Mexico’s First-Quarter Growth Revised Up; Outlook Deteriorates

June 24, 2020

Mexico’s gross domestic product (GDP) contracted an annualized 4.9 percent in first quarter 2020, a smaller decline compared with its preliminary estimate reported at the end of April. However, the outlook worsened. The GDP growth forecast for 2020, compiled by Banco de México, was revised down from -7.1 percent in April to -8.0 percent in May due to the combined impacts of COVID-19 and low oil prices on the Mexican economy. [1]

The latest data available show that exports, industrial production, employment and retail sales fell. Inflation increased, and the peso gained ground against the dollar in May.

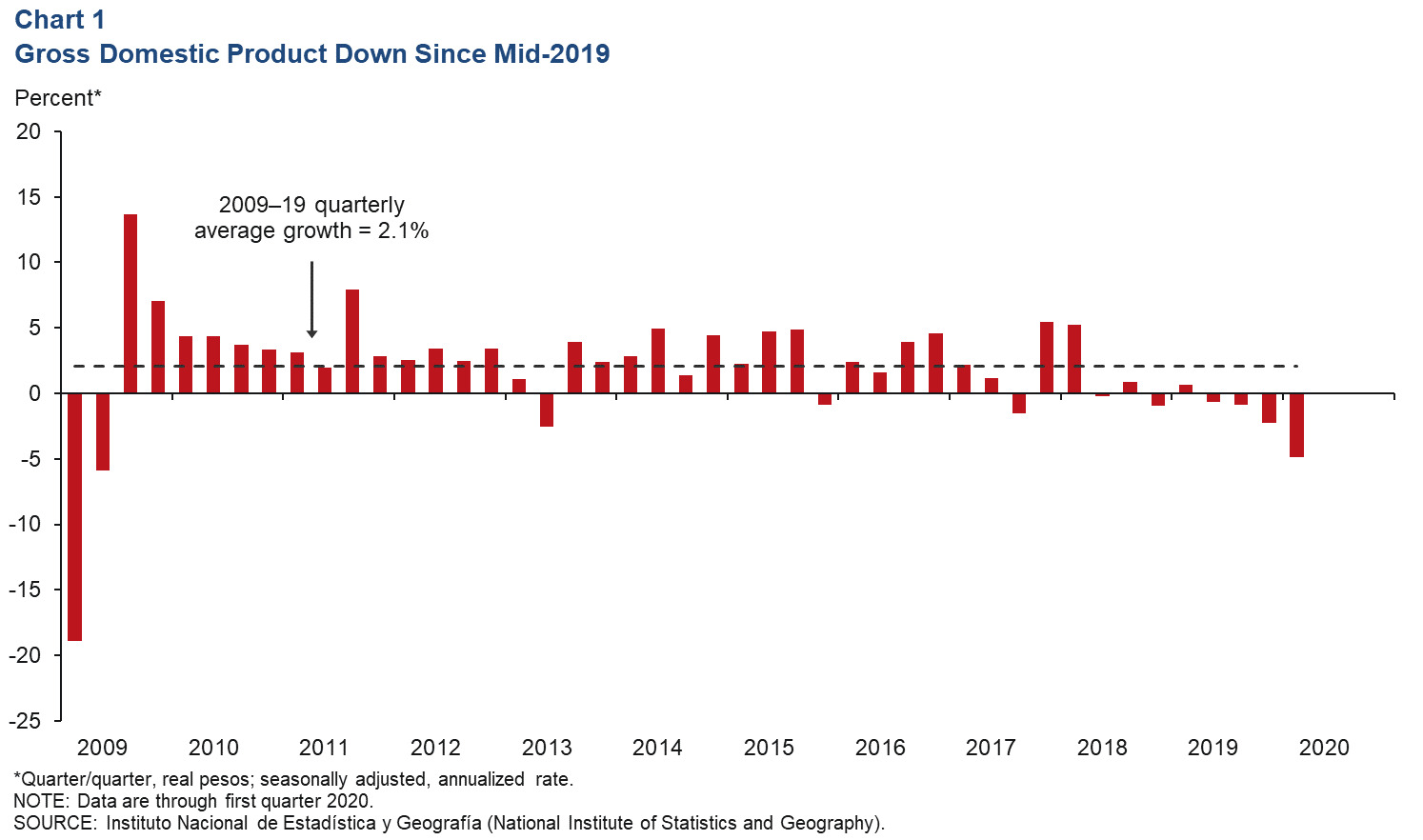

First-Quarter Output Revised Up

Mexico’s first-quarter GDP dropped an annualized 4.9 percent, revised up from its previous estimate of -6.2 percent (Chart 1). Output from goods-producing industries (manufacturing, construction, utilities and mining) fell 4.9 percent, while service-related activities (wholesale and retail trade, transportation and business services) fell 3.5 percent. Agricultural output rose 7.2 percent.

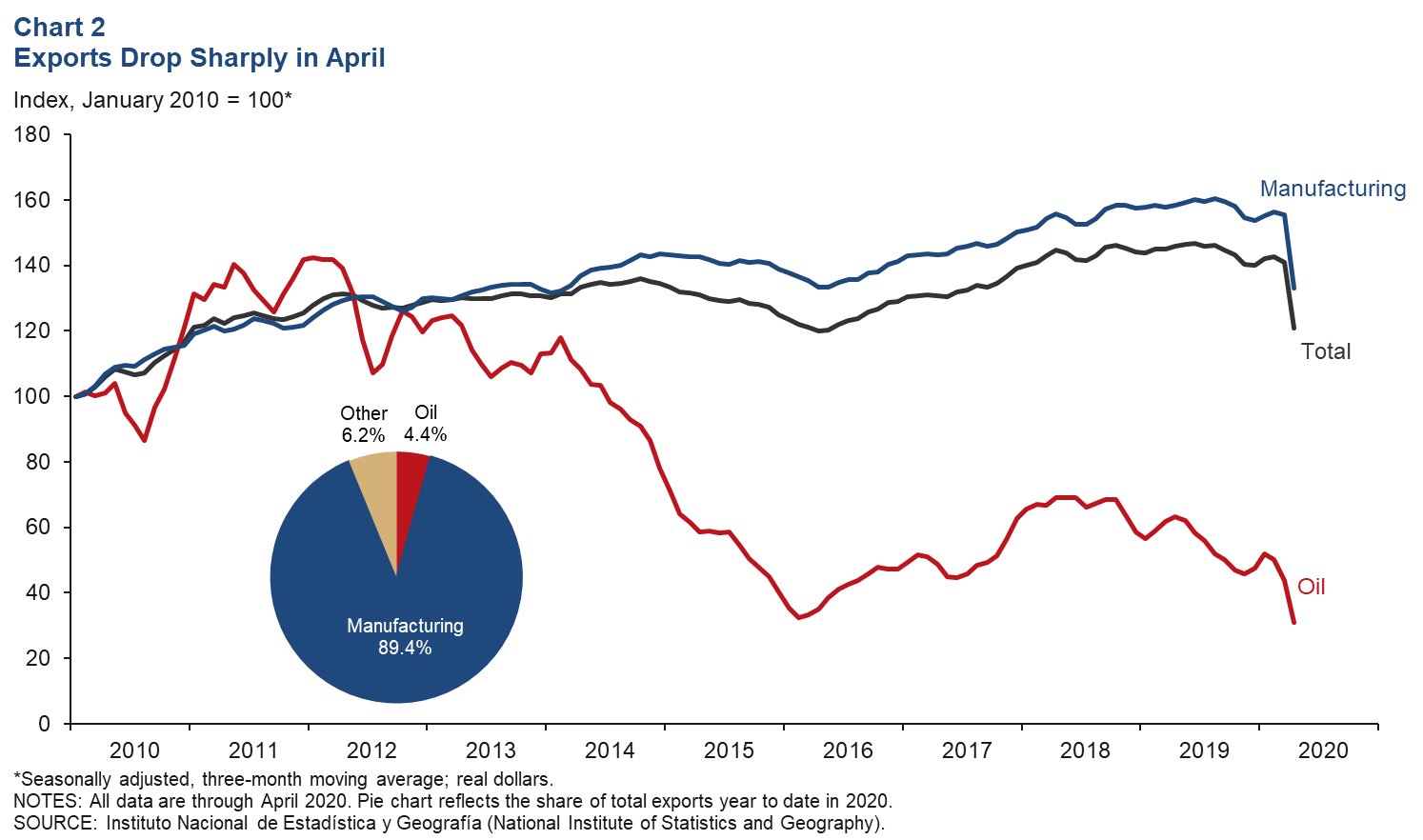

Exports Contract Further

The three-month moving average of total exports plunged 14.3 percent in April, as oil exports fell 29.0 percent, and manufacturing exports contracted 14.4 percent (Chart 2). On a month-over-month basis, total exports fell 37.2 percent in April, and manufacturing exports declined 39.2 percent. Through April, exports fell 12.6 percent, compared with the same period in 2019, as manufacturing exports declined 11.9 percent and oil exports slipped 38.9 percent.

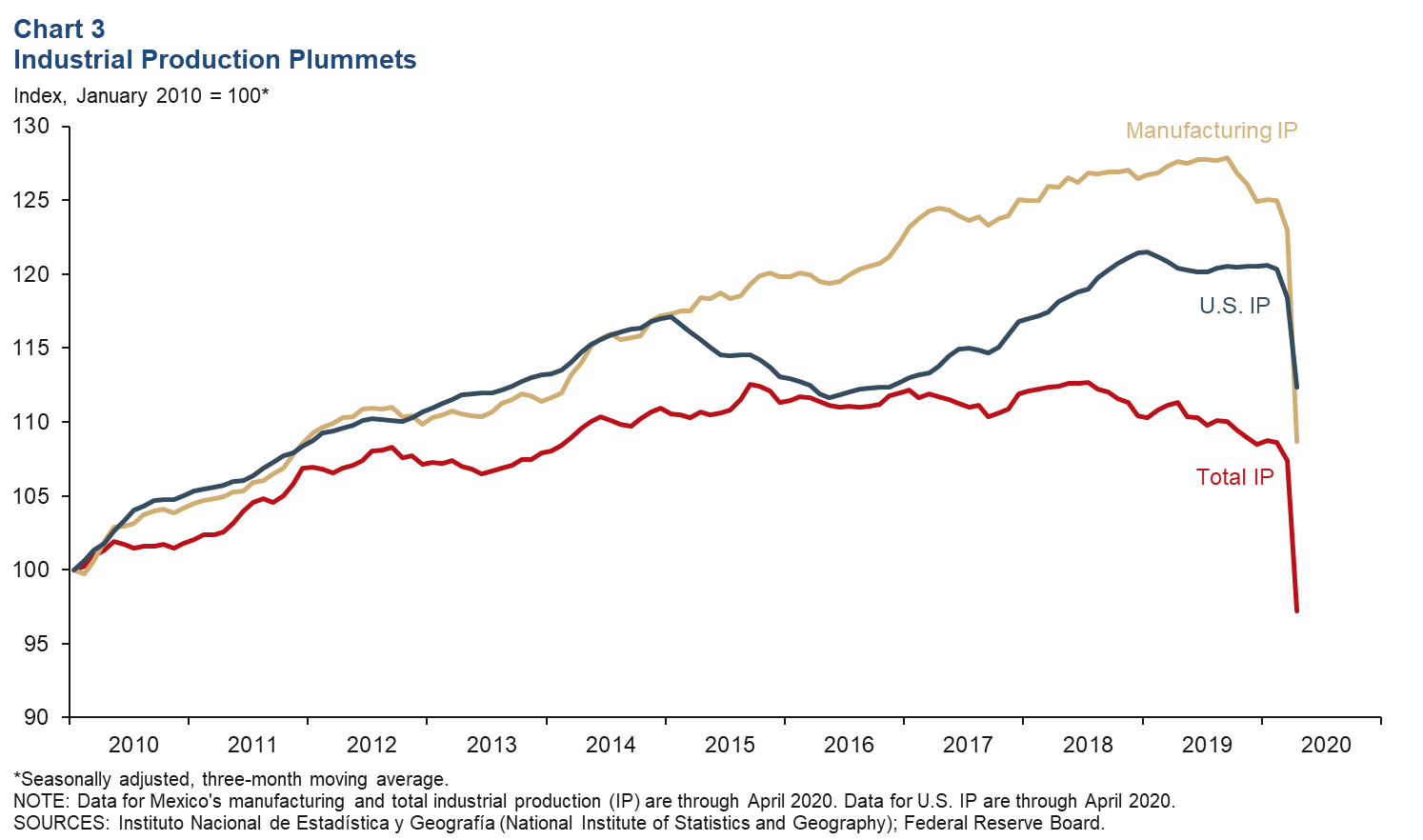

Industrial Production Continues to Slide

Mexico’s industrial production (IP) three-month moving average (February–April) index—which includes manufacturing, construction, oil and gas extraction, and utilities— dipped 9.4 percent, and manufacturing was down 11.6 percent (Chart 3). On a month-over-month basis, IP fell 25.1 percent in April, while the manufacturing index contracted 30.5 percent. North of the border, U.S. IP decreased 11.2 percent in April after falling 4.6 percent in March. The correlation between IP in Mexico and the U.S. increased considerably with the rise of intra-industry trade after the implementation of the 1994 North American Free Trade Agreement.

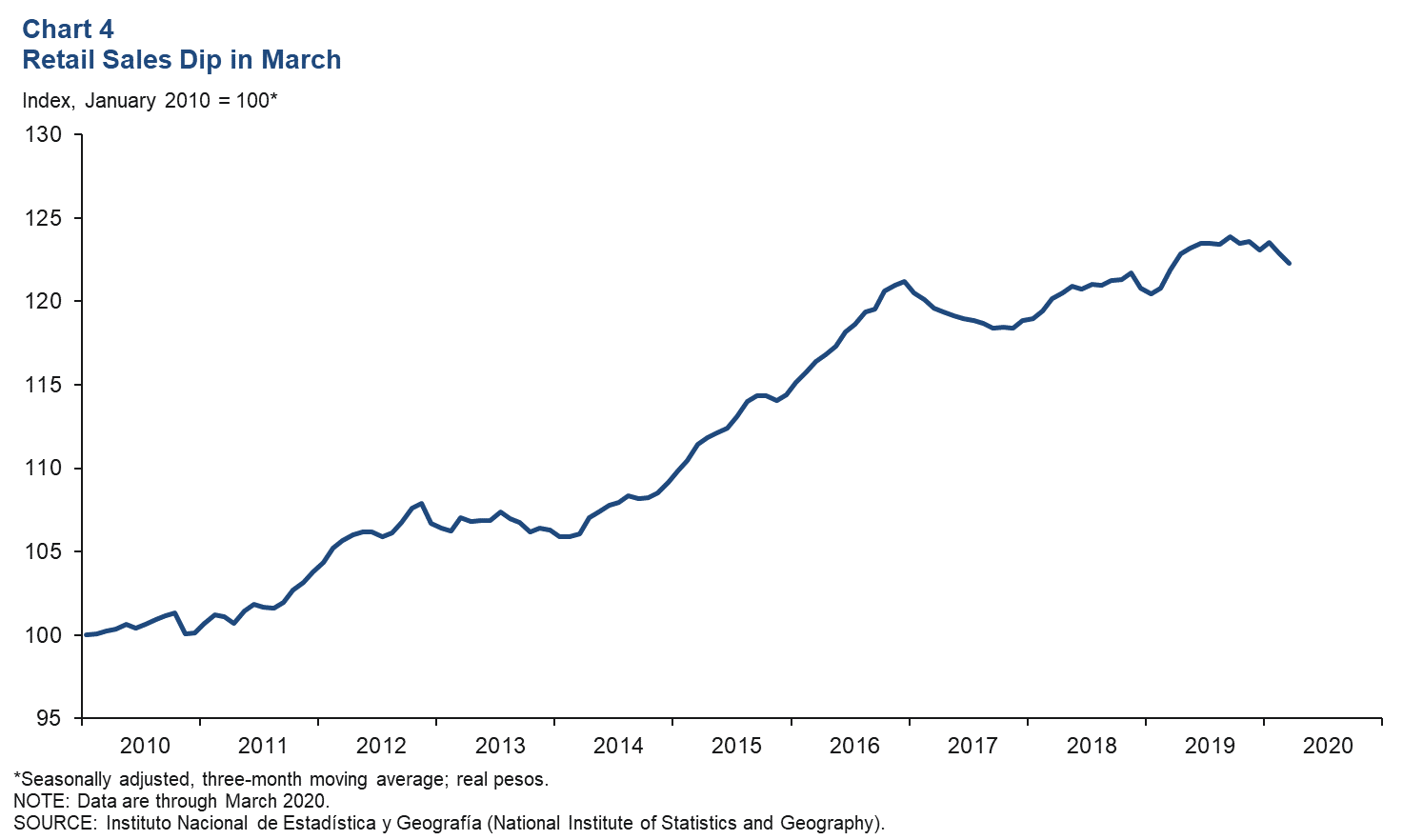

Retail Sales Worsen

The real retail sales three-month moving average (January–March) index decreased 0.5 percent (Chart 4). On a month-over-month basis, retail sales fell 0.8 percent in March. Since December 2019, the retail sales index has dipped 1.6 percent.

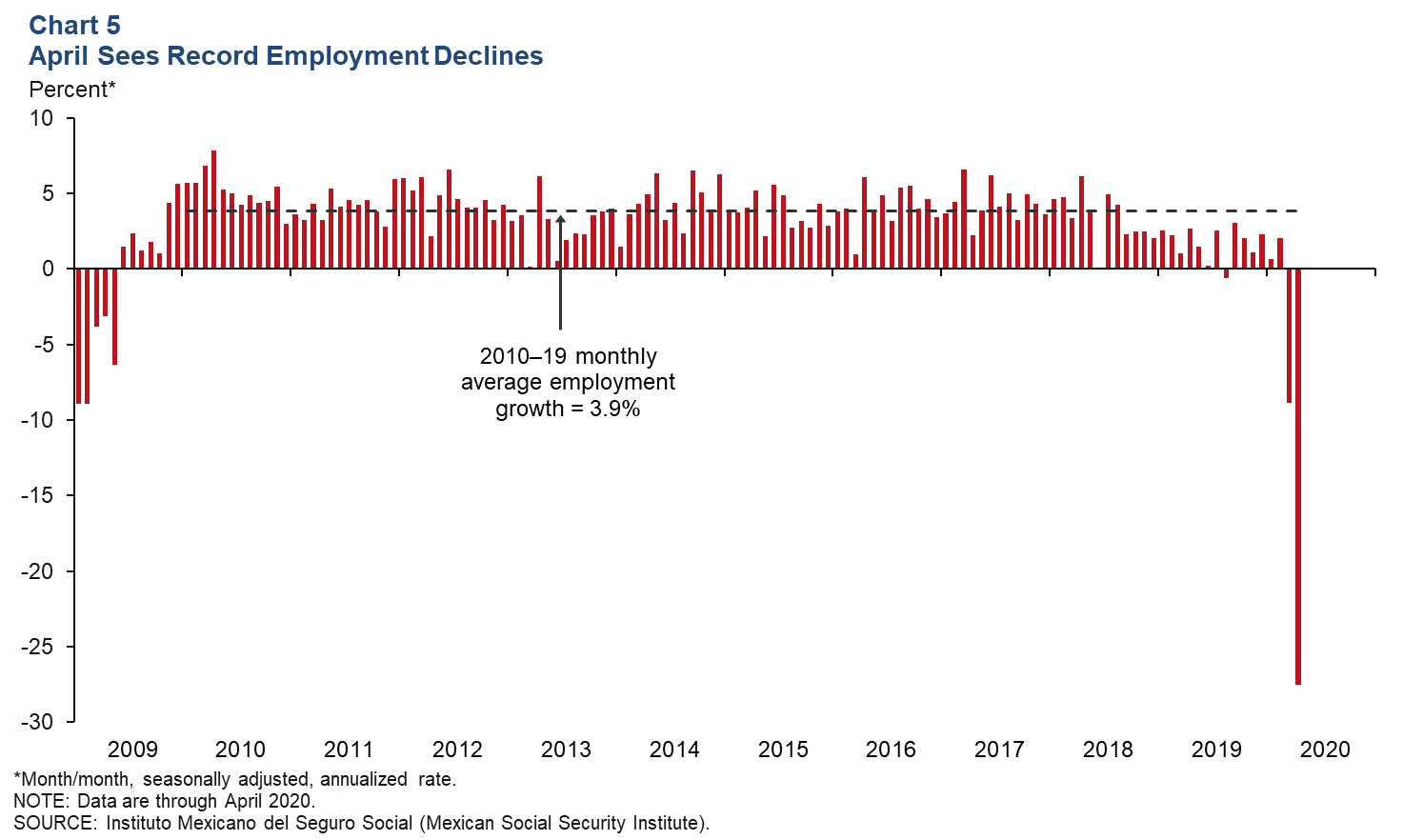

Employment Plummets

Formal sector employment—jobs with government benefits and pensions—fell an annualized 27.5 percent in April, its sharpest decline since the series began in 1994 (Chart 5). Year-over-year employment contracted 2.2 percent in April, the first annual contraction since the end of the Great Recession. Meanwhile, total employment, representing 55 million workers and including informal sector jobs, grew 2.2 percent year over year in first quarter 2020, above its 10-year average of 1.9 percent. The unemployment rate in March was 3.3 percent, down from 3.6 percent a year earlier.

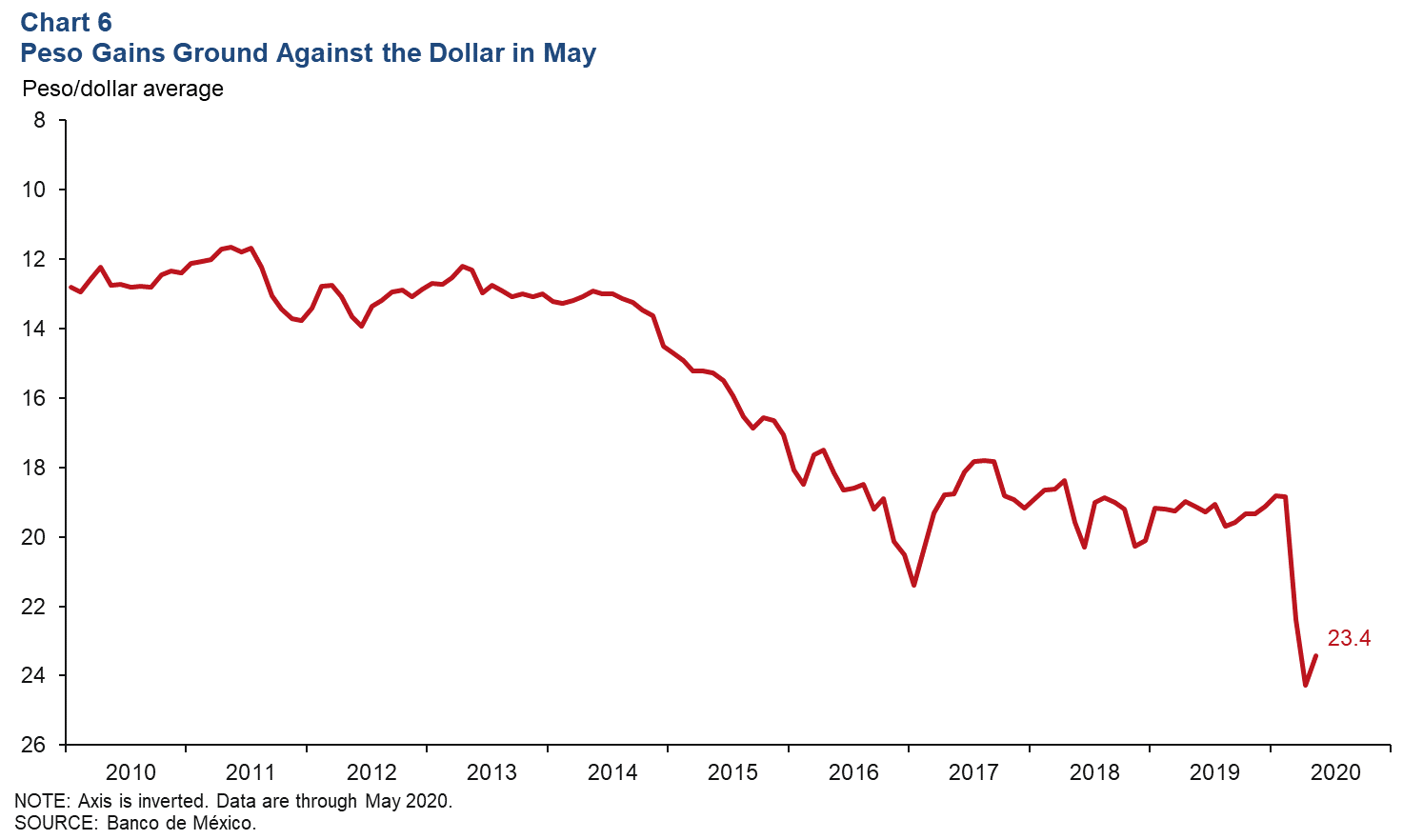

Peso Strengthens Somewhat in May

The Mexican currency averaged 23.4 pesos per dollar in May, up 3.6 percent from April (Chart 6). The peso has depreciated 18.4 percent against the dollar since December 2019. The Mexican peso has been under pressure due to increased uncertainty regarding how COVID-19 will affect domestic and global growth.

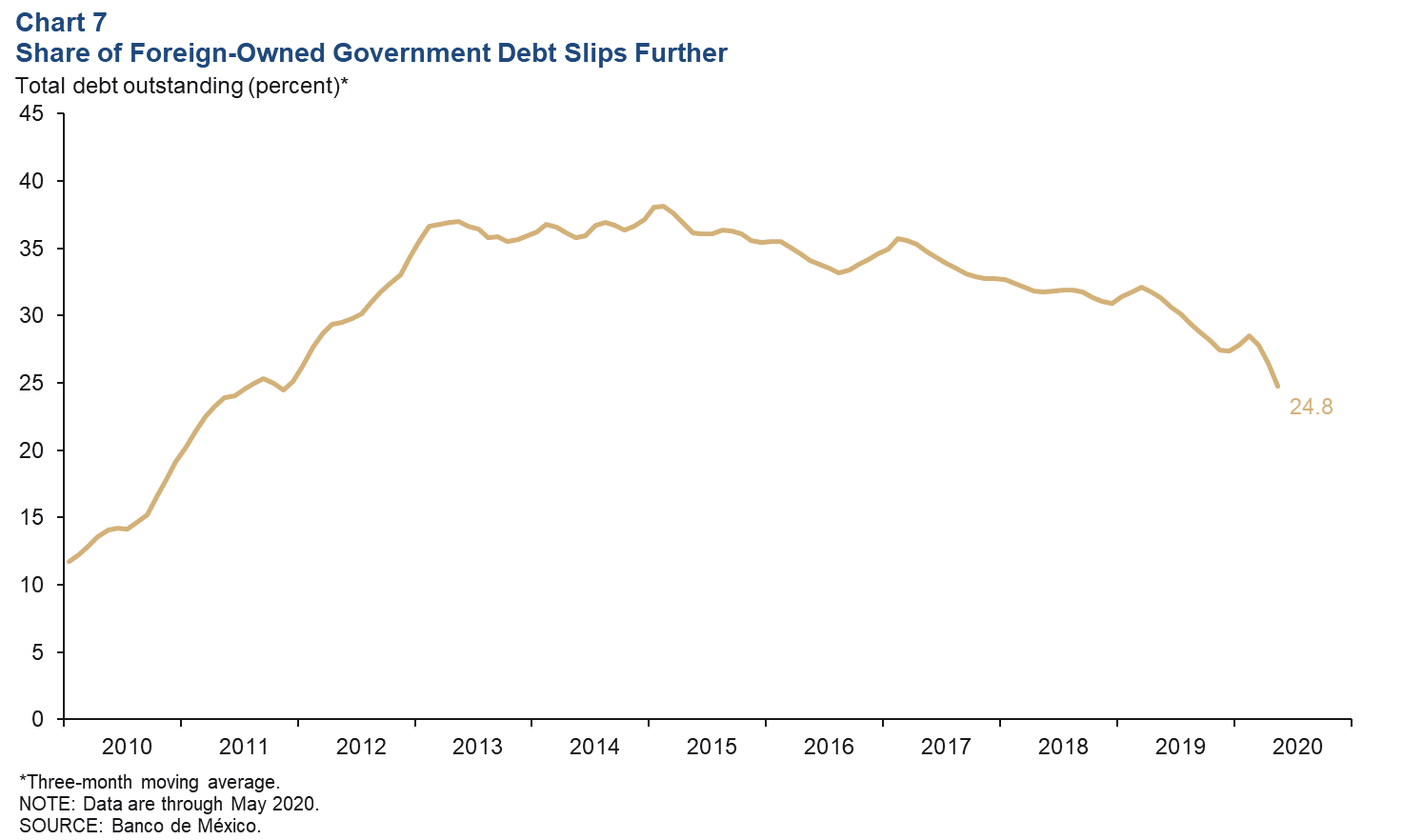

Foreign-Owned Government Debt Share Decreases

The share of peso‐denominated Mexican government debt held abroad fell to 23.7 percent in May. The three-month moving average fell to 24.8 percent (Chart 7). The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and is also a sign of confidence in the Mexican economy.

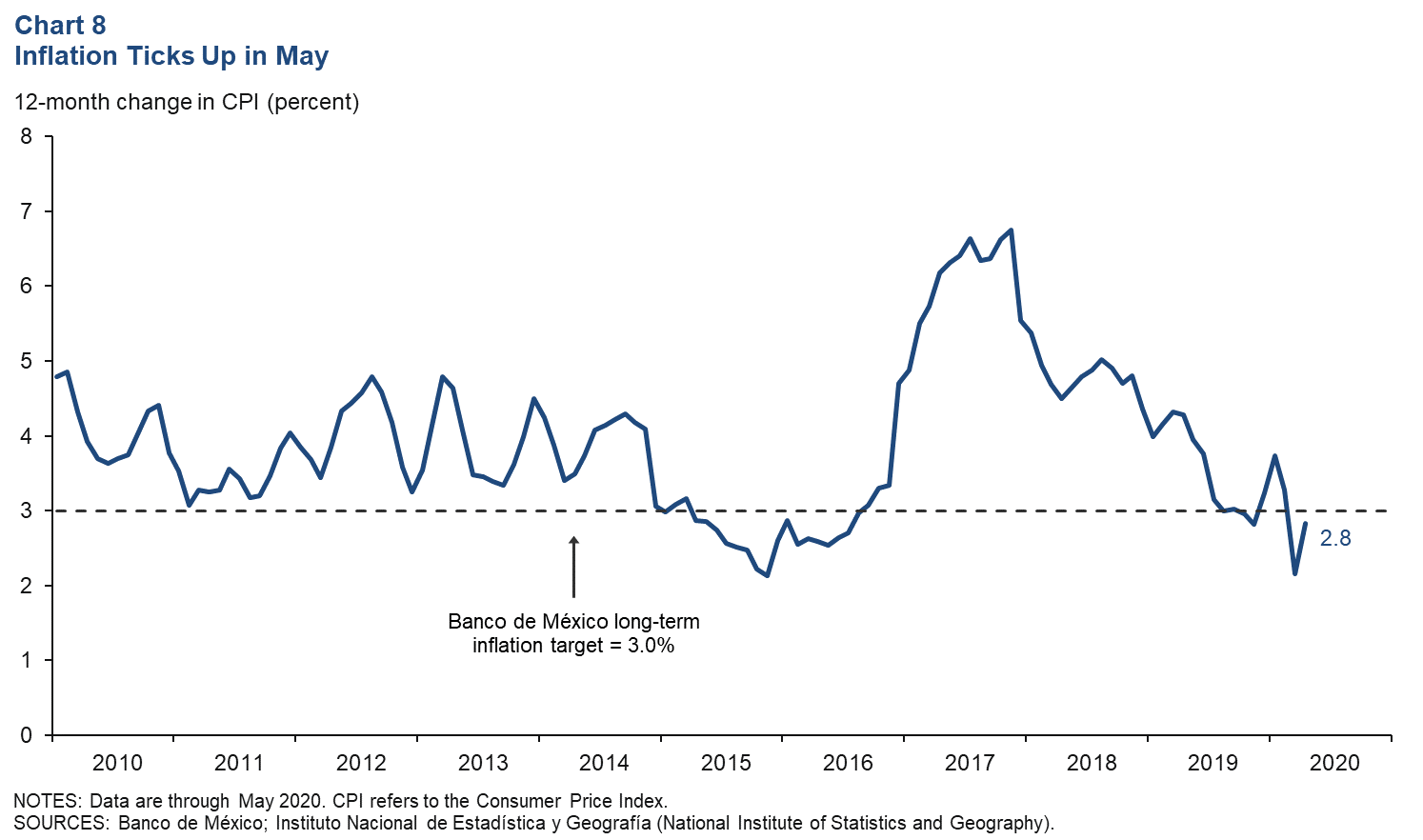

Inflation Rises

Mexico’s consumer price index (CPI) increased 2.8 percent in May over the prior 12 months, up from 2.2 percent in April (Chart 8). CPI core inflation (excluding food and energy) rose 3.6 percent over the previous 12 months in May. Banco de México reduced the benchmark interest rate by 50 basis points to a three-year low of 5.5 percent on May 14. Officials had already surprised markets with a one-half-percentage-point cut on April 21. In making its rate cut, Mexico’s central bank cited the financial market volatility, stemming from uncertainty regarding the impact of COVID-19 on world economic activity.

Notes

- Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Mayo de 2020, (communiqué on economic expectations, Banco de México, May 2020). The survey period was May 16–28.

About the Authors

Cañas is a senior business economist, and Smith is a research analyst in the Research Department at the Federal Reserve Bank of Dallas.