Mexico’s Economic Activity Flat in 2019; Modest Growth Expected in 2020

January 31, 2020

Mexico’s gross domestic product (GDP) declined 0.2 percent through third quarter 2019. The consensus GDP growth forecast for 2019, compiled by Banco de México, remained at 0.0 percent in December.[1] Growth for 2020 is forecast to be 1.1 percent.

Other data were mixed. Latest data available show the monthly economic activity index and industrial production increased, while exports and retail sales fell. Employment growth strengthened but remained below average. Inflation declined as the peso gained ground against the dollar in December.

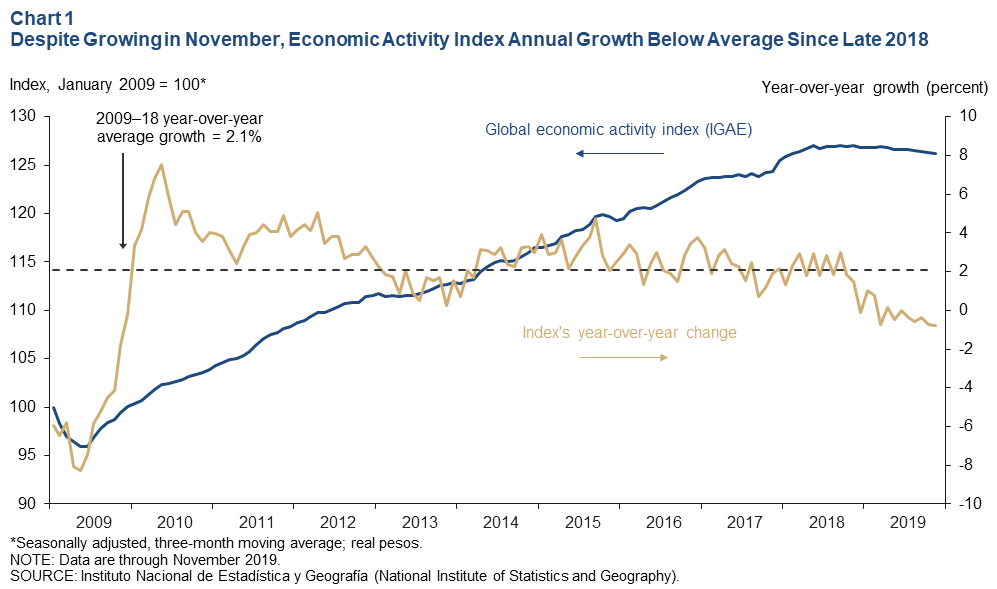

Economic Activity Up in November, Year-Over-Year Growth Weak

Mexico’s global economic activity index, the monthly proxy for GDP, rose 0.1 percent in November after falling 0.4 percent in October. The index’s three-month moving average declined 0.1 percent (Chart 1). Service-related activities (including trade and transportation) were flat in November. Goods-producing industries (including manufacturing, construction and utilities) increased 0.8 percent. Agricultural output fell 2.0 percent. The index was down 0.8 percent year-over-year in November.

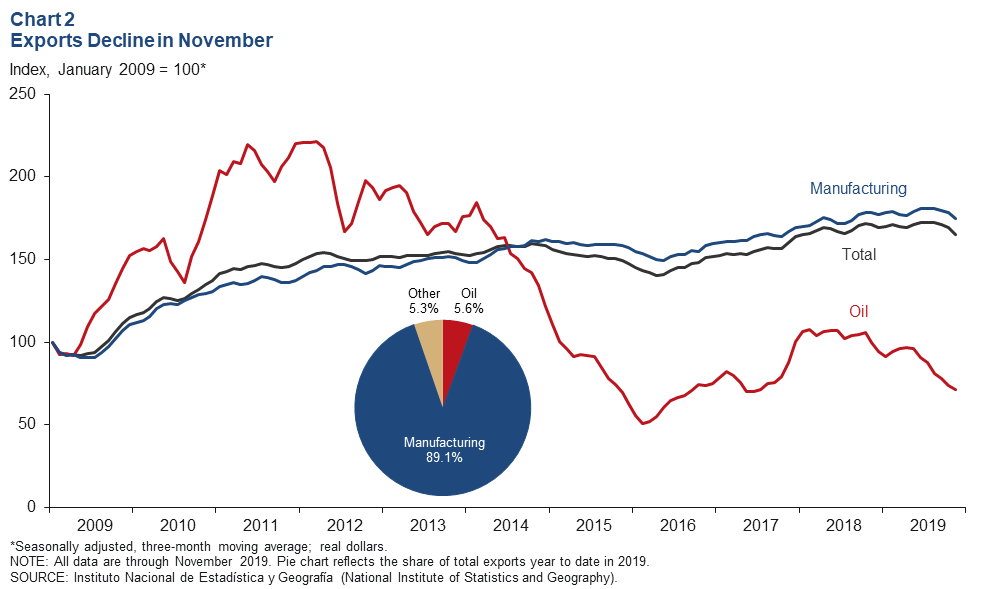

Exports Continue to Fall

Total exports fell 1.4 percent in November after decreasing 0.1 percent in October. Manufacturing exports decreased 1.8 percent in November after falling 0.2 percent in October. Three-month moving averages have shown a steady decline in oil exports since May and flat-to-down activity in manufacturing and total exports (Chart 2). Consistent with the recent weakness, total exports were up only 0.9 percent through November, compared with the same period in 2018, as manufacturing exports grew 2.1 percent but oil exports fell 18.0 percent.

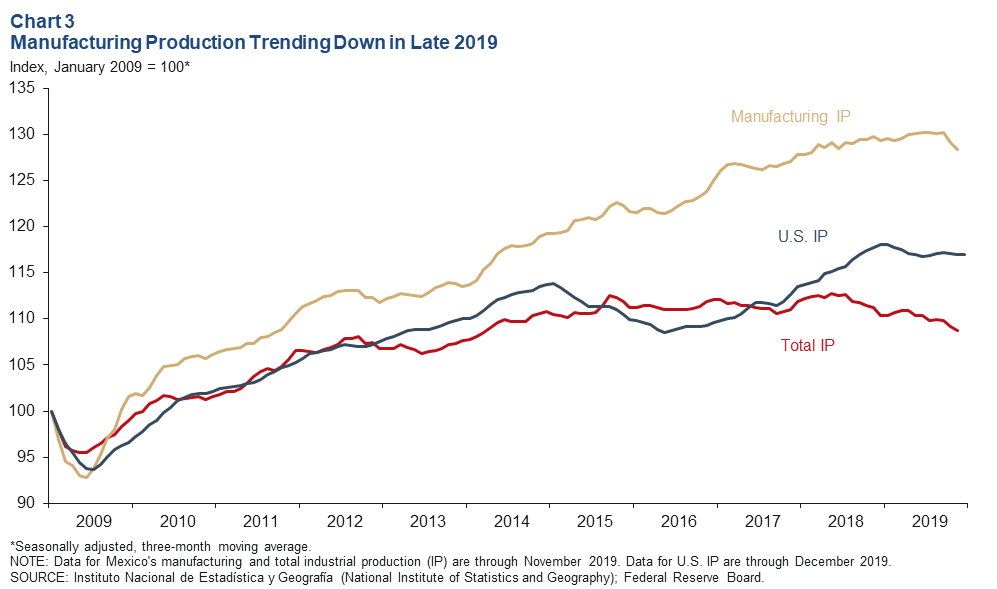

Industrial Production Edges Up in November

Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—increased 0.8 percent in November after falling 1.5 percent in October. The manufacturing index rose 0.2 percent in November after decreasing 2.4 percent in October. The three-month moving average of manufacturing IP has been trending down for the last three months (Chart 3). The recent manufacturing slowdown is partly due to General Motors’ strike during September and October, the longest since 1970. North of the border, U.S. IP declined 0.4 percent in December after rising 0.8 percent in November. The correlation between IP in Mexico and the U.S. increased considerably with the rise of intra-industry trade after the implementation of the 1994 North American Free Trade Agreement.

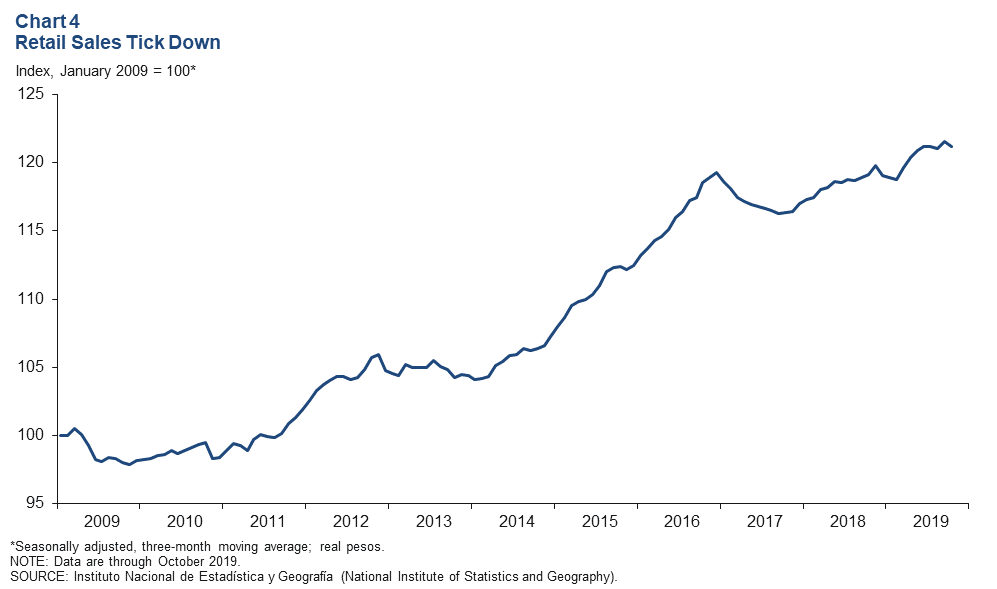

Retail Sales Decrease in October

Real retail sales declined 2.3 percent in October after rising 1.1 percent in September. The three-month moving average ticked down 0.3 percent after increasing 0.4 percent in September (Chart 4). Meanwhile, retail sales are up 2.0 percent since December 2018.

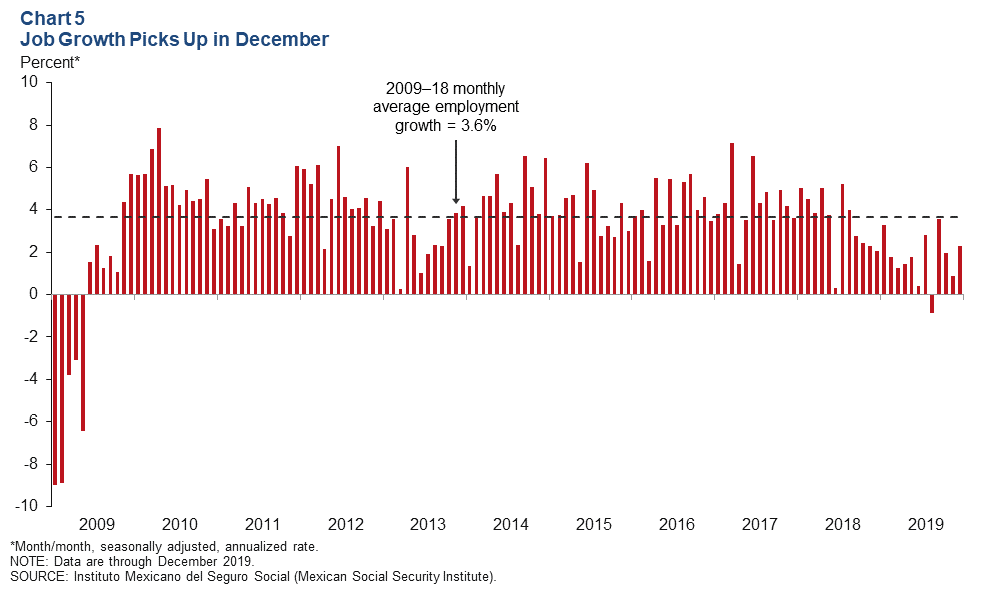

Employment Growth Remains Positive but Below Average

Formal sector employment—jobs with government benefits and pensions—grew an annualized 2.3 percent in December, well below the 10-year average of 3.6 percent (Chart 5). Year-over-year employment grew 1.7 percent, the slowest annual job growth since the end of the Great Recession. Meanwhile, total employment, representing 55 million workers and including informal sector jobs, grew 2.2 percent in third quarter 2019, slightly above its 10-year average of 2.0 percent. The unemployment rate in December was 3.1 percent, down from 3.6 percent a year earlier.

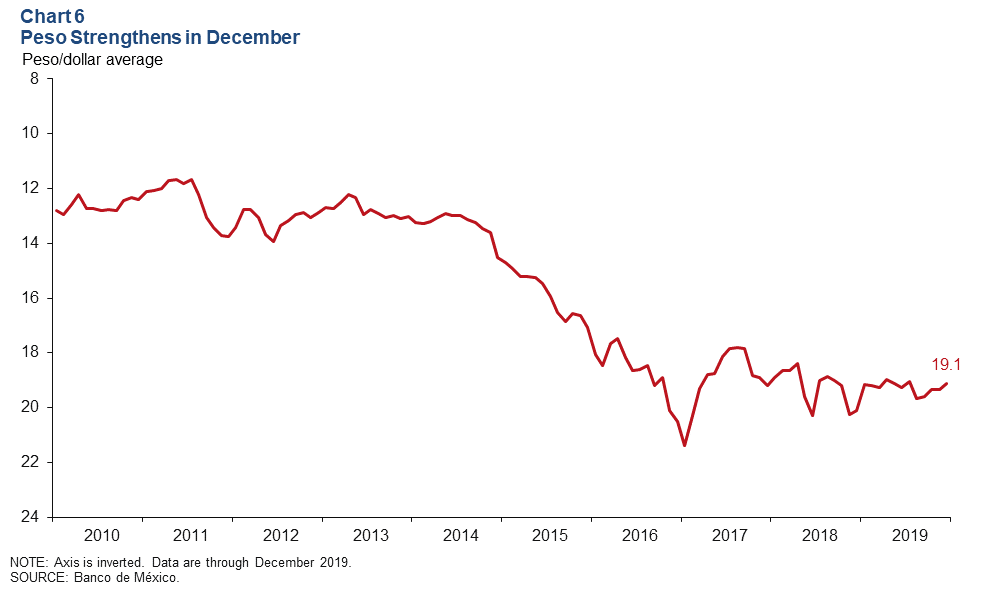

Peso Gains Ground Against the Dollar in December

The Mexican currency averaged 19.1 pesos per dollar in December (Chart 6). The peso has gained 5.3 percent against the dollar since December 2018. The Mexican currency has been under pressure due to increased uncertainty regarding U.S. trade policy and Mexico’s domestic policy. Nevertheless, it closed the year without significant variation.

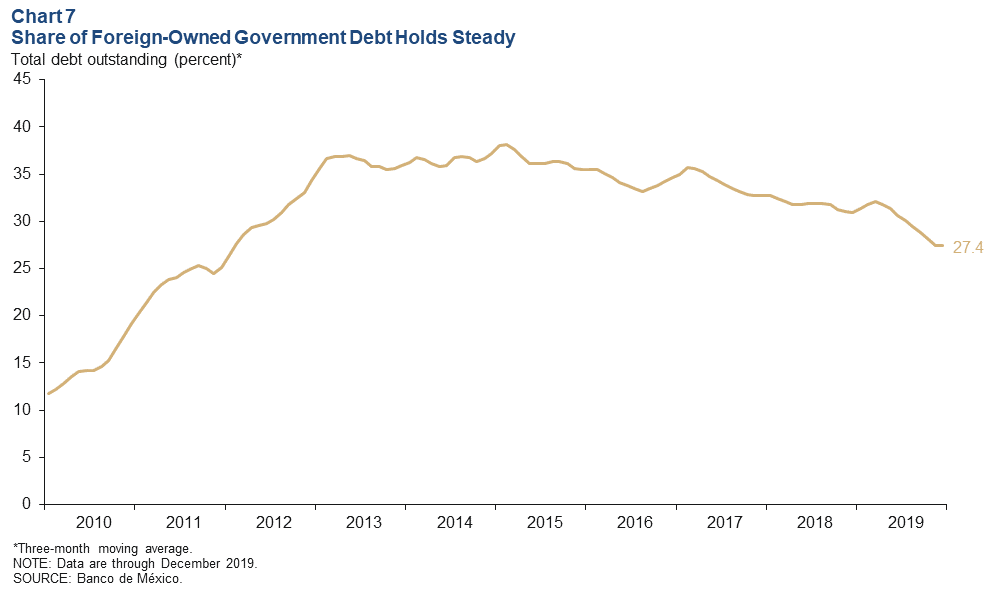

Foreign-Owned Government Debt Ticks Up

The share of peso‐denominated Mexican government debt held abroad rose to 28.3 percent in December. However, the three-month moving average remained at 27.4 percent, its lowest level since early 2012 (Chart 7). The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors but is also a sign of confidence in the Mexican economy.

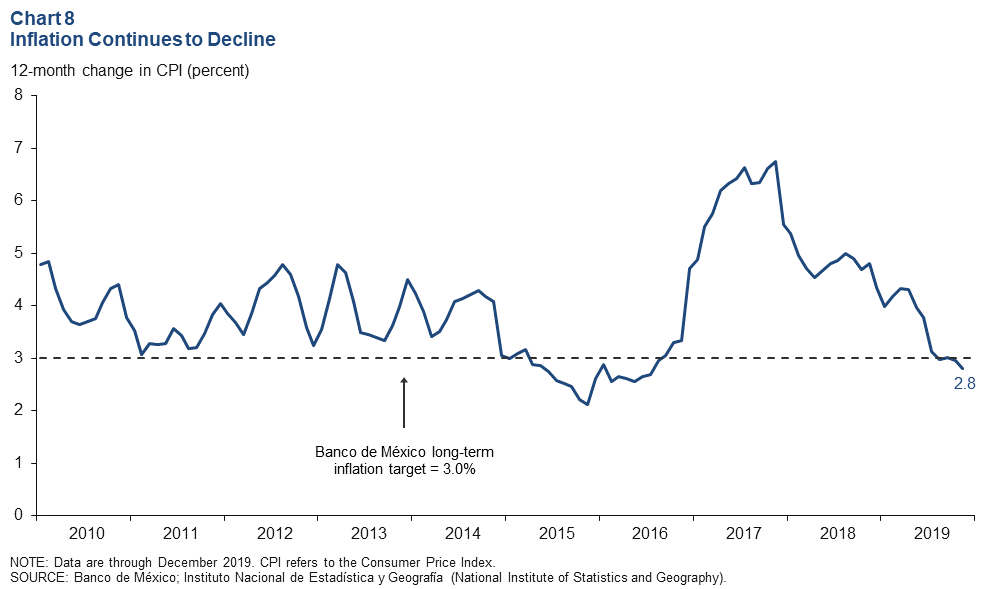

Inflation Falls in December

The Consumer Price Index (CPI) increased 2.8 percent over the prior 12 months in December, down from 2.9 percent in November (Chart 8). CPI core inflation (excluding food and energy) rose 3.6 percent over the previous 12 months in December. Mexico’s central bank lowered its benchmark interest rate by 25 basis points to 7.25 percent in December. The central bank cited slowing inflation, increasing slack in the economy and the behavior of external and domestic yield curves.

Note

- Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Diciembre de 2019 (communiqué on economic expectations, Banco de México, December 2019).

About the Authors

Cañas is a senior business economist, and Smith is a research assistant in the Research Department at the Federal Reserve Bank of Dallas.