Texas Employment Forecast

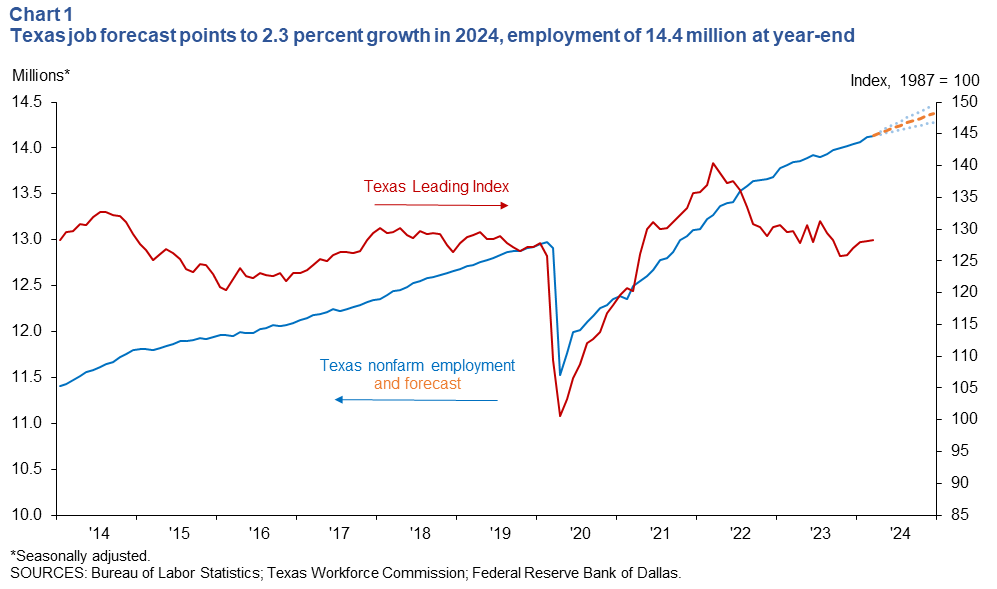

The Texas Employment Forecast indicates jobs will increase 2.3 percent (329,400 jobs) in 2024, with an 80 percent confidence band of 1.7 to 3.0 percent. The forecast is based on an average of four models that include projected national GDP, oil futures prices and the Texas and U.S. leading indexes. The forecast suggests job growth will be above the state’s long-term average, employment in December 2024 will reach 14.4 million, and growth for the remainder of the year will be 2.3 percent (Chart 1).

Texas employment grew 1.6 percent in March, with 18,400 jobs added, and February employment growth was revised down to 4.1 percent.

“Job growth slowed in March due to a deceleration in job gains in the private service sector and the goods-producing sector,” said Luis Torres, Dallas Fed senior business economist. “March’s job growth slowdown was led by losses in trade, transportation and utilities—the state’s largest employment sector—and manufacturing and financial services. Employment in oil and gas, other services, and leisure and hospitality led growth. Except for San Antonio, the major MSAs [metropolitan statistical areas] registered flat or negative growth in March.”

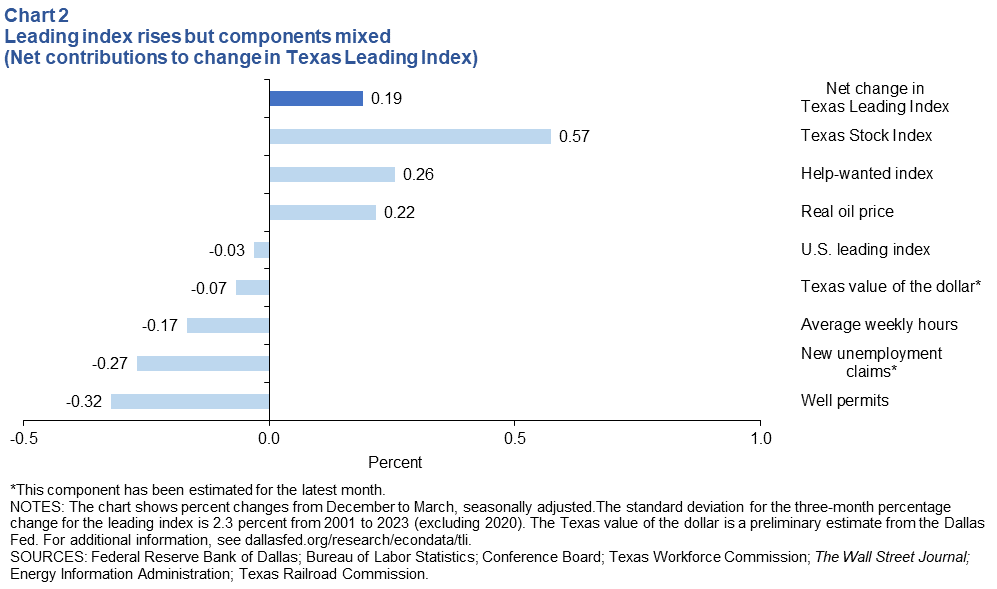

The Texas Leading Index was flat through March. The three-month change was positive, led by an increase in the Texas Stock Index (Chart 2). Gains in oil prices and increases in the help-wanted index also contributed to growth. Meanwhile, drags on the index included decreases in well permits, the average weekly hours worked and the U.S. leading index in addition to increases in new unemployment claims and the Texas value of the dollar.

Next release: May 17, 2024

Methodology

The Dallas Fed’s Texas employment forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

The forecast is based on the average of four models. Three models are vector autoregressions where Texas payroll employment is regressed on the lags of West Texas Intermediate (WTI) oil prices, the U.S. leading index and the Texas Leading Index, respectively. The fourth model is an autoregressive distributed lag model with regression of payroll employment on lags of payroll employment, current and lagged values of U.S. GDP growth and WTI oil prices, and Texas COVID-19 hospitalizations through March 2023. Forecasts of Texas payroll employment from this model also use as inputs forecasts of U.S. GDP growth from Blue Chip Economic Indicators and WTI oil price futures. All models include four COVID-19 dummy variables (March–June 2020).

For additional details, see dallasfed.org/research/forecast/.

Contact Information

For more information about the Texas Employment Forecast, contact Luis Torres at luis.torres@dal.frb.org.