Mexico's economy rebounds in fourth quarter 2025

| December 2025 economic report | |||

| GDP, real Q4 '25 |

Employment, formal December '25 |

CPI January '26 |

Peso/dollar January '26 |

| 1.2% y/y | 90,000 jobs m/m | 3.8% y/y | 17.6 |

Mexico's economy expanded at year-end 2025. GDP grew 1.2 percent year-over-year in the fourth quarter after contracting 0.2 percent in the third quarter. Growth was driven by a gradual recovery in the manufacturing sector and strong momentum in services. The consensus forecast for 2026 real GDP growth compiled by Banco de México was 1.3 percent as of January (Table 1). The latest data largely point to continued growth, as industrial production, exports, employment and retail sales expanded. Additionally, the peso appreciated and Mexico’s consumer price index ticked up in January, and remittances ticked down in December.

| Table 1 Consensus forecasts for 2026 Mexico growth, inflation and exchange rate |

|||

| November | December | ||

| Real GDP growth in Q4, year over year | 1.2 | 1.3 | |

| Real GDP growth in 2026 | 1.7 | 1.6 | |

| CPI December 2026, year over year | 3.9 | 4.0 | |

| Peso/dollar exchange rate at end of year | 19.20 | 18.50 | |

| NOTES: CPI refers to consumer price index. The survey period was Jan. 15–27.

SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Enero de 2026 (communiqué on economic expectations, Banco de México, Enero 2025). |

|||

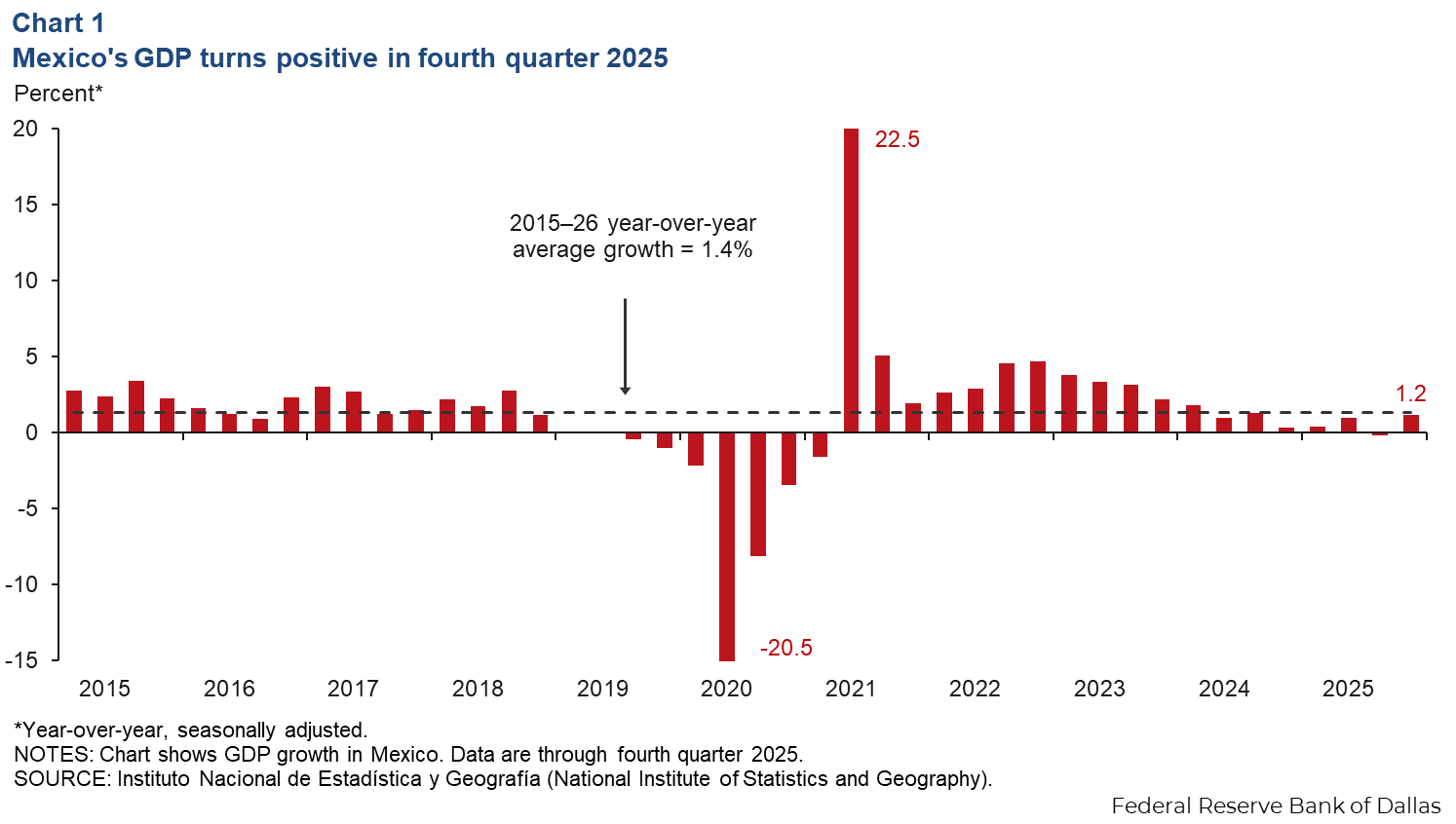

Strong fourth-quarter GDP growth

Mexico’s GDP grew 1.2 percent year-over-year in the fourth quarter (Chart 1). Goods producing sectors (manufacturing, construction, utilities and mining) grew 0.3 percent after falling 3.0 percent in the previous quarter. Services sectors (wholesale and retail trade, transportation and business services) grew 2.0 percent, up from 0.9 in the third quarter. Agricultural output increased 6.0 percent, after expanding 3.0 percent in the previous quarter.

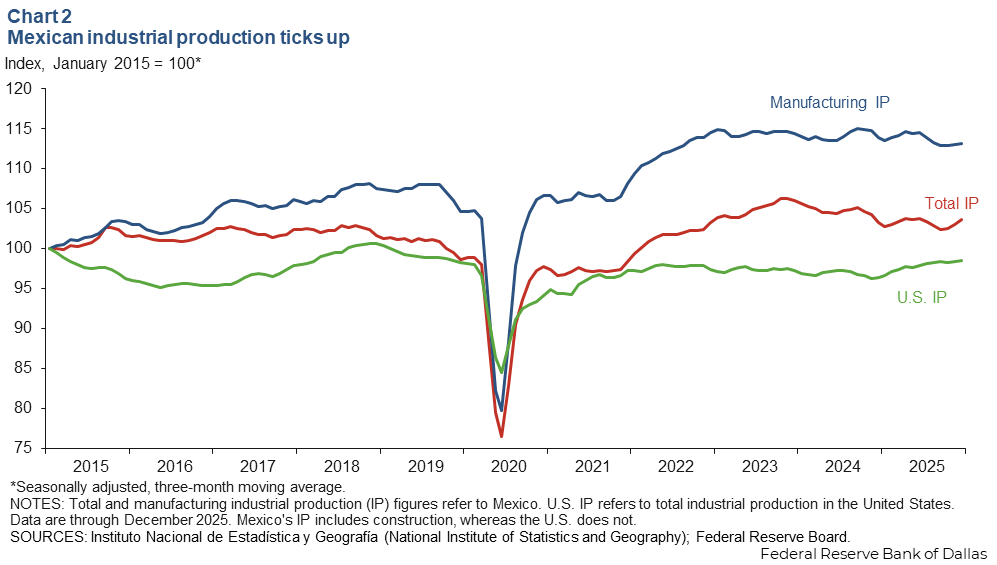

Industrial production ticks up

The three-month moving average of Mexico’s industrial production (IP) index, which includes manufacturing, construction, oil and gas extraction and utilities, rose 0.6 percent in December (Chart 2). Meanwhile manufacturing IP edged up 0.1 percent. In the U.S., the three-month moving average of industrial production ticked up 0.2 percent.

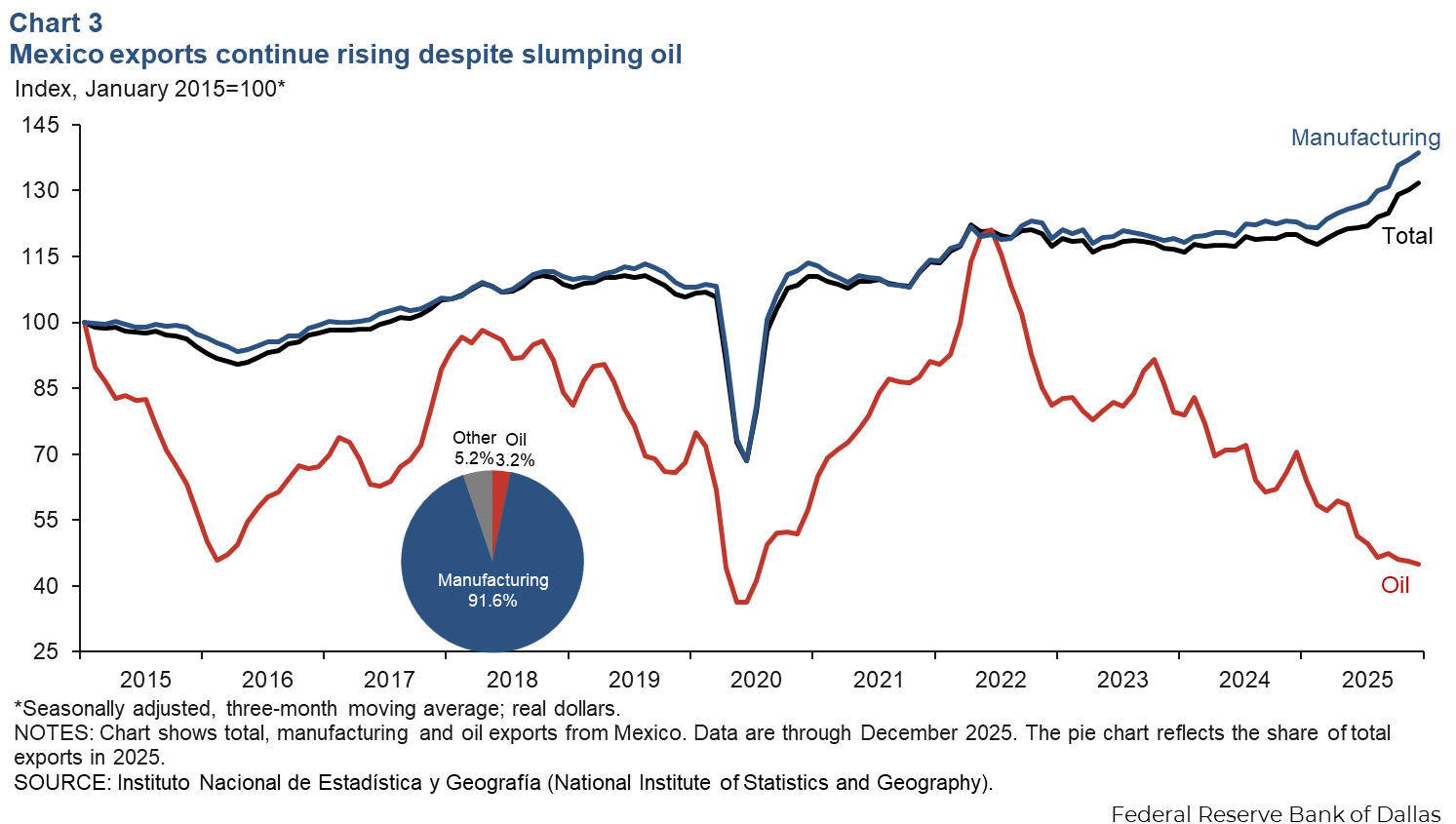

Exports increase further

The three-month moving average of Mexico’s total exports increased 1.2 percent in December (Chart 3). The manufacturing sector, which accounts for the majority of exports, increased 1.1 percent, while oil exports declined 1.2 percent. In 2025, total exports grew 5.0 percent, manufacturing exports increased 7.1 percent, and oil exports contracted 28.1 percent.

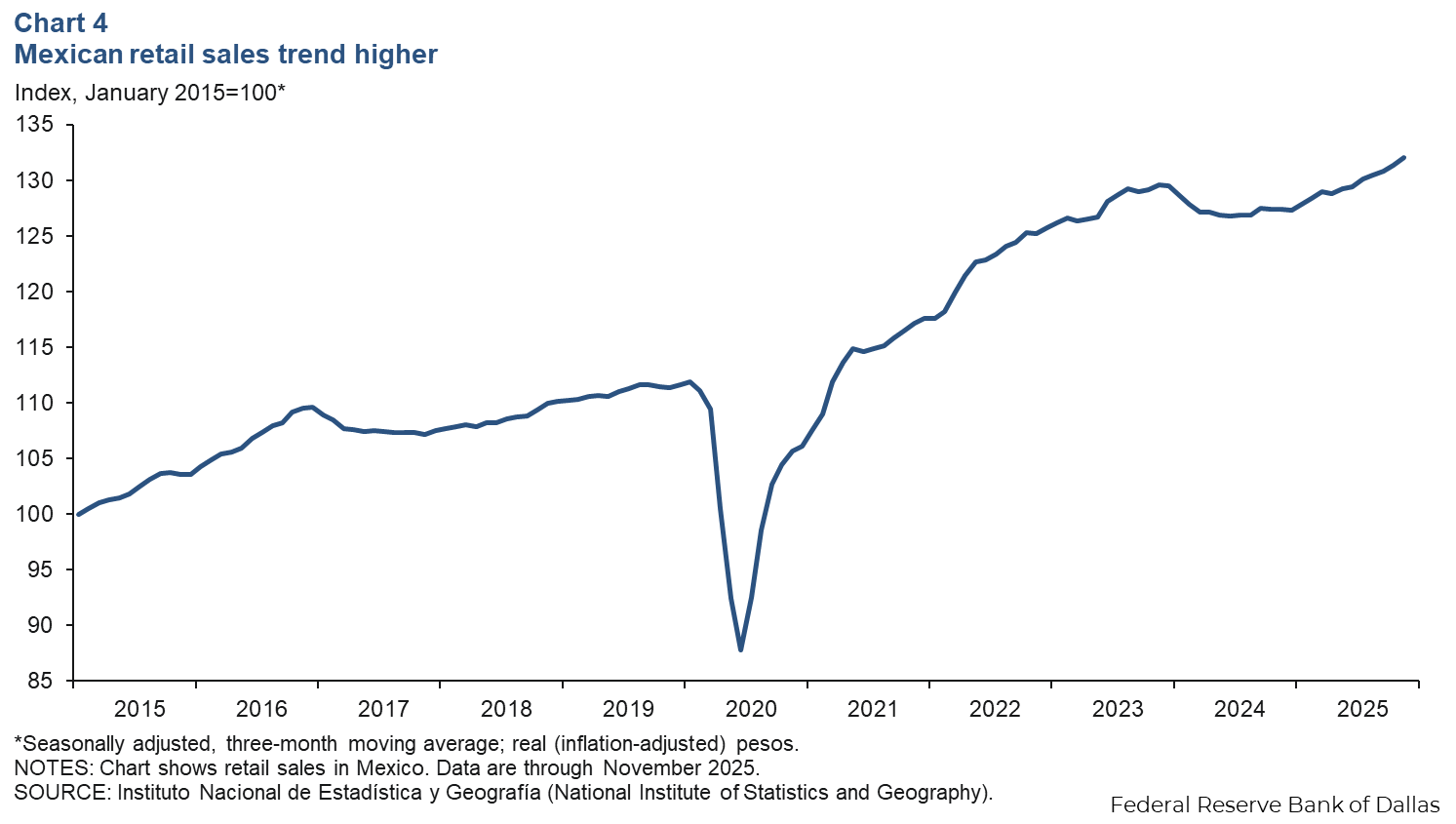

Retail sales growth maintains momentum

The three-month moving average of the index of real retail sales edged up 0.5 percent in November (Chart 4). On a year-over-year basis, the smoothed retail sales index grew 3.7 percent. Consumption in Mexico continues growing, driven by increased purchasing power from minimum wage increases and higher remittances, despite recent declines in social programs.

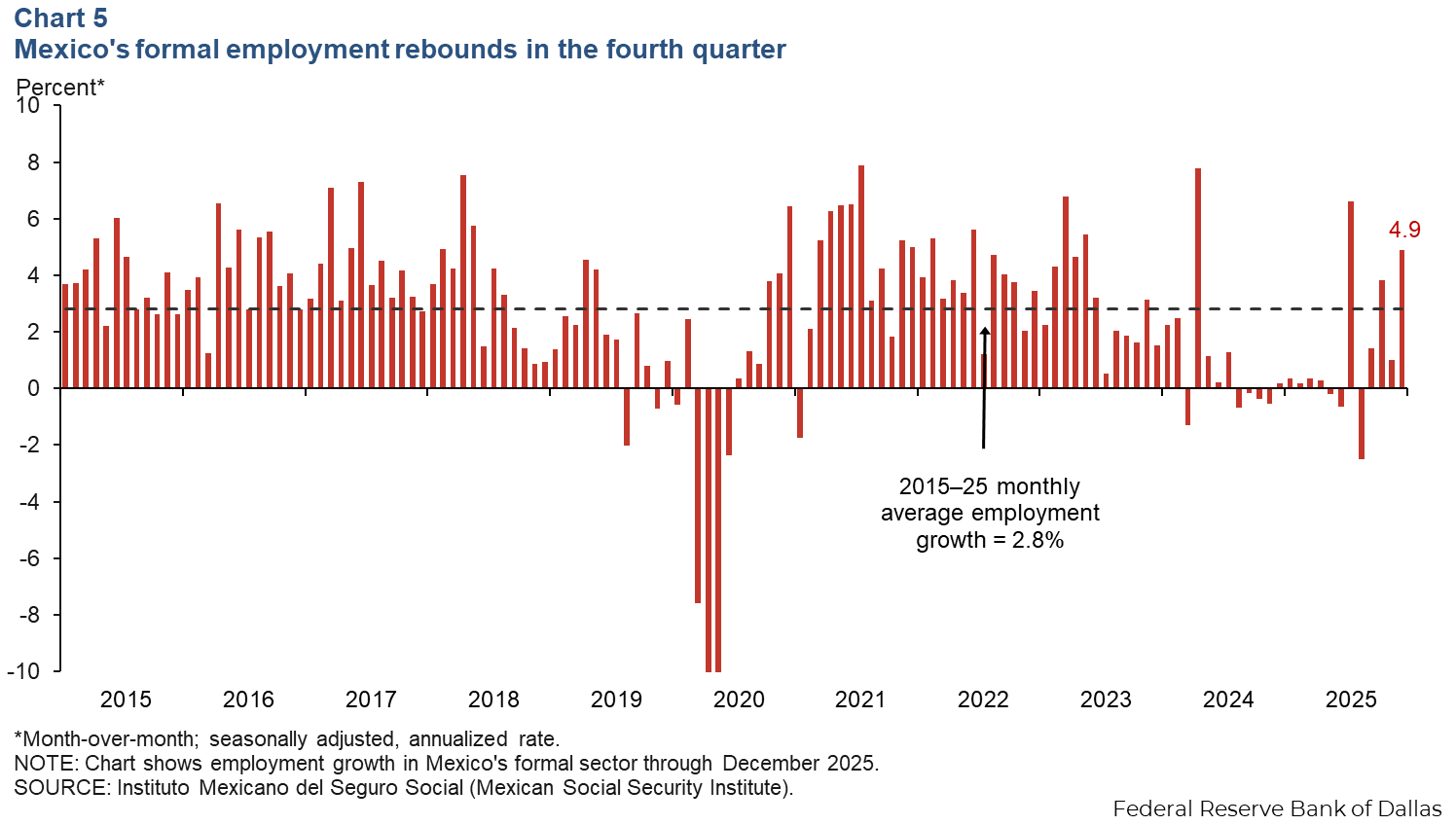

Employment growth accelerates

Formal employment (jobs with government benefits and pensions) increased an annualized 4.9 percent (90,000 jobs) in December after growing 1.0 percent in November (Chart 5). On a year-over-year basis, formal employment rose 1.3 percent. Total employment, which represents 60.6 million workers and includes informal sector jobs, increased 1.8 percent relative to the prior year. The unemployment rate, which tracks only the formal sector, ticked down to 2.6 percent in December.

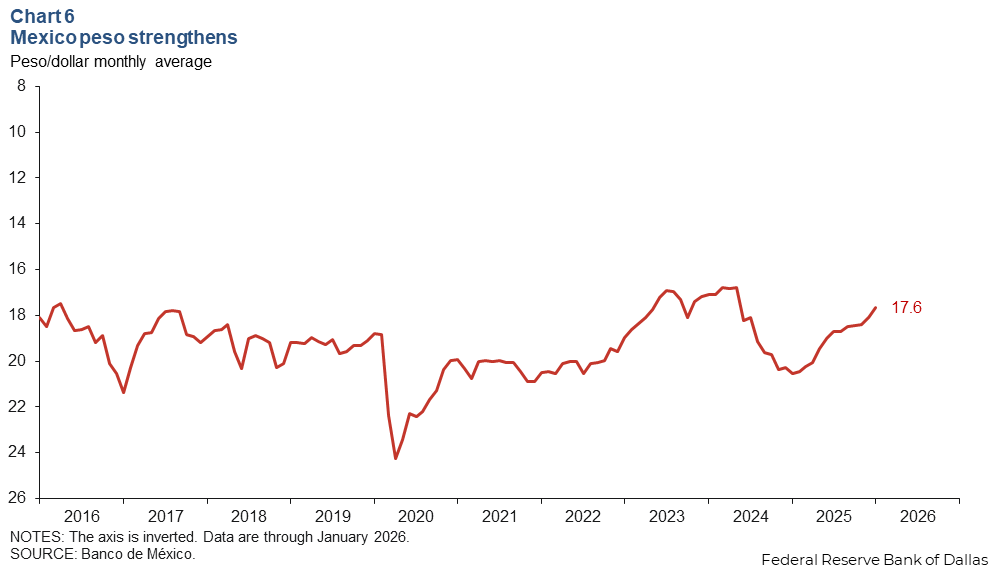

Mexican peso continues strengthening against dollar

The Mexican currency averaged 17.6 pesos per dollar in January (Chart 6). The peso gained ground against the dollar during all of 2025, mainly due to the interest rate differential between the two countries and overall U.S. dollar weakness. The peso appreciated 12.1 percent in 2025.

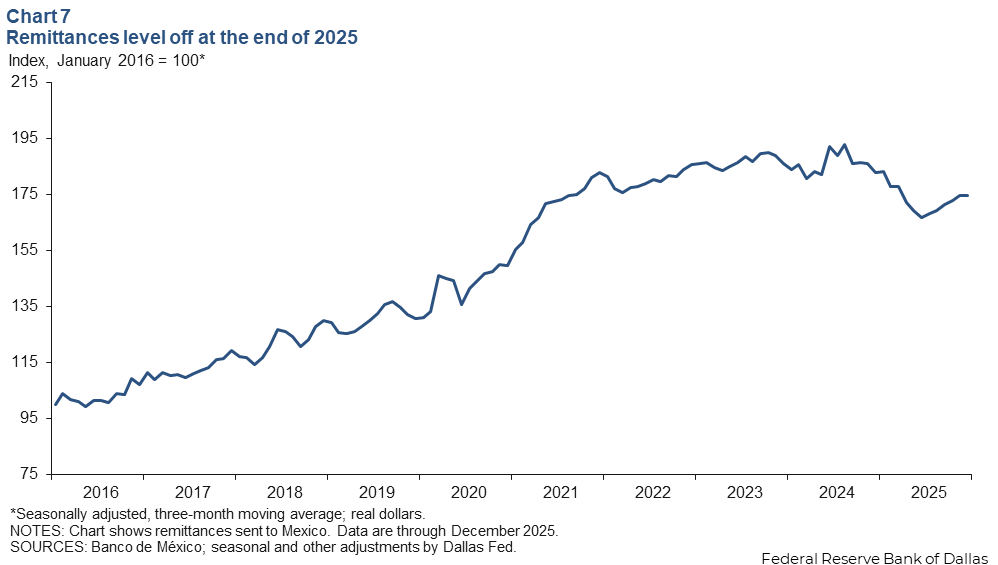

Remittances little changed

The three-month moving average of inflation adjusted remittances to Mexico ticked down a slight 0.1 percent in December after rising 1.0 percent in November (Chart 7). Remittances hit a trough in June 2025 and have since rebounded. However, even with U.S. dollar weakness relative to the peso, real remittances declined 6.9 percent in 2025 relative to the same period in 2024. Transfers from the U.S. account for 95 percent of Mexican remittances.

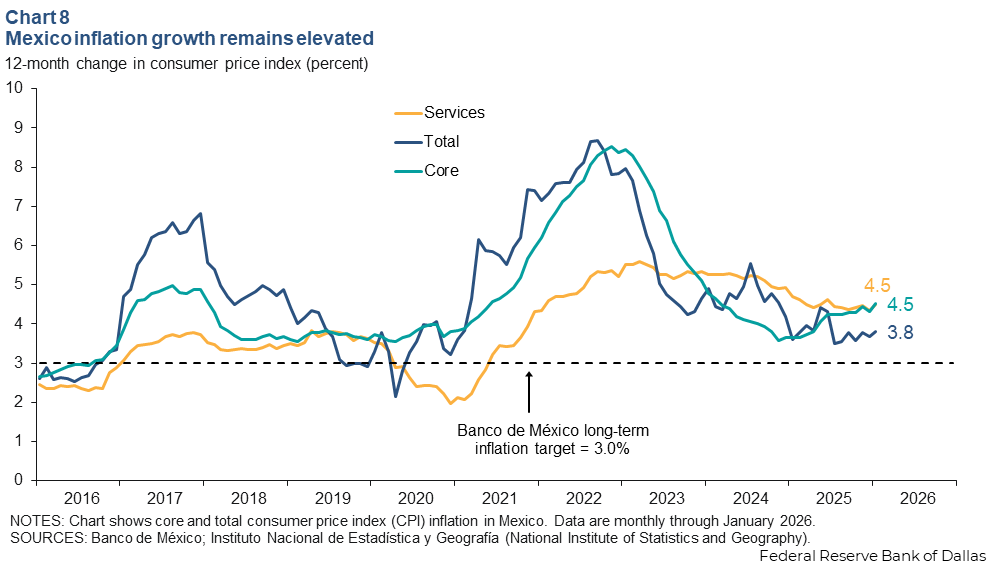

Inflation ticks up at the start of 2026

Mexico’s consumer price index (CPI) grew 3.8 percent year-over-year in January 2026 after increasing an annualized 3.7 percent in December (Chart 8). Core CPI inflation, which excludes food and energy, rose 4.5 percent, up from 4.3 in December. Meanwhile, services inflation grew to 4.5 percent from 4.3 percent. In February, Mexico’s central bank held its benchmark rate at 7.0 percent, in line with market expectations. The central bank anticipates inflation to persist throughout the year, reaching the bank’s 3.0 percent target by first quarter of 2027, two quarters later than previously expected.

About the authors