Calibrating central bank inflation messages is key to policy success

Central bank communication is itself a key monetary policy tool. A well-crafted message about the current and future state of the economy can influence the private sector’s expectations and guide behavior to ensure that the economy remains strong and prices stable even amid threatening supply-and-demand shocks.

An effective message is generally multifaceted. For instance, when talking about inflation, a central bank may want to inform the public how to interpret data. Is an increase in inflation temporary due to some transitory shocks or more prolonged owing to a slow unwinding of price pressures?

Distinguishing between these two cases and carefully explaining the reasoning behind the data is even more difficult if the private sector has limited attention to devote to the central bank’s public message.

The challenge becomes designing the message in a way that is sufficiently informative to help the private sector navigate the complexity of an inflation episode and yet pointed enough to be understood and acted upon.

To address how to craft such a message, I proceed in three steps. First, I characterize how agents in the private sector select information about aggregate macroeconomic outcomes to make economic decisions in a theoretical framework that accounts for their information-processing limits.

Second, using a lab experiment, I look at how individuals actually behave when facing uncertainty in complex economic environments. Third, I go back to the central bank’s information design stage with the lessons drawn from the experimental evidence and characterize the desired features of an effective communication strategy and public message.What private agents should notice most

The first step is understanding how private agents with a limited attention span react to information about complex economic developments. This requires a framework to study the trade-off between the attention required to make informed decisions and the benefits of making those choices. For instance, in a monetary policy setting, a firm looking to adjust its prices may wish to understand whether inflation is transitory or persistent.

Consider an economy in which the states of the world are determined by two tendencies of inflation: the inflation level (high or low) and its duration (temporary or permanent). Private agents in this environment make decisions about their own consumption and prices, and optimal choices depend on current and prospective inflation rates. To make optimal economic decisions, the agents process information about the prevailing inflation environment.

Agents know that they have a limited attention span (or information-processing capacity) to understand the implications of inflationary regimes on their choices. Consistent with the rational inattention literature, we call these agents rationally inattentive.In this setting, their optimal attention strategies balance the effort required to reduce uncertainty about the dimensions of inflation and the benefits of making economic decisions in the current environment.

What private agents actually pay attention to

The second step is to look at direct analysis of how people actually handle uncertainty in complex environments. This requires observing what people effectively choose to focus on to make decisions. This evidence can be gathered in a controlled laboratory experiment.

In the experiment used here, subjects face sets of balls of various colors, with the relative frequencies of the various colors differing from one set to the next. The subjects earn prizes based on their assessment of the colors with the highest relative frequency.

The colors can be interpreted as different possible states—for example, the four possible combinations of level and duration in our inflation example. Determining the relative frequency of each color is akin to understanding the likelihood of the possible inflationary regimes individuals face. This understanding translates into a ranking of possible inflation regimes from the most to the least likely.

Further, processing information to discern the highest-frequency color is akin to the effort paid to understand a prevailing inflation regime. Subjects earn prizes for correct assessments, which are akin to the gains that would accrue to private agents in our inflation example from correctly ascertaining the current inflation regime (and making consumption and pricing decisions tailored to that regime).

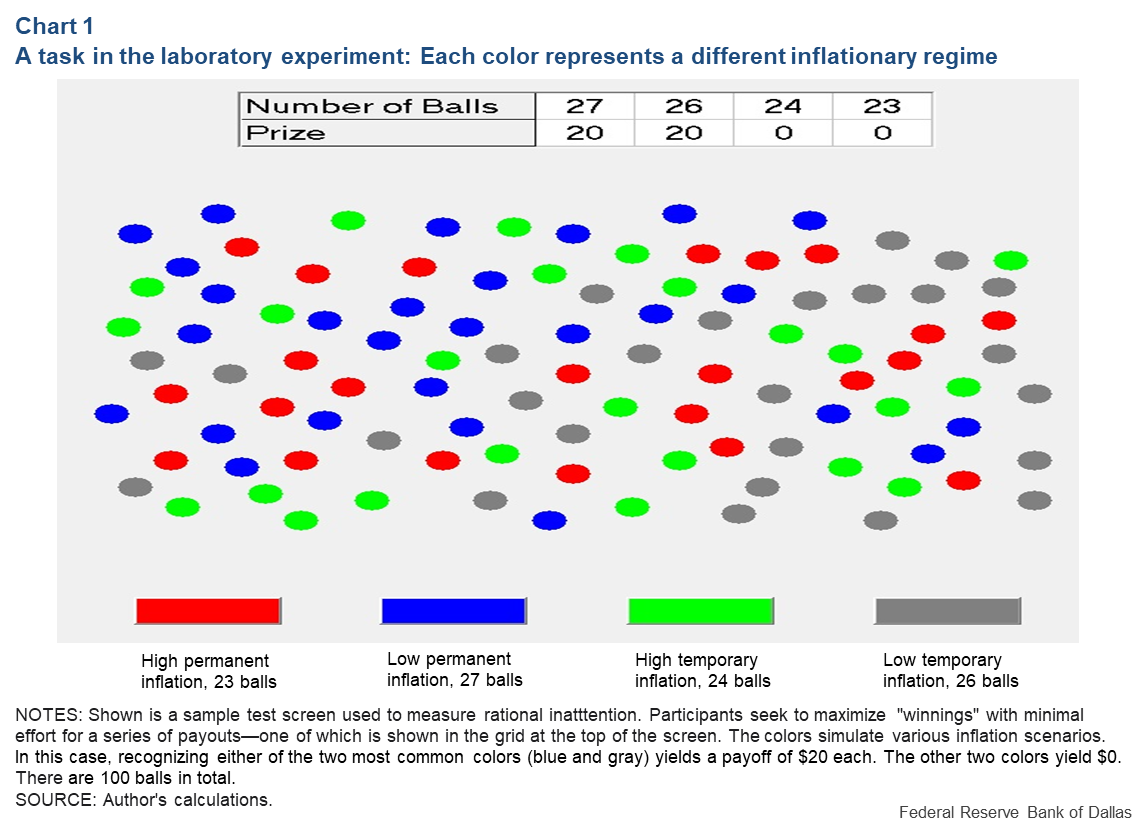

Chart 1 provides an example of the tasks subjects face in the laboratory. Subjects are asked to pick the color (red, blue, green or gray) that appears with the highest frequency. They will go through around 150 periods with no time limit on each period to detect the most-prevalent-colored balls.

The number of balls is displayed in the first row of Chart 1: 27, 26, 24 and 23, ranging from the most to the least likely color. These numbers—but not the corresponding colors—are provided to test subjects. The color assigned to each number is random, and all combinations are equally likely.

In one-third of the periods, the prize vector is (20, 20, 0, 0) as in Chart 1, second row. Thus, subjects will receive 20 if the color they pick is the most common or second most common. In one-third of the periods, the prize vector is (20, 0, 0, 0), while the last third has a prize vector of (20, 20, 19, 19). The order of these payoff vectors is randomized over the 150 periods.

In the end, one period of the total 150 is randomly selected, and the subject is paid based upon their success during that period.

Comparing the theoretical predictions to experimental data produces three main results:

Result 1 (impact of complexity): Theoretical agents and subjects generally try to simplify the environment they face. Consider Chart 1, with its prize vector of (20, 20, 0, 0): The payoffs to identifying the most frequent and next frequent colors are the same. In the inflation example, this represents the case where the outcomes of private agents’ decisions depend only on the level of inflation, not its duration.

The theory predicts that private agents optimally focus attention on assessing the level of inflation and ignore its duration. This strategy reduces the complex four-world environment into a simpler two-world environment. The experimental data show that the participants generally try to mimic the theoretical agents’ strategy by eliminating the least frequent colors. However, due to cognitive constraints, they do not always manage to select the first-ranked colors.

Result 2 (role of incentives): Weaker incentives to arrive at a correct assessment mean that less information is being processed. Consider again Chart 1, but assume that the two zero-paying choices, now pay $19. In this case, both theory and data show that agents optimally decide to stay uninformed and pick an action at random. This result is intuitive: If inflation bears little or no cost on the optimal pricing strategy, there is no need to spend precious cognitive resources in understanding which inflationary regime agents are in.

Result 3 (steeper incentive and rankings): Suppose that the payoff to correctly identifying the most frequent color is large relative to the payoffs associated with incorrect guesses—the prize vector (20, 0, 0, 0). This setting provides a strong incentive for the agents to have a deeper understanding of duration as well as the level of inflation.

Theory predicts that in such a case, agents should optimally acquire more information to discern correctly the most likely inflation regime in both of its dimensions. The experimental data show that, however, even with steeper incentives, it might be too hard for subjects to distinguish the most likely color. They forego the additional gains that a more-informed selection affords them to avoid processing precise information about the environment.

What kind of attention should the central bank’s message seek?

Lessons from the experimental data can be used by a central bank to inform the design of public messages that effectively guide rationally inattentive agents’ behaviors, using minimal attention resources.

In a theoretical model that takes as an input the complexity faced by the public interpreting the central bank’s message, I found that, to effectively navigate people’s attention limits, the optimal communication strategy should consider the joint design of content, context and the clarity of public messages—that is, what to send, when to send it and who the intended audience is.

Using a central bank’s communication as an effective monetary policy tool involves a difficult balance of precision and clarity. In this balance, it is paramount to account for the limited attention span of the intended audience.

About the Author

Antonella Tutino

Tutino is a senior research economist in the Research Department at the Federal Reserve Bank.

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.