Texas economic activity suddenly contracts in March; outlook worsens due to COVID-19

The economic downturn in Texas has begun, recent data suggest. The coronavirus (COVID-19) outbreak initially affected manufacturers and retailers with supply lines in China. The virus’ subsequent arrival in the U.S. has produced a severe drop-off in demand for large parts of the service sector.

Some of the demand declines have intensified due to public health measures, such as social distancing and shelter-in-place policies. Additionally, record-low oil prices and the prospect of sustained depressed levels in the energy sector will further slow growth in Texas.

Before the COVID-19 outbreak in the U.S., economic activity in Texas had broadly improved. Service sector revenue and manufacturing production increased in January and February. However, data from the Dallas Fed’s Texas Service Sector Outlook Survey and Texas Manufacturing Outlook Survey show a sudden contraction in March. Unsurprisingly, the service sector looks to be in worse condition than manufacturing.

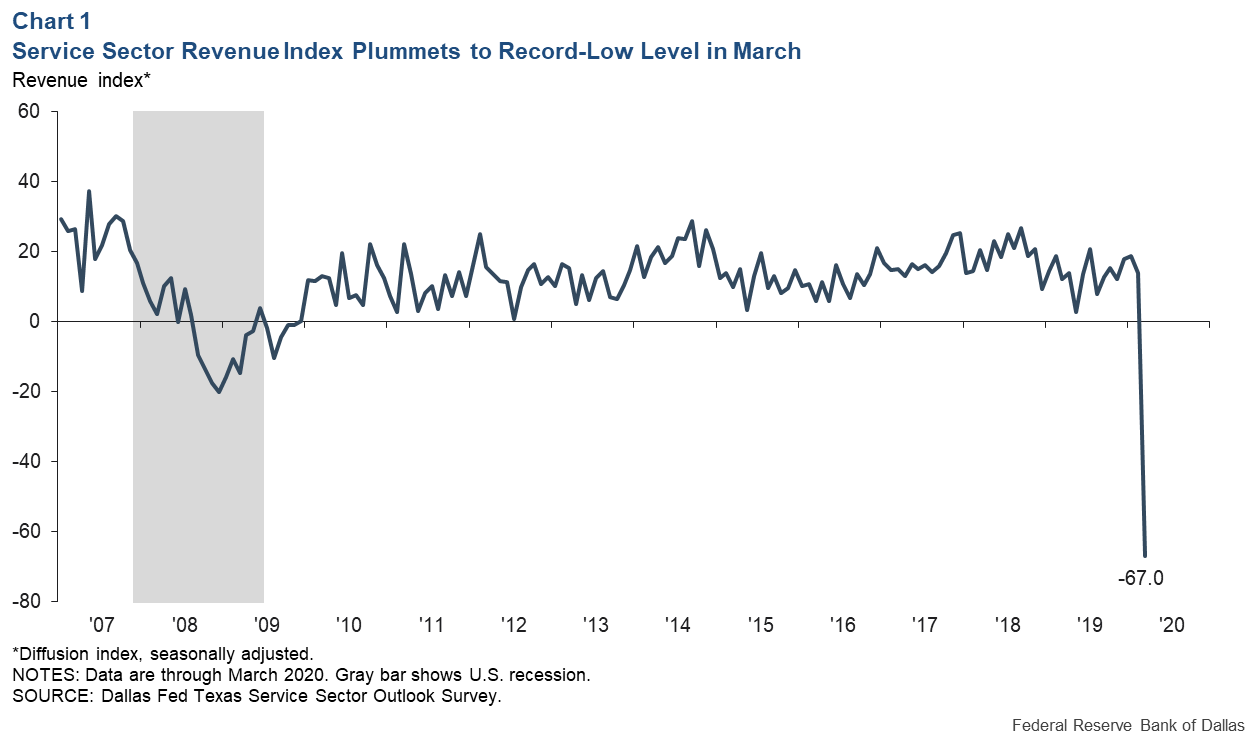

The Texas Service Sector Outlook Survey revenue index plummeted in March to a record low (Chart 1). The outlook surveys use diffusion indexes; the percentage of respondents reporting a decrease is subtracted from the percentage reporting an increase. Negative results indicate contraction, positive ones indicate expansion, and zero suggests no change.

The service sector index fell to -67.0 from 14.0 in February. This measure includes retailers, of whom 83 percent saw a decline in retail sales in March compared with February. The service sector also includes some of the hardest-hit industries, including airlines, hotels, restaurants and bars, and arts and recreation.

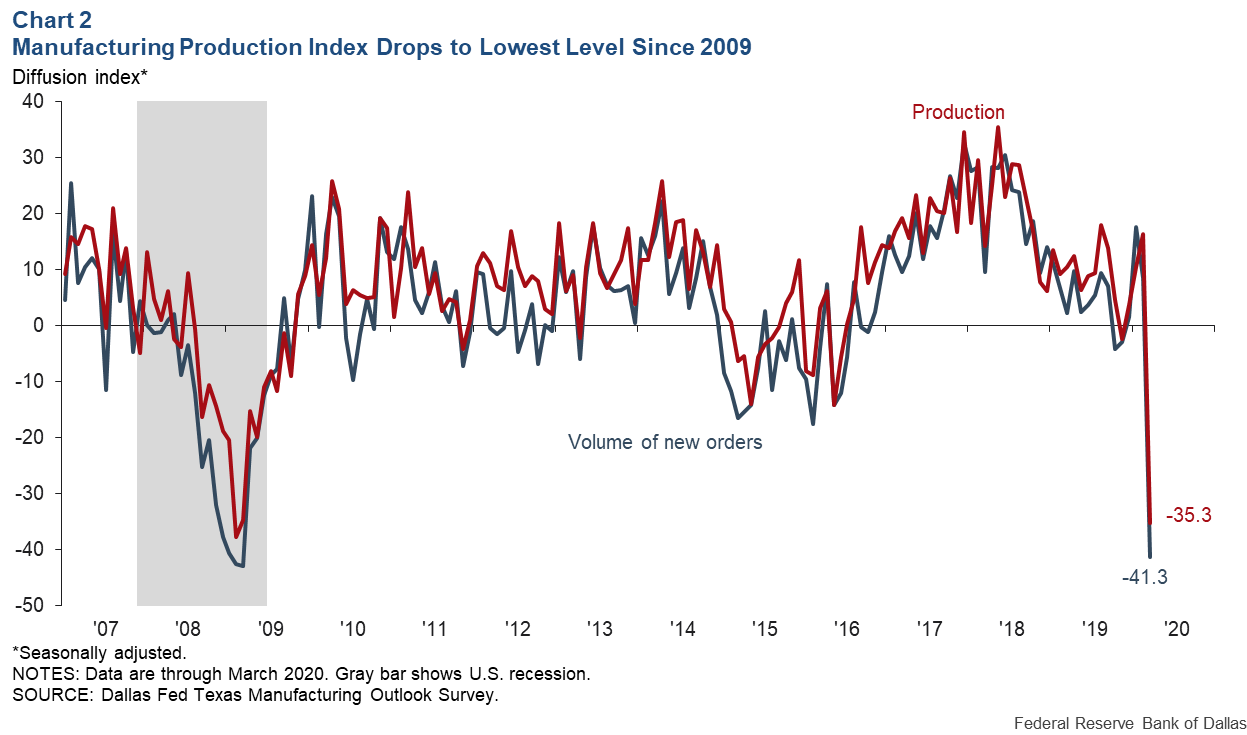

The Texas Manufacturing Outlook Survey production index dropped to -35.3 from 16.4 in February (Chart 2). Additionally, the new orders index, an indicator of demand, fell to -41.3—its lowest level since the Great Recession—from 8.4 in February.

Outlook worsens among Texas businesses

The Dallas Fed posed a series of special questions about COVID-19 along with the March Texas Business Outlook Surveys (TBOS) conducted March 17–25. Many firms noted a negative impact from the virus, both currently and going forward in 2020.

More than two-thirds of respondents said COVID-19 is negatively affecting current demand for their products or services. The share rose to 75 percent when respondents were asked about expectations for the balance of the year. Among those seeing weaker demand, the average magnitude of decline is about 36 percent. Those expecting weakness through the remainder of the year anticipate a demand decline of around 31 percent.

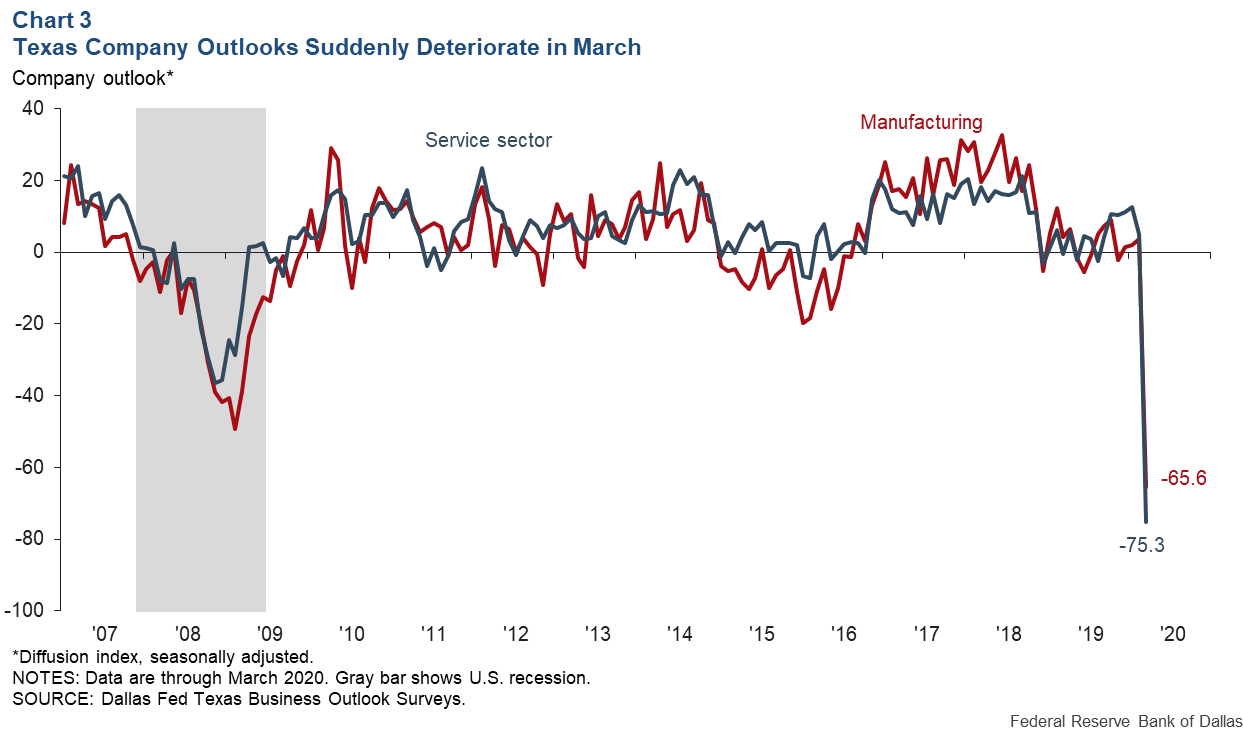

As a result, company outlooks for both manufacturing and service sectors weakened considerably in March, with the indexes reaching all-time lows (Chart 3).

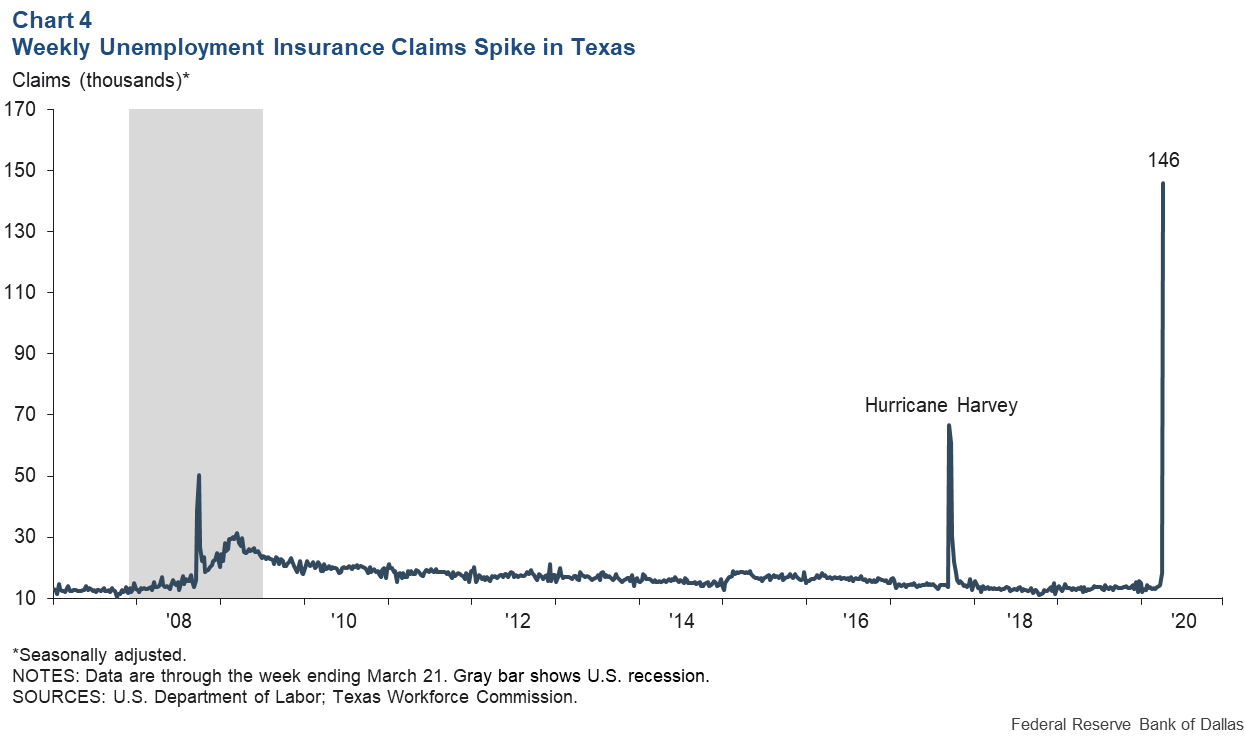

Massive layoffs have followed the contracting economic activity and worsening business outlooks, with weekly unemployment claims in Texas jumping 690 percent to 146,000 for the week ended March 21 (Chart 4).

Just over one-third of TBOS respondents noted a negative impact from COVID-19 on their employee head count, though about 70 percent said employment reductions are temporary.

In a follow-up flash poll, only about 30 percent of responding firms who cited temporary employment declines due to COVID-19 said they would reinstate employees if social distancing and shelter-in-place mandates were lifted today. The remaining 70 percent said that factor alone is insufficient, with some noting they would also need to see a return of demand, while others said they would first need to feel it was safe for their workers and the community.

Survey respondents expect significant job losses in the second quarter and recovery to begin during third quarter 2020. However, the timing of the recovery depends on the containment of the virus and the effectiveness of fiscal stimulus packages passed at the federal level. Overall, the majority of survey participants expect the COVID-19 impact to last less than six months.

Nevertheless, Texas is likely to bounce back more slowly than the nation on average due to the decline in the energy sector.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.