Federal dollars could drive electric vehicle charging across Texas

Surveys often find that consumers who are reluctant to switch to electric vehicles cite inadequate charging facilities. The recently approved federal Infrastructure Investment and Jobs Act seeks to address such concerns, providing funding to expand charging infrastructure along interstates and in rural areas.

A total of $7.5 billion is earmarked for construction of 500,000 chargers by 2030. Texas is set to receive more than $400 million over the next five years, the most funding of any state. This could roughly double the number of charging stations along interstates in Texas.

The new facilities will boost the number of direct-current chargers, the most powerful chargers available, which can “refill” even the largest batteries in around 30 minutes. Less-powerful chargers, while cheaper, are much slower and can require hours for a full recharge.

Infrastructure in Texas

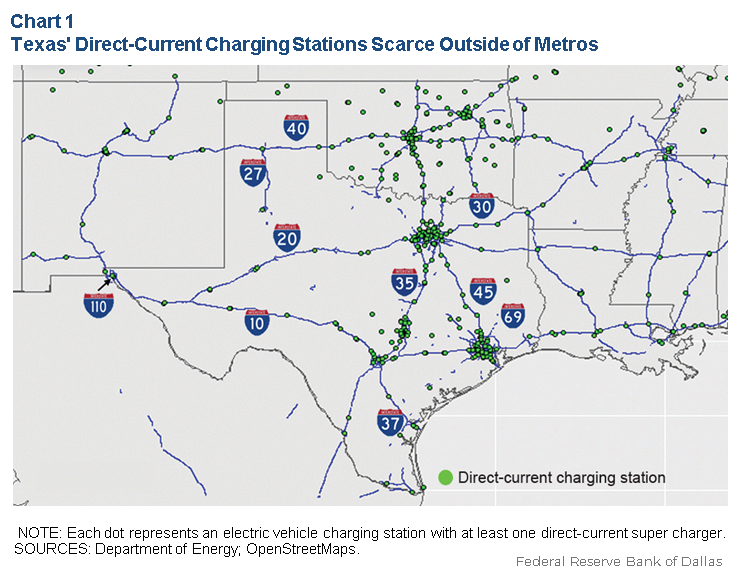

There are 266 charging stations with direct-current charging ports throughout the state.[1] Over 80 percent of those charging stations are in the vicinity of the Dallas–Fort Worth, Houston, Austin and San Antonio metropolitan areas (Chart 1). The remainder are scattered across the state, primarily along interstates.

The fast chargers are concentrated in the largest metros because that’s where most electric vehicles are—data show that these areas account for more than 85 percent of the roughly 88,000 battery-powered electric vehicles registered in Texas.[2]

Expanding Charging Access

The small number of electric vehicles in rural areas reduces the economic incentives for building commercial charging stations there. As a result, infrastructure remains sparse in rural Texas and, more generally, in most neighboring states.

At the same time, the lack of charging infrastructure is believed to hold back electric vehicle adoption—the scarcity of facilities makes electric ownership less convenient for those unable to charge at home or at work. Additionally, while electric vehicle range has increased dramatically in recent years, surveys have found that consumers remain concerned about recharging during long trips away from home.[3]

For the 2021 model year, gasoline-powered cars had a median range of about 400 miles on a tank of gas; most electric vehicles go 60 to 80 percent of that distance on a charge.

A total of $5 billion has been allocated to fast-charging infrastructure, requiring stations with at least four direct-current, fast-charging ports at least every 50 miles along interstates. Another $2.5 billion will support charging in rural areas and other underserved communities.

States must submit final charging-station plans to the Joint Office of Energy and Transportation by Aug. 1, 2022, to be reviewed and approved by the Federal Highway Administration by Sept. 30, 2022.

Though the Texas Department of Transportation is still in the planning process, the agency has identified numerous “study areas” along major interstates and in nearly every county in Texas where new charging stations might be placed.

Subsequent planning and installation could take up to 18 months, but greater accessibility to charging infrastructure appears likely.

Notes

- National Renewable Energy Laboratory, U.S. Department of Energy, accessed May 25, 2022.

- State EV Registration Dashboard for Texas, Atlas Public Policy's EV Hub, accessed May 25, 2022.

- “U.S. Electric Vehicle Experience Ownership Study,” J.D. Power, accessed May 25, 2022.

About the Authors

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: https://www.dallasfed.org/research/swe/2022/swe2202.