Mexico’s economy picks up at start of 2022

March 31, 2022

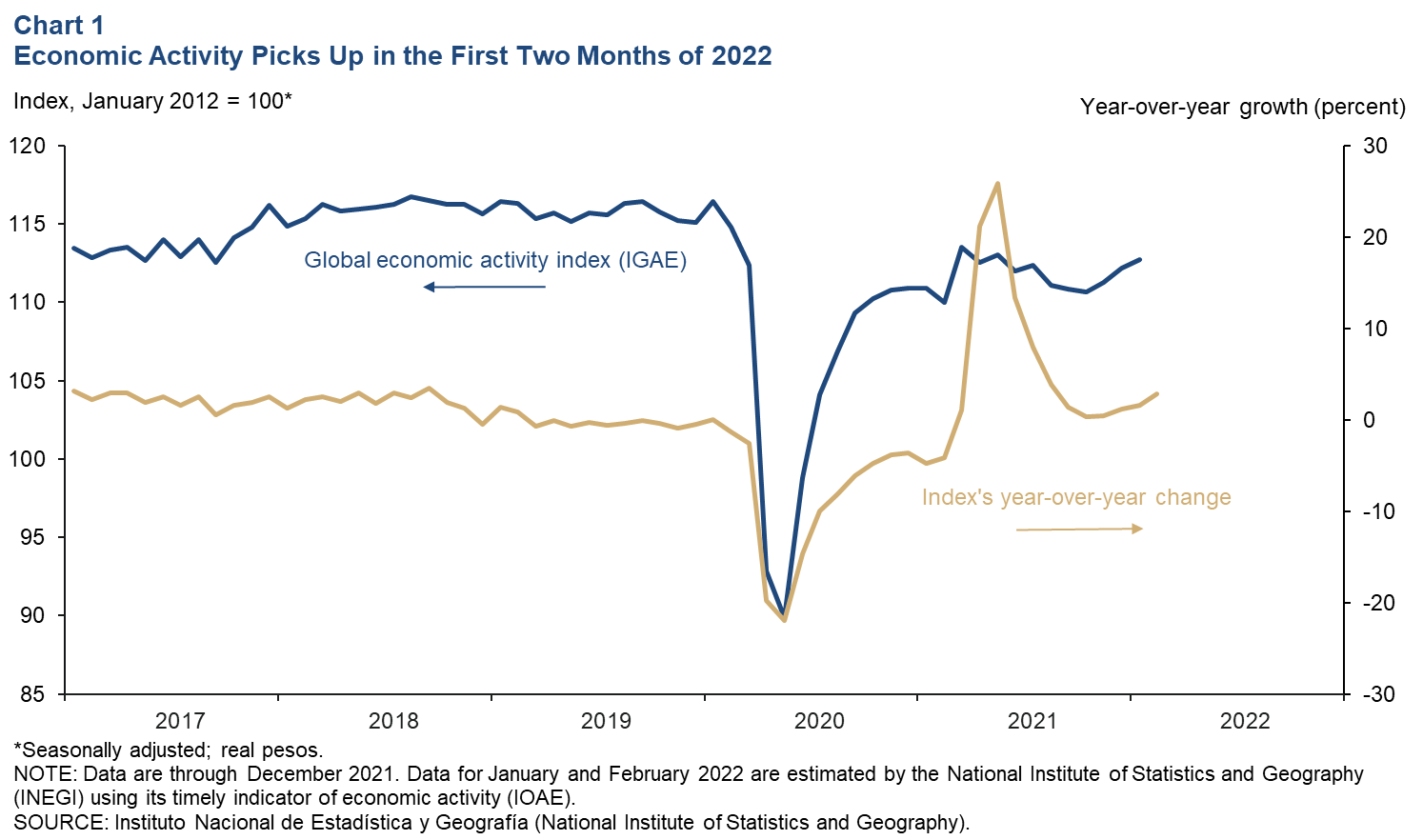

Revised estimates indicate that Mexico’s GDP grew an annualized 0.1 percent in fourth quarter 2021 after falling 2.8 percent in the third quarter. As a result, GDP grew 1.1 percent in 2021 (fourth quarter/fourth quarter). Furthermore, Mexico’s global economic activity index—the monthly proxy for GDP growth—shows a pickup in activity during the first two months of 2022.

The consensus forecast for 2022 GDP growth, compiled by Banco de México, remained 2.6 percent in February (fourth quarter/fourth quarter).[1]The latest data available show that industrial production, retail sales and employment grew, while exports ticked down. The peso held steady in February against the dollar, but inflation remained elevated.

New COVID-19 cases in Mexico continued to decline, nearing pre-omicron levels. The vaccination rate rose further and now encompasses 62 percent of the population.

Economic activity improves

Year-over-year growth in the global economic activity index (IGAE) improved from 1.6 percent in January to 2.8 percent in February (Chart 1). Service-related activities (including trade and transportation) grew 1.6 percent in February from year-ago levels after expanding 0.5 percent in January. Goods-producing industries (including manufacturing, construction and utilities) increased 3.5 percent in February after expanding 12.7 percent in January. It bears noting that the IGAE also rose on a month-over-month basis.

Industrial Production Expands

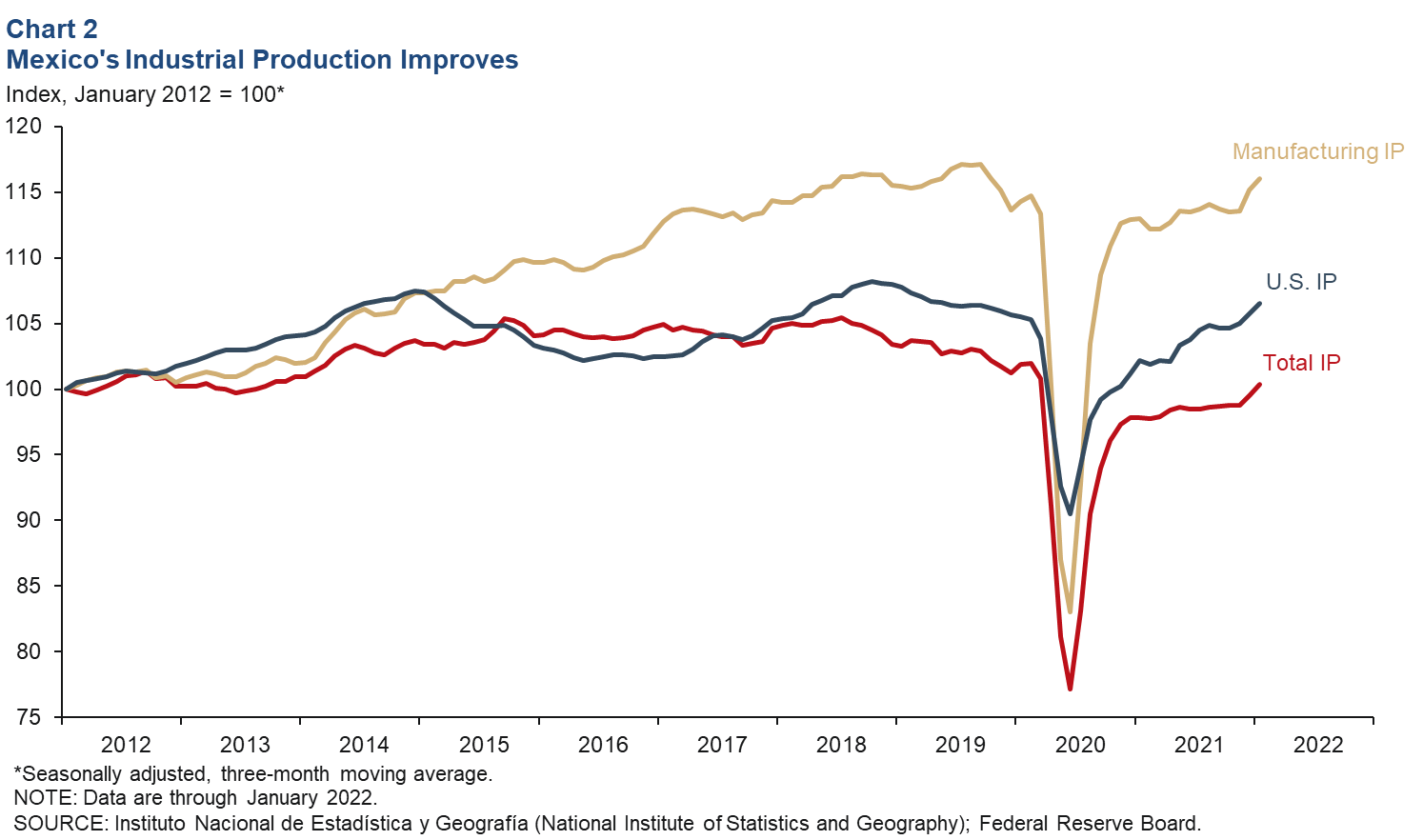

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—improved in January from December (Chart 2). On a month-over-month and unsmoothed basis, IP was up 1.0 percent in January, while manufacturing IP was up 0.3 percent. North of the border, U.S. IP increased 1.5 percent in January after decreasing 0.1 percent in December. The correlation between IP in Mexico and the U.S. increased considerably with the rise of intra-industry trade between the two countries since the early 1990s.

Exports decline slightly

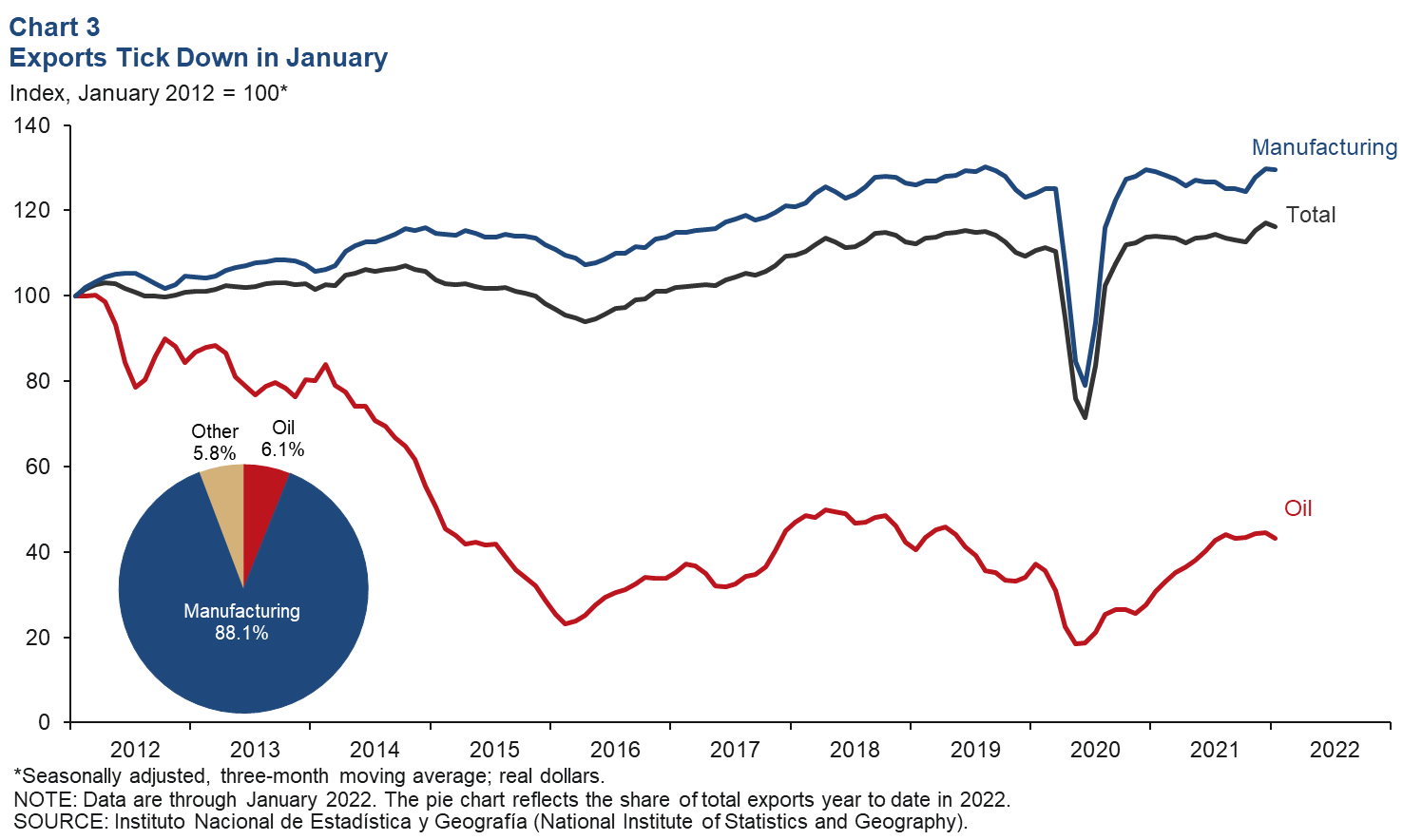

The three-month moving average of total exports declined 0.6 percent in January from December as oil exports fell 3.0 percent and the much-larger manufacturing category fell 0.3 percent (Chart 3). On a month-over-month and unsmoothed basis, total exports contracted 5.9 percent in January; oil exports fell 1.5 percent, and manufacturing exports fell 6.3 percent. Mexico’s total monthly exports in January were 9.1 percent above prepandemic levels (February 2020) and 2.8 percent higher than 12 months prior.

Retail sales strengthen

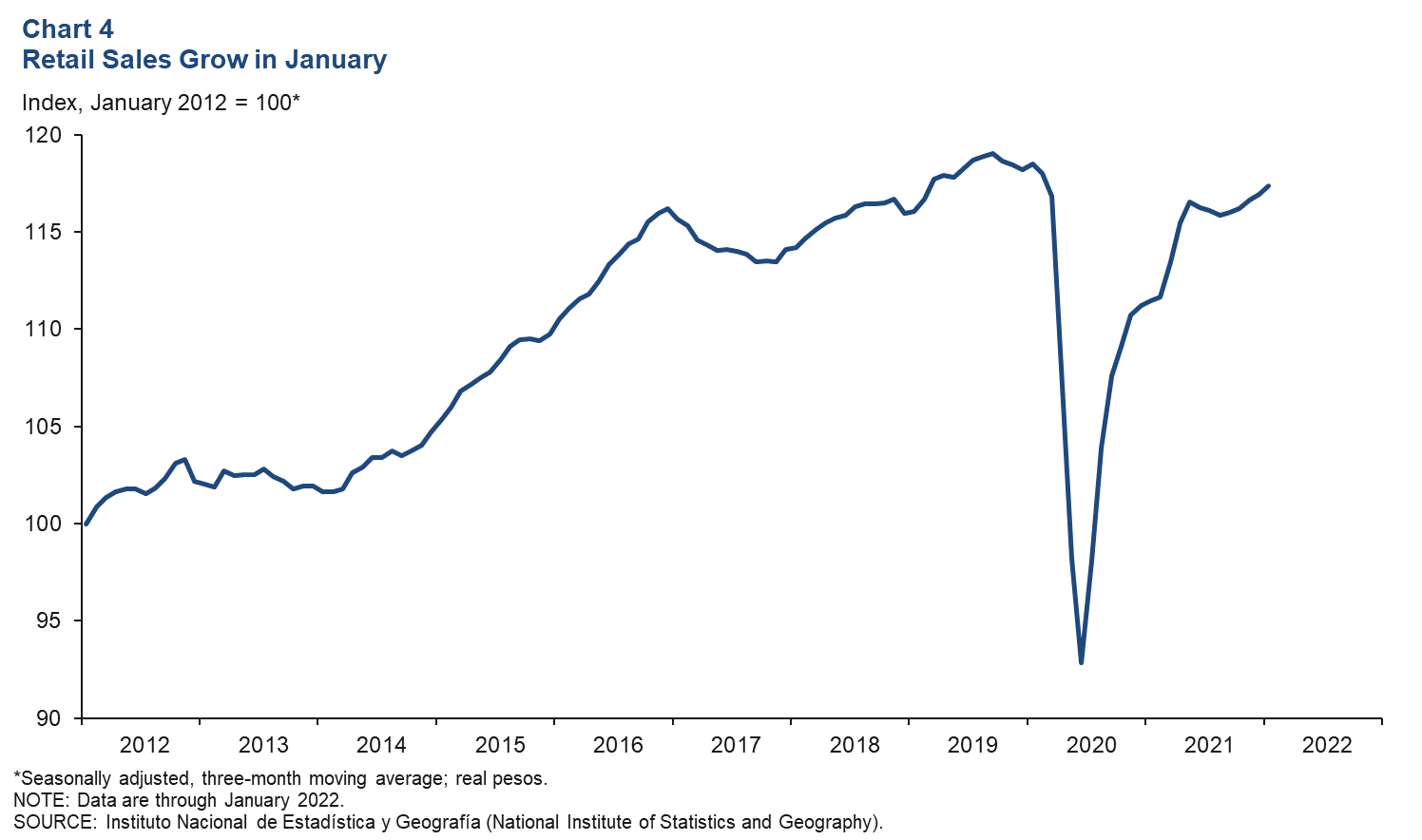

The index of real Mexico retail sales increased 0.4 percent month-over-month based on a three-month moving average through January (Chart 4). On a month-over-month and unsmoothed basis, retail sales grew 0.6 percent in January after coming in flat in December. In January, retail sales finally reached prepandemic levels (February 2020).

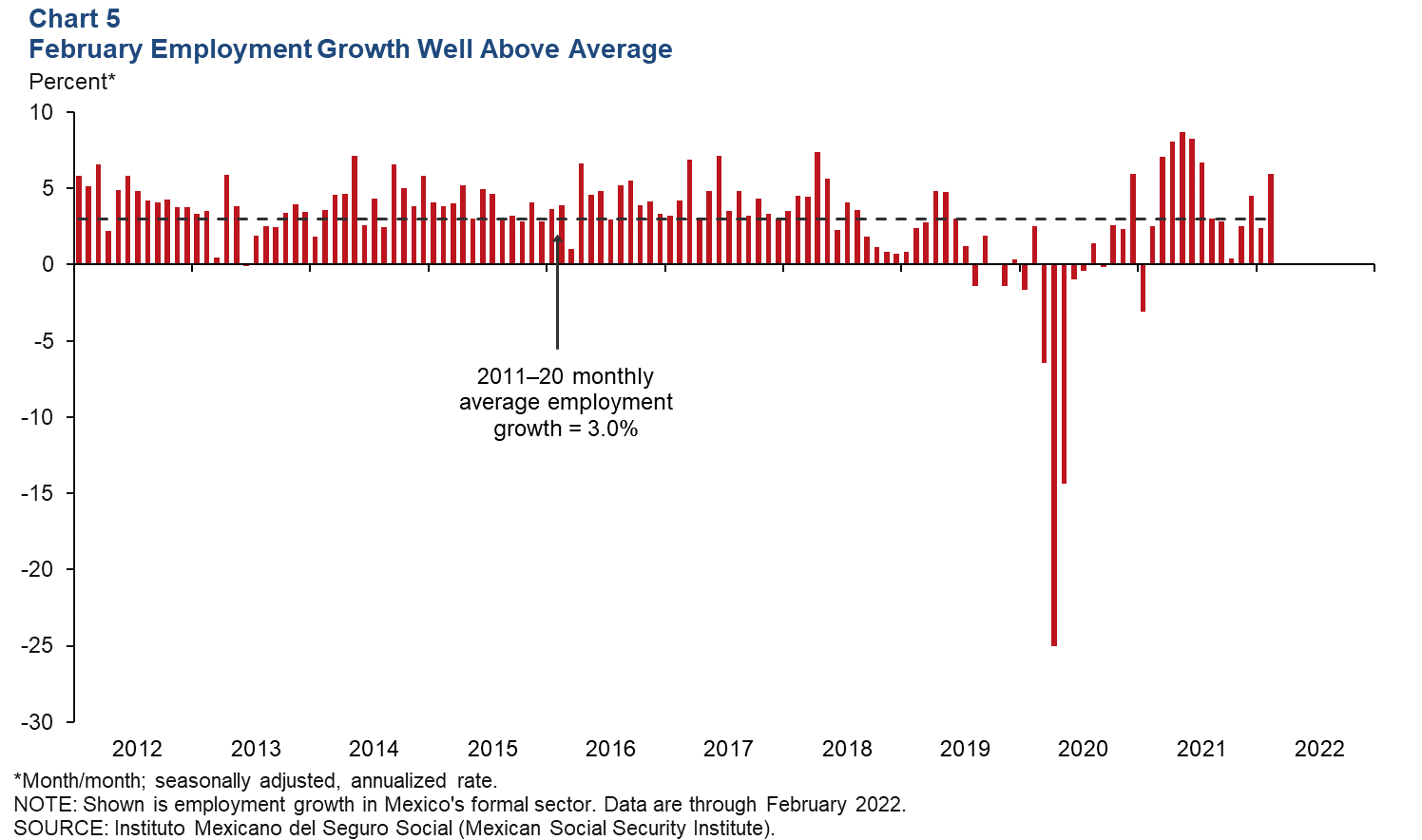

Employment expansion continues

Formal sector employment—jobs with government benefits and pensions—grew an annualized 5.9 percent (99,800 jobs) in February after increasing 2.4 percent in January (Chart 5). Year-over-year employment growth was 5.0 percent in February. Total employment, representing 56.6 million workers and including informal sector jobs, was up 6.2 percent year over year in fourth quarter 2021. The unemployment rate in January was 3.6 percent, down from 3.8 percent in December. Employment in Mexico recovered to prepandemic levels in September 2021.

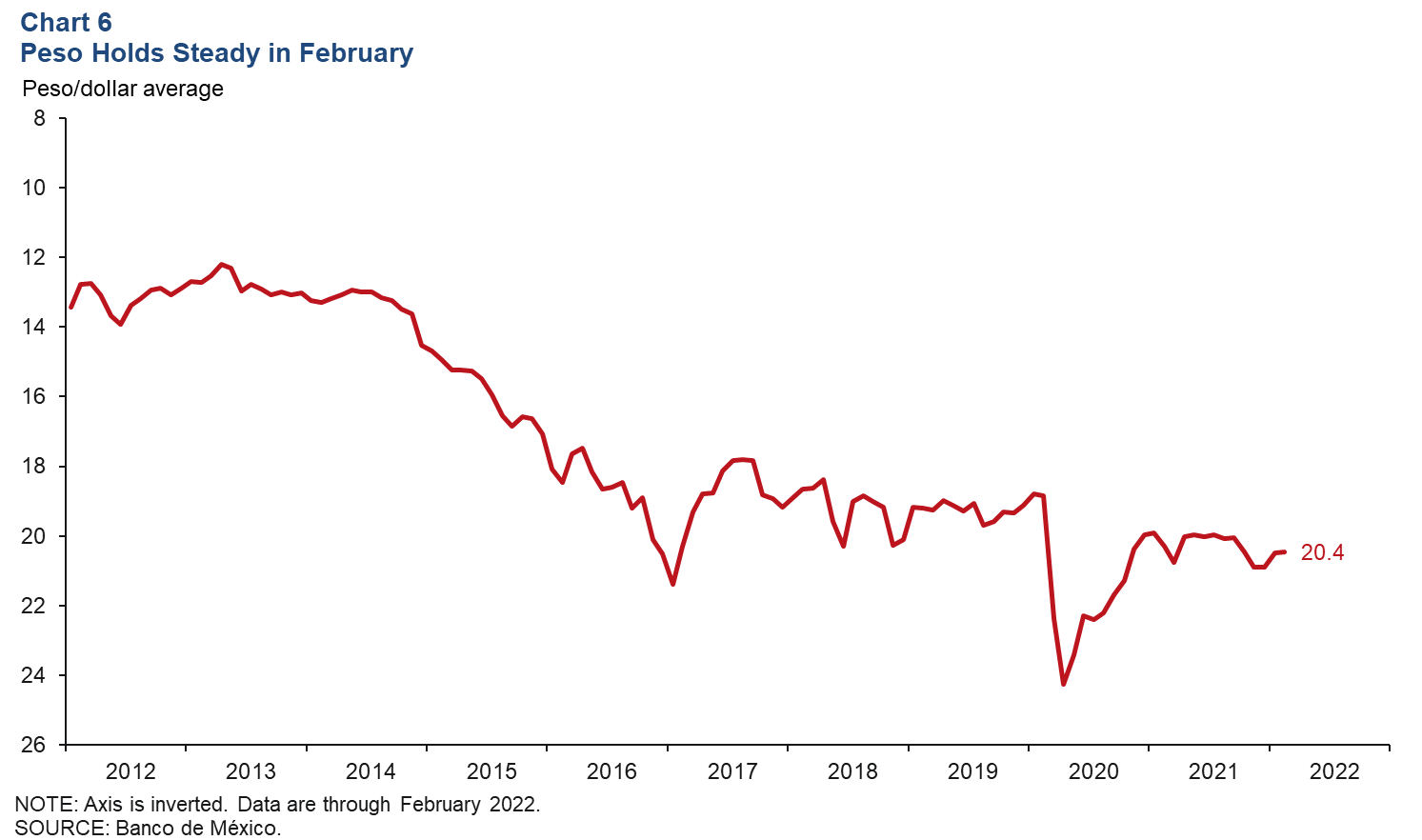

Peso holds steady against the dollar

The Mexican currency averaged 20.4 pesos per dollar in February, about the same as in January (Chart 6). However, the peso is down 7.8 percent from its prepandemic level in February 2020 . The peso has been under pressure due to persistently higher average inflation in Mexico than in the U.S. and, more recently, increased uncertainty regarding domestic and global growth.

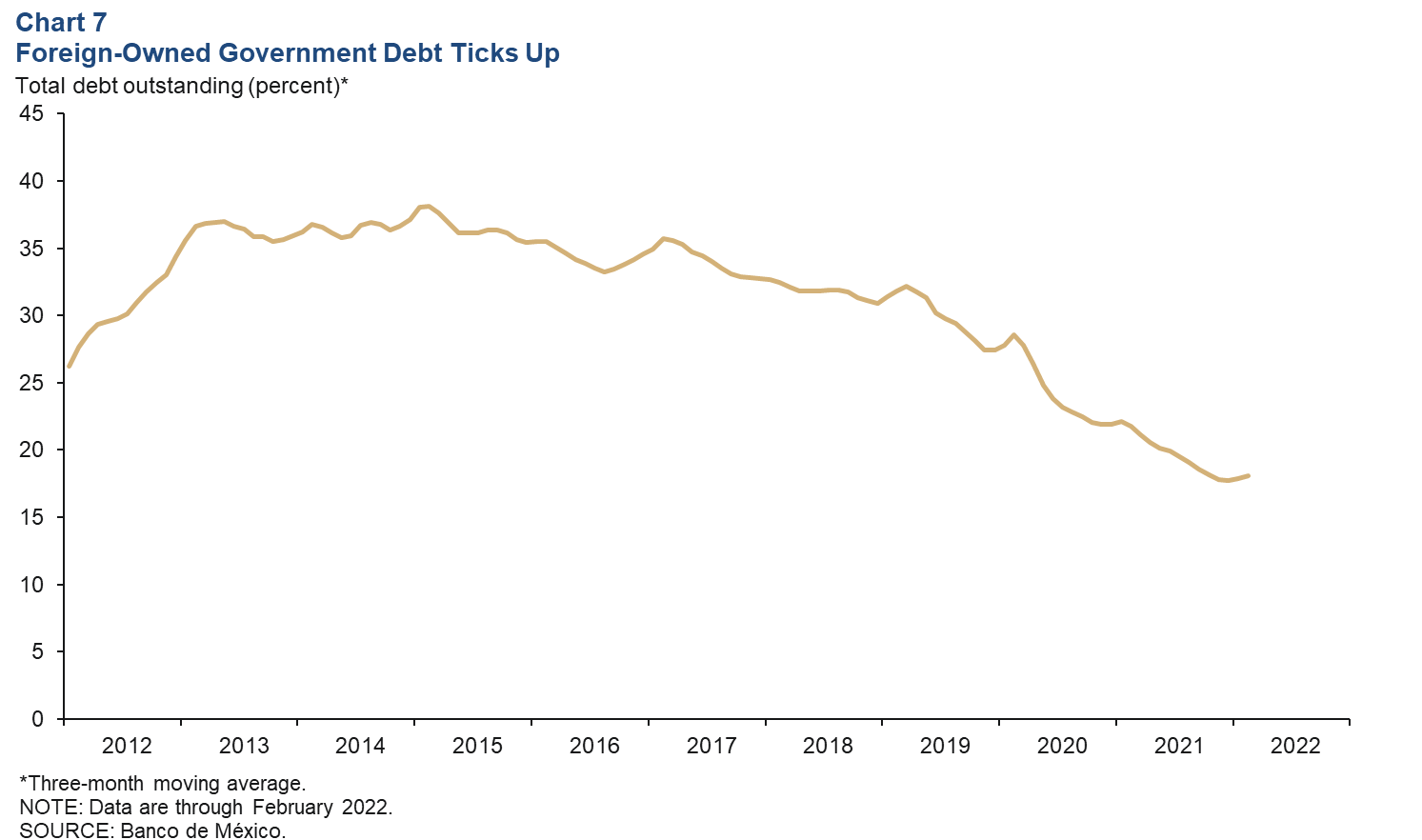

Foreign-owned government debt edges up

The three-month moving average of foreign‐owned Mexican government securities increased slightly to 18.1 percent in February, up 1.2 percent from its January value (Chart 7). The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and a sign of confidence in the Mexican economy. It’s noteworthy that the measure has been on a downward trend since peaking in early 2015.

Inflation moves up

Mexico’s Consumer Price Index (CPI) was up 7.3 percent in February over the prior 12 months, rising at a slightly faster pace than in January (Chart 8). CPI core inflation (excluding food and energy) rose 6.6 percent in February over the previous 12 months. In March, Mexico’s central bank increased the benchmark interest rate to 6.5 percent, hiking it by 50 basis points for the third straight time since December. In the public announcement accompanying the interest rate decision, the central bank cited several factors for the increase, including persistent global and domestic inflationary pressures associated with the pandemic in addition to increases in energy, agricultural and livestock product prices.

Note

- The consensus GDP forecast cited here is based on a fourth quarter/fourth quarter growth rate. The forecast based on average year-over-year growth is 2.0 percent for 2022. See Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Febrero de 2022 (communiqué on economic expectations, Banco de México, February 2022). The survey period was Feb. 18–28.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.