Fed’s new inflation targeting policy seeks to maintain well-anchored inflation expectations

The 2007–09 global financial crisis packed an economic punch that led the Federal Reserve to its first-ever monetary policy framework review. The Fed concluded this effort by announcing a major change in its monetary policy strategy—moving from what has been described as flexible “inflation targeting” to flexible “average inflation targeting.”

The change reflects lessons learned over time and from other countries and represents an evolution of the framework to better adapt monetary policy to the challenges of a low-inflation, low-interest-rate environment.

Monetary policy evolution

The Federal Open Market Committee (FOMC) lowered its policy rate—the federal funds rate—to near zero in response to the financial crisis. It also decided to keep an “ample” level of reserves in the banking system, changing the way monetary policy guides the federal funds rate. The Fed also expanded its toolkit and communication practices with balance-sheet policies supported by forward guidance. Forward guidance refers to a commitment by the central bank on the future path of the policy rate.

The FOMC issued its first statement of longer-run goals and policy strategy in 2012 and subsequently amended it in 2019. That statement included the Fed’s first explicit commitment to an inflation rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures (PCE). That strategy is often referred to as flexible inflation targeting.

The changing U.S. economy

The Fed’s most recent (2019–20) review of its monetary policy framework (strategy, policy tools and communication practices) was motivated by growing awareness of structural transformations of the economy, including diminished sensitivity of inflation to resource slack.

This is not just a U.S. phenomenon; countries around the world have had similar experiences. Recent research suggests the downward drift in longer-term inflation expectations and the disinflationary pressures arising from diminishing pricing power and globalization have been important factors holding down inflation.

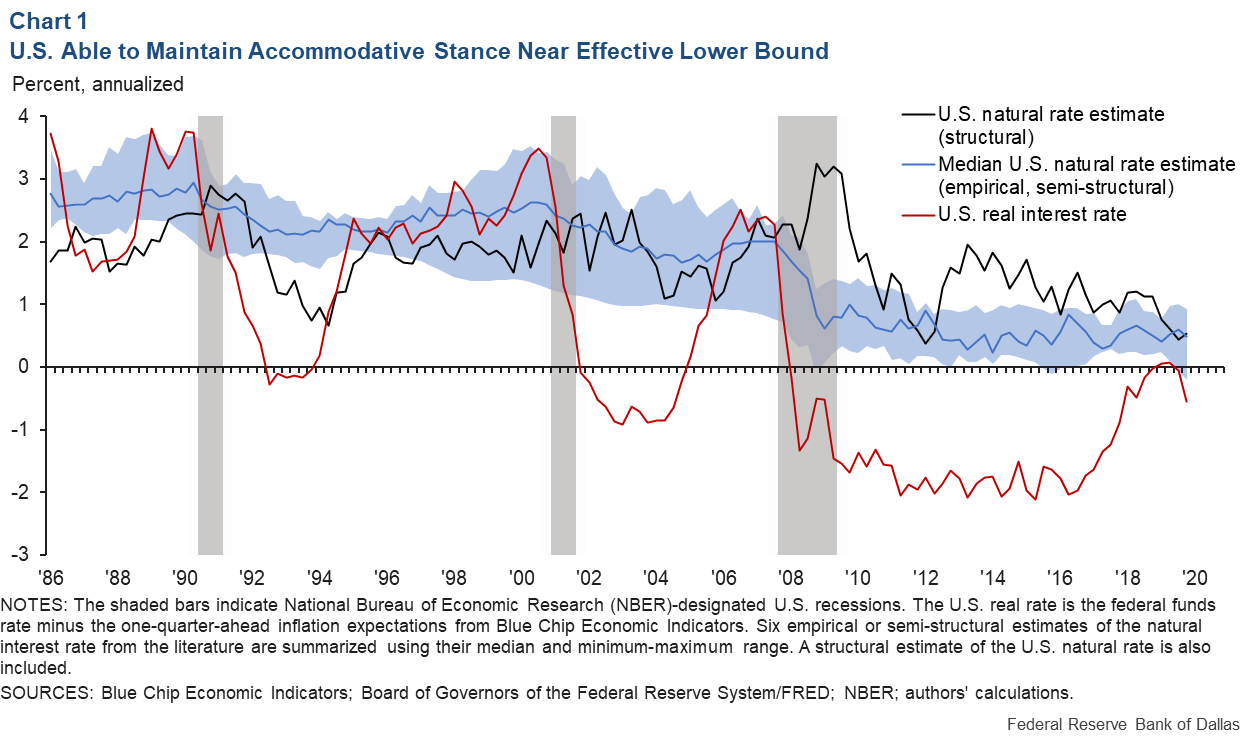

Another important structural change is the decline in the natural rate of interest—the real rate consistent with full employment and inflation at its target. Estimates of the natural rate in the U.S. have fallen notably from their pre-2007–09 recession levels above 2 percent to less than 1 percent (Chart 1).

The decline in the natural rate is a worldwide phenomenon resulting from population aging, slowing productivity growth and globalization.

A decline in the natural rate reduces the space to stimulate the U.S. economy through cuts in the federal funds rate, leaving the Fed more reliant on other policy tools such as balance sheet policies and forward guidance. The likelihood of being constrained by the effective lower bound—that is, when interest rates cannot fall below zero—is greater in low-interest-rate environments.

The Fed’s strategy change, acknowledging a new environment

Fed Chair Jerome Powell announced the more significant changes resulting from the Fed’s monetary policy framework review on Aug. 27, 2020.

The statement of longer-run goals and policy strategy explicitly acknowledges the challenges posed by the proximity of interest rates to the effective lower bound. By reducing the Fed’s scope to support the economy through interest rate cuts, the lower bound increases downward risks to employment and inflation. The statement also highlights that the Fed is prepared to use its full range of tools to achieve its dual-mandate objectives—stable prices and maximum sustainable employment.

Notably, the Fed changed its language on inflation, replacing its 2 percent inflation target commitment, and instead said it will “[seek] to achieve inflation that averages 2 percent over time.”

This change is a substantial departure from the previous flexible inflation-targeting regime. Monetary policy under inflation targeting was symmetric—the Fed would equally respond to overshooting and undershooting of the target. The Fed lets “bygones be bygones,” since it does not attempt to make up for past inflation deviations from target.

By comparison, average inflation targeting means that policymakers would consider those deviations and can allow inflation to modestly and temporarily run above the target to make up for past shortfalls, or vice versa.

How monetary policy could change

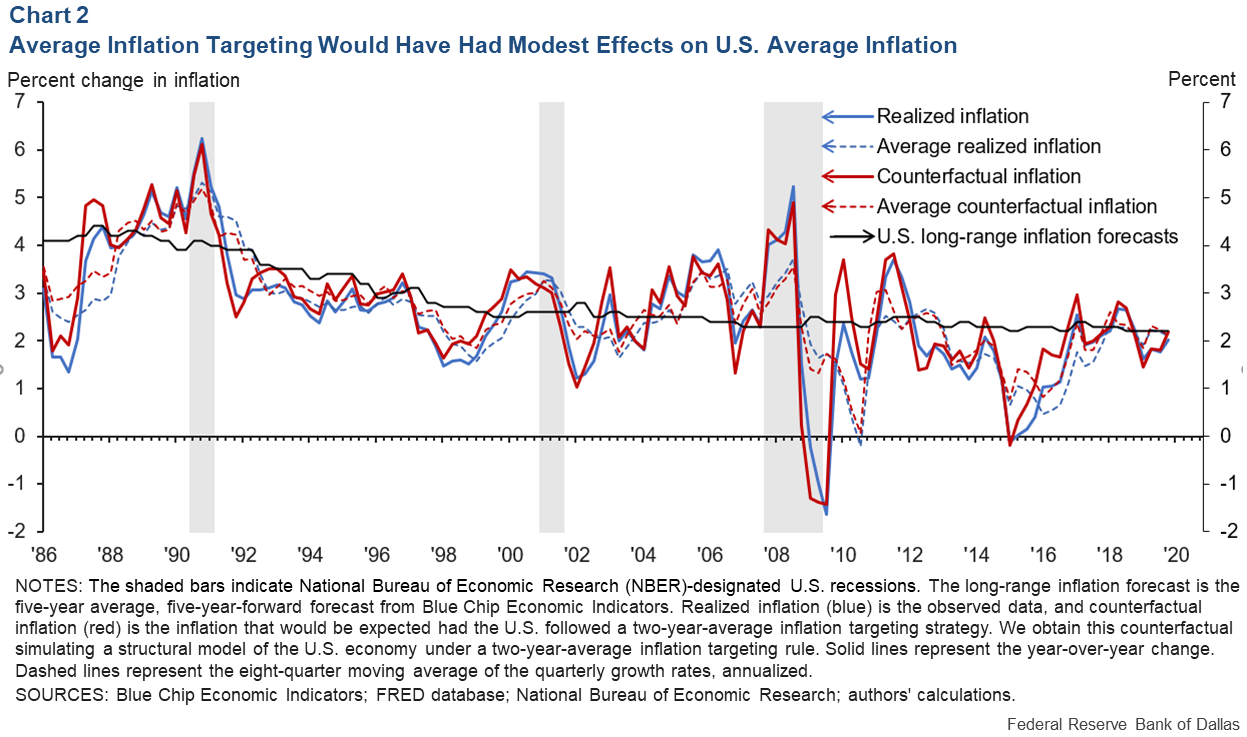

Based on an estimated medium-scale structural model of the U.S. and global economies, we explore how inflation would have behaved had the Federal Reserve adopted a regime of flexible average inflation targeting from 1986 (following a period of high U.S. inflation) to 2019 (Chart 2).

The behavior of households and firms is modeled at the individual level, with agents fully informed and rational. In our counterfactual scenario—in which policymakers react to two-year-average inflation rather than to contemporaneous inflation alone—key structural parameters on preferences and technology remain unchanged at their estimated values. We assume the economy is hit with the same sequence of domestic and foreign shocks (including monetary ones).

Our counterfactual analysis suggests that, if long-run inflation expectations had remained as observed in the data, the cyclical part of U.S. inflation would have been only 0.1 percentage points higher on average under average inflation targeting than what occurred under the previous monetary policy regime.

This finding does not explicitly consider the intent of policymakers. Monetary policy implementation could also have been different (perhaps even more aggressive at providing accommodation) under the average inflation targeting regime.

Staying well-anchored around long-run expectations is arguably an important rationale for average inflation targeting. We also do not explicitly consider that if long-run inflation expectations had firmed up in this counterfactual, it would have likely resulted in higher overall realized inflation.

Why ‘Average Inflation Targeting’ Then?

When aggregate demand shocks drive the economy to the effective lower bound, theory suggests that the cumulative effect also puts sustained downward pressure on inflation. The concern is that below-target inflation outcomes may become entrenched in lower, below-target inflation expectations. This would pose a challenge to the Fed in meeting its dual-mandate goals.

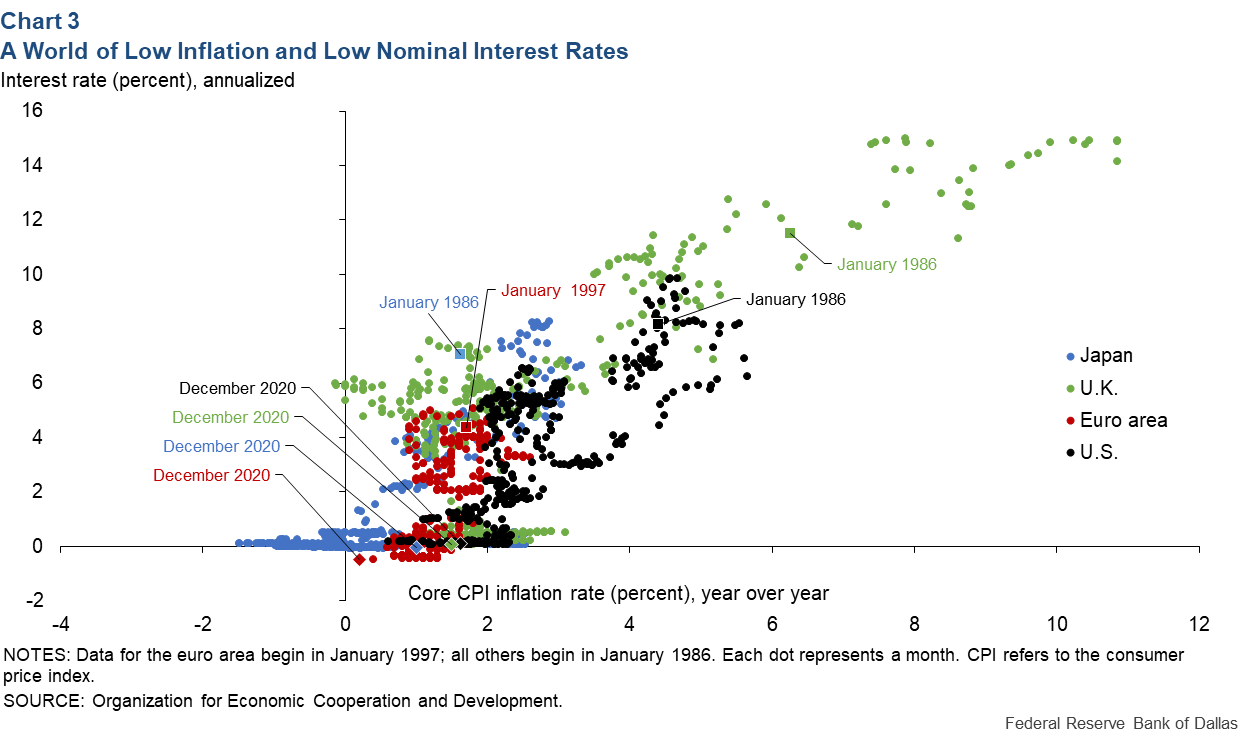

There might be a number of plausible long-run outcomes for the economy. One is consistent with monetary policy implemented in the U.S. since the ‘80s, after inflation was tamed and inflation expectations became anchored around the Fed’s target. Another possible outcome is the low-nominal-interest-rate, deflationary regime observed in Japan during the same period (Chart 3). Average inflation targeting allows policy space for the Fed to “make up” for lost inflation to sustain the former equilibrium.

By adopting average inflation targeting, the Fed is communicating that 2 percent is not a ceiling for inflation and that it may let inflation exceed 2 percent modestly and temporarily to make up for past low inflation. The key aim of this policy shift is anchoring inflation expectations.

Monetary Policy Continues to Evolve

The Fed’s evolving understanding of the economy and its reassessment of the natural rate of interest have led to arguably the most significant policy change since 2012. The new strategy of flexible average inflation targeting provides more flexibility to pursue the central bank’s maximum employment and price stability mandates in the current low-interest-rate environment.

It also reinforces the importance of keeping U.S. inflation expectations well-anchored. However, as our understanding of monetary policy transmission and the economy evolves, the Fed will become challenged anew and will continue adapting to achieve broad-based growth consistent with its long-run inflation target.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.