Texas Employment Forecast

The Texas Employment Forecast estimates jobs will increase 1.6 percent in 2024, with an 80 percent confidence band of 1.5 to 1.7 percent. The forecast is based on an average of four models that include projected national gross domestic product, oil futures prices and the Texas and U.S. leading indexes. Three of the four forecasts declined this month as a result of weaker leading indexes and lower oil futures prices. Downward benchmark revisions to second quarter job growth also played a role. The forecast suggests 230,000 jobs will be added in the state this year, and employment in December 2024 will reach 14.2 million jobs (Chart 1). Employment growth for the last month of the year is expected to rise to 1.9 percent.

Texas employment growth has disappointed in recent months, increasing only an annualized 0.9 percent in November and 0.1 percent in October. “Texas employment expansion was weak, with only 10,000 jobs added in November. Gains were concentrated in smaller private sector services, such as information and financial activities, although some larger sectors also expanded including the education and health sector and government,” said Jesus Cañas, Dallas Fed senior business economist. “In the major metropolitan areas, employment in Houston, Austin, Fort Worth and San Antonio grew while falling in Dallas,” he added.

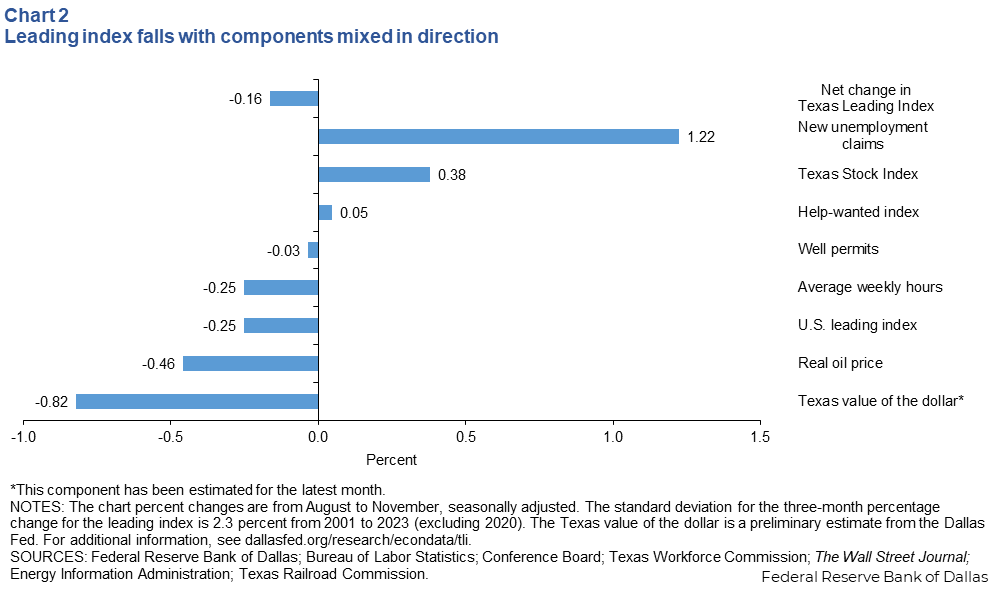

The Texas Leading Index fell slightly during the three months through November (Chart 2). The index was dragged down by decreases in average hours worked, the U.S. leading index, well permits and the real price of West Texas Intermediate oil, plus the increase in the Texas value of the dollar. Increases in the Texas stock index and help-wanted index and a fall in new unemployment claims contributed positively.

Next release: January 24, 2025

Methodology

The Dallas Fed’s Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

The forecast is based on the average of four models. Three models are vector autoregressions for which Texas payroll employment is regressed on the lags of West Texas Intermediate (WTI) oil prices, the U.S. leading index and the Texas Leading Index. The fourth model is an autoregressive distributed lag model with regression of payroll employment on lags of payroll employment, current and lagged values of U.S. GDP growth and WTI oil prices, and Texas COVID-19 hospitalizations through March 2023. Forecasts of Texas payroll employment from this model also use forecasts of U.S. GDP growth from Blue Chip Economic Indicators and WTI oil price futures as inputs. All models include four COVID-19 dummy variables (March–June 2020).

For additional details, see dallasfed.org/research/forecast/.

Note

An update to the Texas Leading Index resulted in the employment forecast changing from 2.1 percent to 2.2 percent.

Contact Information

For more information about the Texas Employment Forecast, contact Jesus Cañas at jesus.canas@dal.frb.org.