Does homeownership provide an escape from high rent burdens?

In the fall, months after Congress approved the Coronavirus Aid, Relief, and Economic Security Act, 7.9 percent of government-insured mortgages (roughly $160 billion) were in forbearance, according to the Mortgage Bankers Association.

Many first-time homebuyers—often with little savings and vulnerable to economic shocks—obtain their mortgages through the Federal Housing Administration (FHA) loan program. Often, these borrowers are moving from apartments and have presumably weighed the costs of renting versus owning.

In September, we wrote about how an uncertain economic outlook and expiration of federally mandated mortgage forbearance in early 2021 could prompt calls for a large-scale modification initiative for FHA loans. This will be complicated because a majority of recent FHA borrowers devoted more than 43 percent of their monthly income to repaying debt.

Dr. Edward Golding, executive director of the Massachusetts Institute of Technology’s Golub Center for Finance and Policy, responded to our observation with the following question posted on LinkedIn: “What is the counterfactual? If these families had rented, often at higher costs, wouldn’t these be the same families facing eviction?”

We follow up by exploring an aspect of Golding’s questions: Do first-time homebuyers using FHA mortgages typically increase or decrease their monthly housing expenses relative to when they were renting? We focus on first-time homebuyers because the questions imply that those transitioning from renting to owning could often lower their monthly expenses by purchasing a home.

First-time homebuyers generally increase housing expenses

The FHA collects data on borrowers’ current (pre-mortgage) housing-related expenses, subsequent (post-mortgage) expenses and qualifying income. We examine changes in these expenses—each as the share of income—for 5.1 million insured mortgages to first-time homebuyers between 2004 and 2018.

In addition to the mortgage payment, post-mortgage expenses include property taxes and homeowners insurance. An implicit assumption of our analysis is that for rental properties, the costs associated with property taxes and insurance are factored into rent. In the parlance of the mortgage industry, we are looking at changes in “front-end ratios” immediately before and after a loan has been originated.

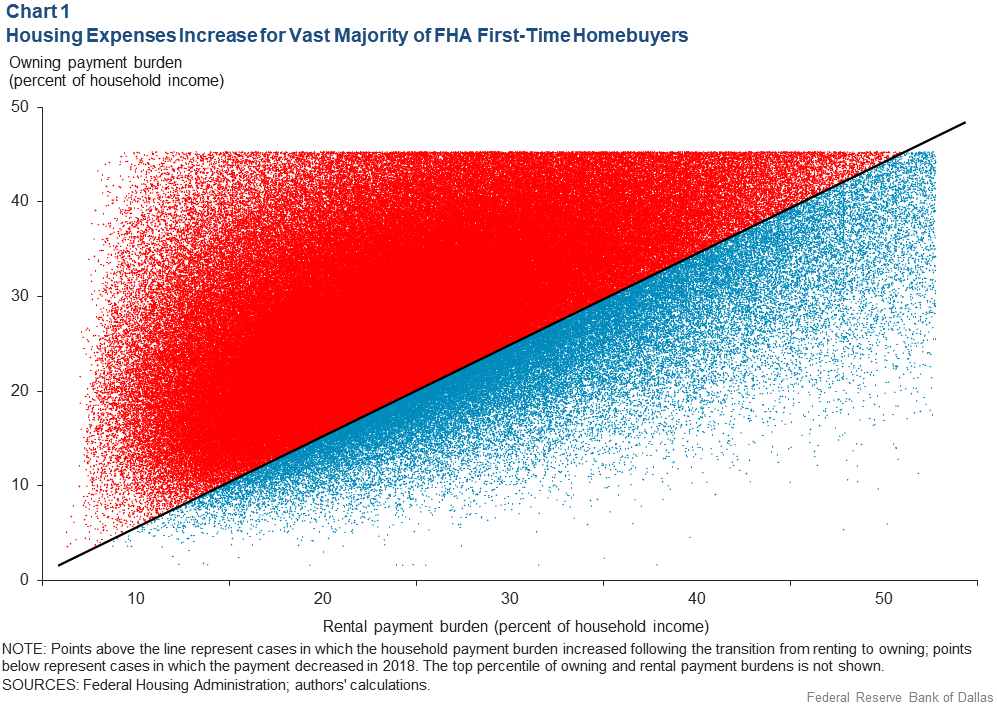

Chart 1 provides a scatter plot of the payment burdens for first-time FHA borrowers who, after renting, purchased a home during the most recent year in our data, 2018. To eliminate outliers, we drop loans with apparent coding errors and those in the bottom and top 1 percentile of rental and mortgage payment burdens.

Points above the 45-degree line (shown in red) represent cases where the household’s payment burden increased following the transition to homeownership. Similarly, points below the 45-degree line (shown in blue) represent cases where, as Golding suggests, the household’s payment burden decreased.

While there are cases where households lowered their monthly housing expenses in 2018 by purchasing a home, the vast majority (86 percent) increased their payment burden. This likely reflects the tendency for households transitioning to owning to purchase a home that is larger than their former residence. Given the transaction costs in buying/selling a home, it makes sense for households to initially buy more housing than they need so that they can “grow into” their new home and amortize those costs over time.

Golding’s point, however, was that it is precisely those households with high mortgage-payment burdens that are more likely to have experienced even higher rental payment burdens.

To check this, we consider the same four intervals of the “back-end” debt-to-income (DTI) ratio—covering all monthly debt, not just housing-related obligations—used in our previous article to establish a positive connection between DTI and default. The four DTI levels used are:

- Low DTIs (less than or equal to 36 percent).

- Moderate DTIs (between 36 and 43).

- High DTIs (greater than or equal to 43 but less than 50).

- Very high DTIs (at or above 50).

If Golding is correct, the percentage of households lowering their payment burden by owning should increase as we move from low to high back-end DTI ratios. Similarly, the average change in housing expenses should decline (and perhaps turn negative) as we again move from low to high back-end ratios.

FHA data for 2004 to 2018, shown in Table 1, indicate that as the back-end mortgage ratio moves up from the low to higher ranges, the percentage of households reducing their housing expenses by becoming homeowners declines rather than increases.

Table 1: Highly Indebted Homebuyers Increase Housing Expenses the Most

| Owning payment burden | Back-end debt-to-income ratio | Percent reducing payment burden | Average percentage-point change in payment burden |

| Low | < 36 | 20 | +4.8 |

| Medium | 36-42 | 16 | +7.2 |

| High | 43-50 | 15 | +8.5 |

| Very high | > 50 | 16 | +8.9 |

| SOURCE: Federal Housing Administration. | |||

Furthermore, the average change in monthly housing expenses is positive and increasing as we move from low to high DTI ratios. This suggests—contrary to Golding’s suggestion—that typically FHA borrowers at higher risk of default due to a high DTI (at or above 43 percent) on average increased their housing payment burden. The average increase was 8.5 percentage points for borrowers with DTIs of 43–50 percent and 8.9 percentage points for those with DTIs exceeding 50 percent.

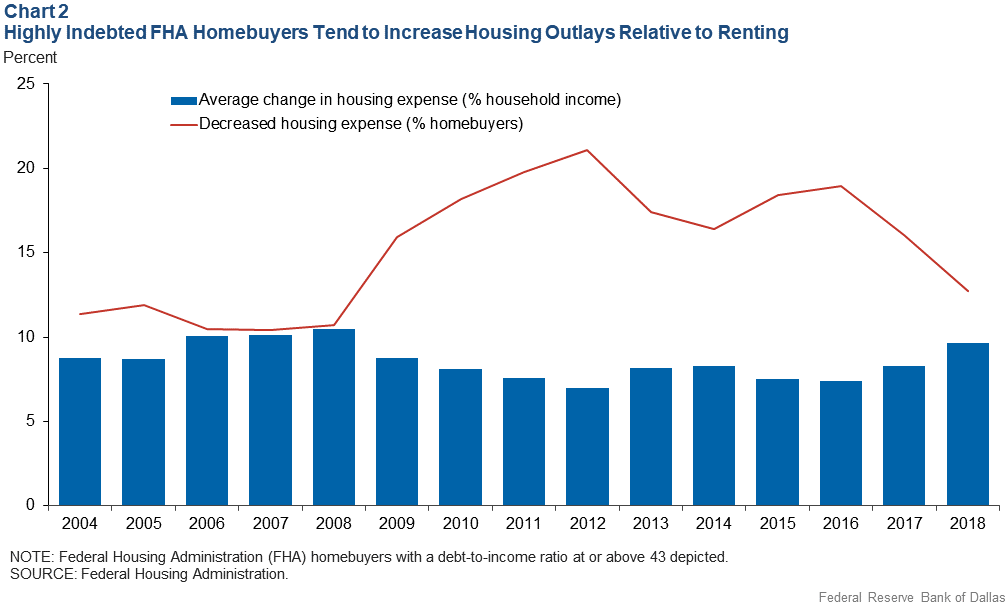

Has this payment-burden relationship between owning and renting changed over time for those with DTIs at or above 43 percent? To investigate this, we calculate the annual percentage of high-DTI borrowers who lower their payment burden and the average change in payment burden (Chart 2).

The likelihood that first-time buyers lower their monthly housing expenses by purchasing a house fluctuates somewhat over time. In the mid-2000s, between 10 and 12 percent reduced their payment burden.

But as the financial crisis hit in the latter half of the decade and house prices declined across the country, the fraction reducing the payment burden increased to 16 to 21 percent. By 2018, the likelihood was back down to around 13 percent. The average change in housing expenses by transitioning from renting to owning fluctuated from 7 to 10 percent over the 15-year period.

Homeownership not typically an escape from high rent burdens

Our previous work demonstrated that a higher debt-service burden is associated with greater mortgage default risk. Golding suggests that these same households would face an even higher risk of losing their housing if they remained renters.

We have shown that households, particularly those with high mortgage debt-to-income ratios, generally increase their payment burdens in the transition from renting to owning. Consequently, in these tough times, most of these households face a more difficult challenge managing their budgets as owners instead of as renters. This reflects that homeownership does not typically provide an escape from high debt burdens.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.