Mexico’s economy shows mixed signals

| May 2025 economic report | |||

| GDP, real Q1 '25 |

Employment, formal May '25 |

CPI May '25 |

Peso/dollar May '25 |

| 0.8% q/q | -3,700 jobs m/m | 4.4% y/y | 19.44 |

Mexico’s economy expanded slightly in the first quarter. A sizable increase in the agricultural sector drove the expansion. The consensus forecast for 2025 real GDP growth (fourth quarter, year over year) compiled by Banco de México was 0.2 percent in May (Table 1). The latest data available indicated a mixed economic outlook as employment and remittances fell, while output primarily driven by agriculture, industrial production, exports and retail sales grew. Moreover, the peso strengthened, and inflation rose in May.

| Table 1 Consensus forecasts for 2025 Mexico growth, inflation and exchange rate |

|||

| April | May | ||

| Real GDP growth in Q4, year over year | 0.5 | 0.4 | |

| Real GDP growth in 2025 | 0.2 | 0.2 | |

| CPI December 2025, year over year | 3.8 | 3.9 | |

| Peso/dollar exchange rate at end of year | 20.81 | 20.50 | |

| NOTE: CPI refers to the consumer price index. The survey period was May 14-28.

SOURCE:Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Mayo de 2025 (communiqué on economic expectations, Banco de México, May 2025). |

|||

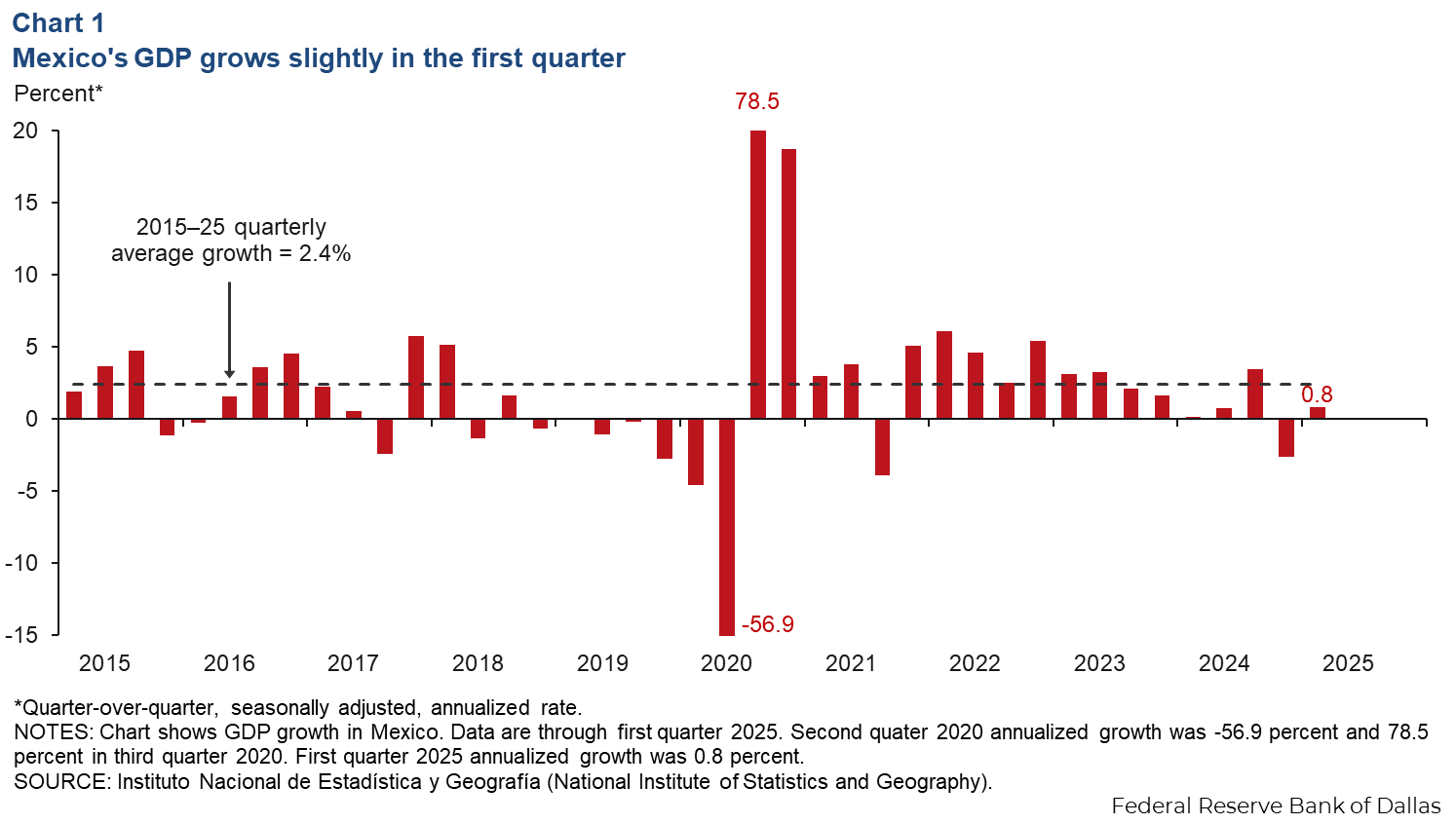

Output grows slightly in first quarter

Mexico’s first-quarter GDP grew an annualized 0.8 percent (Chart 1). The goods-producing sectors (manufacturing, construction, utilities and mining) contracted 1.2 percent after falling 4.7 percent in the previous quarter. Activity in the services-providing sectors (wholesale and retail trade, transportation and business services) was flat, down from 0.8 growth in the fourth quarter. Agricultural output rebounded, expanding 36.6 percent in the first quarter after declining 31.1 percent in fourth quarter 2024.

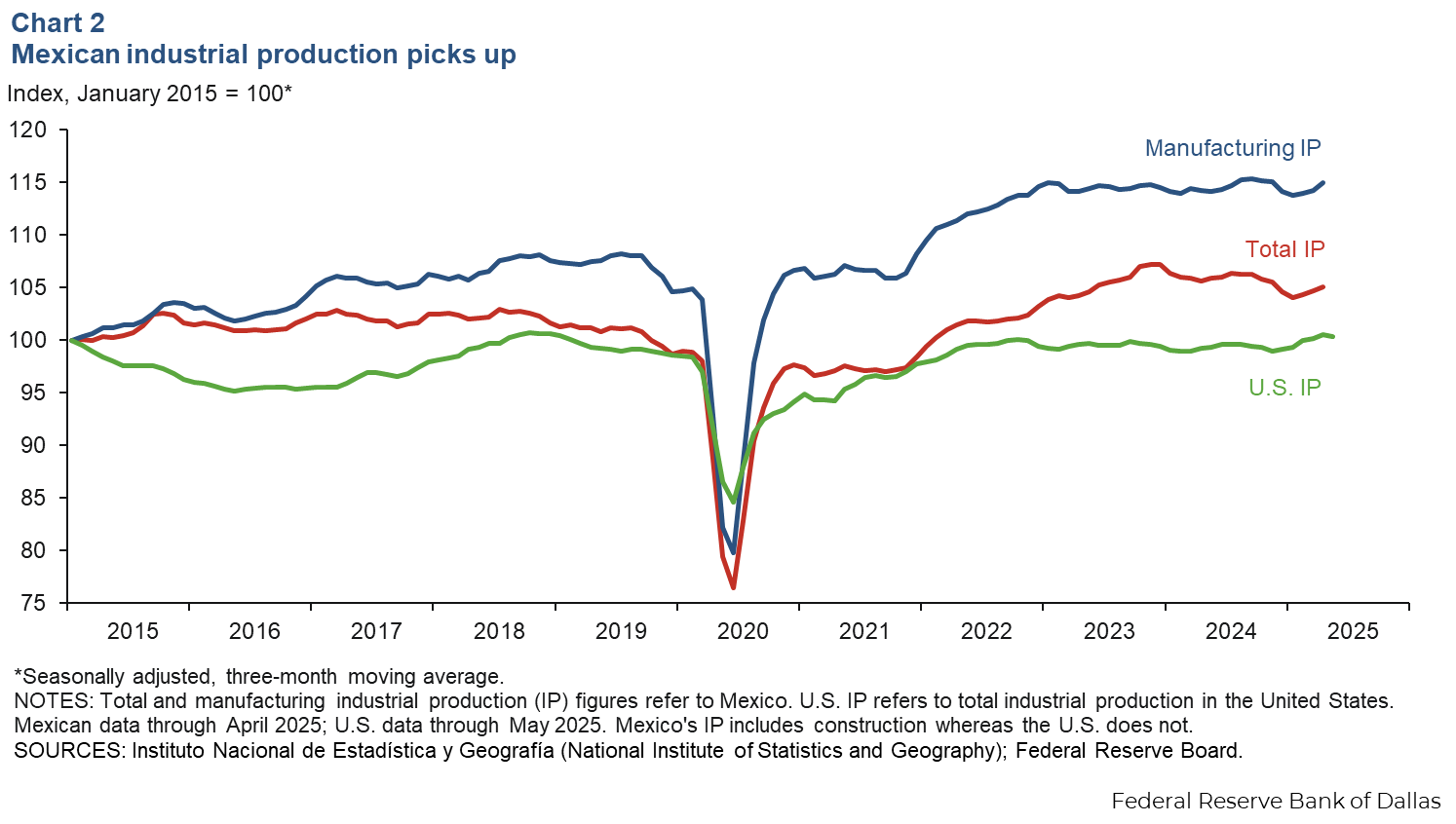

Industrial production increases

The three-month moving average of Mexico’s industrial production (IP) index, which includes manufacturing, construction, oil and gas extraction, and utilities, edged up for the third consecutive month in April. Total IP increased 0.4 percent while manufacturing IP grew 0.7 percent (Chart 2). North of the border, the three-month moving average of U.S. IP was down 0.1 percent in May. With the rise of intra-industry trade between the U.S. and Mexico since the early 1990s, the correlation between Mexican and U.S. IP has increased considerably.

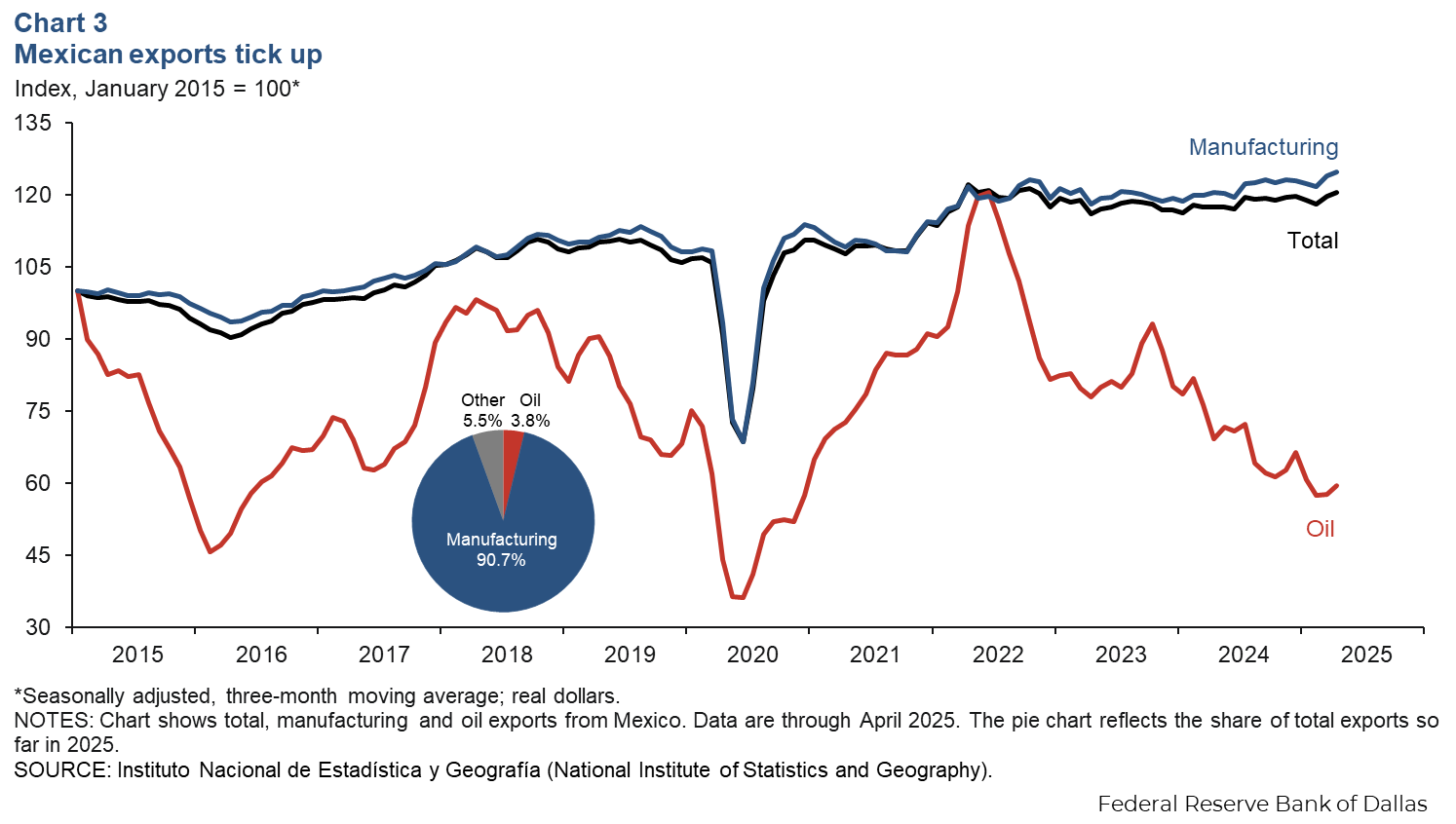

Exports tick up in April

The three-month moving average of Mexico’s total exports increased 0.8 percent in April (Chart 3). The manufacturing sector, which accounts for most exports, increased 0.7 percent, while oil exports climbed 3.2 percent. On a year-over-year basis, the smoothed total exports index increased 2.7 percent, while manufacturing exports increased 3.6 percent, and oil exports fell 14.0 percent.

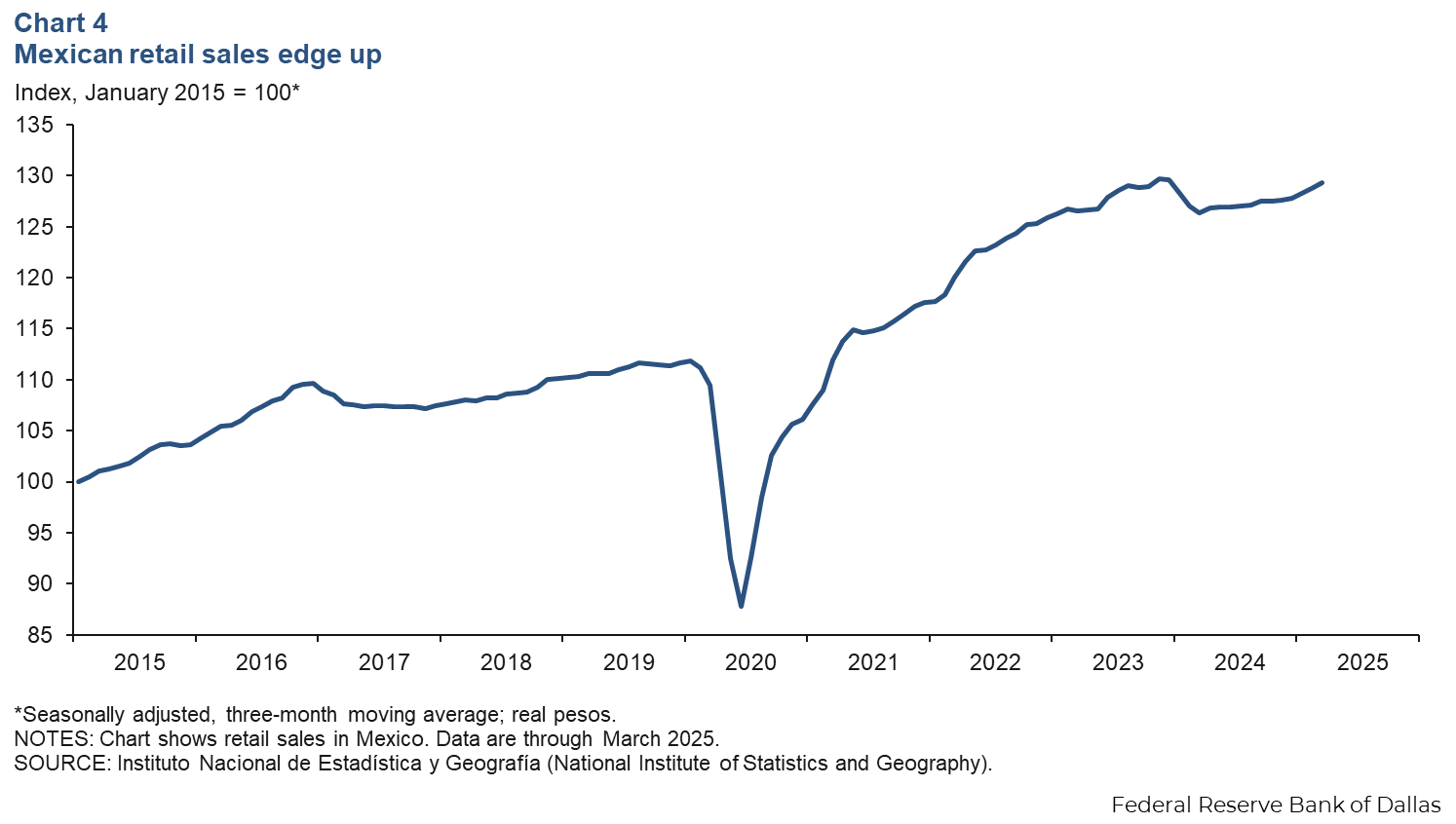

Retail sales growth accelerates in March

The three-month moving average of real retail sales edged up 0.5 percent in March (Chart 4). On a year-over-year basis, the smoothed retail sales index grew 2.4 percent.

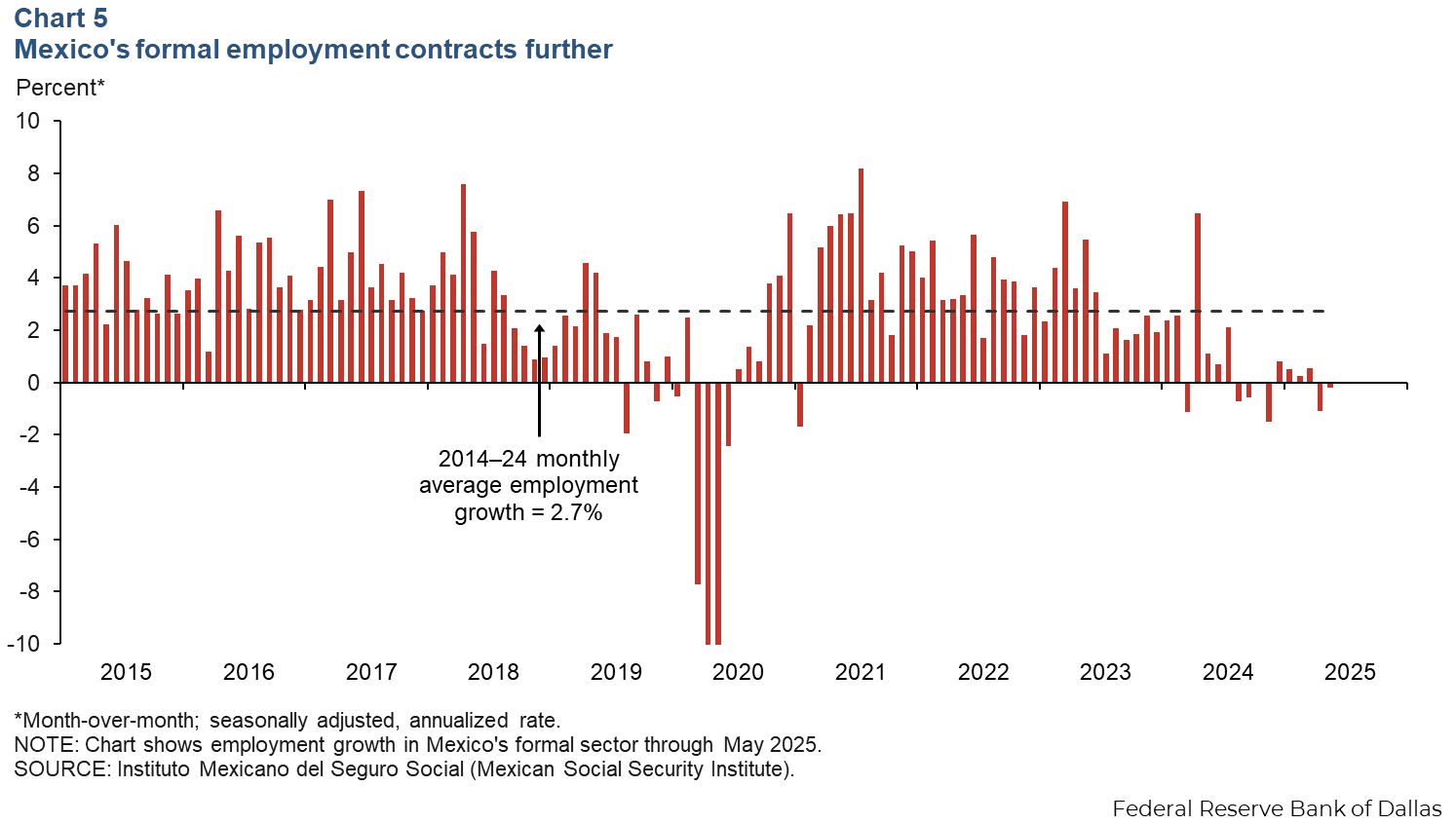

Employment declines for the second straight month

Formal sector employment (jobs with government benefits and pensions) fell an annualized 0.2 percent (-3,700 jobs) in May after declining 1.1 percent in April (Chart 5). Compared to a year ago, employment grew only 0.1 percent. The unemployment rate, which tracks only the formal sector, remained unchanged at 2.6 percent in April.

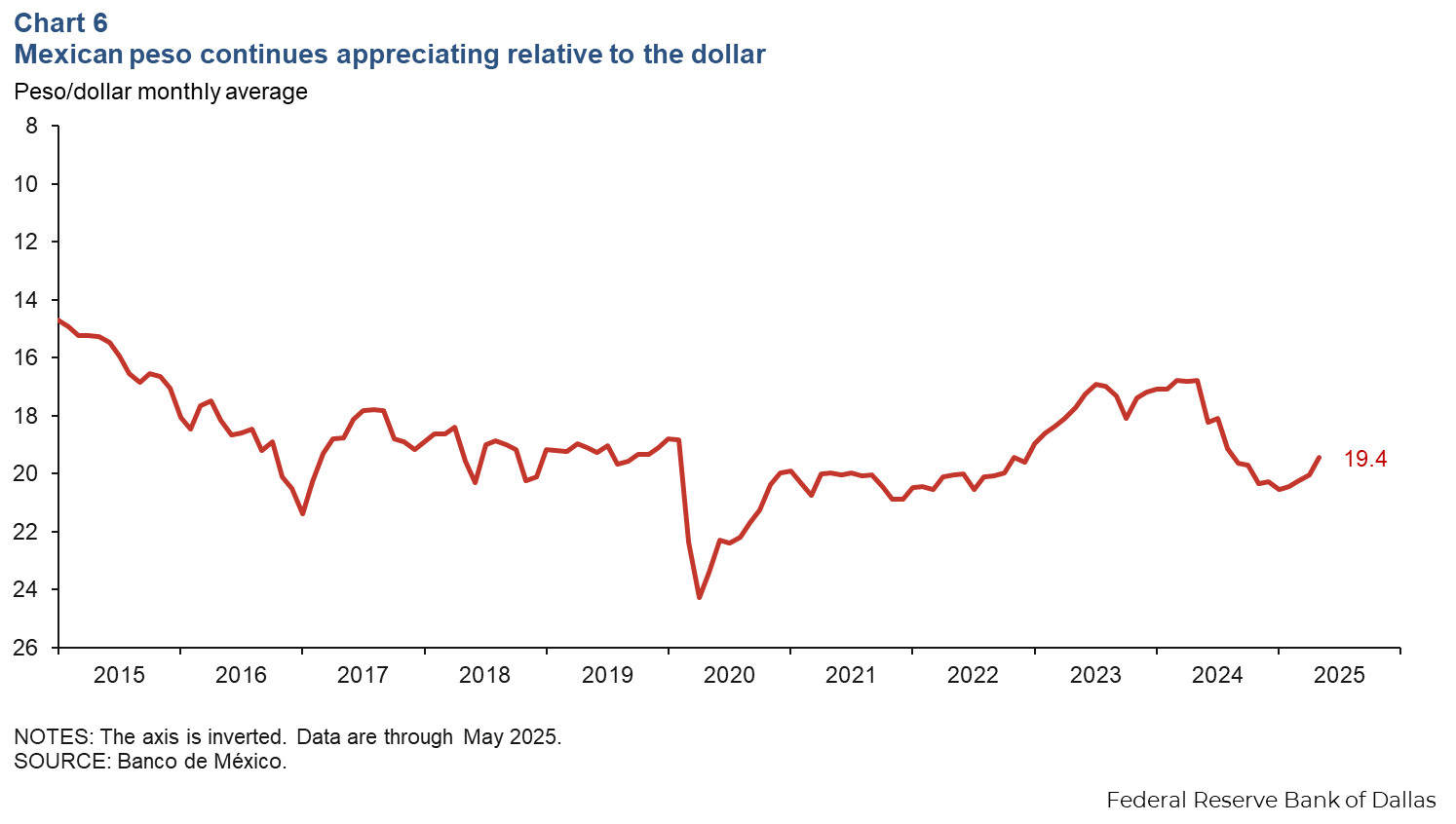

Peso continues to strengthen against the dollar

The Mexican currency averaged 19.4 pesos per dollar in May, stronger than the previous month’s reading of 20.1 pesos per dollar (Chart 6). The peso has been gaining ground against the dollar consistently since the start of 2025.

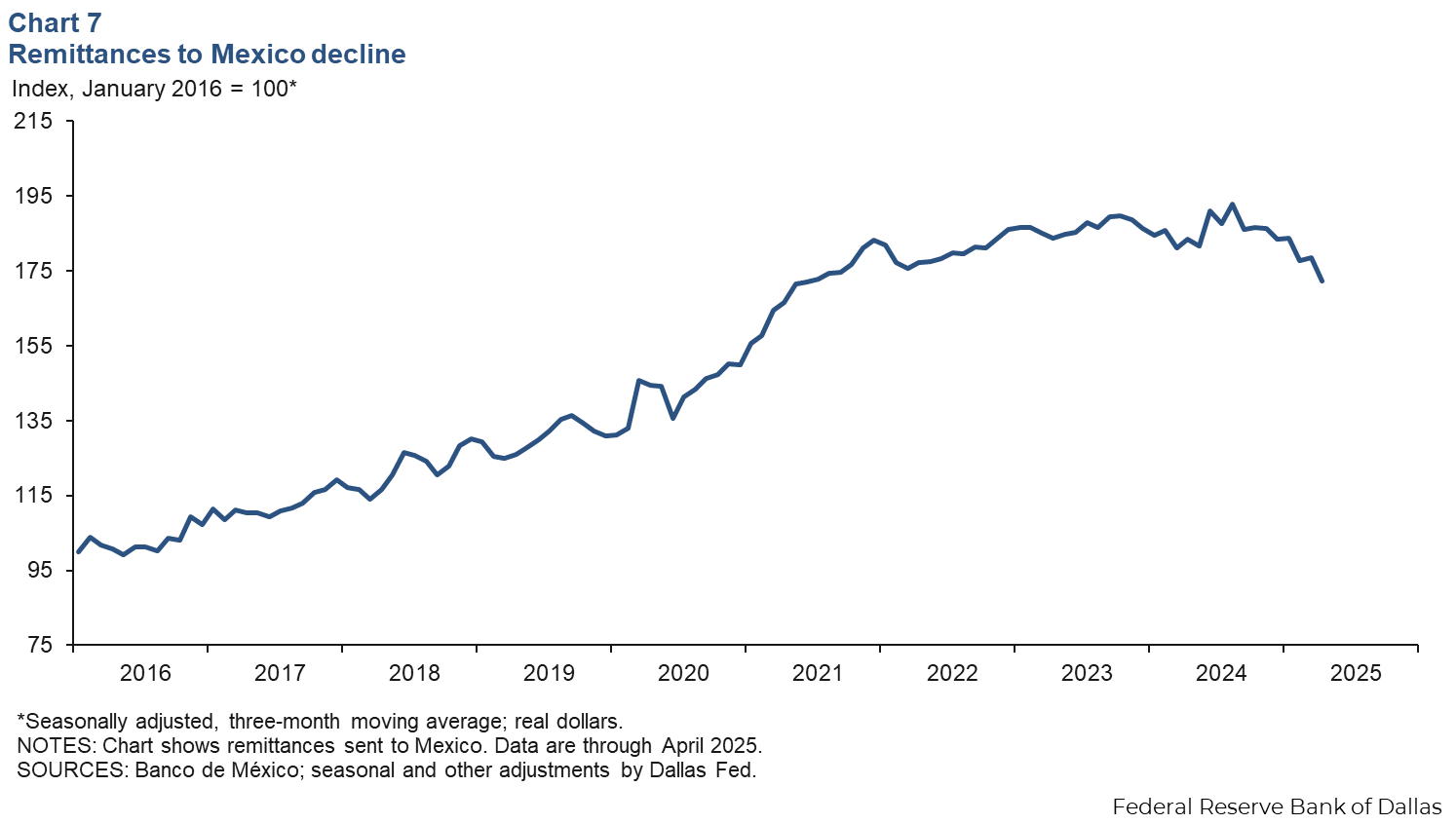

Remittances continue to fall

The three-month moving average of real remittances to Mexico decreased 3.4 percent in April after increasing 0.3 percent in March (Chart 7) . Furthermore, remittances declined 6.0 percent compared to April 2024. The exchange rate plays a role in the volume of remittances because it determines the cost to the sender and the amount the recipient receives. For example, if the peso appreciates against the dollar, the recipient will receive fewer pesos for a given number of dollars.

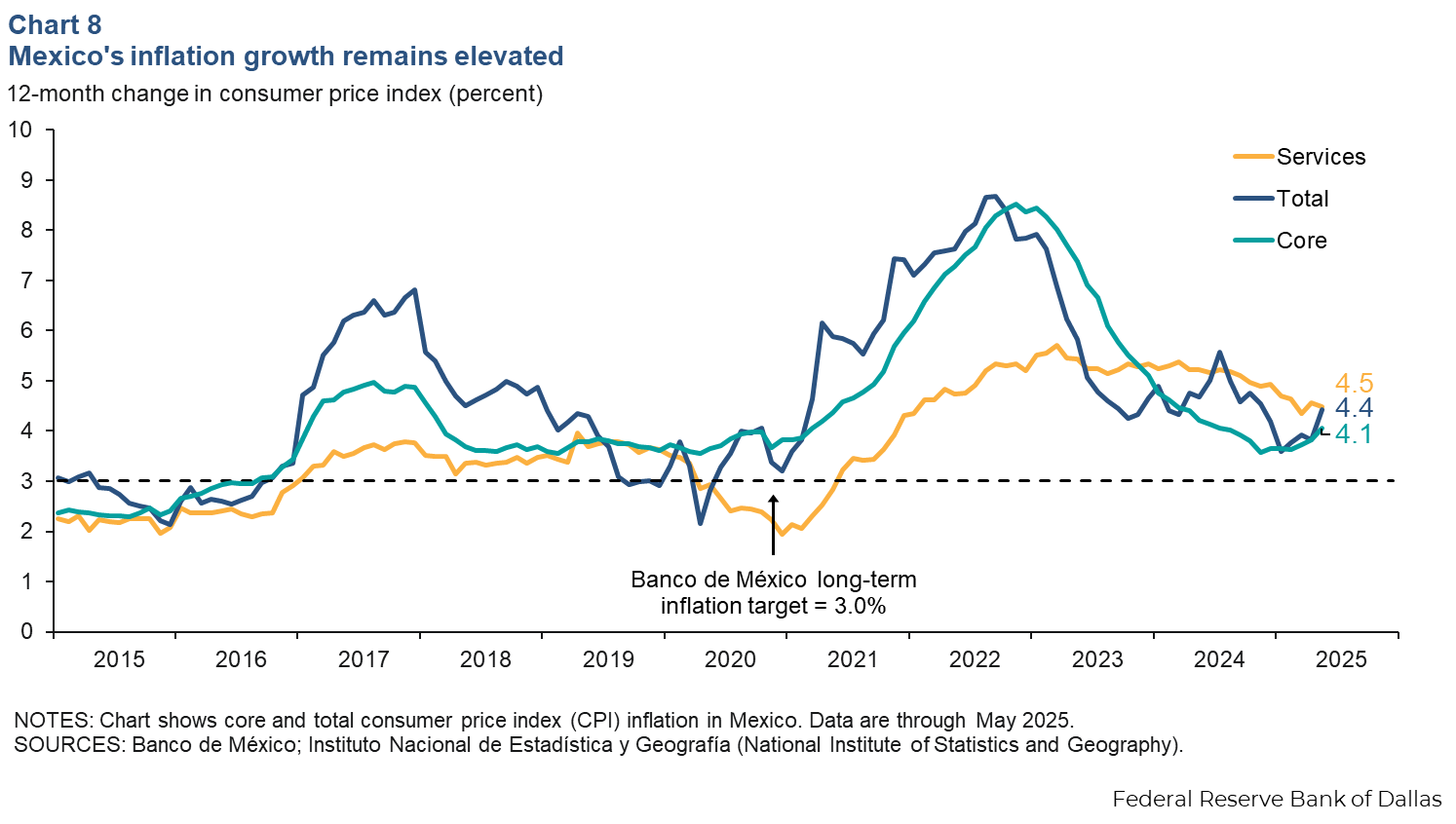

Inflation edges up

Mexico’s consumer price index (CPI) rose 4.4 percent in May over the prior 12 months from 3.8 percent in April (Chart 8). Core CPI inflation, which excludes food and energy, also increased to 4.1 percent. Meanwhile, services inflation ticked down but remained elevated at 4.5 percent. In May, Mexico’s central bank lowered its benchmark rate 50 basis points to 8.5 percent, in line with market expectations. In its statement, the central bank noted significant downward risks to growth amid elevated uncertainty and trade tensions. The central bank expects inflation to persist and foresees reaching its 3.0 percent target by third quarter 2026.

About the authors