Government-funded R&D produces long-term productivity gains

Economists and policymakers have been broadly concerned about slowing U.S. productivity growth in recent decades, particularly since the late 1960s.

Productivity growth occurs when more economic output is produced without using more inputs to production, such as workers or machinery. Economists interpret productivity growth as reflecting technological progress and greater know-how.

Examining several measures of U.S. productivity, we find that increases in nondefense government research and development (R&D) appear to spur sustained growth in long-term productivity.

Productivity gains improve economic well-being

Broadly speaking, productivity growth is what fuels long-run increases in living standards. When workers are more productive—meaning they can produce more from an hour of labor—their wages should rise to reflect as much. Slower U.S. productivity growth, in turn, means wages and living standards don’t rise as quickly.

While the deceleration in U.S. productivity growth is evident in the data, there is less agreement about why productivity has been slowing. Economists Simon Johnson and Jonathan Gruber offer a potential explanation in their book, Jump-Starting America: How Breakthrough Science Can Revive Economic Growth and the American Dream. They say government-funded R&D is key to productivity growth, and the nation previously invested more in such efforts.

“A declining public sector role in R&D has coincided with a slowdown in productivity growth and a stagnating standard of living for most Americans,” they write.

Government R&D broadens our knowledge

While the slowdown in U.S. productivity growth since the late 1960s coincides with a relative decline in government R&D spending, the causality underlying this relationship is far from clear. Higher growth in public infrastructure or R&D spending by businesses could also have driven faster productivity growth in the early post-World War II era.

Why might government-funded R&D be particularly important for productivity growth?

Broadly speaking, the private sector invests more heavily in the development part of R&D, that is, bringing goods to market and creating work that can be patented. The government, conversely, tends to invest relatively more in basic and applied research, work that expands our fundamental knowledge and efforts that can generate big spillovers but can be hard to patent.

Think physics research conducted with particle accelerators at the National Laboratories or DNA sequencing for the Human Genome Project, R&D funded by the Department of Energy and National Institutes of Health. Other government-funded R&D is conducted at universities or contracted out to private firms. Much of this focuses on basic research, which the private sector underfunds because it can be difficult to monetize the results.

New paper explores R&D appropriations shocks

In our new Federal Reserve Bank of Dallas working paper, “The Returns to Government R&D: Evidence from U.S. Appropriations Shocks,” we use a novel empirical strategy to contribute causal evidence on the effects of government-funded R&D on U.S. productivity growth and other measures of innovation.

We first analyze the post-war history of congressional appropriations for the R&D activities of five major federal agencies that account for the lion’s share of federal R&D investments: the Department of Defense, Department of Energy, National Aeronautics and Space Administration, National Institutes of Health and National Science Foundation.

Our analysis identifies large, relatively unanticipated changes (shocks) in the R&D appropriations for these agencies that were not motivated by short-run macroeconomic conditions. We use these R&D appropriations shocks to estimate the dynamic causal effects of government-funded R&D on productivity growth and other measures of innovation.

We find that shocks to nondefense R&D appropriations lead to significant increases in various measures of productivity and scientific innovation, but only with a delay—consistent with implementation lags and a gradual diffusion of new knowledge.

R&D appropriations shocks boost total factor productivity

Our preferred measure of productivity is utilization-adjusted total factor productivity. It reflects all residual growth in business-sector output less all measurable inputs, adjusted for short-run business cycle fluctuations that can affect the use of available inputs such as labor (hence, utilization-adjusted). In our analysis, we use data the Federal Reserve Bank of San Francisco constructs on total factor productivity for the U.S. business sector.

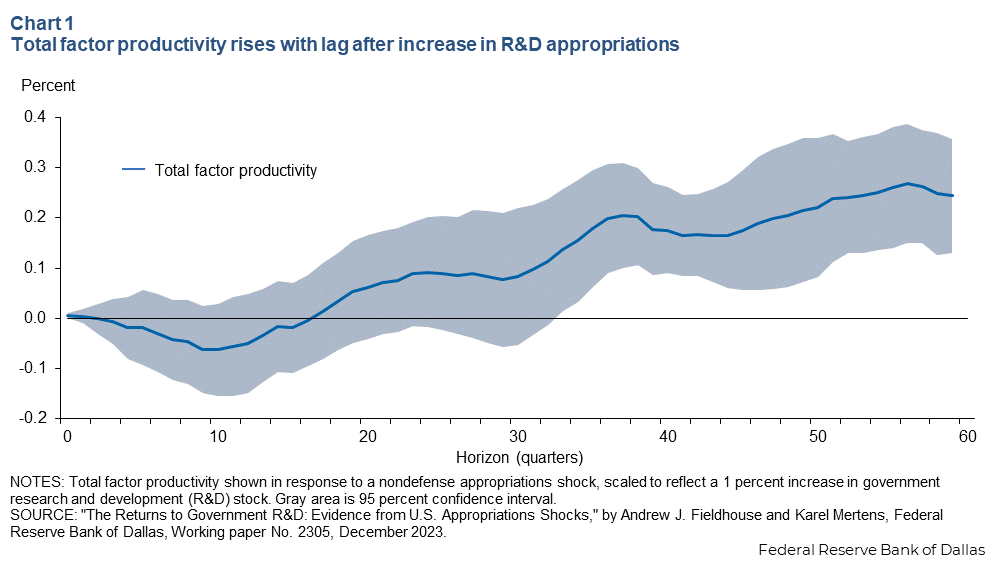

Chart 1 shows the cumulative change in utilization-adjusted total factor productivity following a positive shock to nondefense R&D appropriations.

After about eight years, productivity starts to significantly and steadily increase. It continues rising and remains persistently elevated for at least 15 years after the increase in R&D appropriations. Put differently, greater nondefense government R&D appears to spur gains in long-term productivity, thus increasing living standards.

Similarly, we find that increases in nondefense government R&D boost business-sector labor productivity (output per hour worked) and potential output (noninflationary levels of output reflecting productivity growth), again with a lag and then a highly persistent effect.

We also find evidence that nondefense R&D appropriations shocks increase innovative inputs and outputs, such as the number of scientific researchers employed, the number of science and engineering doctoral recipients and the flow of new, innovative patents. These effects also only materialize after a lag.

For instance, the number of newly minted PhDs in science, technology, engineering and mathematics (commonly known as STEM) fields rises only after about seven or eight years, roughly the time it takes a professor to secure a federal research grant, recruit a student to join the lab and then see the student through to a degree.

No clear evidence defense R&D provides similar productivity gains’

On the other hand, we find no evidence of an economically or statistically significant increase in productivity or other measures of private sector innovation in response to R&D for national defense functions, at least not over the 15-year horizons we consider.

But why would nondefense R&D have a different effect than defense R&D?

For starters, military know-how is often classified to maintain military superiority, deliberately impeding knowledge spillovers. The military also invests relatively more in the development of weapons systems and less in basic and applied research than the nondefense agencies—the National Aeronautics and Space Administration, National Institutes of Health, National Science Foundation and the Department of Energy (excluding its R&D for nuclear weapons).

Defense R&D activities surely contribute to our national security, but they do not appear to drive economic growth the same way as nondefense R&D, at least not within a similar time frame.

Diminished public investment, gains since 1960s

We use the nondefense R&D appropriations shocks to estimate how responsive productivity growth is to changes in the government R&D capital stock. Then we apply those estimates to the actual growth in government R&D capital to quantify its contribution to productivity growth.

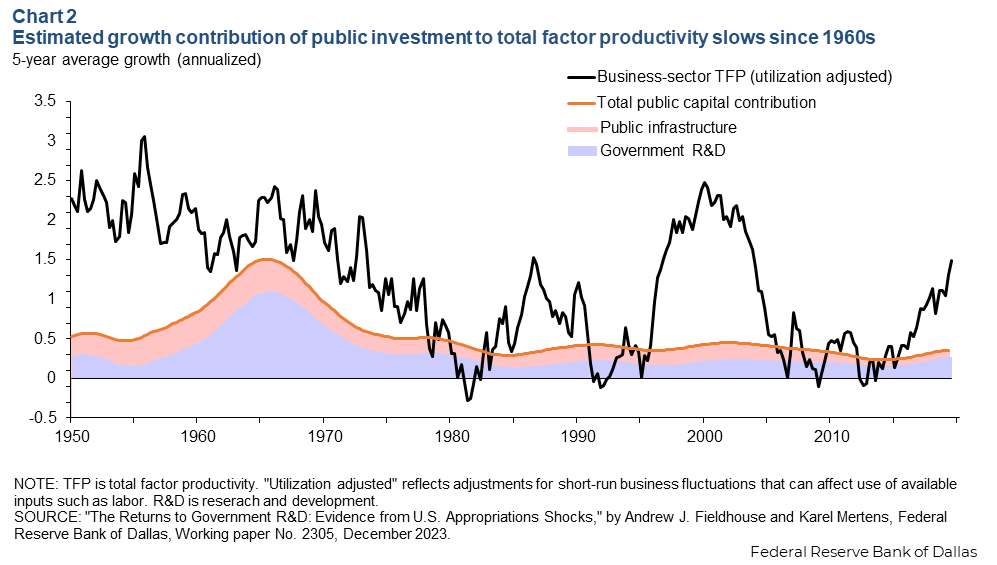

Chart 2 shows our preferred measure of total factor productivity growth (black line), along with our estimates of the contribution of government R&D capital (blue) and public infrastructure capital (red) to that productivity growth.

U.S. productivity growth has slowed markedly since the late 1960s—apart from the information technology revolution near the start of the century—and government-funded R&D heavily contributed to the faster postwar rates of productivity growth.

Our estimates indicate that government-funded R&D accounts for roughly one quarter of all business sector productivity growth since World War II, including one quarter of the deceleration in productivity growth since the late 1960s.

Correlation does not imply causation in general, but our new causal evidence lends support to the thesis of Gruber and Johnson about the important relationship between government-funded R&D and U.S. productivity growth.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.