Texas electrical grid remains vulnerable to extreme weather events

January 17, 2023 (revised January 24, 2023)

The Texas deep freeze in February 2021 exposed the inability of the state’s energy supply chain to withstand extremely cold temperatures. Nearly two years later, questions remain whether the electrical grid is now more resilient to winter weather.

New regulations, weatherization standards and operational changes have addressed many shortcomings, but some critical gaps persist.A cold snap in the days surrounding Christmas 2022 did not result in rolling blackouts or worse, as was the case in February 2021. However, power plants and natural gas facilities still failed in the below-freezing temperatures. With intermittent sources of renewable power becoming a large and growing presence in the energy mix, thermal power reliability is crucial.

Taken together, the Texas grid is in better shape than it was during the 2021 deep freeze. However, improved enforcement of weatherization standards, incentives for thermal power plant development and enhanced demand-response programs would help ensure the power grid stands up to future demand growth and the challenges of extreme weather.

What went wrong in February 2021

The deep freeze two years ago brought single-digit and subzero temperatures across most of Texas along with ice and snow. Multiple natural gas and coal power plants experienced equipment failures and were forced offline. Wind speeds fell to extremely low levels, and many of the few wind turbines producing power froze.

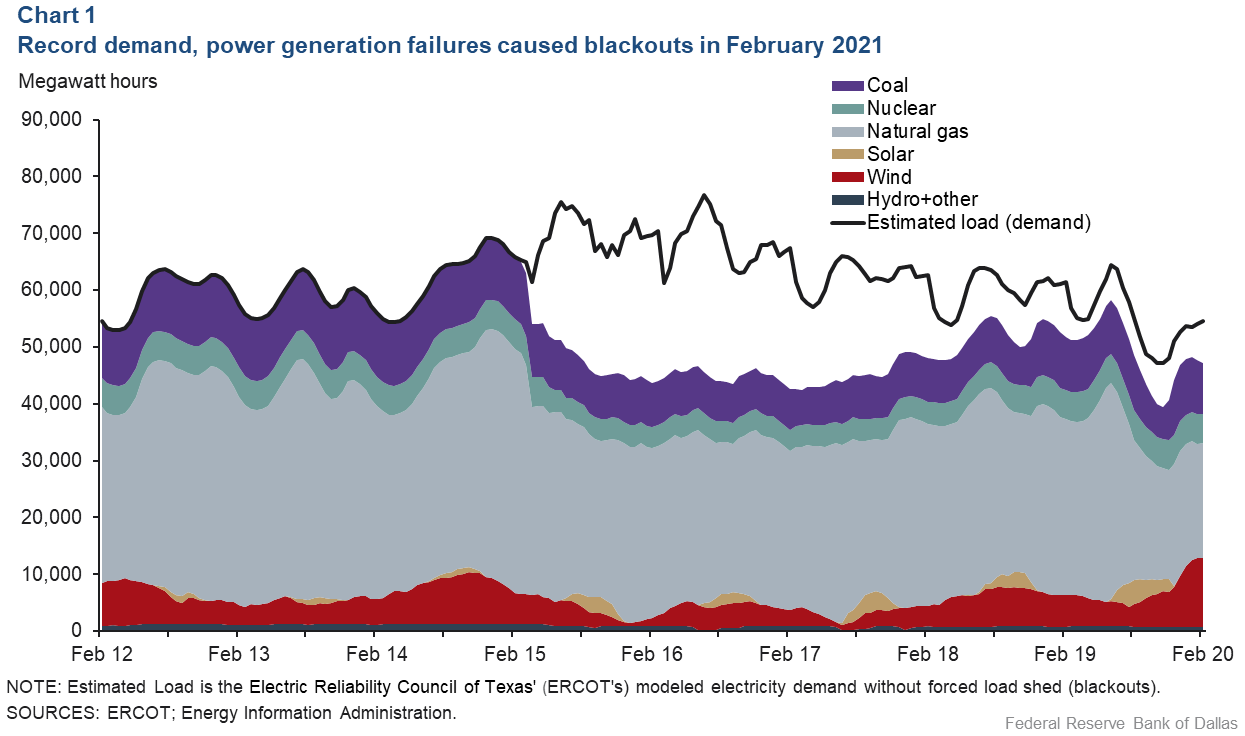

Power generation was unable to match record demand, forcing the state’s grid operator, the Electric Reliability Council of Texas (ERCOT), to order power cut to millions of customers to maintain grid stability. In the process, electricity was also unknowingly disrupted to many natural gas production and processing facilities, which had already struggled to operate in cold temperatures. A “doom-loop” resulted for power plants unable to procure supply (Chart 1).

The situation did not significantly improve until temperatures rose above freezing four days after the event began.

Improvements made since February 2021

Updated weatherization standards for energy facilities were approved in May 2021. The Texas Public Utility Commission was charged with writing and implementing requirements for power plants, while the Texas Railroad Commission, the state’s oil and gas regulator, was given responsibility for developing requirements for natural gas facilities.

Additionally, the new rules required state authorities and industry participants to develop a map to better ensure that critical natural gas facilities would continue receiving power if rolling blackouts were ordered.

ERCOT also underwent a series of management and grid operation changes. They included requiring more thermal power generation to be held in reserve in case power plants unexpectedly go offline or demand suddenly outstrips forecasts.

Christmas 2022 cold snap tests grid improvement efforts

During the cold and wind event of Christmas 2022, temperatures dropped to the low teens across most of Texas, and electricity demand surged to over 73,000 megawatts (MW)—near the wintertime record set in February 2021. (A megawatt can be consumed by roughly 200 homes in Texas during peak-demand hours.)

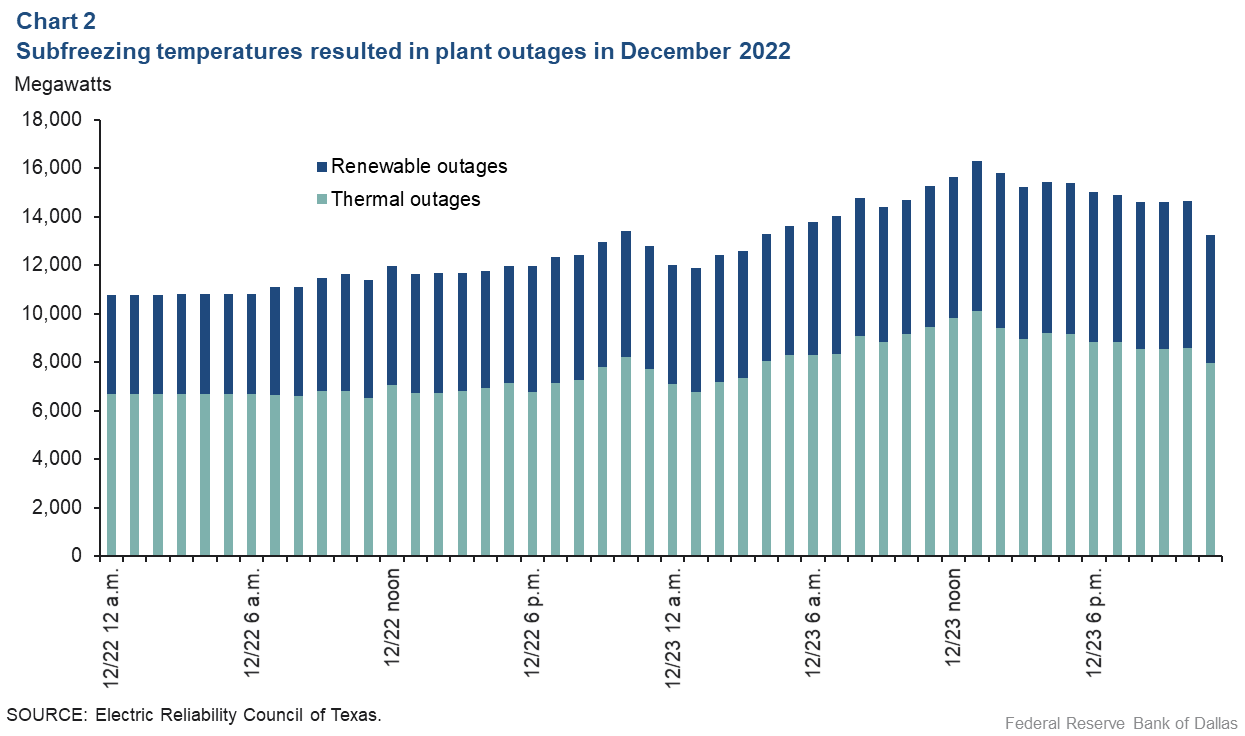

As the temperature fell and demand soared, 10,000 MW of thermal power plant capacity and 6,000 MW of renewable generating capacity was offline due to the conditions (Chart 2). Additionally, Texas natural gas production is estimated to have fallen by almost 20 percent on Dec. 23 from the week before, according to Bloomberg New Energy Finance.

Despite these difficulties, power generation and reserves remained adequate during the cold spell, and ERCOT was not forced to shed load. Nationally, several other major regional grids, which experienced colder temperatures and precipitation, had more thermal-plant failures and resorted to rolling blackouts.

Vulnerabilities remain in the Texas system

The Texas grid passed the Christmas-time test. However, the cold front was nothing like the deep freeze of February 2021 with respect to how long very low temperatures remained in place and how much freezing precipitation fell.

Of significant concern is how power demand during the most-recent episode nearly exceeded levels of two years prior despite temperatures being roughly 10 degrees warmer. ERCOT’s own demand forecast was off by over 12,000 MW the day before the cold front arrived. State population growth, electrification of home heating and other trends appear to have substantially affected winter electricity consumption.

Wind-power generation soared as temperatures plunged with the arrival of the cold front, with northerly winds exceeding 35 mph in many parts of the state. But similar to the 2021 deep freeze, wind speeds generally fell to 5 mph the day after the front passed, forcing the grid to rely primarily on thermal power plants and their associated supply chain. While the vast majority of thermal power plants stayed online during the cold spell and kept the lights on, failures still occurred.

Additionally, the nearly 20 percent drop in natural gas production should be a cause for concern especially when recognizing how much less severe the weather system was relative to the 2021 deep freeze. Likewise, a gas distribution company in North Texas experienced service interruptions due to the conditions. Limited resources and self-policing appeared to hinder state inspection and implementation of weatherization standards.

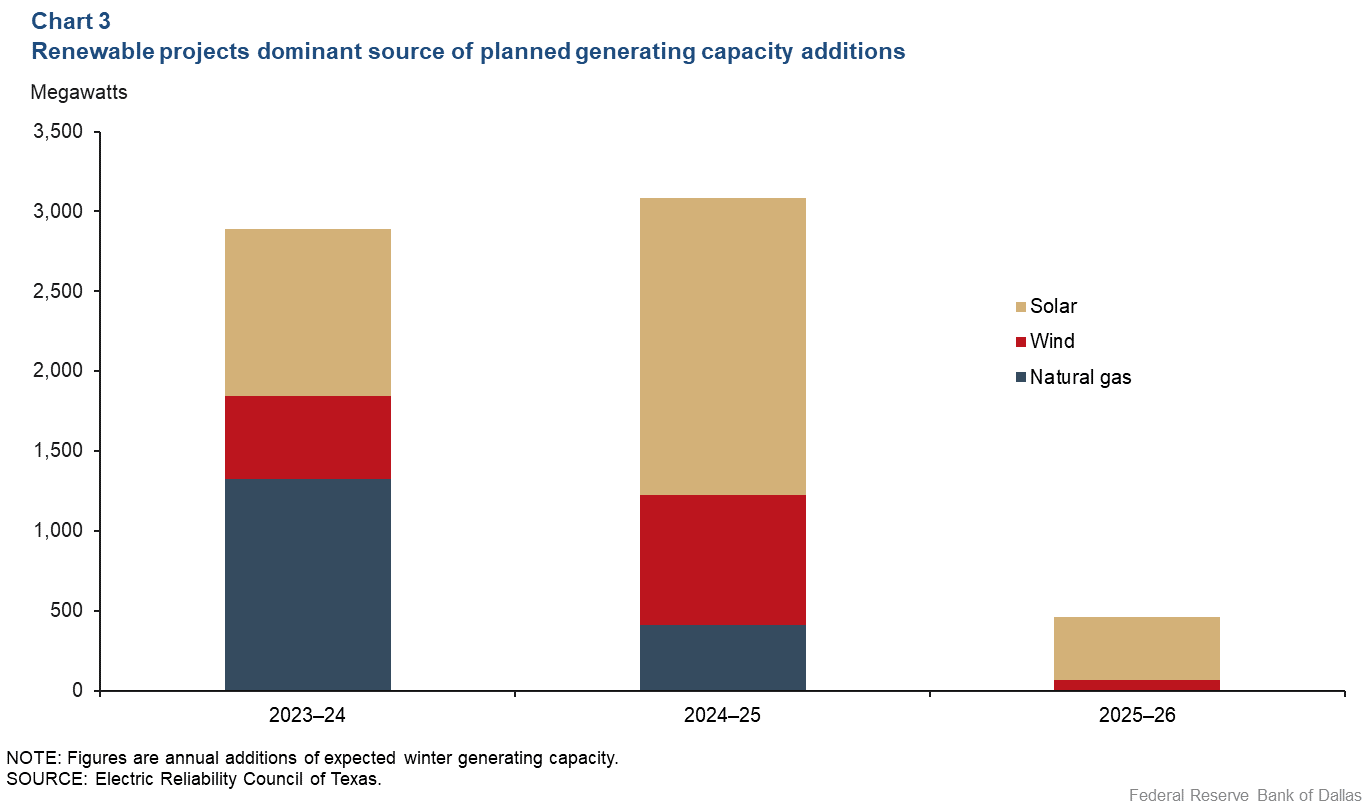

Wind and solar are the leading share of planned capacity additions in Texas over the next several years, but with utilization rates that are well below installed capacity due to weather and time of day, their expected contributions are limited (Chart 3).

With electricity demand continuing to grow, grid reliability increasingly hinges on an aging collection of coal and gas plants. These facilities are proving less reliable at offsetting expected drops in intermittent power sources in both extreme cold and heat. However, market incentives for additional thermal-plant construction are inadequate.

State utility regulators are evaluating electricity market modifications that could help the situation, but between now and whenever new capacity comes online under an improved market structure, ERCOT will be challenged to balance supply and demand during severe weather events because of the growing mismatch between rising renewable capacity and dispatchable, completely reliable resources.

Finally, Texas does not have a widespread demand response program where customers are paid to reduce power consumption when grid conditions tighten. Such efforts are primarily left to local utilities and retail providers. Additionally, bitcoin mining operations pursue demand response agreements with ERCOT itself.

A statewide effort and incentive program would greatly assist grid stability during extreme weather events in the short term, while enhanced energy efficiency standards for new buildings would help in the long run.

Grid stability challenges are surmountable

There have been significant improvements to the Texas electrical grid over the past two years. However, the occurrence of no blackouts since February 2021 is a low bar to meet.

The cold snap last month demonstrated that progress has been made, but it also exposed the remaining vulnerabilities as electricity demand increases and extreme weather becomes more common. Proper regulatory enforcement and continued review and improvement of policies will help ensure the state’s power grid is up to the challenges of the future.

The amount that Texas natural gas production declined on Dec. 23 was revised with data from Bloomberg New Energy Finance.