowed and business outlooks deteriorated in the March to mid-April reporting period. New findings from the Dallas Fed show that nearly 60 percent of the approximately 350 Texas company executives surveyed April 15–23 expect higher tariffs to negatively affect their businesses this year.

Regional Fed business outlook surveys released since the April Beige Book from the New York, Philadelphia, Richmond, Kansas City and Dallas districts broadly convey slowing demand and diminished expectations of future conditions, with readings indicating either a slowdown in growth or outright contraction in six months.

About the authors