Mexico’s economic growth continues, inflation moderates

April 4, 2023

| March 2023 economic report | |||

| GDP, real Q4 '22 |

Employment, formal Feb. '23 |

CPI Mar. '23 |

Peso/dollar Feb. '23 |

| 1.8% q/q | 84,600 jobs m/m | 7.6% y/y | 18.6 |

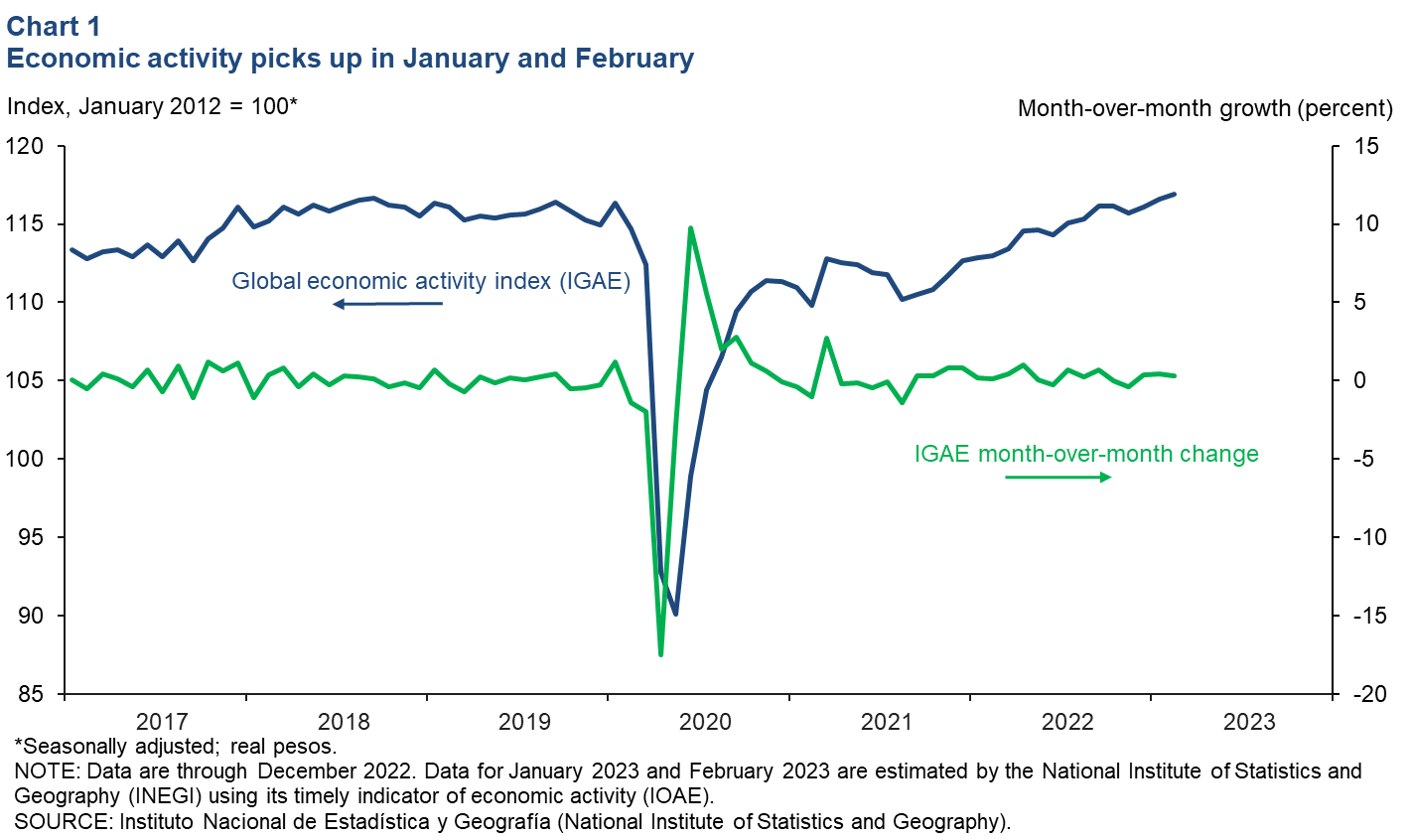

Mexico’s proxy for monthly GDP growth averaged a 0.4 percent increase in the first two months of 2023. Nevertheless, the economy is expected to slow considerably this year because tight monetary conditions will likely weaken domestic demand and slower U.S. growth will affect Mexican manufacturing exports.

The consensus forecast for 2023 GDP growth (fourth quarter/fourth quarter), compiled by Banco de México, held steady in February at 0.7 percent (Table 1).

| Table 1 Consensus forecasts for 2023 Mexico growth, inflation and exchange rate |

|||

| January | February | ||

| Real GDP growth (Q4/Q4) | 0.7 | 0.7 | |

| Real GDP (average year/year) | 1.0 | 1.2 | |

| CPI (Dec. '23/Dec. '22) | 5.2 | 5.3 | |

| Exchange rate—pesos/dollar (end of year) | 20.2 | 19.8 | |

| NOTES: CPI refers to consumer price index. The survey period was Feb. 21–28. SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Febrero de 2023 (communiqué on economic expectations, Banco de México, February 2023). |

|||

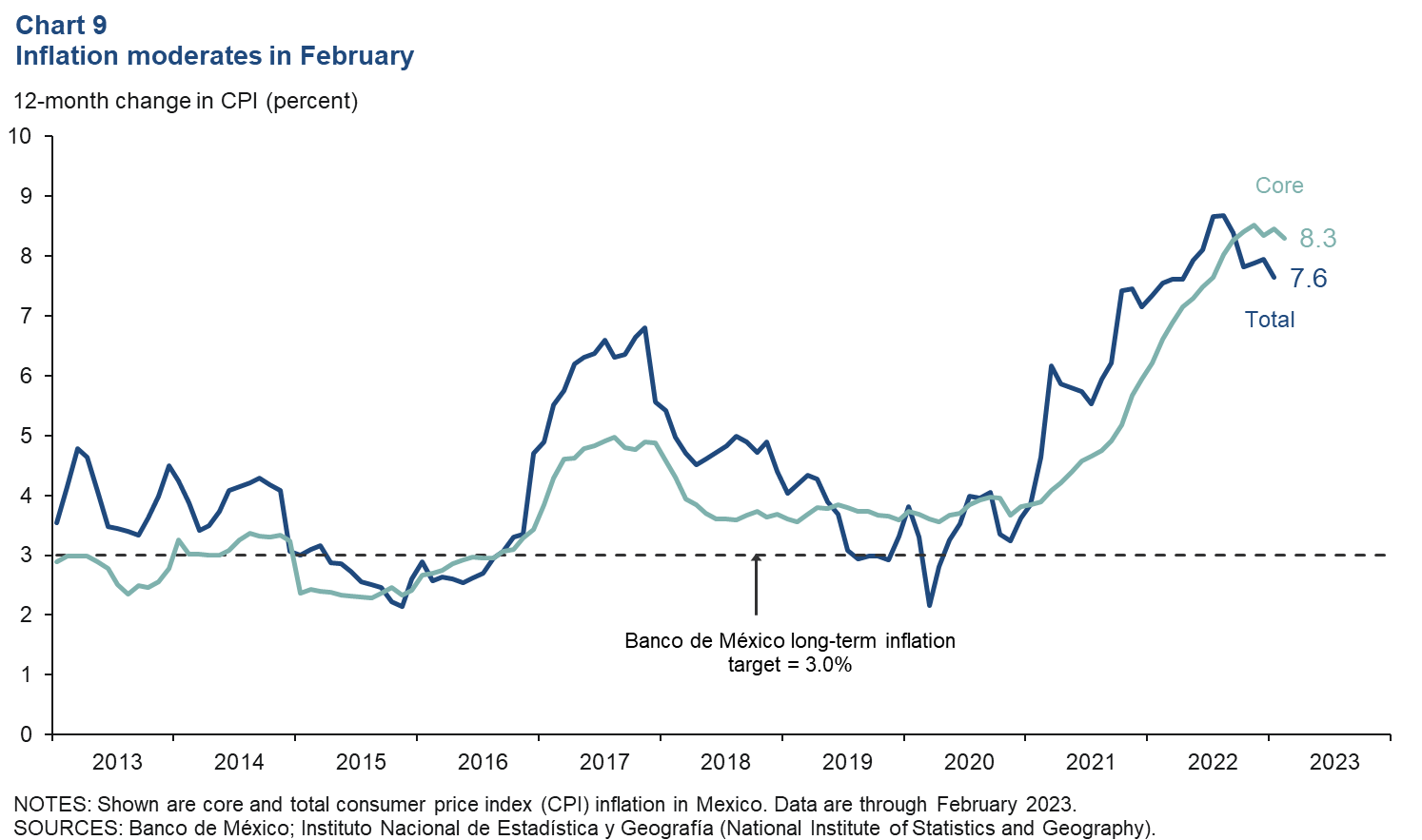

The latest data available show industrial production, retail sales and employment increased while exports fell. In February, the peso strengthened against the dollar, and inflation slowed.

Economic growth continues

Mexico’s global economic activity index (IGAE)—the monthly proxy for GDP growth—rose 0.3 percent month-over-month in February after growing 0.4 percent in January (Chart 1). Driving this increase was the goods-producing sector (including manufacturing, construction and utilities), which rose 1.0 percent in both January and February. Service-related activities (including trade and transportation) posted no growth during the period. On a year-over-year basis, IGAE was up 3.5 percent in February.

Industrial production rises in January

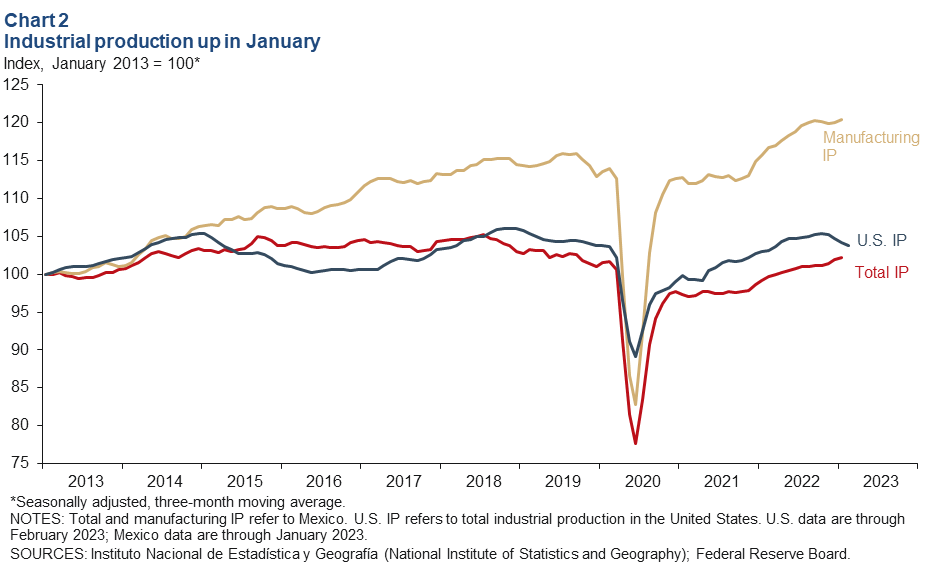

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—rose 0.3 percent in January over December (Chart 2). On a month-over-month and unsmoothed basis, IP was unchanged in January. North of the border, the three-month moving average of U.S. IP fell 0.3 percent in February—its fourth consecutive decline. With the rise of intra-industry trade between the U.S. and Mexico since the early 1990s, the correlation between Mexican and U.S. IP has increased considerably. If U.S. manufacturing activity continues slowing, it is likely that Mexico’s manufacturing sector will follow.

Exports fall in February

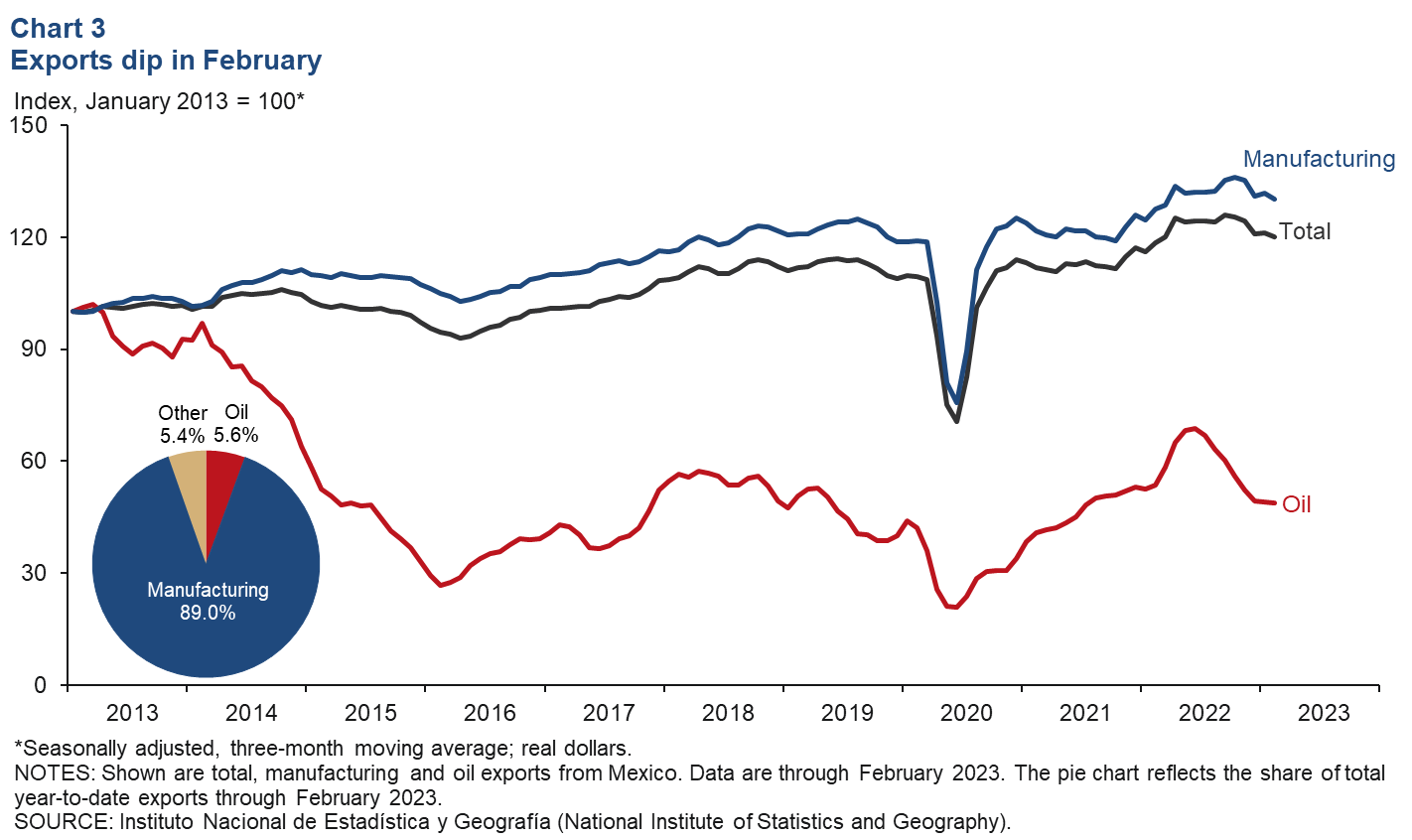

The three-month moving average of Mexico’s total exports fell 1.0 percent in February after rising 0.7 percent in January (Chart 3). On a month-over-month and unsmoothed basis, total exports fell 6.2 percent in February, with oil exports down 12.9 percent and the much-larger manufacturing sector’s exports shrinking 6.4 percent. The fall in oil prices led to a sharp decline in oil exports in the second half of 2022, but exports have leveled out in the new year. Total exports increased 2 percent during the first two months of 2023 compared with the same period a year ago. Manufacturing exports were up 3.2 percent, while oil exports fell 12 percent.

Retail sales remain elevated in January

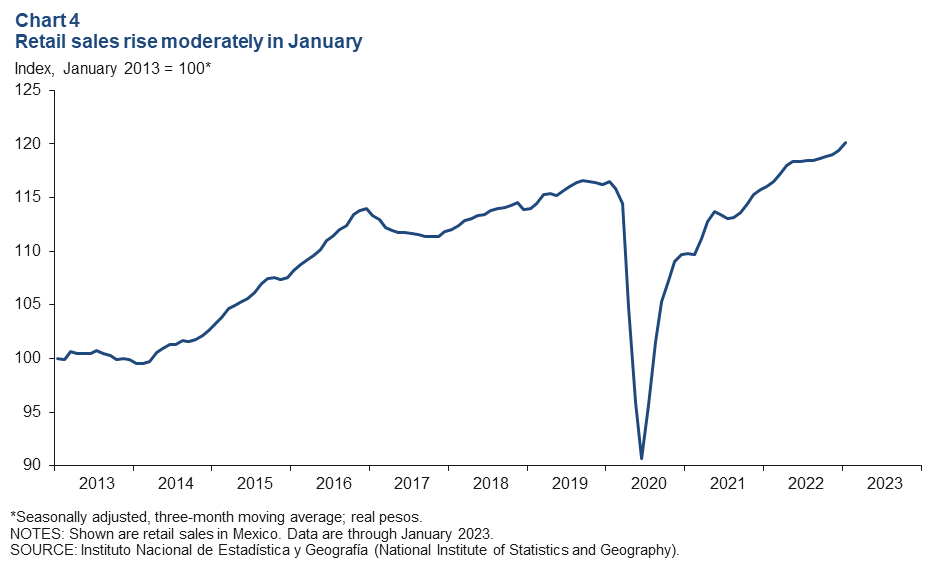

The three-month moving index of real retail sales rose 0.6 percent in January (Chart 4). Year over year, the smoothed retail sales index was up 3.5 percent. On a month-over-month and unsmoothed basis, retail sales rose 1.6 percent in January. Mexico’s domestic market has been relatively strong, and that could help mitigate a fall in manufacturing exports resulting from a possible economic slowdown in the U.S.

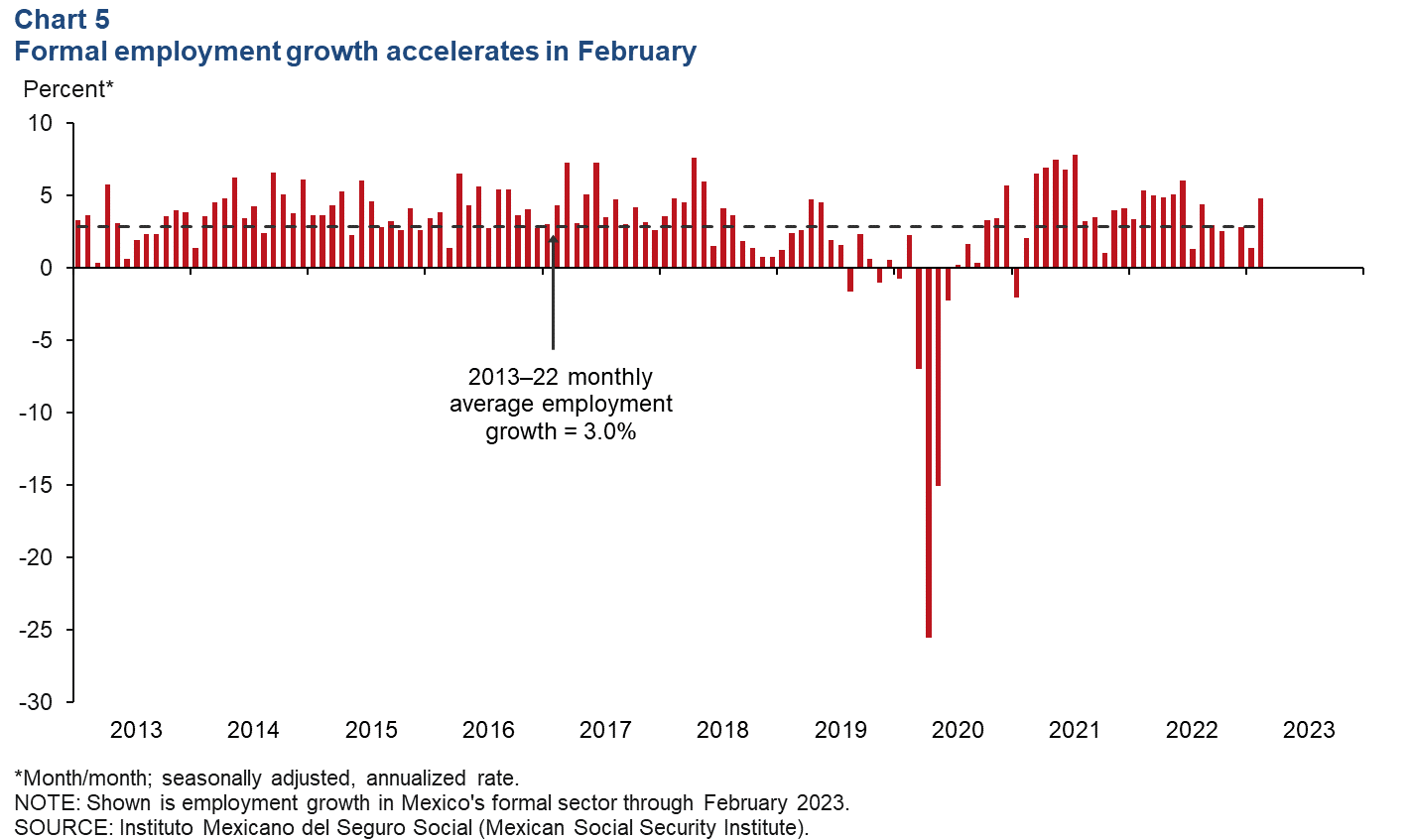

Employment growth robust in February

Formal sector employment—jobs with government benefits and pensions—rose an annualized 4.8 percent in February (84,600 jobs) after rising 1.4 percent in January (Chart 5). Year-over-year employment growth was 3.4 percent in February. Total employment, representing 58.3 million workers and including informal sector jobs, was up 3.1 percent year over year in fourth quarter 2022. The unemployment rate was 2.9 percent in January, down from December’s 3.0 percent reading.

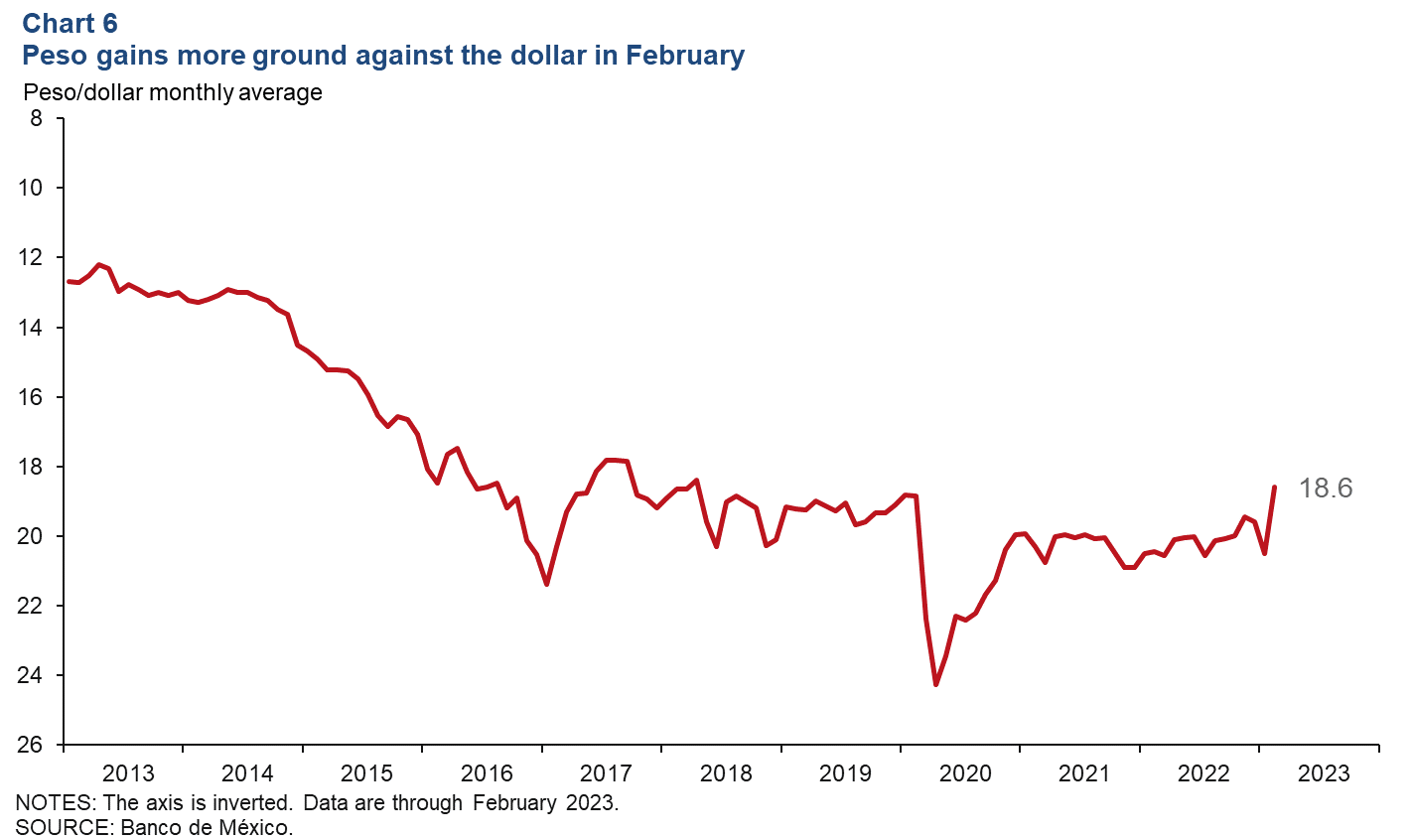

Peso strengthens in February

The Mexican currency averaged 18.6 pesos per dollar in February, stronger than January’s average of 20.5 pesos (Chart 6). Strong appreciation in fourth quarter 2022 continued into the new year, with the peso stronger than it has been since April 2018. Mexico’s central bank has aggressively raised domestic interest rates in anticipation of, and in response to, U.S. interest rate hikes this year and stubbornly high inflation, contributing to the strength of the peso.

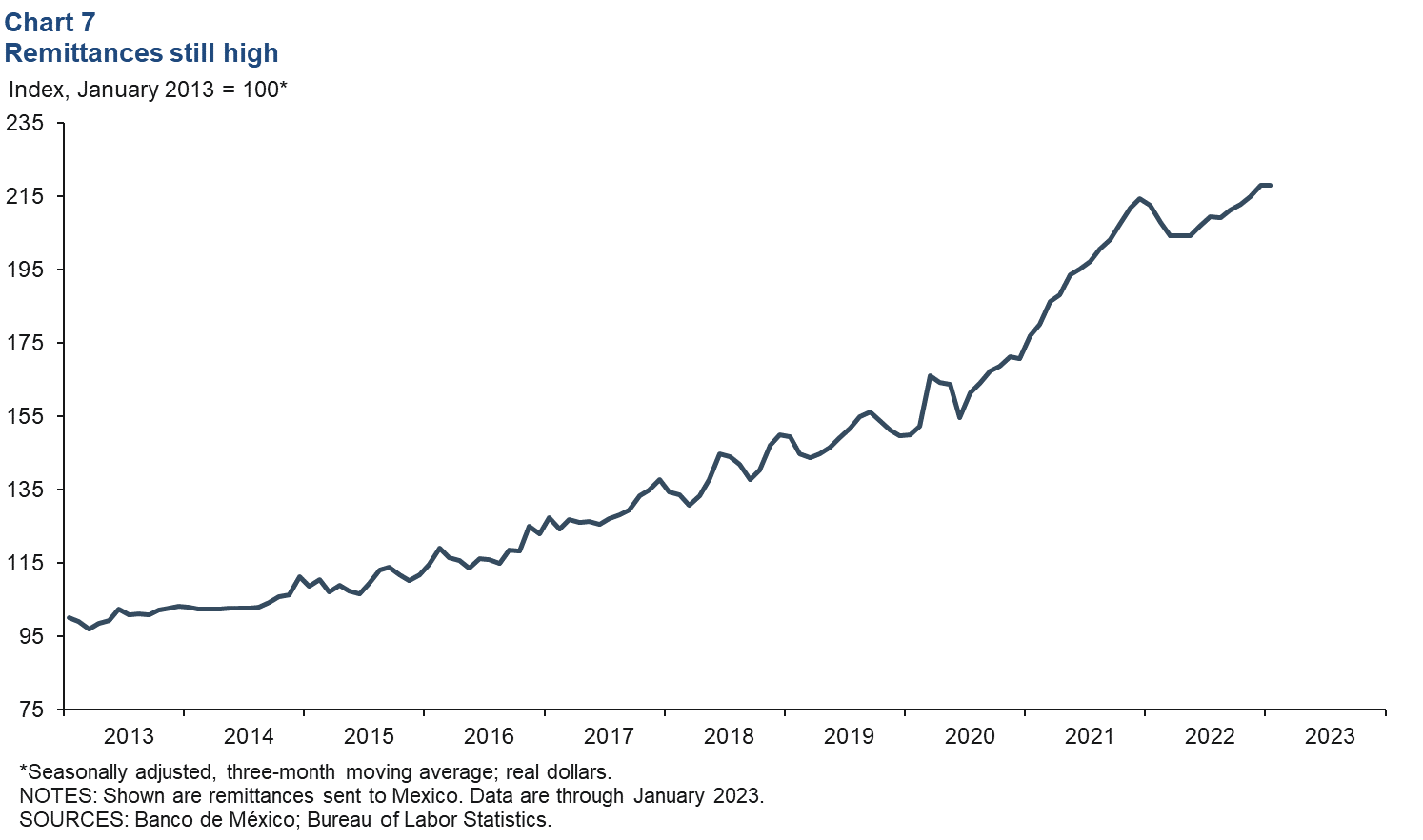

Remittances remain elevated in January

The three-month moving average of real remittances was unchanged in January after rising 1.4 percent in December (Chart 7). On a month-over-month and unsmoothed basis, remittances fell 2.2 percent in January after rising 4.8 percent in December. Remittance flows slowed at the beginning of 2022 due to high inflation in the U.S. and elsewhere but picked up in the second half of the year. Even with the month-over-month dip, remittances are close to record highs.

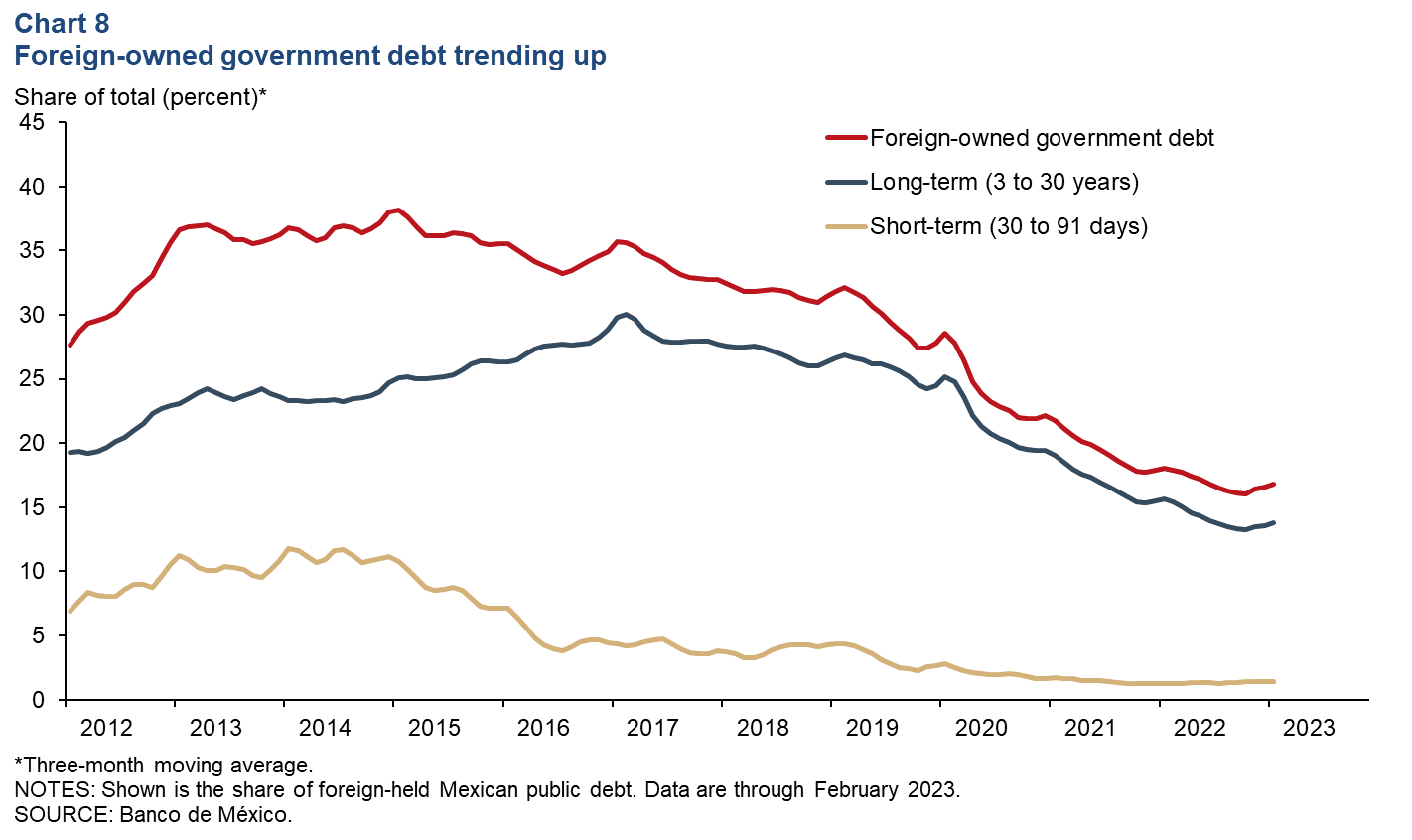

Foreign-owned debt rises in February

The three-month moving average of foreign-owned Mexican government securities rose for the third month in a row in February, to 16.8 percent (Chart 8). Nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and a sign of confidence in the Mexican economy. This measure had been on a downward trend since peaking in 2015, but it appears the trend has reversed since December 2022. Long-term government securities make up 82.0 percent of foreign-owned Mexican public debt.

Inflation slows in February

Mexico’s consumer price index (CPI) increased 7.6 percent in February over the prior 12 months, a deceleration from January’s 8.0 percent growth (Chart 9). CPI core inflation, which excludes food and energy, decelerated to 8.3 percent from January’s 8.5 percent rise. In March, Mexico’s central bank raised its benchmark interest rate 25 basis points to 11.25 percent, slowing down the pace of tightening following February’s 50-basis-point rate increase. This was the bank’s 15th consecutive rate hike going back to June 2021. The central bank mentioned the recent stress in the U.S. and European banking sectors in its official announcement but stated that banking institutions in Mexico exceed regulatory requirements for liquidity and capitalization. The bank’s next meeting is May 18.

About the authors