Texas Manufacturing Outlook Survey

Texas Manufacturing Output Grows, but New Orders Decline and Outlooks Worsen

For this month’s survey, Texas business executives were asked supplemental questions on labor market conditions. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

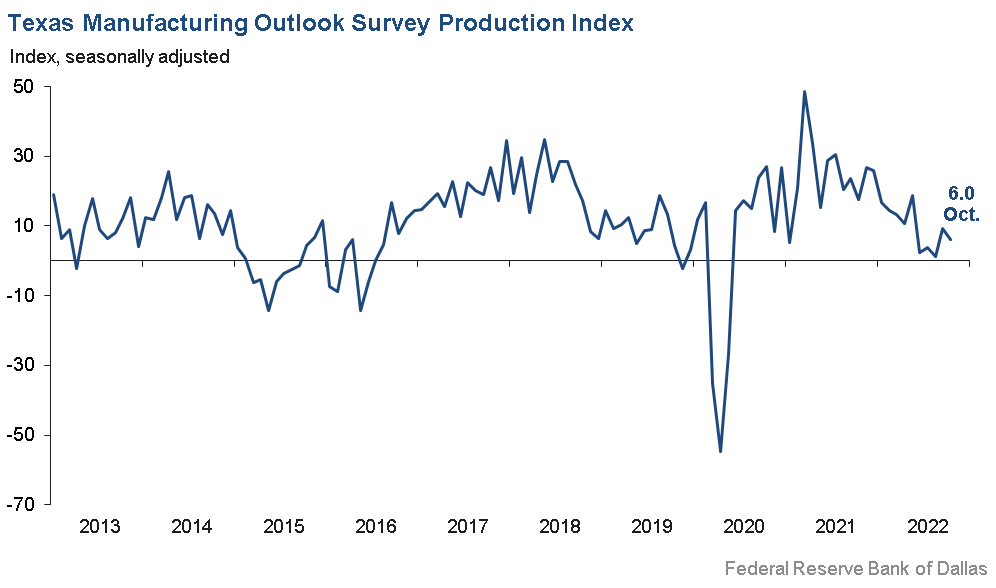

Growth in Texas factory activity continued in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged down three points to 6.0, suggesting a slight deceleration in output growth.

Other measures of manufacturing activity also moved down this month. The new orders index slipped to -8.8―its fifth month in a row in negative territory—suggesting a continued decrease in demand. The growth rate of orders index also remained negative and dropped 12 points to -13.2. The capacity utilization index was positive but moved down from 13.4 to 9.1, and the shipments index dipped into negative territory for the first time since May 2020, coming in at -1.6.

Perceptions of broader business conditions worsened in October. The general business activity index posted a sixth consecutive negative reading and edged down from -17.2 to -19.4. The company outlook index also remained negative and was largely unchanged at -9.1. The outlook uncertainty index pushed higher to 38.3.

Labor market measures continued to indicate robust employment growth, though workweeks are no longer lengthening. The employment index ticked up to 17.1, a reading significantly above its series average of 7.8. Twenty-six percent of firms noted net hiring, while 9 percent noted net layoffs. The hours worked index fell to a near-zero reading this month—indicating no change in workweek length—ending a two-year trend of increases.

Prices and wages continued to increase at an elevated pace. The raw materials prices index moved down five points to 32.0, converging toward its series average of 28.1. The finished goods prices index, however, rose four points to 22.2, pushing further above its series average of 9.0. The wages and benefits index remained elevated at 36.7, unchanged from September.

Expectations regarding future manufacturing activity were mixed in October. The future production index remained positive, though it plummeted 25 points to 3.1, its lowest reading since April 2020. The future general business activity index remained negative and largely unchanged at -21.2. Other measures of future manufacturing activity saw large declines in index values this month, though most remained in positive territory, with the exception of the future new orders index, which fell to -4.5.

Next release: Monday, November 28

Data were collected Oct. 18–26, and 96 Texas manufacturers responded to the survey. The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Results Summary

Historical data are available from June 2004 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 6.0 | 9.3 | –3.3 | 10.8 | 29(+) | 27.0 | 52.0 | 21.0 |

Capacity Utilization | 9.1 | 13.4 | –4.3 | 8.7 | 2(+) | 27.0 | 55.1 | 17.9 |

New Orders | –8.8 | –6.4 | –2.4 | 6.6 | 5(–) | 24.4 | 42.4 | 33.2 |

Growth Rate of Orders | –13.2 | –1.7 | –11.5 | 0.6 | 6(–) | 17.0 | 52.8 | 30.2 |

Unfilled Orders | –0.4 | –0.1 | –0.3 | –1.4 | 3(–) | 17.6 | 64.4 | 18.0 |

Shipments | –1.6 | 7.1 | –8.7 | 9.5 | 1(–) | 28.9 | 40.7 | 30.5 |

Delivery Time | 1.5 | 0.9 | +0.6 | 1.4 | 2(+) | 20.4 | 60.7 | 18.9 |

Finished Goods Inventories | –12.6 | 3.3 | –15.9 | –3.2 | 1(–) | 15.8 | 55.8 | 28.4 |

Prices Paid for Raw Materials | 32.0 | 37.1 | –5.1 | 28.1 | 30(+) | 47.5 | 37.0 | 15.5 |

Prices Received for Finished Goods | 22.2 | 18.1 | +4.1 | 9.0 | 27(+) | 31.6 | 59.0 | 9.4 |

Wages and Benefits | 36.7 | 36.6 | +0.1 | 20.7 | 30(+) | 36.7 | 63.3 | 0.0 |

Employment | 17.1 | 15.0 | +2.1 | 7.8 | 28(+) | 26.4 | 64.3 | 9.3 |

Hours Worked | –0.1 | 8.0 | –8.1 | 3.8 | 1(–) | 17.3 | 65.3 | 17.4 |

Capital Expenditures | 7.1 | 13.6 | –6.5 | 7.0 | 27(+) | 19.6 | 67.9 | 12.5 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –9.1 | –10.7 | +1.6 | 6.3 | 8(–) | 16.8 | 57.3 | 25.9 |

General Business Activity | –19.4 | –17.2 | –2.2 | 2.6 | 6(–) | 16.1 | 48.4 | 35.5 |

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 38.3 | 27.2 | +11.1 | 16.5 | 18(+) | 44.7 | 48.9 | 6.4 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 3.1 | 28.3 | –25.2 | 38.0 | 30(+) | 26.8 | 49.5 | 23.7 |

Capacity Utilization | 3.4 | 19.3 | –15.9 | 34.9 | 30(+) | 26.4 | 50.6 | 23.0 |

New Orders | –4.5 | 22.1 | –26.6 | 35.4 | 1(–) | 22.4 | 50.7 | 26.9 |

Growth Rate of Orders | 1.5 | 16.2 | –14.7 | 26.3 | 4(+) | 25.3 | 50.9 | 23.8 |

Unfilled Orders | –6.2 | –6.2 | 0.0 | 3.5 | 5(–) | 11.2 | 71.4 | 17.4 |

Shipments | 1.0 | 16.3 | –15.3 | 36.3 | 30(+) | 24.1 | 52.7 | 23.1 |

Delivery Time | 2.3 | –1.3 | +3.6 | –1.2 | 1(+) | 18.4 | 65.5 | 16.1 |

Finished Goods Inventories | –2.3 | 5.0 | –7.3 | 0.4 | 1(–) | 15.7 | 66.3 | 18.0 |

Prices Paid for Raw Materials | 25.8 | 22.9 | +2.9 | 34.6 | 31(+) | 42.7 | 40.4 | 16.9 |

Prices Received for Finished Goods | 26.4 | 22.8 | +3.6 | 21.2 | 30(+) | 40.2 | 46.0 | 13.8 |

Wages and Benefits | 43.4 | 50.9 | –7.5 | 39.4 | 30(+) | 48.2 | 47.0 | 4.8 |

Employment | 11.7 | 28.2 | –16.5 | 23.4 | 29(+) | 28.8 | 54.1 | 17.1 |

Hours Worked | 3.0 | 5.4 | –2.4 | 9.4 | 2(+) | 11.9 | 79.2 | 8.9 |

Capital Expenditures | 9.8 | 15.4 | –5.6 | 20.0 | 29(+) | 28.1 | 53.6 | 18.3 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Increase | % Reporting No Change | % Reporting Worsened |

Company Outlook | –14.1 | –6.9 | –7.2 | 19.7 | 6(–) | 20.2 | 45.5 | 34.3 |

General Business Activity | –21.2 | –22.4 | +1.2 | 13.9 | 6(–) | 17.6 | 43.7 | 38.8 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

†Added to survey in January 2018.

Data have been seasonally adjusted as necessary, with the exception of the outlook uncertainty index, which does not yet have a sufficiently long time series to test for seasonality.

Production Index

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- The outlook has dimmed slightly. Some raw material costs have decreased, while others continue to increase or stay the same (higher level). Some customers are quietly cutting back on orders. We are in the food business, so the change is subtle. Maybe they are reducing quantities slightly or just moving delivery dates out a week or two. I think we are starting to see a subtle softness in demand.

- Inflation in key raw materials and manufacturing expenses is expected to continue.

- Uncertainty is driven by the current political climate and the lack of accountability within the federal governance structure. We just cannot have a capitalistic and growth environment without a common defense at the border and domestic tranquility across America.

- As a contract manufacturer for many different sectors, we see that home goods sales such as mattress subcomponents and comforters and pillows have consistently dropped and are half of what they were this time last year.

- We have been anticipating (and experiencing) a decline in business for several months now. The rate increases are starting to go too far.

- The inflation in paper prices has artificially increased our sales numbers as we pass on that doubling of raw material cost increases over the past few months. It is squeezing our clients’ budgets and will impact next year’s sales overall. Plus, as inflation hits every sector of our employees’ lives, the 5 percent pay increase we gave out early this year has been lost and they are getting further behind.

- Some international projects have come through, but there’s no big change in domestic projects.

- Inflation in raw material costs continues to be a drag on our profitability. We are unable to pass these costs on to our customers.

- Many items that were in short supply this spring are plentiful now.

- Overall business is down, especially in the building and construction market segment. Our industry is being severely impacted by competition from Mexico as well as Colombia, Ecuador, Malaysia, Vietnam, the Dominican Republic and Turkey. Mexico is exempt from Section 232 aluminum tariffs and is exporting to the U.S. at record levels. China is shipping aluminum products to Mexico at record levels, which has a negative impact on the U.S.

- Some raw materials are going down in cost; however, many other purchased components have had an increase in cost. Those levying surcharges have not removed those fees.

- Business is slowing. Companies are being more deliberate in how they spend money.

- We are still running strong and steady; however, we feel that the worsening economy will eventually catch up with us and may bring us back to reality.

- Biden's “Inflation Reduction Act” adds nearly a trillion dollars in government spending. Inflation occurs when too many dollars chase too few goods. So this will aggravate inflation. Mislabeling a bill doesn’t change the facts.

- Inflationary pressure is reducing orders while supply-chain pressure eases, so we have excess inventory for our customers. One customer is liquidating and will draw down their business. Several large customers with potential orders have delayed awards due to the market.

- We have seen a significant decrease in new orders, which is not sustainable [for us].

- Our business is shifting to cloud-based recurring revenue from premises-based system sales. This is the reason for our decrease in orders and inventory.

- We are still seeing issues with materials we source, particularly solar panels and products with aluminum. Lead times are four to six months in areas that had been two to four weeks.

- We saw weakness in the personal electronics market grow in the third quarter and began to see weakness in the industrial market space. We expect most markets to weaken in the fourth quarter, though an exception may be automotive.

- This year, new orders and business sales have been lower than last year and, looking forward to next year, I do not see an increase in sales for 2023.

- We continue to see long lead times and increased prices on components. A major customer has delayed or reduced capital spending for 2023, which moves projects (revenue) out for us six to 12 months.

- There is nothing positive to build on.

- Our production constraint has shifted from supply chain to labor. We cannot hire fast enough to increase production as fast as we would like to.

Historical Data

Historical data can be downloaded dating back to June 2004.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Manufacturing Outlook Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Manufacturing Outlook Survey is released on the web.