Old oil fields reimagined as lithium sources

Demand for lithium has boomed in recent years amid rising global sales of electric vehicles and increasing use of lithium-ion batteries to store electricity. These developments—important features of the energy transition—are expected to continue, with many forecasts anticipating a doubling or tripling of lithium demand by the end of the decade.

In turn, companies have sought new, sometimes unconventional supply sources in unusual locations. This includes oil and gas formations, which often have brines that contain lithium.

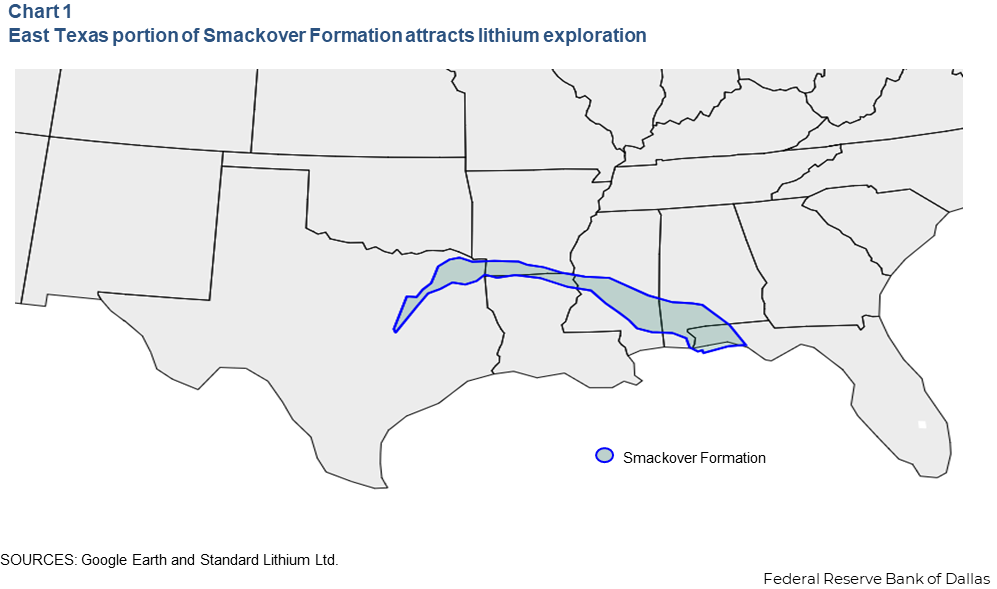

The Smackover Formation, extending broadly from East Texas to Florida, is ground zero in the effort to produce lithium from oilfield brines (Chart 1). Oil was discovered in the Arkansas portion of the Smackover more than 100 years ago, and brines there contain high concentrations of bromine and lithium.

Although the Smackover’s best oil days have passed, bromine output remains significant. It is widely used, particularly as a flame retardant, and its production depends on a well-established infrastructure for the transport, production and processing of brine.

Commercial interest in the formation’s lithium is more recent, having begun less than 10 years ago. A handful of companies either hold acreage for potential development or are developing technology that could be used by other companies operating in the area. Two companies have publicly announced intentions to begin commercial production in the next few years: oil major ExxonMobil and Standard Lithium, partnering with Norway-based energy producer Equinor.

Interest in the East Texas portion of the Smackover has followed, particularly in Cass, Franklin, Morris and Titus counties. While commercial production is unlikely in the immediate future, exploratory work has revealed very high concentrations of lithium at some test wells. If these results turn out to be representative of the formation’s East Texas flank, further activity is anticipated.

Unconventional methods for unconventional resources

A distinguishing feature of the push to produce lithium in the Smackover is the technology used. Lithium is generally produced using large evaporation ponds or from hard rock mines. Neither is applicable to the Smackover or other basins in the region. Companies instead plan to use what is called direct lithium extraction (DLE).

DLE is a catch-all for a variety of technologies whose purpose is to extract lithium from brines without the need for large evaporation ponds. Apart from oilfield brines, the approach is being tested on projects involving extraction from other unconventional sources, including geothermal brines and salt lakes (such as the Great Salt Lake in Utah).

Initial research on DLE began in the 1970s and 1980s, but successful commercialization has remained elusive. Many companies have produced small amounts of lithium, but doing so in sufficient quantity and quality to be profitable has been challenging. As a result, there is an inherent uncertainty about the eventual outcomes of projects using DLE.

Still, if barriers can be overcome in the Smackover, it could lead to dramatically increased domestic lithium production. Australia, Chile and China are the leading producers of lithium, while the U.S. accounts for only a small portion of the global supply. Within the U.S., only the Silver Peak mine in Nevada produces lithium in commercial quantities.

Other basins generate less interest

The Eleventh Federal Reserve District, comprising Texas, southern New Mexico and northern Louisiana, has a long history of oil and gas production. That doesn’t necessarily signal widespread efforts to produce lithium in the region’s other basins, though. That depends on there being ample amounts of brine with a sufficient lithium concentration.

The Permian Basin is the epicenter of oil and gas activity in the U.S. and produces a substantial amount of brine as an unwanted byproduct. This would seem to make the area a prime candidate for the application of DLE, as the existing oil and gas activity mitigates the cost of drilling wells specifically to source the brine.

These positives are tempered, however, by lithium concentration in the brines, which so far appears significantly lower than in the Smackover. Thus, interest in the Permian is limited, although several companies are testing DLE technologies there.Prospects appear generally unfavorable elsewhere, according to a recent study from the Bureau of Economic Geology at the University of Texas at Austin’s Jackson School of Geosciences. The study used several sources of information to better understand the potential for lithium production. Most basins were found to either have low concentrations of lithium or produce little brine; the few exceptions are areas with relatively little oil and gas exploration.

Texas sees battery boom as renewables grow

Potential lithium production in the region would be welcomed at a time Texas is seeing significant capacity additions of renewable energy for its electric grid. These additions are often paired with lithium-ion batteries; fully exploiting solar and wind power depends on batteries to store power to help balance power production and demand. Texas is expected to install more battery storage capacity than any other state in 2024.

About the authors