Rents, home values depressed in air pollution hotspots

Wildfire smoke pollution may significantly affect housing market activity in locations hundreds or even thousands of miles away from the fires.

Over the past two decades, wildfire activity has become more extreme and intense, leading to elevated pollution levels. Canadian wildfires caused some of the most polluted days on record in parts of the United States in June 2023, sending smoke plumes to areas where more than 122 million people live.

In particular, wildfires are responsible for more than 15 percent of particulate matter (PM2.5) emissions in the U.S. PM2.5 pollutants are less than 2.5 micrometers in diameter, or about 1/20th the diameter of a single human hair. They pose numerous cardiovascular and respiratory health hazards. An ambient concentration of less than 12 micrograms per cubic meter (µg/m3) is considered healthy. These particles can be carried thousands of miles by wildfire smoke plumes, with long-term economic implications for affected areas.

A recent paper explores the impact of wildfire air pollution on rental and home prices in areas exposed to smoke plumes but not directly affected by wildfires. The paper finds that rental prices decrease by about 0.7 percent per one µg/m3 increase in PM2.5; home prices decrease by about 4 percent for the same increase.

The paper also establishes that air pollution affects market liquidity in a meaningful way. Overall, these findings provide a better understanding of the relationship between air pollution and the rental market while also detailing the differences between homeowners and renters that drive their responses to air pollution.

Air pollution affects rental prices in Las Vegas

Data from the Las Vegas Metropolitan Statistical Area (MSA) provide insight into the impact of air pollution, an example corroborated in other areas. Las Vegas has not been directly threatened by wildfires, but households in the area have been heavily exposed to large amounts of wildfire smoke and associated air pollution, making it a good environment to test the effect of wildfire air pollution on rents.

The Environmental Protection Agency’s (EPA’s) Air Quality System, a collection of thousands of surface-based pollution monitors distributed across the U.S., provides a data source to assess the smoke’s impact on rents. These monitors report PM2.5 levels on a daily basis. Rental contract data are sourced from the Las Vegas Realtors’ Multiple Listing Service, with information on individual lease agreements from August 2008 to December 2019.

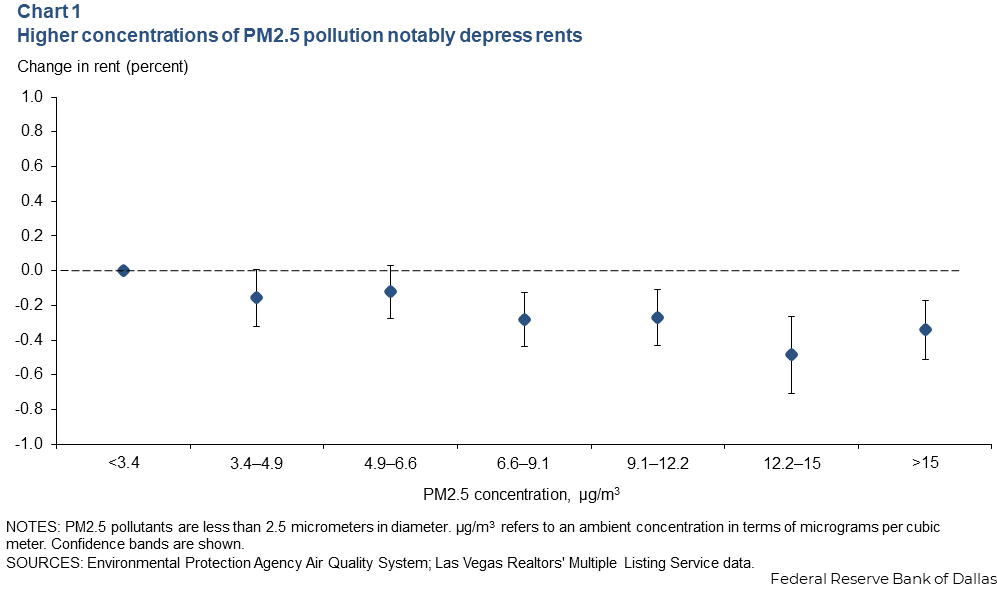

The marginal effect of additional air pollution on rents depends on the level of PM2.5 (Chart 1). While the impact of PM2.5 on rental prices is negligible at low PM2.5 levels, there is a negative effect on rental prices when PM2.5 concentrations exceed 6.6 µg/m3. The greatest negative effect occurs when the PM2.5 concentration surpasses 12.2 µg/m3. This illustrates the negative marginal effect on rents in areas with greater concentrations of PM2.5.

Pollution data collected from the EPA Air Quality System, however, fail to account for variations in PM2.5 concentration from other sources, such as vehicle emissions and industrial emissions. Wildfire smoke data from the National Oceanic and Atmospheric Administration’s Hazard Mapping System, as well as predicted smoke pollution data from the Stanford Echo Lab, better account for shocks to PM2.5 levels attributable to wildfires.

Analysis of this data reveals a similar relationship between PM2.5 concentrations and rents. On average, a one µg/m3 increase in PM2.5 levels reduces rent by approximately 0.7 percent. Notably, similar results are found using data from Chicago and the Bay Area in California, indicating the robustness of this relationship. This translates to a net loss of approximately $108.53 over the course of a year, given the mean monthly rent of $1,292.26 in the Las Vegas MSA.

A negative relationship also exists between PM2.5 and housing prices, as there is about a 4 percent decrease in housing prices following a one µg/m3 increase in PM2.5 concentration. The magnitude of this decrease is significantly larger than for rental prices, indicating a potential discrepancy in how homeowners and renters respond to air pollution shocks.

Following the behaviors of homeowners and renters

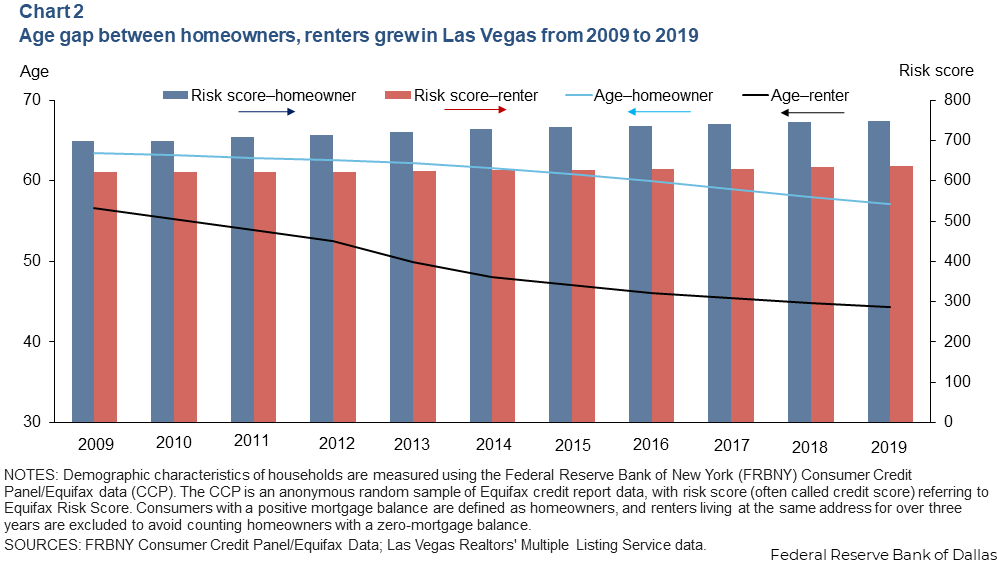

We explored the demographic differences between homeowners and renters to better understand the differential response to PM2.5 pollution, which make their tolerance to air pollution or willingness to pay for clean air differ. These differences are analyzed using information on age and Equifax risk score (credit score) profiles of households from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax data (CCP).

CCP data indicate a growing age gap between homeowners and renters in Las Vegas (Chart 2). On average, renters in Las Vegas are younger and have lower Equifax risk scores compared with local homeowners.

We looked at communities with and without age restrictions among homeowners and renters to assess the potential effect of age in the response to PM2.5 pollution. For context, age-restricted communities require that all residents be older than age 55. On average, age-restricted communities have a greater negative rental price response to additional air pollution than those without age restrictions.

Taking a closer look, we analyzed the effect of PM2.5 pollution on rent over three periods: 2008–11, 2012–15 and 2016–19. Rents responded more strongly to PM2.5 pollution during the earlier periods, when the average age of renters was significantly higher.

Together, these results indicate that age-related differences in tolerance to air pollution may be driving the differential response to additional PM2.5 between homeowners and renters. Given their younger age, renters’ health is likely more resilient to air pollution fluctuation than that of older homeowners, leading to differences in tolerance and housing market responses to pollution.

Housing price response to air pollution extends beyond emission source

The relationship between PM2.5 pollution and rent prices has important implications for how housing markets react to the pollution shocks that wildfires present. Notably, these implications extend far beyond the immediate vicinity of these fires, as smoke plumes carry PM2.5 particles thousands of miles from their source.

As a result, housing markets across the U.S. will feel the effects of climate-driven increases in wildfire activity, not just those in fire-prone areas.

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.