Minority depository institutions have vital role serving vulnerable communities

Minority depository institutions (MDIs) are community banks bringing financial services to typically underserved areas and at-risk populations. About 45 percent of their branches and branch deposits are in counties the Centers for Disease Control and Prevention (CDC) designates as socially vulnerable and prone to economic, health and safety challenges, including illness and natural disaster.

MDIs—whose scope is outlined in federal law— merit particular attention because of the unique role they play in nurturing economic activity in minority and low- and moderate-income communities. Home Mortgage Disclosure Act data show that about 40 percent of MDI mortgage originations are to minority borrowers and about 20 percent are to borrowers located in socially vulnerable counties. Public and private sector efforts are underway to find innovative ways to support MDIs.

Minority depository institutions defined, oversight outlined

The term “minority depository institution” initially appeared in the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, a law enacted following the savings and loan crisis in which Texas prominently figured. An MDI is defined as a federally insured depository institution for which 51 percent or more of the voting stock is owned by minority individuals; or a majority of the board of directors is minority and the community that the institution serves is predominantly minority.

Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted toward minority ownership. The law defined minority as “Black American, Asian American, Hispanic American or Native American.”

The law also set regulatory goals for the Federal Deposit Insurance Corp. (FDIC) to encourage MDIs’ preservation, solvency and promotion to the community. The Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 amended and expanded the law to further mandate that the Federal Reserve Board of Governors, the Office of the Comptroller of the Currency and the National Credit Union Administration join with the FDIC in preserving MDIs and encouraging the establishment of new ones. The agencies must file annual progress reports to Congress that describe the actions they have taken to meet these goals.

Institutions under pressure along with community banks

Nationwide, there are 148 MDIs with combined assets of $320 billion, representing 3 percent of U.S. banks and 1 percent of U.S. bank assets. California has the most MDIs headquartered in the state, 34, followed by Texas with 25, New York with 13, Oklahoma with 12 and Florida with 10.

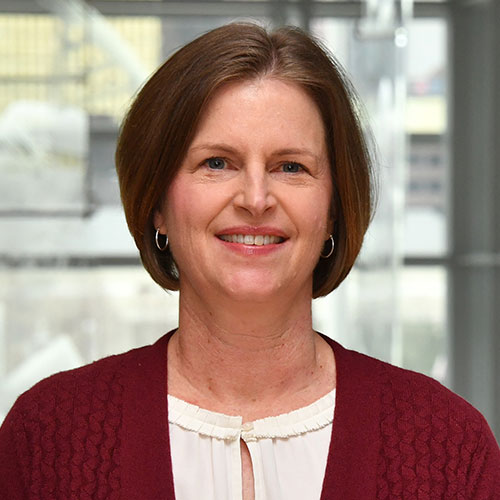

Most MDIs are community banks—holding less than $10 billion in assets, generally loans. Many are in urban areas, though Native American MDIs tend to be more rural. The median MDI has assets of $401 million; only eight MDIs have assets greater than $10 billion. Overall, MDI assets have risen during the past 10 years, with MDIs designated as Asian/Pacific Islander-owned and Hispanic-owned leading the rise (Chart 1).

Despite this asset growth, over the past 10 years the number of MDIs has declined 20 percent, from 186 to 148. This appears to mirror the trend of fewer community banks operating in the U.S. as a result of voluntary mergers.

Asset mix varies among institutions

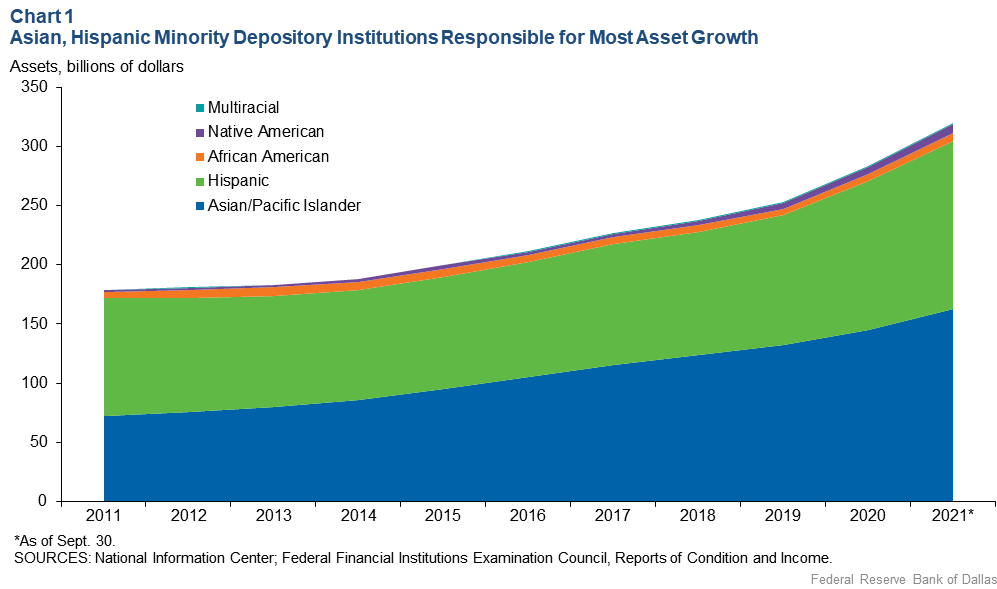

On average, MDIs tend to have a larger share of loans secured by commercial real estate than their non-MDI community bank peers (Chart 2). However, the loan mix varies meaningfully across groups. Commercial real estate loan concentrations are highest among African American and Asian/Pacific Islander MDIs, while Native American MDIs hold more residential real estate loans and Hispanic MDIs more consumer loans.

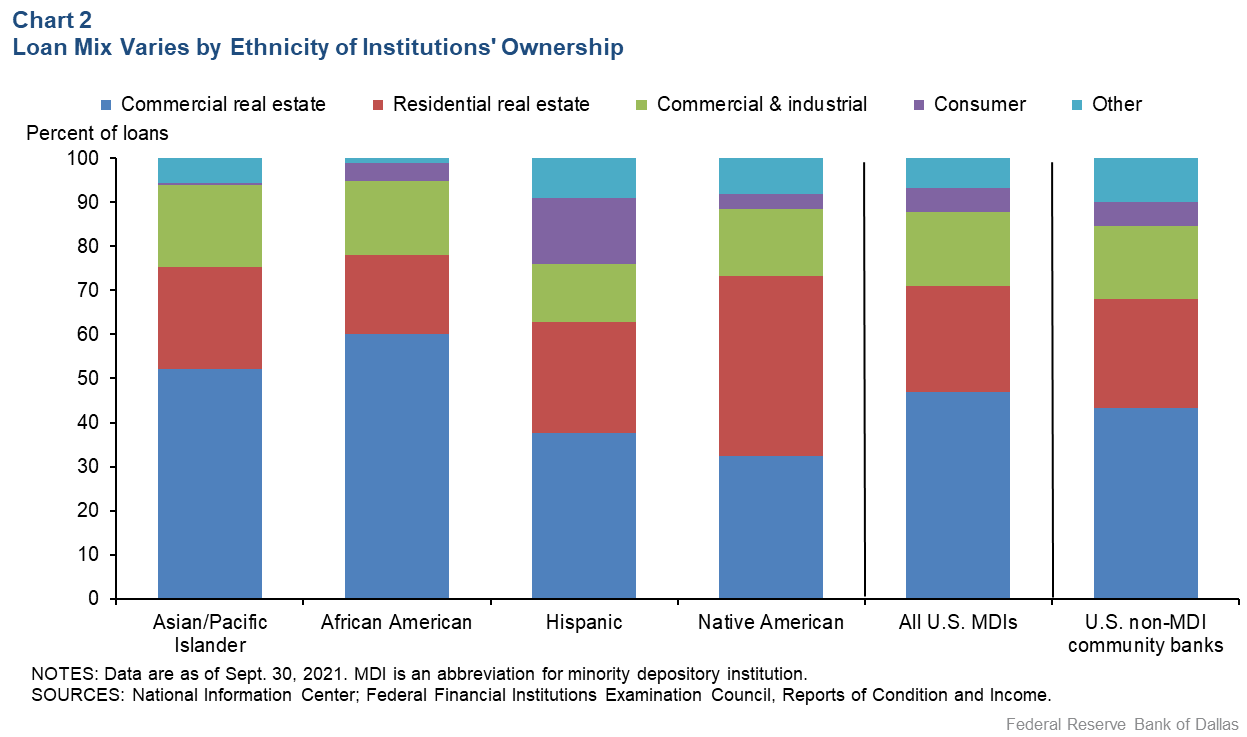

Overall, MDIs are slightly more profitable, even while carrying lower asset quality, than non-MDI community banks. Performance also varies by ethnicity. African American MDIs tend to lag behind others, reporting lower profitability, a higher efficiency ratio (expenses as a share of revenues) and a larger share of noncurrent loans (Chart 3).

The gap in African American MDI performance may, in part, be attributed to their relatively small asset size because smaller institutions tend to have a higher overhead expense, according to a FDIC Community Banking Study released in December 2020. The median asset size for African American MDIs is $223 million, compared with $230 million for Native American MDIs, $495 million for Asian/Pacific Islander MDIs and $684 million for Hispanic MDIs.

African American MDIs also hold a relatively large share of small loans to businesses, which can be more costly and labor intensive to underwrite than larger loans. Twenty-three percent of loans at African American MDIs are commercial and industrial loans and loans secured by nonfarm nonresidential real estate with origination amounts less than $1 million, compared with 17 percent of loans at Native American MDIs and 9 percent of loans at Hispanic and Asian/Pacific Islander MDIs.

Serving ‘socially vulnerable’ populations

Although MDIs account for a small share of banks and bank assets, a relatively large share of their branches and branch deposits are in “socially vulnerable” counties. The CDC’s definition of social vulnerability uses 15 pieces of census data in four broad categories—socioeconomic status, household composition and disability, minority status and language, and housing type and transportation.

Using the CDC’s county-level social vulnerability index (SVI), we identified vulnerable counties as those with an SVI in the top (worst) quartile. Combining this data with bank branch deposit data, we can then determine what percentage of a bank’s branches and deposits are in these socially vulnerable counties.

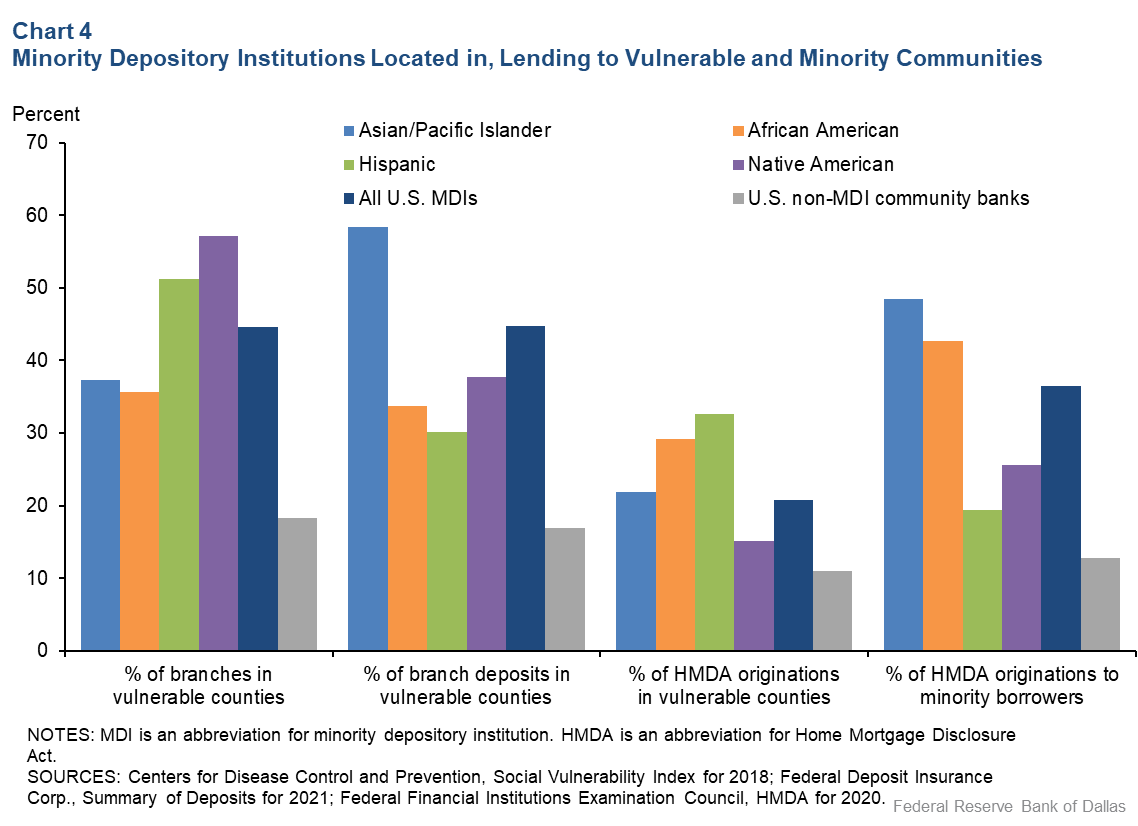

We find that 45 percent of MDI bank branches holding 45 percent of MDI branch deposits are in vulnerable counties, compared with 18 percent of non-MDI community bank branches holding 17 percent of non-MDI community bank branch deposits (Chart 4). Native American MDIs have the largest share of branches in vulnerable counties, followed by Hispanic MDIs, Asian/Pacific Islander MDIs and African American MDIs.

MDIs also originate a comparatively large share of residential mortgages to minority borrowers and borrowers in socially vulnerable counties, according to Home Mortgage Disclosure Act data. Originations to minority borrowers account for 37 percent of total mortgage originations, compared with 13 percent for non-MDI community banks.

Asian/Pacific Islander MDIs account for the largest share of originations to minority borrowers, followed by African American MDIs, Native American MDIs and Hispanic MDIs. Additionally, 21 percent of MDI mortgage originations are to borrowers in socially vulnerable counties, compared with 11 percent for non-MDI community banks. Hispanic MDIs account for the largest share of such originations, followed by African American MDIs, Asian/Pacific Islander MDIs and Native American MDIs.

Although MDIs account for a small share of banks and bank assets, their activities in socially vulnerable areas are outsized. Efforts to support MDIs could be expected to have positive impacts on vulnerable minority communities, including greater financial inclusion in underserved areas, more intermediation to minority-owned businesses and higher levels of economic development.

Given this, both public and private sector entities are developing programs to help support MDIs so they can expand their impact in these communities. The Treasury Department announced in mid-December that as part of its Emergency Capital Investment Program, 34 MDIs would receive capital injections in 2022, allowing them to broaden intermediation efforts.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.