Reciprocal deposit networks provide means to exceed FDIC’s $250,000 account cap

Updated September 6, 2024, with revised 14th paragraph.

The failures of Silicon Valley Bank, Silvergate Bank and Signature Bank in March 2023 and the ensuing banking turmoil have increased the appetite for deposit insurance.

“Reciprocal deposit networks,” a recent facilitator of this appetite, represent a market-based approach to insuring deposits in excess of the Federal Deposit Insurance Corp. (FDIC) $250,000 limit. Regulators impose caps on the concentration of reciprocal deposits banks can hold before they face adverse oversight consequences due to perceived overutilization.

Because of their prominence, reciprocal deposits are important in the broader discussion of deposit insurance. Though they have the potential to increase banks’ moral hazard, they also bring increased trust and safety to the banking system.

Deposit insurance covers most bank accounts

Although about 99 percent of deposit accounts linked to the $16 trillion total bank deposits in circulation fall below the $250,000 FDIC maximum threshold for insurance, the remaining 1 percent of accounts contain more than $7 trillion in uninsured deposits.

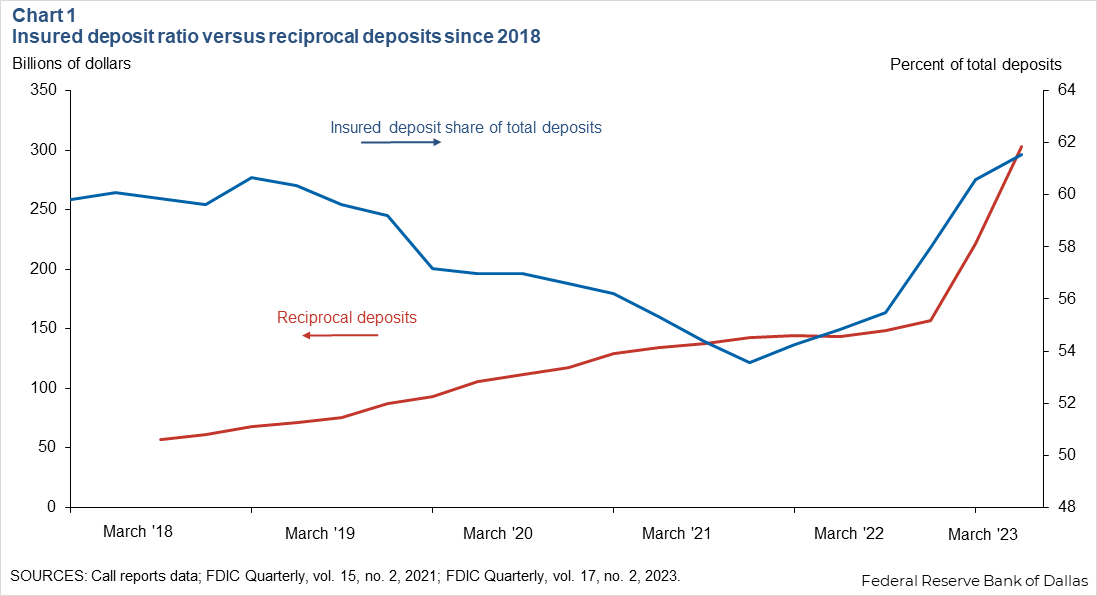

The level of insured deposits increased sharply in fourth quarter 2021, following a steady decline over the past decade. It has continued to increase since the Federal Reserve began tightening monetary policy to fight inflation in March 2022.

Reciprocal deposit networks have aided this recent growth of insured deposits. These networks, which have been around since the early 2000s, essentially offer a matching service that allows banks to interchange deposits in order to increase exposure to FDIC insurance. Reciprocal deposits rose to more than $300 billion in second quarter 2023, up from almost $157 billion at the end of 2022 (Chart 1).

How reciprocal deposits operate

To illustrate how these networks function, consider a customer who places a $500,000 deposit into their home bank, which happens to belong to a reciprocal deposit network (set up by an existing third party such as IntraFi or R&T Deposit Solutions, two of the largest networks). Without the use of a reciprocal network, only half of this customer’s deposit would be insured since it exceeds the $250,000 FDIC limit.

With the customer’s consent, however, the bank can utilize the reciprocal deposit network to split the $500,000 deposit into two $250,000 deposits. The customer’s home bank retains one of the deposits on their books, while the second is sent through the network and swapped with a different $250,000 deposit from another bank (hence the name reciprocal).

As a result, the FDIC now fully covers the customer’s original $500,000 deposit. Further, even though their deposit is spread across two separate banks, through additional interbank transfers, the customer receives the same standard market interest rate offered by their home bank. Ultimately, this means that reciprocal deposits are not designed for investors to reach for yield—that is, to simply obtain a higher interest rate.

Reciprocal deposit networks provide an alternative for depositors who may historically have insured their deposits by opening a multitude of deposit accounts below the FDIC limit—for example, a depositor with $1 million opening four separate $250,000 accounts.

Through a network, the burden of “splitting” large deposits is on the bank and not the depositor and can thus be more attractive especially for those with deposits that would require an unwieldy amount of accounts to fully insure.

This transfer of responsibility comes with a cost: The third party operating the reciprocal network receives a small fee in exchange for matching banks and depositors through its algorithm. Participating banks sometimes absorb the fee; other times they pass it on to customers.

Regulatory view changed in 2018

Before 2018, all reciprocal deposits were considered brokered deposits and thus received special attention by regulatory and supervisory agencies—such as the Office of the Comptroller of the Currency, the Federal Reserve and FDIC—that assess bank soundness and the likelihood of default. (Brokered deposits are generally sold to banks through a deposit broker and often command a higher interest rate.)

This special attention is a consequence of brokered deposits’ historical association with elevated probabilities of bank instability and failure. However, research suggests that reciprocal deposits reduce a bank’s probability of default and are associated with lower resolution costs in case of bankruptcy. This more positive view of reciprocal deposits in part led legislators to revisit the classification of reciprocal deposits in 2018.

Since then, a capped amount of reciprocal deposits can be classified as nonbrokered deposits. That is, reciprocal deposits are treated as core, nonbrokered deposits up to the lesser of $5 billion or 20 percent of liabilities for low-risk, well-capitalized banks. These banks can still reciprocate deposits over the stated limit, but these deposits would be classified as brokered. The brokered classification causes these deposits to receive greater scrutiny from regulators during bank assessment periods and exposes the institution to higher FDIC insurance fees.

Overall cap on reciprocal deposits roughly equals $1.3 trillion

Through some simplifying assumptions, we can compute an upper limit for the total amount of nonbrokered deposits that U.S. banks can channel into reciprocal networks. We hold the bank size and liability distribution constant and assume that all banks are in good standing (for example, are well-rated and well-capitalized). Holding each bank to its individual cap (the lesser of $5 billion and 20 percent of liabilities), we obtain a total value of $1.3 trillion of insured nonbrokered reciprocal deposits.

This amount represents the current maximum capacity for nonbrokered reciprocal deposits if uninsured deposits were optimally shuffled and reciprocated among individual banks. Our calculation implies that some uninsured deposits would have to flow to small banks from very large banks where they are currently heavily concentrated.

However, the high concentration of uninsured deposits in large banks might ultimately prevent the $1.3 trillion cap on reciprocal deposits from being reached. Depositors at large banks, for example, might have less appetite for deposit insurance. By virtue of banking with a larger institution, they might not be as concerned about the safety of their deposits, making the $1.3 trillion cap harder to realize in practice.

In the first two quarters of 2023, however, even large banks experienced a steady increase in reciprocal deposits, suggesting that no bank is completely safe in the mind of depositors.

Advantages for small and midsize banks and their customers

In contrast to larger banks, small and midsize banks and their depositors may find reciprocal deposit networks more attractive. Reciprocal deposits provide a way to retain large levels of deposits, for example, and thus help small banks compete with bigger institutions. In the same fashion, depositors benefit by having their deposits fully insured and are therefore able to hedge against the greater perceived risks associated with smaller institutions.

This likely explains why some of the largest proportional increases in reciprocal deposits during the first half of 2023 occurred at midsize banks (those with assets between $10 billion and $100 billion). Indeed, the total amount of reciprocal deposits for this group grew about 170 percent from fourth quarter 2022 to second quarter 2023. These banks were also the focus of more public scrutiny than their larger counterparts during the spring 2023 crises, as many shared similarities with the banks that failed.

Accordingly, as a group, midsize banks experienced the largest withdrawal of deposits over the same period, with depositors moving their money to institutions perceived as safer and/or out of the banking system altogether to money market funds (Table 1).

| Table 1: Midsize banks lead in deposit withdrawals Change from fourth quarter 2022 to second quarter 2023 | ||||

| Total asset sizes (dollars, billions) | 0–1 | 1–10 | 10–100 | More than 100 |

| Reciprocal deposits (%) | 51.4 | 64.9 | 168.1 | 79.3 |

| Total deposits (%) | -0.4 | 0.3 | -2.3 | -1.1 |

| SOURCE: Call Reports data. | ||||

Policy considerations involving large deposits

The broader use of reciprocal deposits warrants a closer policy evaluation. At the bank level, the current cap on the level of reciprocal deposits creates a trade-off. On one hand, reciprocal deposit networks contain many benefits, such as helping retain clients in times of stress.

On the other, too much demand for reciprocal services may push reciprocal deposit levels far above bank’s caps, and thus cause large increases in brokered deposits as well. This would force a bank into the uncomfortable situation of choosing between pleasing its customers or its regulators—each pushing in the opposite direction.

An increase in the scope of deposit insurance, even coming directly from a change in the FDIC coverage limits, also introduces a trade-off at the system level. More deposit insurance can alleviate safety concerns and instill faith and security in the banking system, increase depositor welfare and incentivize small-versus-large bank competition. However, it also raises concerns that banks, due to this increased perceived security, might engage in more aggressive profit-seeking activities, thereby increasing moral hazard.

With all these factors at play, addressing and balancing the trade-offs of increases in reciprocal deposits while maintaining financial stability is a challenging and nuanced task. Ultimately, though, the optimal choice of reciprocal deposit limits is just one aspect of the broader issue of deposit insurance regulation.

Current research suggests that optimal deposit insurance regulation might require a blend of different policies, such as implementing deposit regulations in conjunction with bank balance sheet restrictions. The extension of these types of theoretical approaches to include reciprocal deposit networks might provide some guidance to policymakers in case an overhaul of existing regulations proves necessary.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.