Strong U.S. labor market drives record remittances to Mexico

Mexico is the second-highest receiver of remittances in the world, trailing only India. The payments, mostly from migrants in the U.S., provide a valuable lifeline for millions of Mexican households. They are used mainly for necessities—food, clothing and health care—while they also make up an important part of household expenditures for housing, tuition and debt repayment.

Remittances from the U.S. to Mexico reached a record $55.9 billion in 2022. These transfers accounted for 95 percent of Mexico’s total remittances of $58.5 billion. Mexican migrants, who number 11 million in the U.S., typically send the funds home to support their families. The average monthly remittance to Mexico was $390 in 2022.

In economics terms, the impact of remittances is broadly split based on whether the payments are for consumption or investment purposes. Investment objectives, including human capital, can have positive long-run effects on recipient households and communities by improving health outcomes and increasing educational attainment, earnings and wealth. There is evidence that at the local level in Mexico, households use remittances not only toward consumption but also toward productive activities favoring economic growth.

During the pandemic, remittances from the U.S. played an especially important role in Mexico, whose fiscal response to the COVID-19 downturn was limited, delaying the country’s recovery. We model the flow of remittances from the U.S. and show how they increased after an initial pandemic downturn. Employment in the U.S. construction sector, a leading source of economic activity through the period and a top migrant employer, statistically best explains the recent growth of remittances to Mexico, the model finds.

Host country economy accounts for bulk of remittance growth

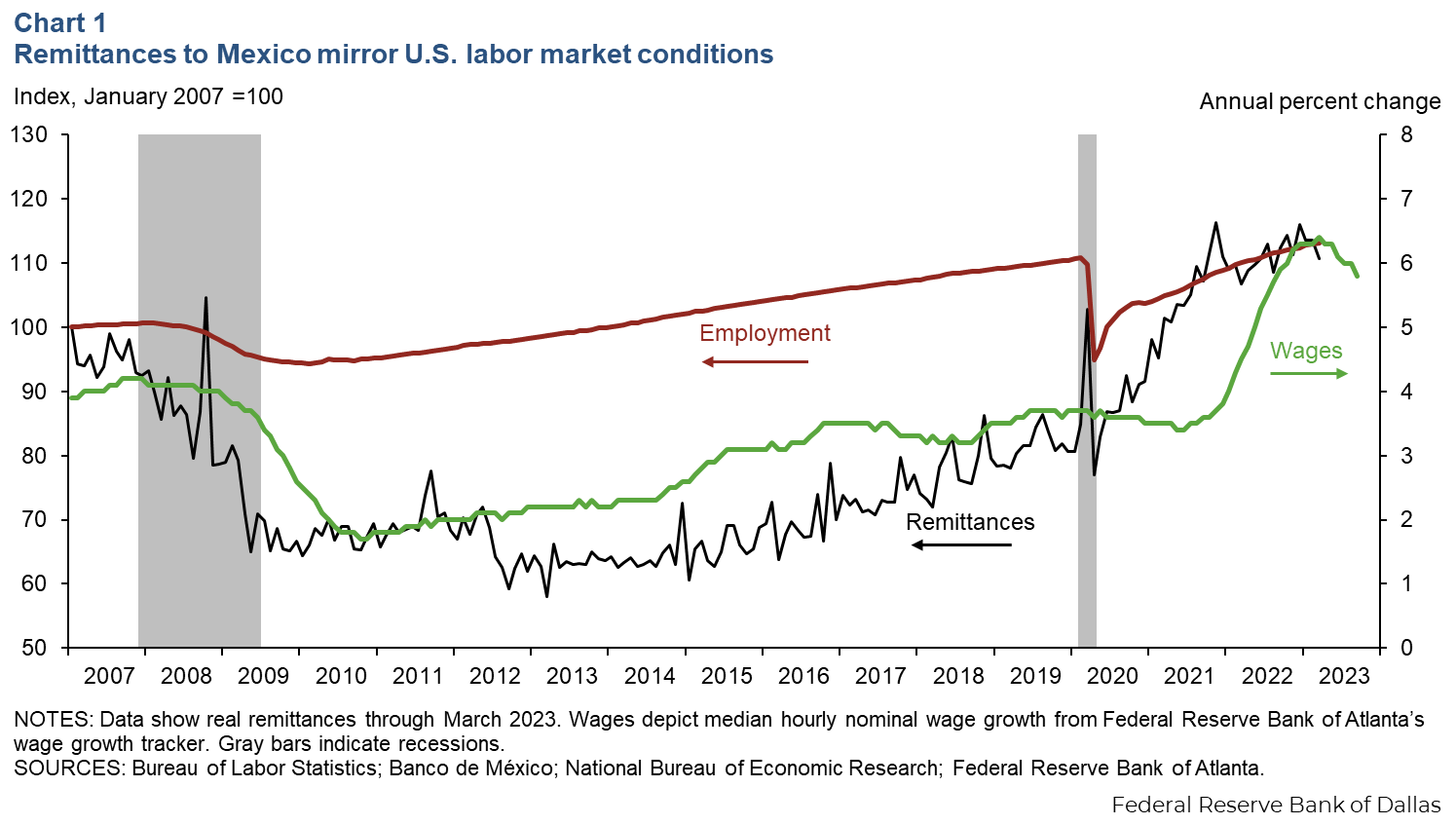

Because remittances usually come from migrants’ earnings, economic conditions in the host country—especially employment—drive the amount sent home. When U.S. employment and wages fell sharply during the Great Recession in 2007–09, remittances also declined (Chart 1).

Remittances stabilized as job and wage growth resumed from 2010 to 2014. The growth accelerated from 2015 until the pandemic, as employment and wage growth picked up. At the pandemic’s onset in March 2020, remittances first spiked then fell before rebounding along with the U.S. labor market in the summer. Remittances stayed high as U.S. wages rapidly rose in 2021–22.

Transaction costs and the exchange rate play a role in the volume of remittances, because together they determine the cost to the sender and the amount the recipient receives. For example, if the peso depreciates against the dollar, a recipient will receive more pesos for a given number of dollars.

Finally, remittances also depend on economic conditions in the receiving country. Research shows that remittances are countercyclical—more funds are transferred when the home country economy deteriorates. Additionally, when economic conditions worsen in countries with a tradition of emigration, such as Mexico, more people will migrate. More migration will increase remittances because there are more immigrants in the host country. For example, during the 1994–95 Mexican recession, also dubbed the “Tequila Crisis,” emigration and remittances spiked.

Modeling the path of remittances to Mexico since the pandemic

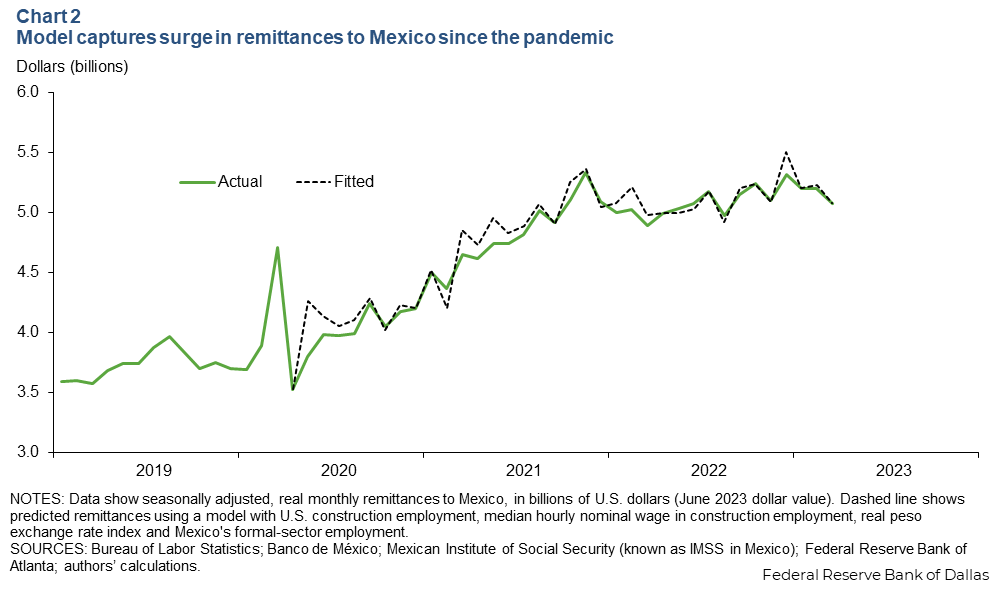

To better understand the growth in remittances since the pandemic, we constructed a forecasting model, which follows the standard methodology in the remittances literature. Our model performs well, closely tracking the growth in remittances since the pandemic (Chart 2).[1]

To capture economic conditions in the U.S., the model uses monthly construction employment from the Bureau of Labor Statistics payroll survey and median hourly nominal construction sector 12-month wage growth from the Federal Reserve Bank of Atlanta’s wage growth tracker. The model also controls for the peso-dollar exchange rate using Banco de México’s real peso exchange rate index. A real exchange rate index controls for the inflation rate differential in the two countries.

To capture labor market conditions in Mexico, the model uses formal-sector employment from the Mexican Institute of Social Security (known in Mexico as IMSS), which includes all jobs with government benefits and pensions.

In an alternative specification, we replaced construction employment and wages with overall U.S. employment and wages, but this worsened the model’s predictive performance. This is partly because, contrary to a typical recession, the pandemic period was characterized by a booming housing sector. In addition, the construction industry is one of the largest employers of Mexican migrants, as one-fifth of Mexican immigrants are employed in that industry, according to the 2021 American Community Survey.

To gauge the contribution of individual variables to the model, we did a Shorrocks-Shapley decomposition, which provides the relative importance of predictor variables in a linear regression. That is, we estimated the relevance of employment, wages, exchange rate and economic conditions in Mexico to the variation in remittances since the pandemic. As expected, U.S. construction employment was by far the most significant contributor to the rebound in remittances and their subsequent growth, accounting for 64 percent of the variation in remittances (Table 1).

| Table 1: Growth in U.S. construction employment accounts for most of remittance variation | |

| Dependent variable: remittances | Contribution to total variation in remittances (percent) |

| Independent variables: |

|

| U.S. construction employment | 63.9 |

| Real peso exchange rate index | 31.4 |

| Mexico employment | 3.5 |

| Median nominal wages in construction | 1.3 |

| TOTAL | 100 |

| NOTE: The table shows the Shorrocks-Shapley decomposition, which provides the relative importance of predictor variables in linear regression. | |

The real peso exchange rate index followed in relative importance, accounting for almost one-third of the variation in remittances. The depreciation of the peso at the start of the pandemic was fundamental to remittances’ rapid pandemic recovery, later helping propel them to record highs.

Following the pandemic’s impact on remittances

Businesses and borders closed as the pandemic took hold. The dollar—generally a safe haven in times of turmoil—rose sharply against emerging market economies' currencies. The peso depreciated 22 percent from December 2019 to April 2020 when it reached its low of 24.3 pesos per dollar. The peso subsequently bounced back, ending 2020 with a 9.8 percent depreciation for the year. The peso-dollar exchange rate did not reach its prepandemic level until January 2023; by then, remittances had skyrocketed.

The deterioration of the Mexican economy and the concern about family members’ living conditions in Mexico during the pandemic were lesser factors in terms of explaining the run-up in remittances. However, our model confirmed the countercyclical nature of remittances since the coefficient on Mexico employment was negative—in other words, as formal-sector employment fell in Mexico, remittances increased.

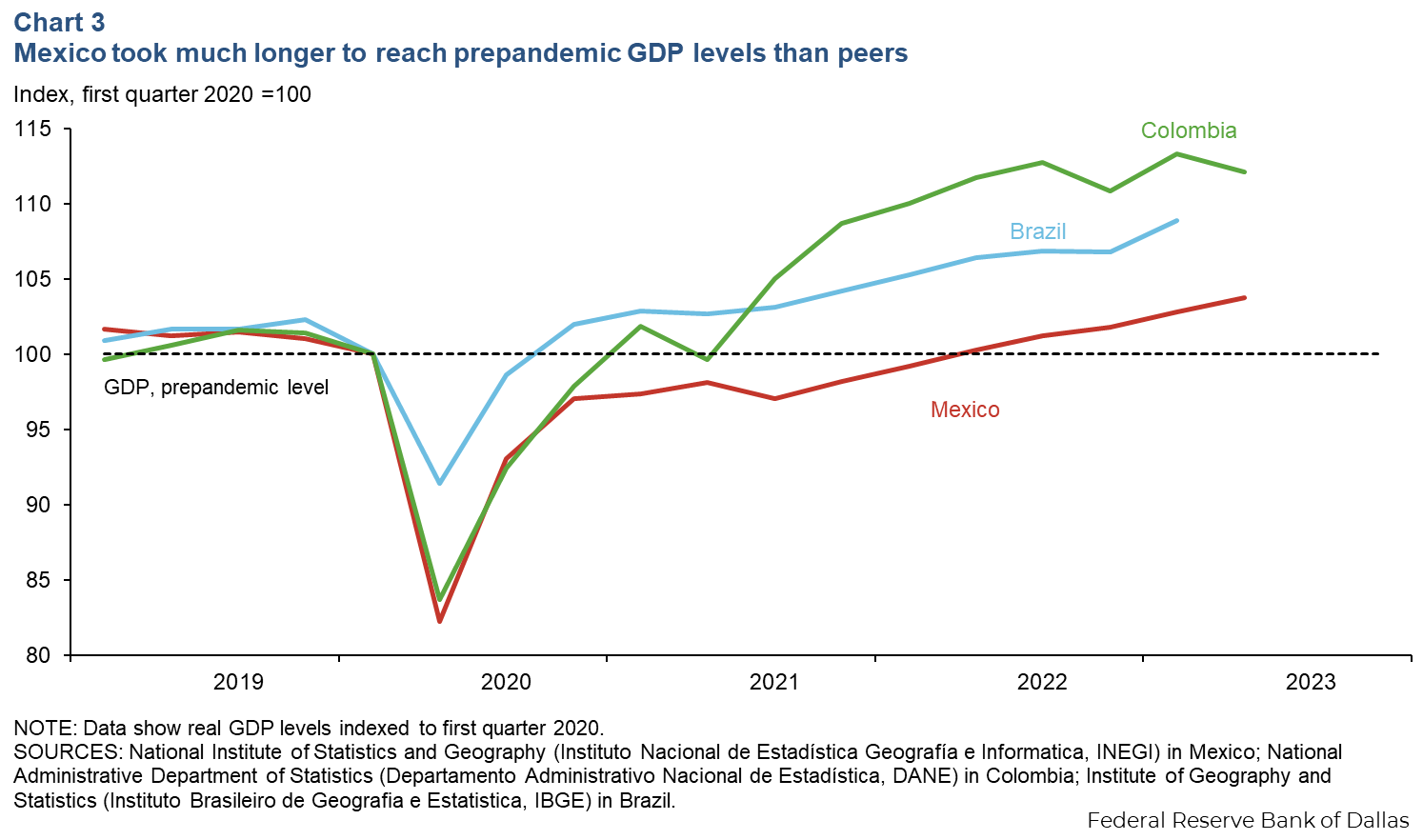

Notably, Mexico’s pandemic economic recovery lagged, likely reflecting the lack of fiscal stimulus and enduring pandemic-related lockdowns and restrictions. Mexico’s pandemic-related stimulus was equivalent to just 1.1 percent of GDP, less than a quarter of the average in Latin America. Mexico GDP took a full nine quarters to reach prepandemic levels, while recovery only took three quarters in Brazil and four in Colombia (Chart 3).

Other research findings—more pronounced and detailed than what we show—also suggest that Mexico’s slow economic recovery and the COVID-19 outbreak (vaccines were not widely distributed until 2021) may have prompted additional remittances.

The “altruistic” explanation of increased remittances, partly the reason for remittances’ countercyclicality, is consistent with these studies, which show that people who had not remitted before the pandemic started doing so, and individuals who had previously stopped renewed their support.

This countercyclical relationship helps explain why migrants in the U.S. sent more money per transaction to Mexico as COVID-19 cases increased. Most likely, remittances provided economic relief to the most vulnerable sectors of the Mexican population, especially given the void left by the Mexican government’s scant fiscal support for the economy. In contrast, outsized U.S. government assistance, through unemployment insurance relief and the Coronavirus Aid, Relief and Economic Security (CARES) Act—a stimulus bill amounting to about one-tenth of U.S. GDP—likely contributed to the increased average transaction amount.

Though migration is an important channel through which remittances are impacted, our model also shows that the recent increase in migration flows from Mexico did not explain the rapid growth in remittances.

In one version of our model, to capture the real-time flow of new Mexican migration to the U.S., we used a proxy—border encounters with Mexicans at the U.S.–Mexico border by U.S. Customs and Border Protection. However, including the proxy for real-time Mexican migration lowered the accuracy of our forecast. Despite both the number of remittance transactions and the average amount remitted per transaction increasing in the pandemic period, the rise was most likely driven by an increase in the number of people sending remittances rather than new arrivals to the U.S.

Remittances matter to the Mexican economy

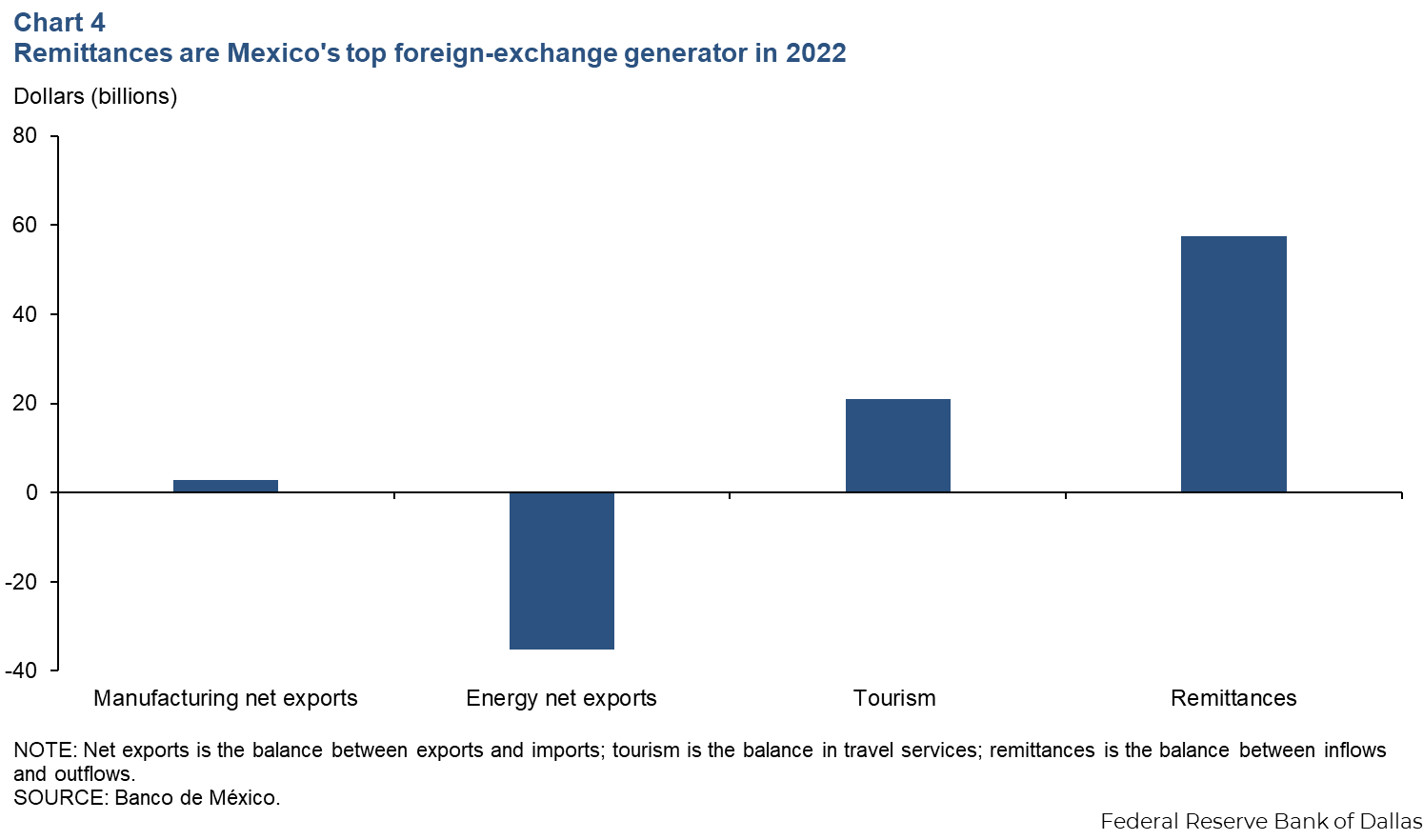

Remittances are Mexico’s main net foreign-exchange generator, ahead of both manufacturing exports and tourism (Chart 4). Remittances also tend to be a stable source of income that helps reduce the government’s need for overseas borrowing in a crisis. Remittances in 2022 were equivalent to 4.5 percent of Mexico’s GDP, up from 2.5 percent 10 years ago.

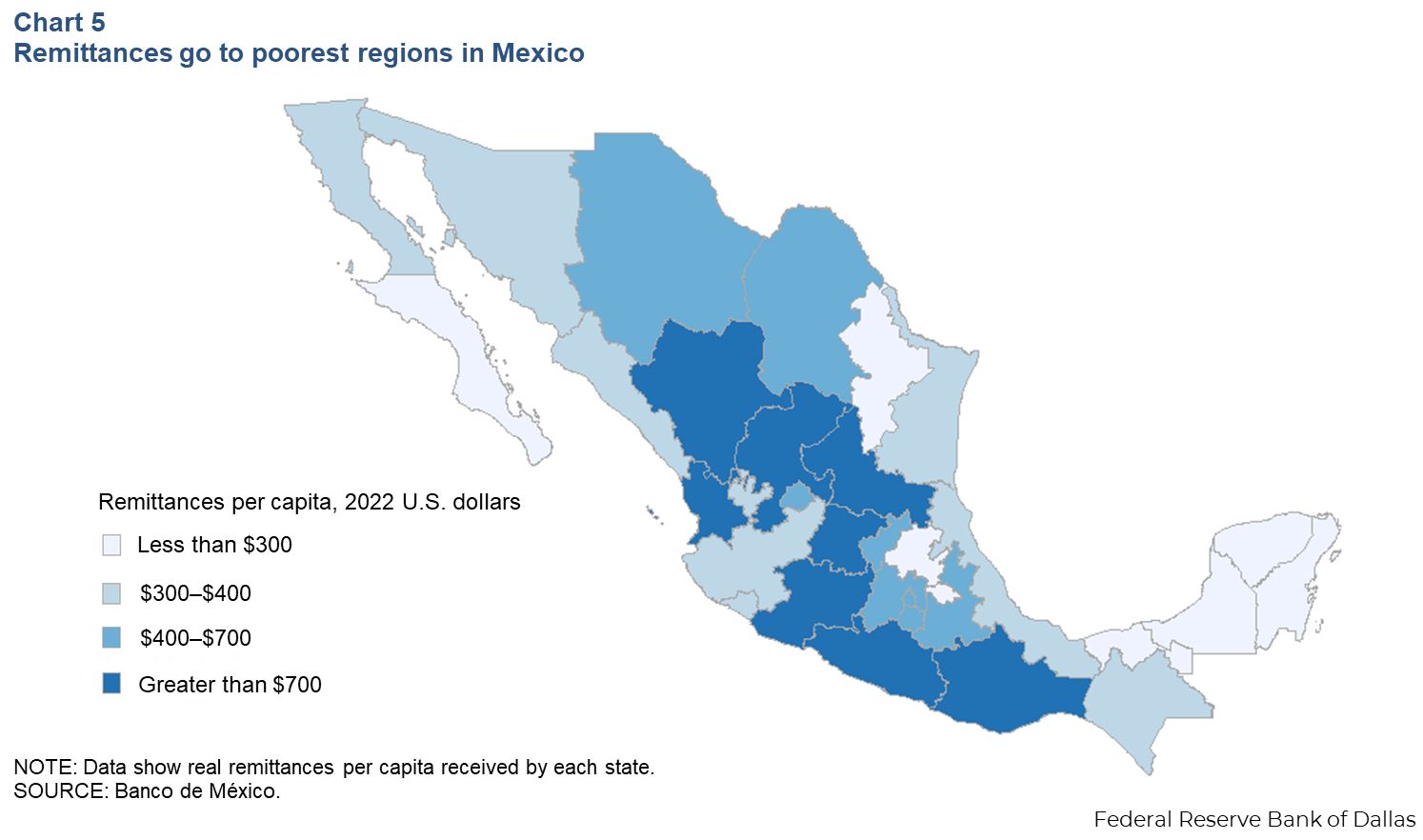

Money sent from abroad generally goes to families in the poorest states of Mexico—such as in the north central and the southwest regions—reflecting the areas from which migrants left. The remittances, thus, help mitigate some regional economic disparities (Chart 5).

Michoacán was the top remittance destination state in per capita terms in 2022, receiving almost $5.3 billion ($1,113 per capita). Zacatecas followed with $1.7 billion ($1,063 per capita) and Guanajuato at $5.1 billion ($835 per capita). Remittances expressed as a share of gross state product were: Guerrero, 18.3 percent; Michoacan, 18.1 percent; Mexico City, 17.0 percent, and Oaxaca, 15.1 percent.

The poverty-reducing effects of remittances have been well-documented. Several studies show that remittances help alleviate poverty and can reduce inequality. Remittances may also promote development by providing funds that recipients can spend on education or health care or can invest in entrepreneurial activities.

Additionally, there is evidence that remittances raise wages in recipient communities, particularly among low-wage workers. One 2010 paper showed how remittances shift the wage distribution, where higher remittances in high-migration states lead to fewer low-wage workers.

Not all remittances represent earnings from legal sources. Drug cartels likely send illicit earnings back to Mexico, although money transmitters and depository institutions that provide remittance transfers are subject to anti-money laundering requirements under the Bank Secrecy Act.

For example, these remittance providers must report suspicious transactions and obtain and record information for each funds transfer of $3,000 or more. Nevertheless, remittances can pose money laundering risks, as funds related to illicit activity may go undetected because of the large volume of transactions. Some news reports estimated that about $4.4 billion of remittances (less than 10 percent of the total) sent to Mexico in 2022 could have come from illegal activity.

Remittances likely to moderate in the short term

Slower U.S. job and wage growth, particularly in construction, combined with a stronger peso will slow growth in remittances, our model suggests. Current high interest rates have already slowed the residential construction industry, as demand has cooled and financing has dried up. There will be fewer new projects and more in the pipeline put on hold or scaled back.

Additionally, the peso has gained ground against the dollar, decreasing the dollar’s purchasing power in Mexico and reducing the incentive to remit.

At the same time, Mexico’s economy has improved. Forecasts have been revised upward, labor markets are tight, consumption is strong, and government spending is growing—reasons to expect that remittances will slow further.

Note

- The model is a linear transfer function run in log differences (monthly growth) as follows: real remittances as a function of U.S. construction employment, U.S. construction wages, Mexico formal-sector employment and the real peso exchange rate index. The model was estimated from January 1995 to April 2020, and the out-of-sample forecast was from May 2020 to March 2023.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.