Central bankers need to take note of transition to clean energy

The path from traditional energy sources to alternative sources with lower greenhouse gas emissions—including renewable energy, and carbon capture and storage—is long and paved with abundant uncertainty.

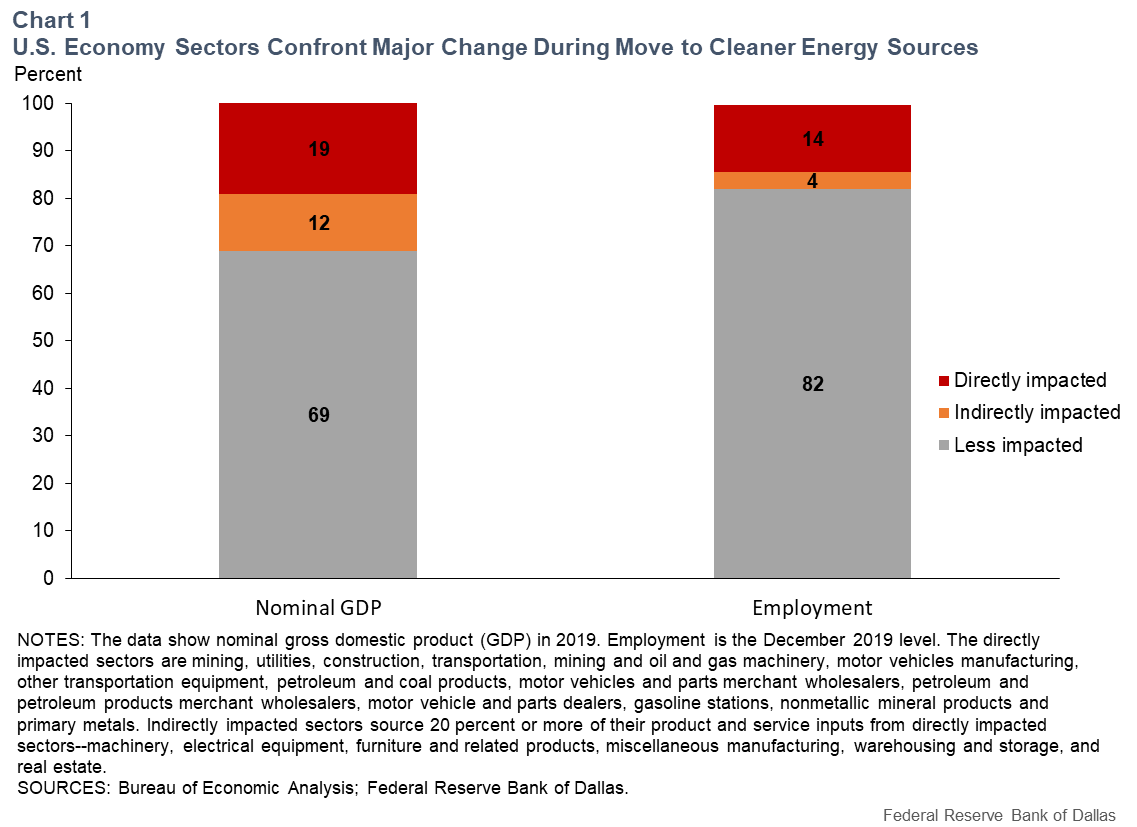

We find that the energy transition potentially affects sectors that account for 31 percent of U.S. gross domestic product (GDP) and 18 percent of employment. Because this represents a substantial share of economic activity, central banks need a deep understanding of the implications of this structural change as part of monetary policy deliberations.

Impact on U.S. output, employment

To this end, we first quantify the economic importance of sectors that the energy transition directly affects. They produce and transform energy or manufacture equipment to do so. Directly affected sectors include oil and gas extraction, utilities, automobile manufacturing, metals and construction. They are broadly in line with the ones the International Energy Agency (IEA) mentioned in reports on the energy transition.

Automobile manufacturers, for example, will likely participate in a shift from combustion engines to battery-powered motors. For its part, the construction sector will devote increasing attention to retrofitting buildings to improve energy efficiency.

Directly impacted sectors generate 19 percent of U.S. nominal GDP and employ 14 percent of the U.S. workforce (Chart 1).

Indirect impacts make up 12 percent of GDP

Next, we look at sectors sourcing a disproportionate share of their inputs from directly impacted sectors. Changes in input costs are a leading impact for such indirect participants. To identify such sectors, we use a series of input–output tables published by the Bureau of Economic Analysis. These tables cover 71 industry categories and show production relationships among industries. For each sector, we calculate the share of products and services sourced from those directly affected.

Specifically, indirectly impacted sectors have above-average exposure to inputs from those directly involved in the energy transition (they receive more than 21 percent of their inputs from these sources). For example, some indirect contributions involve machinery and electrical equipment manufacturing. A total of 12 percent of GDP and 4 percent of workers are so engaged.

Finally, sectors with below-average exposure—classified as the least exposed—include professional and business services, arts and entertainment, and health care. They account for the remaining 68 percent of GDP and 83 percent of the workforce. Business models within this group may be affected less than in the other two groups, though they will likely see an impact.

Uncertainty complicates energy transition

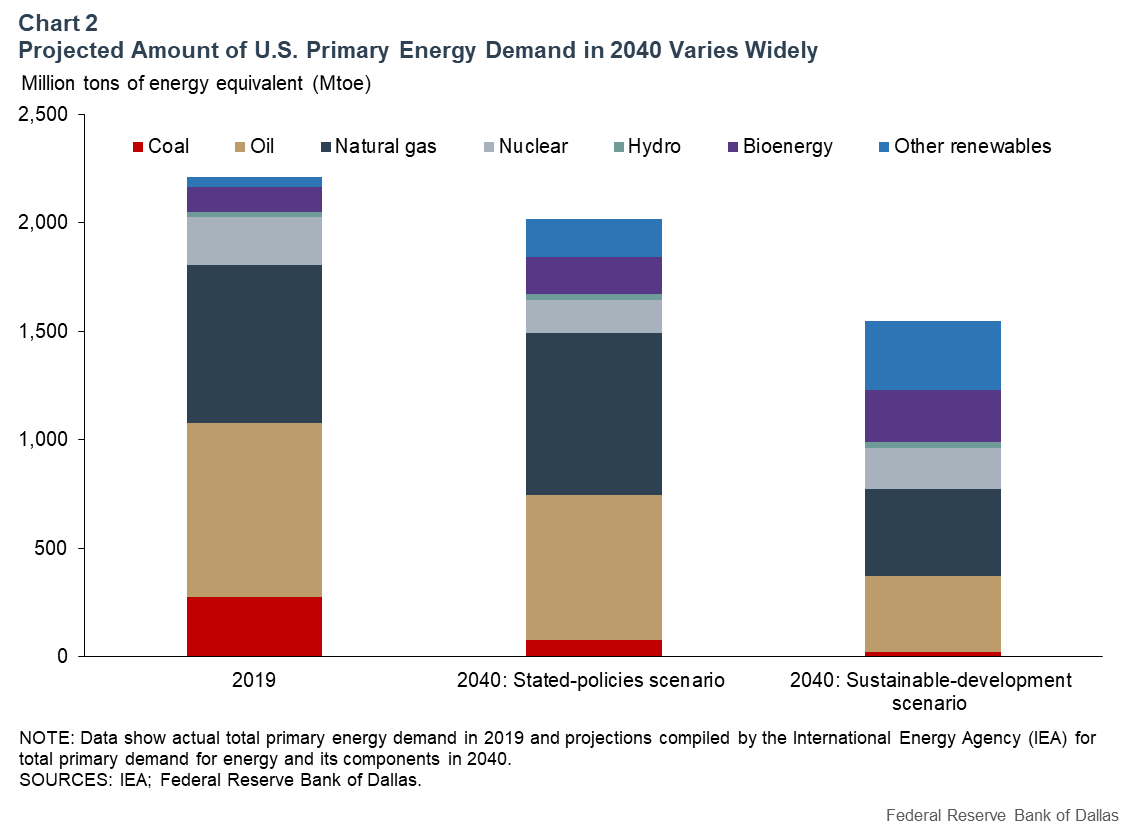

The energy transition, however, is a structural transformation accompanied by high uncertainty. First, it is a long-term process because investment in infrastructure involves high initial costs and long investment cycles. Power plants and related installations are built to last decades. Second, projections of how much energy the U.S. will need and from which sources it will come in 2040 vary significantly.

For example, the IEA projects that under current and stated public policies, fossil fuels will account for 74 percent of U.S. energy consumption in 2040, far greater than the 50 percent share in the “sustainable-development” scenario that envisions more aggressive policies to lower carbon emissions (Chart 2). Total energy consumption is about 25 percent higher in the stated-policies scenario relative to the sustainable-development scenario.

Why does so much uncertainty surround these forecasts? The energy transition is shaped not only by public policies, but also by consumer preferences that are likely to evolve. Innovation by private firms and technological breakthroughs are difficult to forecast. As a result, the cost structures of various energy sources and technological possibilities are highly uncertain.

Developments for central bankers to watch

The energy transition would not be the first structural change that central bankers have had to confront—economic thinking has had to accommodate the emergence of information technology and changing demographics. Because the energy transition would affect a substantial share of the U.S. economy, further study could provide greater insight into the macroeconomic impact.

Central bankers will closely watch several developments. Primarily, they will monitor the energy transition’s potential effects on employment and their distribution across regions and income groups. Secondarily, they will watch how the energy transition may affect productivity growth and, hence, potential output growth given all the unknowns.

It is unclear if these impacts will be meaningful enough to change the longer-run neutral rate of interest—the theoretical federal funds rate at which the stance of central bank monetary policy is neither accommodative nor restrictive.

The answers to these questions will partly depend upon innovation and policy choices. Central bankers will closely watch for developments in the energy transition because of its potential as a structural driver for a significant part of the economy.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.