Anticipated federal restrictions would slow Permian Basin production

Possible changes to oil leasing and permitting requirements governing federal lands could shift oil production, prompting a realignment of Permian Basin activity between Texas and New Mexico. Half of New Mexico’s production comes from federal acreage in the Permian Basin, and the anticipated actions would slow economic growth, adversely affecting that state's employment and tax collections.

In January, federal agencies temporarily halted new leasing and permitting for oil and gas activity on federal lands and began a concurrent government-wide review of policies on fossil fuel development.

Although the timing and outcome of this process are uncertain, we consider two possible regulatory scenarios and their impact on Permian Basin oil production.

Taking both into account, we estimate that by the end of 2025, the Permian will produce between 230,000 and 490,000 barrels per day less than if drilling activity continued at its current pace. As a result, production and employment across the basin will gradually shift from federal lands in New Mexico to private and state lands in New Mexico and Texas, with wide-ranging economic implications for the region.

Federal lands critical to New Mexico’s oil production

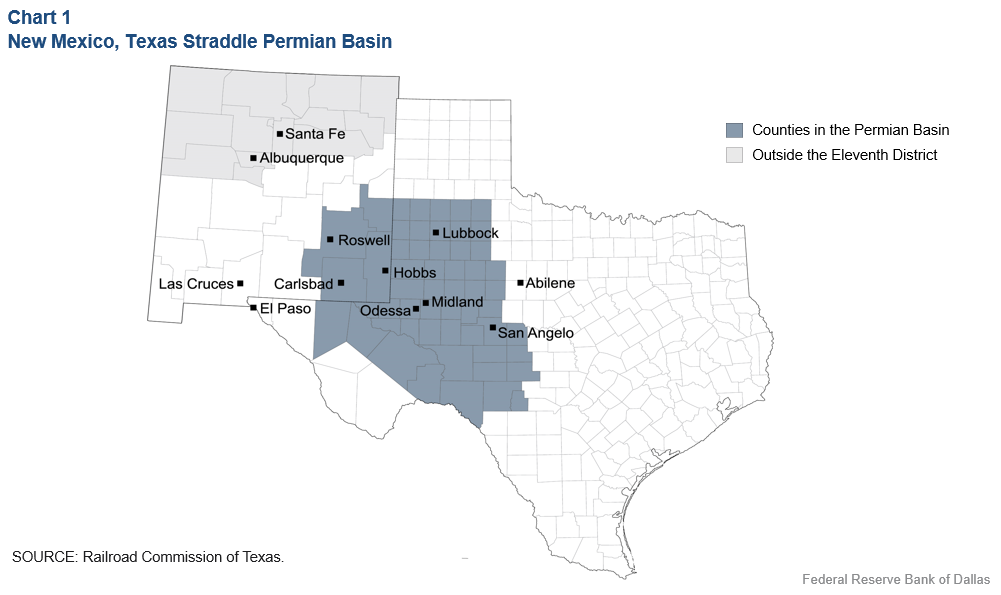

The Permian Basin is the world’s largest shale oil and gas field, straddling the Texas–New Mexico border (Chart 1). The Texas side produced 3.3 million barrels per day (mb/d) of oil on average in 2020, while the New Mexico portion pumped 1.0 mb/d. In New Mexico, half of Permian production in 2020 came from wells on federal lands. All production in Texas is on private and state-owned land. Wells on federal leases are, on average, higher performing than those in other parts of the basin.

Energy companies historically have leased acreage for 10-year periods and applied for permits from the federal government to drill wells. Permits are valid for two years; if a permit goes unused during the period, leaseholders have historically been able to obtain a two-year extension.

Restrictions on leasing, permitting examined

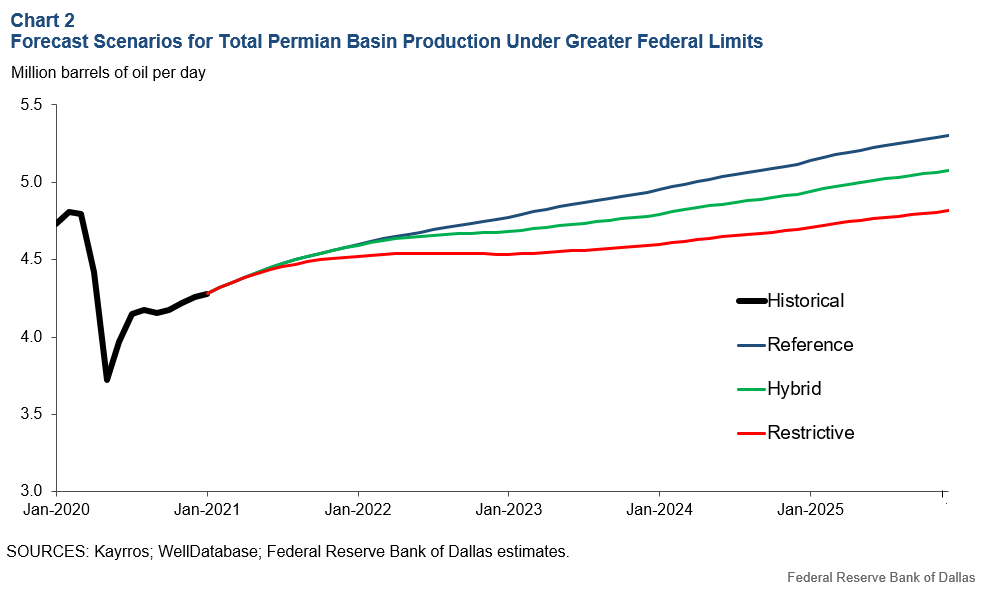

Based on media reports and discussions with stakeholders, we consider two scenarios and a reference scenario to evaluate the impacts of potential policies in the Permian Basin. An average price of $50 for benchmark West Texas Intermediate is assumed (Chart 2).

-

Reference Case: This serves as the benchmark and assumes little-changed leasing, permitting and drilling from first-quarter 2021 levels.

Under this scenario, Permian Basin production grows from 4.3 mb/d today to 5.3 mb/d in December 2025. New Mexico’s production expands from 1.0 mb/d to 1.5 mb/d.

-

Hybrid Case: It assumes no new federal leasing, but existing leaseholders continue receiving drilling permits. Permit reviews are more rigorous, leading to slower approvals and a costlier operating environment beginning in 2022. Based on companies’ public statements, firms that hold acreage across the basin gradually relocate drilling rigs and completion crews to their nonfederal locations.

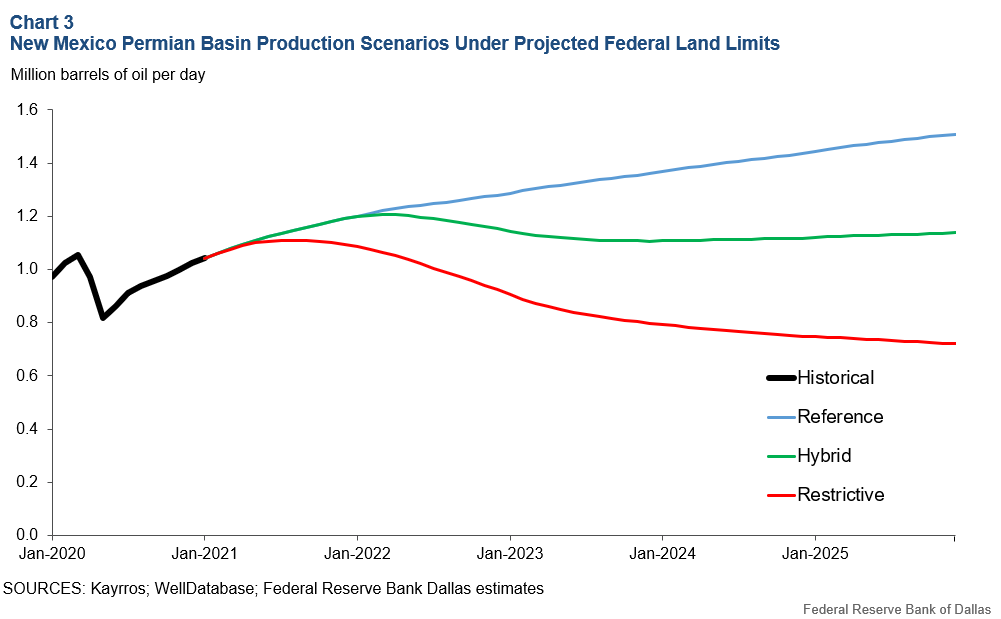

Permian Basin production increases to 5.1 mb/d in 2025, or 0.2 mb/d below the Reference Case. New Mexico’s oil output is 1.1 mb/d, or 0.4 mb/d below the Reference Case in 2025.

-

Restrictive Case: No new federal permits or extensions are granted starting in 2023. This is when the most-recently issued permits will expire. The existing permitting freeze adversely affects production in the near-term due to a lack of approvals of permit modifications and pipeline rights-of-way. As in the Hybrid Case, companies shift their focus to nonfederal acreage.

Permian production climbs to 4.8 mb/d in 2025, or 0.5 mb/d below the Reference Case. New Mexico’s output drops to 0.7 mb/d, or 0.8 mb/d less than the Reference Case.

New Mexico more vulnerable than Texas

These production forecasts have notable impacts across the region, notably in New Mexico (Chart 3).

With an expected shift in drilling from federal acreage, employment moves across state borders from New Mexico to Texas.

We assume that a standard three-well pad on average requires 240 workers. In the Hybrid and Restrictive cases, between 3,500 and 6,600 drilling and completions workers will not be needed in New Mexico from now through year-end 2025, while Texas will require between 5,400 and 7,400 more workers. The ramifications of the shift extend to support and corporate jobs, with secondary effects on local retail and hospitality sectors.

The fiscal impact will also be large. New Mexico received $2.6 billion from oil and gas industry taxes, royalties and fees during fiscal 2020 ended June 30, 2020—one-third of the state’s general fund. A total of $809 million came from the state’s share of minerals revenue on federal properties.

The slowdown in activity and production levels in the Restrictive Case puts a large and growing portion of state revenue at risk after this year. Under the Hybrid Case, production stabilizes and preserves state royalty and tax revenue closer to current levels.

At the same time, oil refineries and chemical facilities on the Gulf Coast would need to adapt to losing barrels from the Permian Basin. These industries expanded capacity in recent years to consume the specific variety of light and super-light crude oil produced in the Permian. Similar oil from West Africa and the Arabian Gulf could most easily substitute for the lost inputs. Suppliers in those regions could also replace Permian volumes previously destined for the export market—primarily to East Asia and South America.

Wide-ranging policy implications

New policies are likely months away, but oil companies, state governments and municipalities are in the process of examining the potential outcomes. Our analysis focuses on the Permian Basin given its location and economic significance to the Dallas Fed’s Eleventh District service area.

We expect production from other basins to decline against business-as-usual forecasts as well, especially in the Gulf of Mexico, where the federal government manages nearly all oil and gas activity.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.