The Russian oil supply shock of 2022

In the immediate aftermath of Russia’s invasion of Ukraine in late February, early estimates suggested that perhaps 3 million barrels a day (mb/d) of petroleum production—almost 3 percent of world production—had been effectively removed from the global oil market, constituting one of the largest supply shortfalls since the 1970s.

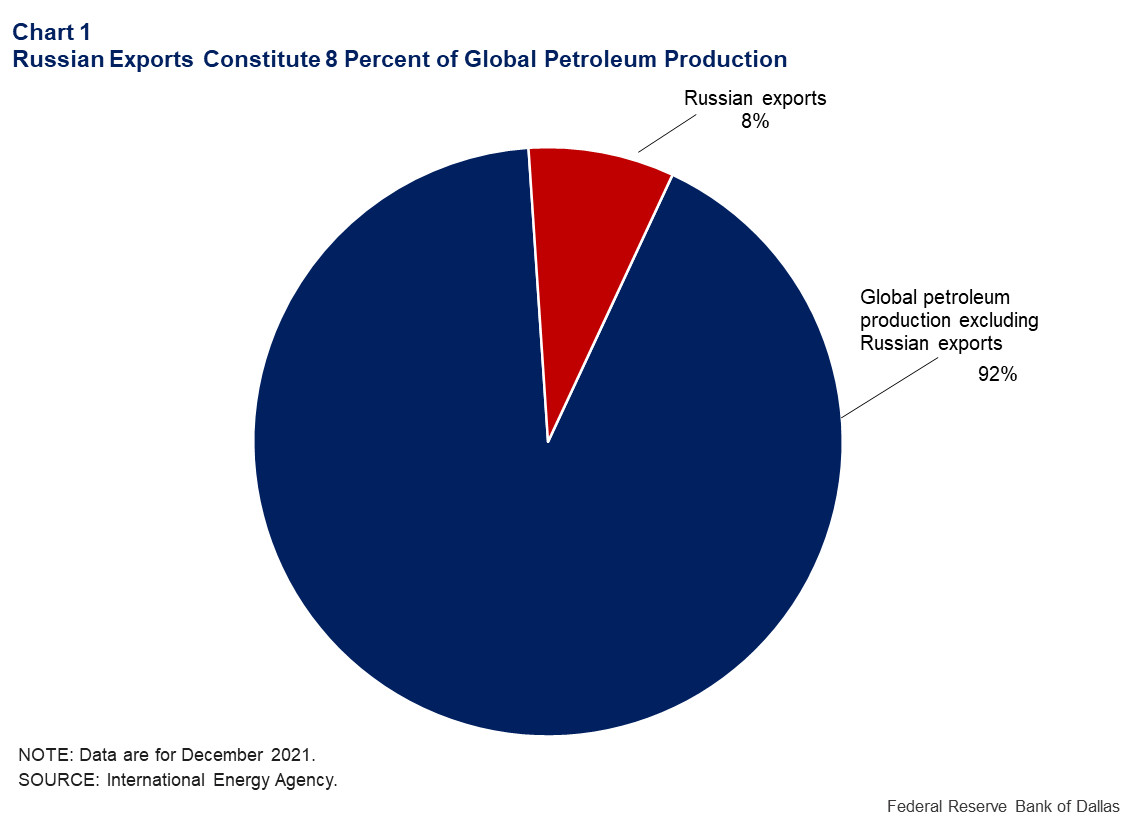

Russia accounts for about 10 percent of global petroleum production. Its crude production exceeds 10 mb/d. It is also a major exporter to world markets, exporting about 5 mb/d of crude oil and close to 3 mb/d of petroleum products (Chart 1). Russia’s main customers include Belarus and China as well as countries in the Organization for Economic Cooperation and Development.

With early reports pointing to a significant disruption in Russia’s petroleum exports, along with the prospect for even greater disruptions in the near future, it is not surprising that the price of West Texas Intermediate crude oil surged to about $120 a barrel in a matter of days following the invasion.

Recent data from Energy Intelligence, however, indicate that the fall in Russian petroleum exports to date has been somewhat smaller than the initial estimate of 3 mb/d and coincided with oil price weakening after March 8.

What changed is that much of the Russian oil that continues to be exported from Baltic and Black Sea ports at steep discounts is not delivered to refiners, as is customary. Instead, trading houses are purchasing the oil and keeping it in commercial storage in Europe, from where it may be potentially resold, bypassing financial sanctions. Buying oil for storage is not prohibited under current sanctions.

How this oil supply shock differs from earlier shocks

Traditionally, oil supply shocks arose because of civil unrest in oil-producing countries or because military conflict resulted in the destruction of oil-production facilities, as in the case of Iraq’s invasion of Kuwait in 1990.

In contrast, the main reason Russian crude oil and refined product exports have been at risk since Russia’s invasion has been the refusal of financial institutions to back such transactions. In addition, oil tanker rates for Russian destinations rose to record levels, reflecting public pressure on oil companies to avoid purchasing Russian oil, fear of official sanctions on Russian energy exports at a later date and attacks on vessels in the Black Sea. This outcome was largely unanticipated, as U.S. and European Union sanctions originally deliberately excluded Russian energy exports.

Another dimension in which the current event differs from historical precedent is that the reduction in Russian oil exports was preceded by a cut in Russian natural gas exports to Europe. Natural gas is used for home heating, for power generation and in industrial production. For example, it plays a central role in the production of fertilizer. The resulting price increases to various degrees have spread across the globe through trade in liquefied natural gas.

It might seem that Europe could cushion the impact of the natural gas and oil shortages by delaying the mothballing of coal and nuclear power plants, but Europe also depends on Russia for 40 percent of its supplies of coal and, more importantly, for natural and enriched uranium.

Finally, the effect of the Russian invasion is not limited to energy markets. Russia and the Ukraine together account for 29 percent of global wheat exports. The disruption of exports from the Black Sea together with financial sanctions on Russia means that the supply of wheat and other grains is likely to be curtailed in 2022 and beyond. The diminished supply, along with a shortage of fertilizer produced from natural gas, will drive up global food prices and reinforce the growth-retarding and inflationary effects of higher fuel prices. Likewise, the war is driving up the price of raw materials and metals produced in Russia.

How can the shortfall be compensated for?

One way of addressing the current oil supply shortfall would be for China to substitute oil from Russia, trading at a steep discount, for higher-priced imports from global markets. However, large increases in Chinese oil imports from Russia are unlikely anytime soon. There is very limited spare capacity in oil pipelines connecting China to Russia, and it is unclear where China would procure the oil tankers required for shipping more oil to China and at what cost.

Another potential solution would be increased oil production elsewhere. One reason the 1990 oil supply shock was associated with only a brief U.S. recession was Saudi Arabia’s decision to offset the shortfall of oil production to the best of its ability, making the net shortfall smaller than the original supply shock.

Saudi Arabia and the United Arab Emirates, however, have already signaled that they will not provide relief this time. This decision reflects the growing strategic cooperation between OPEC and Russia as much as the limited spare capacity of OPEC oil producers.

Likewise, the ability of shale oil producers in the United States to significantly boost oil production in the short run is constrained by supply-chain bottlenecks, labor shortages and the insistence of public investors on capital discipline.

Smaller private companies alone will be unable to respond on the scale required to impact oil prices, and their response will take at least half a year, even under the most favorable circumstances. Moreover, shale oil is a light crude and not a good substitute for the heavier Russian oil.

The Biden administration has sought to negotiate a new deal with Iran, trading sanction relief for increased Iranian oil production and exports. Even if that deal were concluded, however, Iranian oil production would be slow to respond, and the increases would be much smaller than the shortfall that likely must be covered. This conclusion also applies to recent U.S. negotiations with Venezuela.

This leaves releases of crude oil from strategic petroleum reserves as the only viable option in the short run. Hypothetically, the U.S. could release as much as 4.4 mb/d of crude from its Strategic Petroleum Reserve (SPR), but only for about three months. Additional volumes could be released after that period, but at much slower rate.

In response to the invasion, the Biden administration agreed to release 0.5 mb/d over two months from the SPR. This release, coupled with the promise of a similarly sized release by other countries, however, has had seemingly little calming effect on the global oil market

Thus, unless the Russian petroleum supply shortfall can be contained, it appears necessary for the price of oil to increase substantially and to remain elevated for a long period to eliminate the excess demand for oil. The extent of the required increase would depend on the magnitude of the oil supply shortfall. This demand destruction is likely to be assisted by the recessionary effect of higher natural gas prices and other commodity prices, especially in Europe.

Of course, to the extent that adverse shocks to global demand independently lower the demand for crude oil, a more muted oil price response may suffice. A case in point is China’s decision in mid-March to lock down several municipalities amid a surge in omicron COVID-19 infections, raising the prospect of more widespread shutdowns in the future. This news immediately contributed to a decline in the oil price.

It is also possible that financial institutions could resume financing Russian energy exports at some point. Given public support in many countries for banning oil imports from Russia—which is likely to increase as Ukrainian civilian casualties mount—it seems unlikely that financial institutions would relax their position on financing oil imports from Russia anytime soon. However, there are indications that some oil-importing countries are exploring alternative payment schemes that avoid the use of trade credit, bypass current financial sanctions or rely on alternative currencies.

Finally, the economic impact of an extended oil embargo against Russia may cause a political response in Russia. It is unclear how long Russia can sustain its economy without major foreign exchange earnings, especially considering that the West has frozen Russian central bank reserves abroad.

Broader implications for the economy

There are three main implications for the global economy. First, Russia’s invasion of Ukraine will have far-reaching implications for the energy transition to renewables. The scale of the energy supply disruption is large enough to require European countries to pause their plans to move away from fossil fuels in the interest of preserving economic activity. Likewise, efforts to restrain oil and gas production in countries such as the U.S. may have to be reconsidered in response to persistent global shortages.

Second, the surge in global fuel, electricity, residential natural gas and food prices, as well as the supply-chain disruptions caused directly by the invasion of Ukraine and indirectly by the sanctions against Russia, will sustain inflationary pressures in 2022.

Third, if the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable. This slowdown could be more protracted than that in 1991.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.