Using inflation expectations to boost consumer spending poses policy risks

After central banks have cut interest rates as much as they can, economic theory suggests that they can still stimulate spending by lifting households’ inflation expectations.

During periods when the policy rate is stuck at zero, households’ perceived real cost of borrowing (or benefit from saving) decreases when they anticipate higher inflation. This, in turn, induces spending now rather than in the future. Communication that raises inflation expectations has thus been suggested as a policy tool for central banks. Our research suggests that this policy tool has some limitations that central banks must manage when implementing this tool.

Assembling and analyzing datasets

We use data from RAND Corp.’s American Life Panel (RAND-ALP) Survey from 2009–12, when the zero lower bound was binding. This survey measures respondents’ spending and inflation expectations over time. We can, thus, remove the impact of unobservable characteristics of a given household, which may otherwise lead to left-out-variable bias in the empirical results. The survey also enables assessment of the role of observable characteristics, such as mortgagor status.

The RAND data contain additional variables that capture other economic expectations. Such variables can be correlated with inflation expectations and simultaneously influence consumption. (Ignoring these variables would invalidate the empirical results.) These variables include expectations regarding unemployment, nominal interest rates, respondents’ wages, house prices and uncertainty surrounding future inflation and wages.

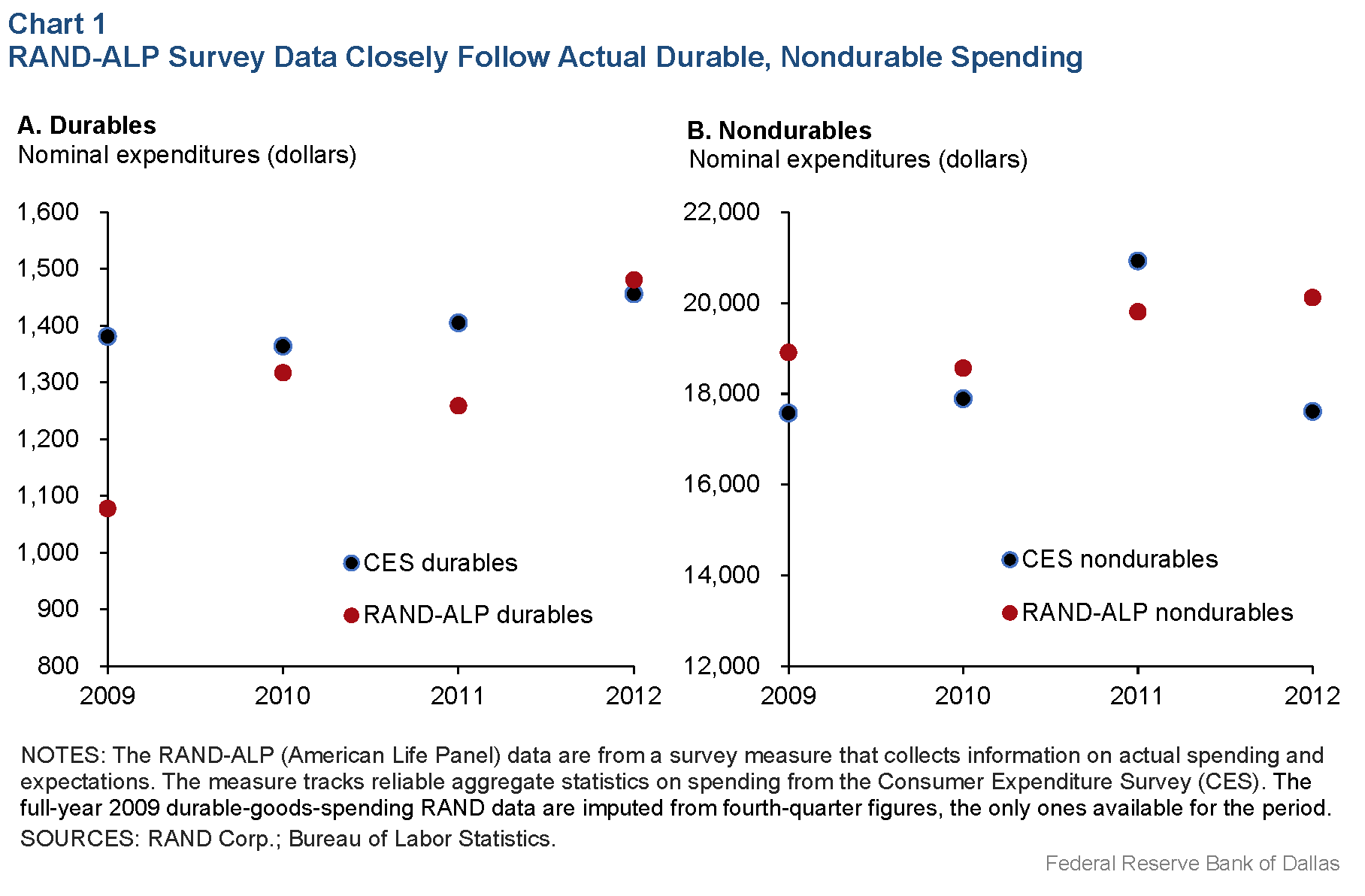

We are also able to decompose the effect of expected inflation into spending on durable goods (such as appliances) and spending on nondurable goods and services. These spending amounts in our sample in most periods closely resemble a comparable spending measure based on the widely used annual Consumer Expenditure Survey (CES) (Chart 1).

The full-year 2009 durable-goods spending RAND data are imputed from fourth-quarter figures—the only ones available for the period—to allow comparison to the CES. This imputation method explains the large discrepancy between CES and RAND data that year.

Our study (“Household Inflation Expectations and Consumer Spending: Evidence from Panel Data”) reconciles a divided literature on inflation expectations. Previous studies have proxied for consumption expenditures with qualitative measures of “readiness to spend” or qualitative measures of actual spending. Moreover, previous researchers have mostly relied on cross-sectional data that do not account for unobservable characteristics of households. The unique characteristics of our source data offer insights into discrepancies arising from this previous research.

Inflation expectations stimulate durable goods spending for some

The data provide a view of inflation expectations and spending both in the aggregate and for different demographic groups. Although it appears that the average effect of inflation expectations on durable goods spending is small (positive) and statistically insignificant, that isn’t true for some population subgroups. Specifically, among the college-educated, a 1 percentage point increase in one-year-ahead inflation expectations increases household durable goods spending by about 21 percent in the immediate quarter.

The estimated effect of inflation expectations on durables spending also appears stronger for lower-income households. For example, among the college educated, households with income at the 25th percentile increase durables spending by 25 percent with a 1 percentage point increase in expected inflation, whereas those with income at the 75th percentile boost durables spending by 14 percent, a statistically insignificant effect.

Households with mortgages on average increase durables spending by 25 percent, and those also with a college education exhibit a larger effect, 39 percent. Moreover, a higher mortgage balance boosts the response among this group by a statistically significant margin.

The differential response of college-educated respondents is consistent with previous research that focuses on differences in IQ or differences in financial literacy.

The other effects are consistent with theoretical predictions. For example, net debtor households, as opposed to net savers, should be more likely to increase spending in response to a decline in the real rate, as would follow from an increase in inflation expectations at the zero lower bound.

Our finding that lower-income households’ spending is more sensitive to inflation expectations conforms to this notion, to the extent that such households are more likely to be net debtors. As another example, higher inflation expectations erode the real (inflation-adjusted) value of nominal debt, suggesting that households with greater nominal debt should experience a more positive consumption response.

Consistent with this argument, a higher mortgage balance amplifies the consumption response to expectations of rising inflation.

Inflation expectations have minor effect on nondurables spending

Separate spending data reveal no response or a slightly negative one to an increase in expected inflation in terms of spending on nondurable goods and services. Among all subgroups, only respondents with no college education and in the 25th income percentile had a positive response to inflation expectations. However, their nondurables spending increased only by 2 percent.

Unemployment fears may counteract inflation expectations’ impact

Raising inflation expectations could pose a downside risk if people associate higher inflation with bad outcomes. Our evidence suggests that pessimism associated with the prospects for rising unemployment contributes to a substantial decrease in consumer spending among households.

Thus, any positive effect that inflation expectations may exert on consumption could be attenuated if accompanied by anticipated higher unemployment.

Aggregate policy implications

The upside to elevated inflation expectations is a clear jump in some respondents’ spending on consumer durables. The 2017 CES reports that approximately 90 percent of aggregate spending is on nondurable goods and services. While durables account for just 10 percent of aggregate consumption, the large effect on durables implies a 1.8 percent increase in one-quarter total spending.

If the central banks’ efforts at raising inflation expectations also raise expectations of future unemployment, the impact of using inflation expectations as a policy tool to stimulate consumption may be limited. Moreover, it is unclear if spending behavior will be persistent because lagged expectations tend to have weak effects on spending patterns.

This suggests that central banks using inflation expectations as a policy tool need to carefully design, implement and communicate their policy to the public in an effort to limit adverse impacts on unemployment expectations.

About the Author

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.