Mexico Sees Historic Drop in Economic Growth in Second Quarter; Outlook Worsens

Aug. 4, 2020

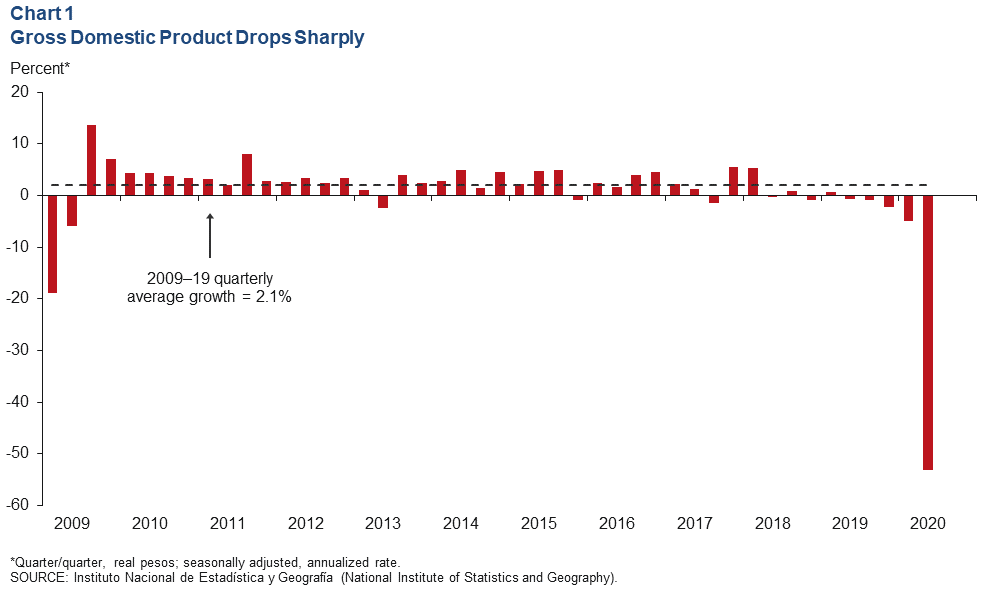

Mexico’s gross domestic product (GDP) contracted an annualized 53.2 percent in second quarter 2020—its largest quarterly drop on record—due to the COVID-19 pandemic. The steep decline will likely result in further downward revisions to the 2020 growth outlook, which currently stands at -8.8 percent.[1]

The latest data available show that exports, industrial production and employment fell. Inflation increased, and the peso was stable against the dollar in July.

Output Nosedives

Mexico’s GDP plunged from an already negative reading the previous quarter (Chart 1). Output from goods-producing industries (manufacturing, construction, utilities and mining) sank an annualized 65.9 percent, while service-related activities (wholesale and retail trade, transportation and business services) fell 46.6 percent. Agricultural output dropped 9.6 percent.

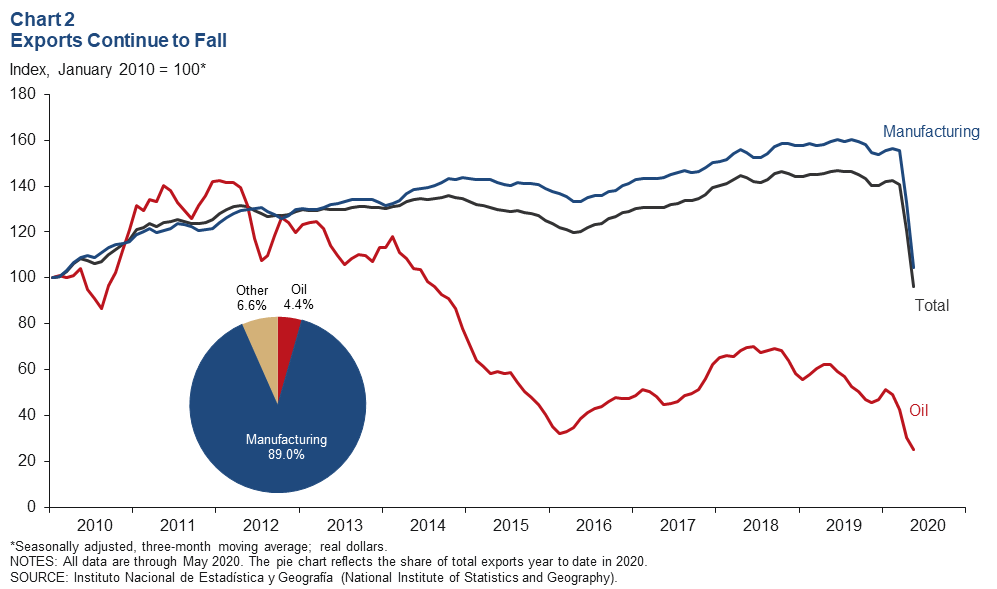

Exports Slide Further

The three-month moving average of total exports dropped 20.2 percent in May as oil exports fell 16.9 percent and manufacturing exports contracted 21.5 percent (Chart 2). On a month-over-month basis, total exports fell 20.6 percent in May and manufacturing exports declined 23.1 percent. This year through May, exports have fallen 21.1 percent compared with the same period in 2019.

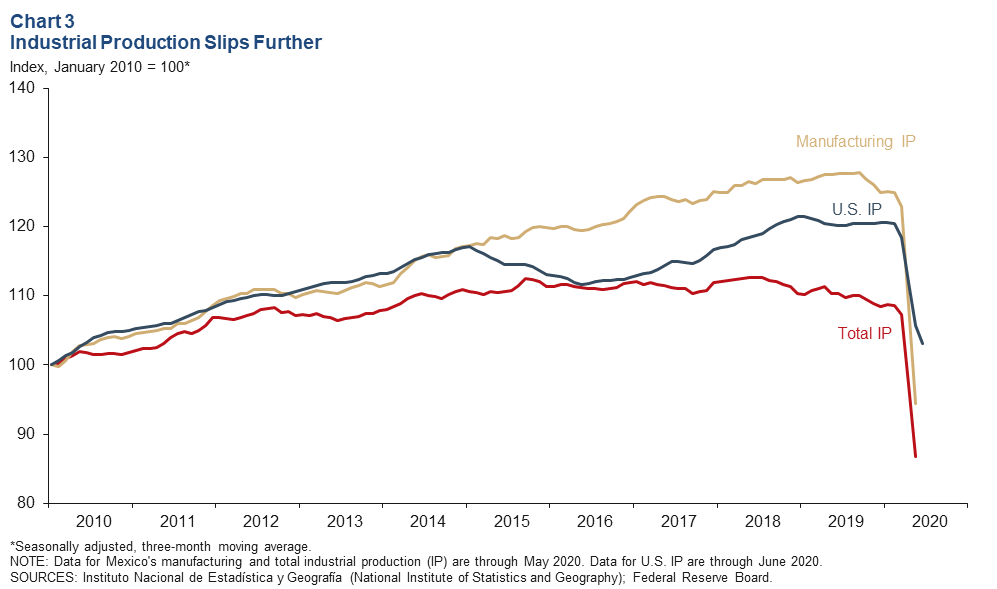

Industrial Production Weakens

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—dropped 10.8 percent in May, and manufacturing IP was down 13.0 percent (Chart 3). On a month-over-month basis, IP fell 1.8 percent in May, while the manufacturing index contracted 0.3 percent. North of the border, U.S. IP increased 5.4 percent in June after rising 1.4 percent in May. The correlation between IP in Mexico and the U.S. increased considerably with the rise of intra-industry trade as a result of the 1994 North American Free Trade Agreement, recently replaced by the United States–Mexico–Canada Agreement.

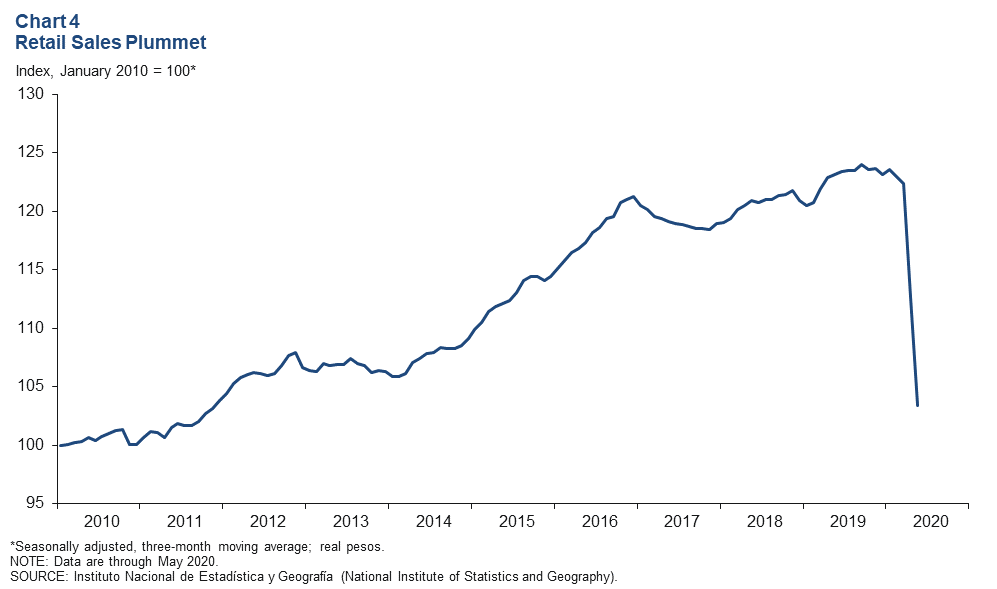

Retail Sales Contract Sharply

The index of real retail sales in Mexico decreased 8.2 percent based on a three-month moving average in May (Chart 4). On a month-over-month basis, retail sales rose 0.8 percent in May after falling 22.5 percent in April. Since December 2019, the retail sales index has declined 23.1 percent.

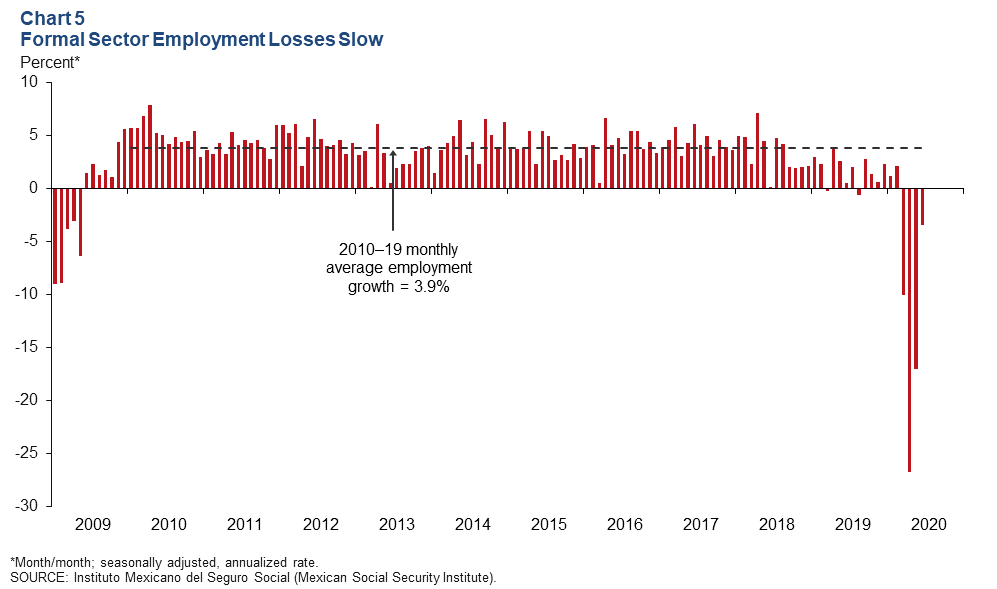

Payrolls Continue to Shrink

Formal sector employment—jobs with government benefits and pensions—fell an annualized 3.5 percent (57,500 jobs) in June, less than May’s 17.0 percent decline (Chart 5). Year-over-year employment contracted 4.2 percent in June. Total employment, representing 55 million workers and including informal sector jobs, grew 2.2 percent year over year in first quarter 2020, above its 10-year average of 1.9 percent. The unemployment rate in March was 3.3 percent, down from 3.6 percent a year earlier.

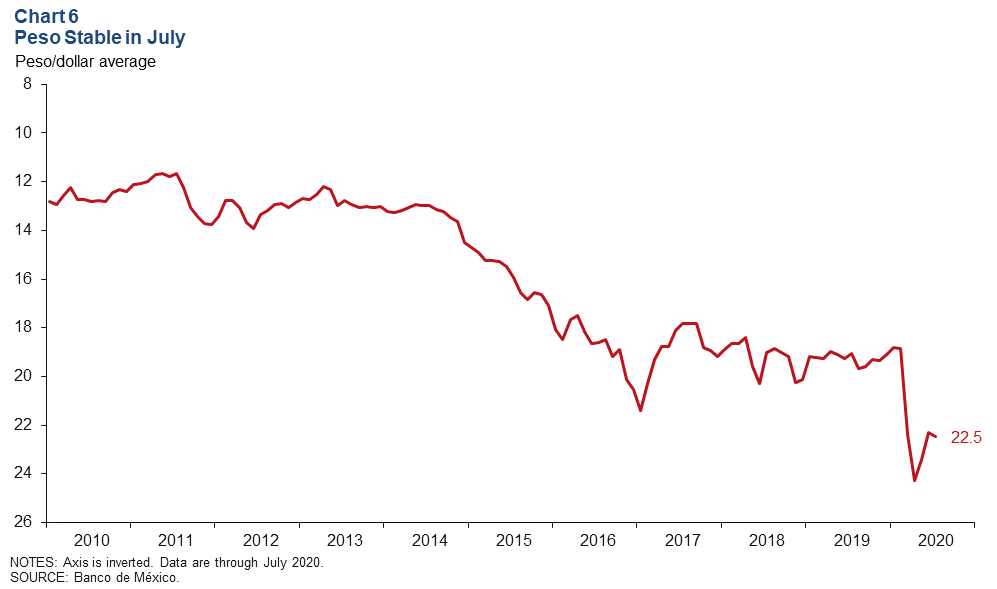

Peso Flat in July

The Mexican currency averaged 22.5 pesos per dollar in July, down 0.5 percent from June, but up 4.6 percent since May (Chart 6). The peso has depreciated 14.7 percent against the dollar since December 2019. The peso has been under pressure due to increased uncertainty regarding how COVID-19 will affect domestic and global growth.

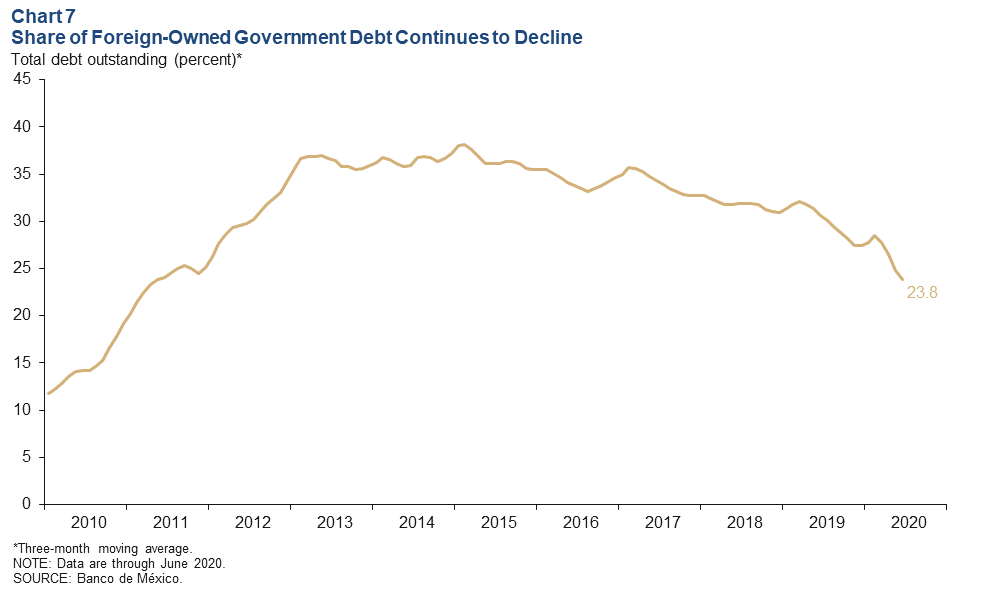

Foreign-Owned Government Debt Share Decreases

The share of peso‐denominated Mexican government debt held abroad fell to 23.3 percent in June. The three-month moving average declined to 23.8 percent (Chart 7). The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and is also a sign of confidence in the Mexican economy.

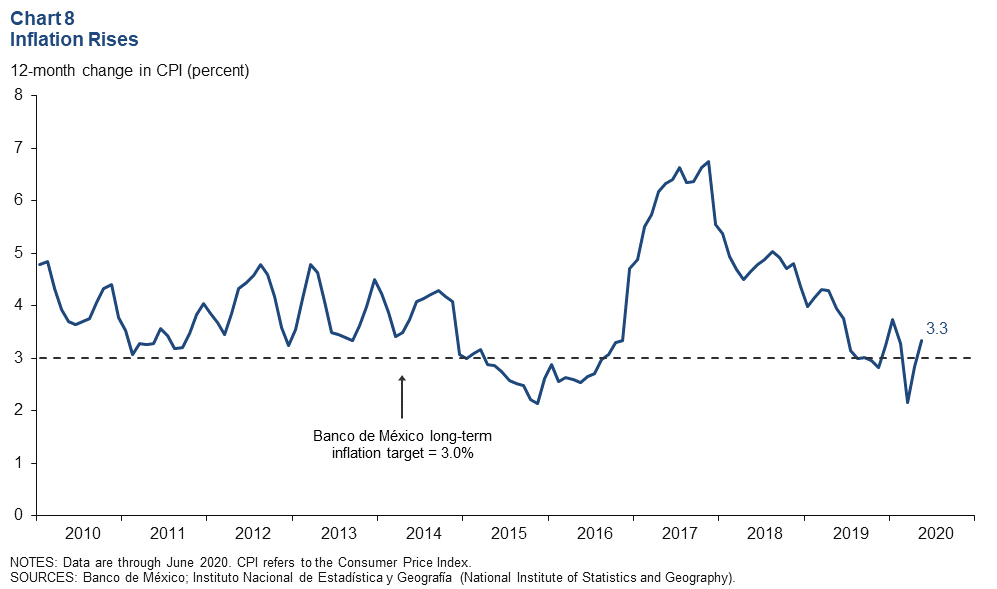

Inflation Back Above Long-Term Target

Mexico’s consumer price index (CPI) increased 3.3 percent in June over the prior 12 months, up from 2.8 percent in May (Chart 8). CPI core inflation (excluding food and energy) rose 3.7 percent in June over the previous 12 months. Banco de México reduced the benchmark interest rate by 50 basis points to a three-year low of 5 percent on June 25. In making its rate cut, Mexico’s central bank cited the financial market volatility stemming from uncertainty regarding the impact of COVID-19 on world economic activity.

Notes

- Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Junio de 2020, (communiqué on economic expectations, Banco de México, June 2020). The survey period was June 24–29.

About the Authors

Cañas is a senior business economist, and Smith is a research analyst in the Research Department at the Federal Reserve Bank of Dallas.