U.S. labor market slack created by COVID-19 pandemic has been absorbed

The U.S. labor market report for August 2021 was weaker than expected with job growth of only 235,000—well below the consensus expectations of 750,000. Despite those disappointing results, our analysis indicates that the labor market slack created by the COVID-19 pandemic has been absorbed. This improvement extends to women as well as specific population subgroups, including Asians, Blacks and Hispanics.

Labor market slack is measured relative to the concept of a “neutral” labor market—conditions that would prevail in the labor market if the effects of the business cycle were removed. The most common measure of labor market slack is the difference between the current unemployment rate and the Congressional Budget Office’s estimate of the “natural” rate of unemployment.

The degree of slack (or tightness) in the labor market is given by the extent to which unemployment is above (or below) the natural rate of unemployment.

Measuring slack with the employment-to-population ratio

We previously discussed using the employment-to-population ratio (E/P) as an alternative measure of labor market conditions. The advantage of the E/P is that it is not affected by an out-of-work individual’s decision whether or not to engage in a job search and, consequently, to be counted as unemployed or out of the labor force.

We detailed how we estimate a natural rate for the employment-to-population ratio (E*/P) using monthly Current Population Survey data. To do this, we estimate career employment rate profiles absent cyclical and seasonal influences for 360 cohorts defined by decade of birth, sex, race/ethnicity and completed education.

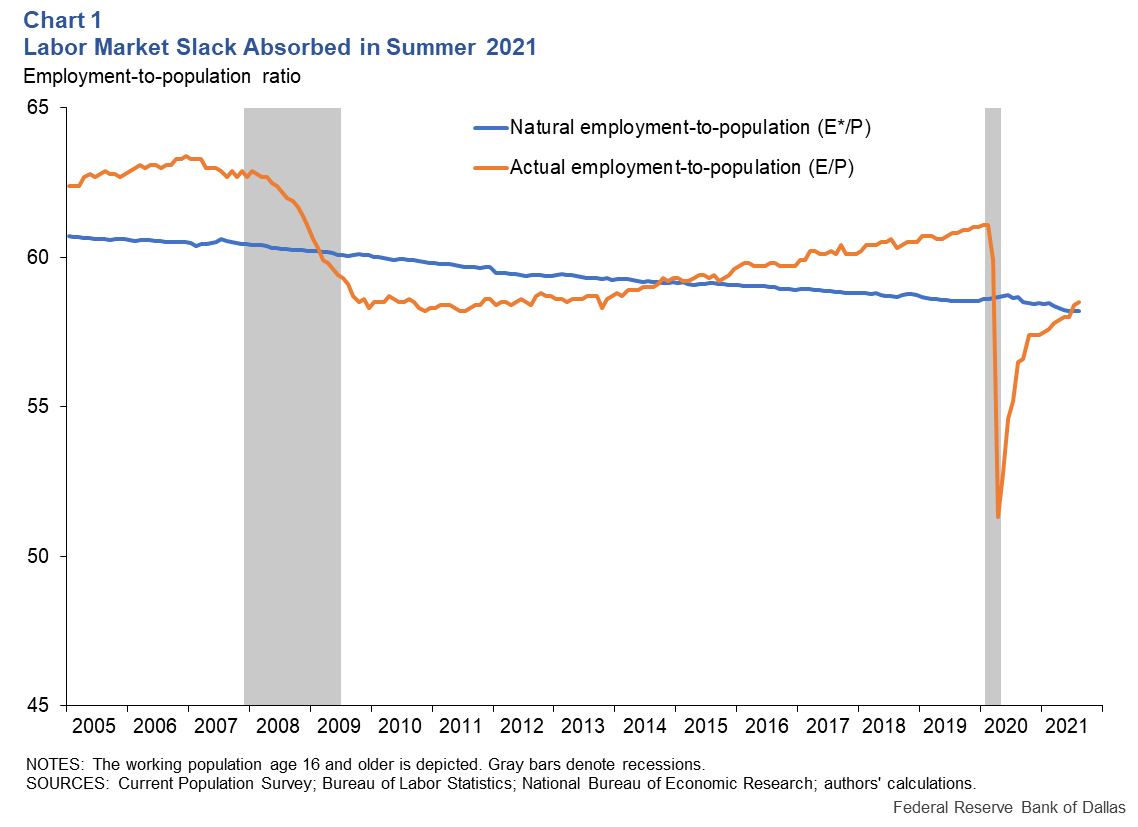

Using the E/P as our measure of labor market conditions, labor market slack exists when the actual E/P is below the estimated E*/P. Chart 1 shows how the wide E/P gap created by the COVID-19 pandemic in 2020 has closed.

A common claim is that there is still considerable slack in the U.S. labor market, as total employment remains 5.3 million below its prepandemic level in February 2020. However, as is clear from Chart 1, the labor market was quite tight in February 2020, so this choice as a benchmark is problematic for gauging the degree of labor market slack.

Slack appears to have been absorbed by August

The August E/P exceeds the E*/P by 0.3 percentage points, which translates to about 785,000 jobs above the overall natural rate of 152.3 million. This difference is comparable to the gap in November 2015.

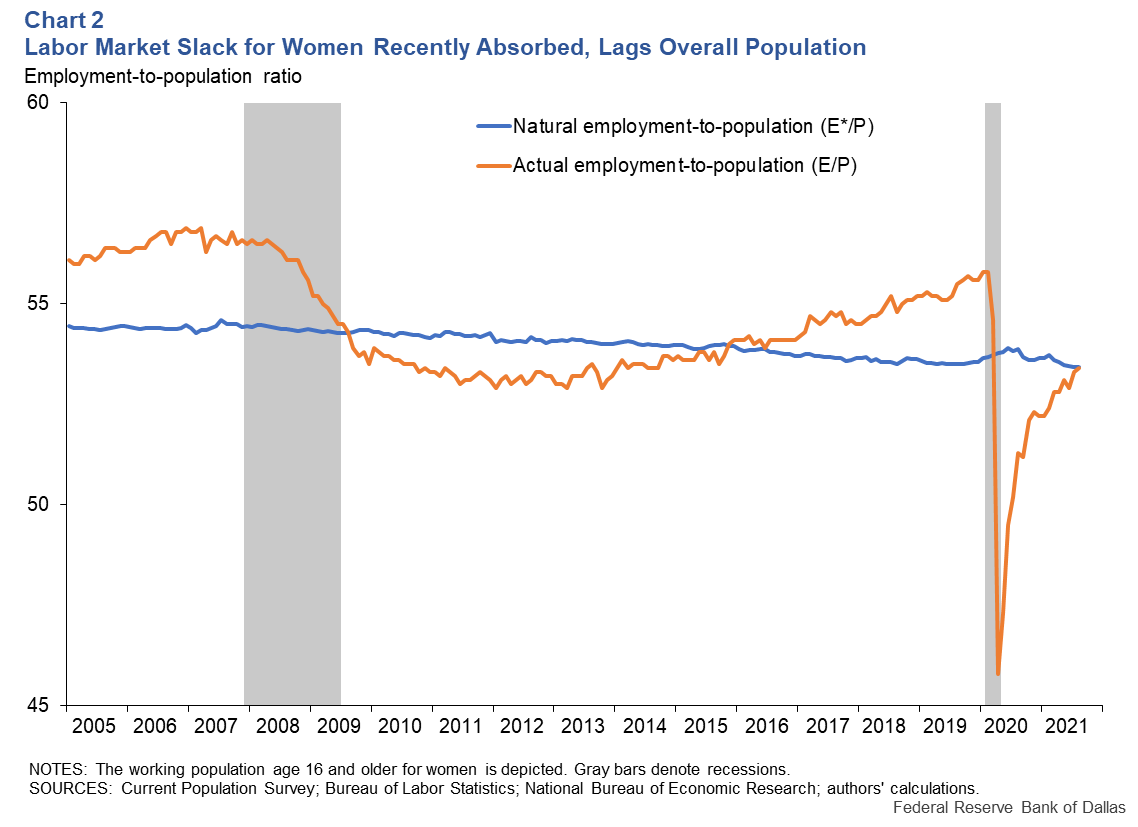

The return of women with young children to work has been hampered by delays in reopening daycare and resumption of schools’ in-class instruction. These challenges were detailed in Dallas Fed Economics last May. Labor market slack for women disappeared by August following months of progress (Chart 2).

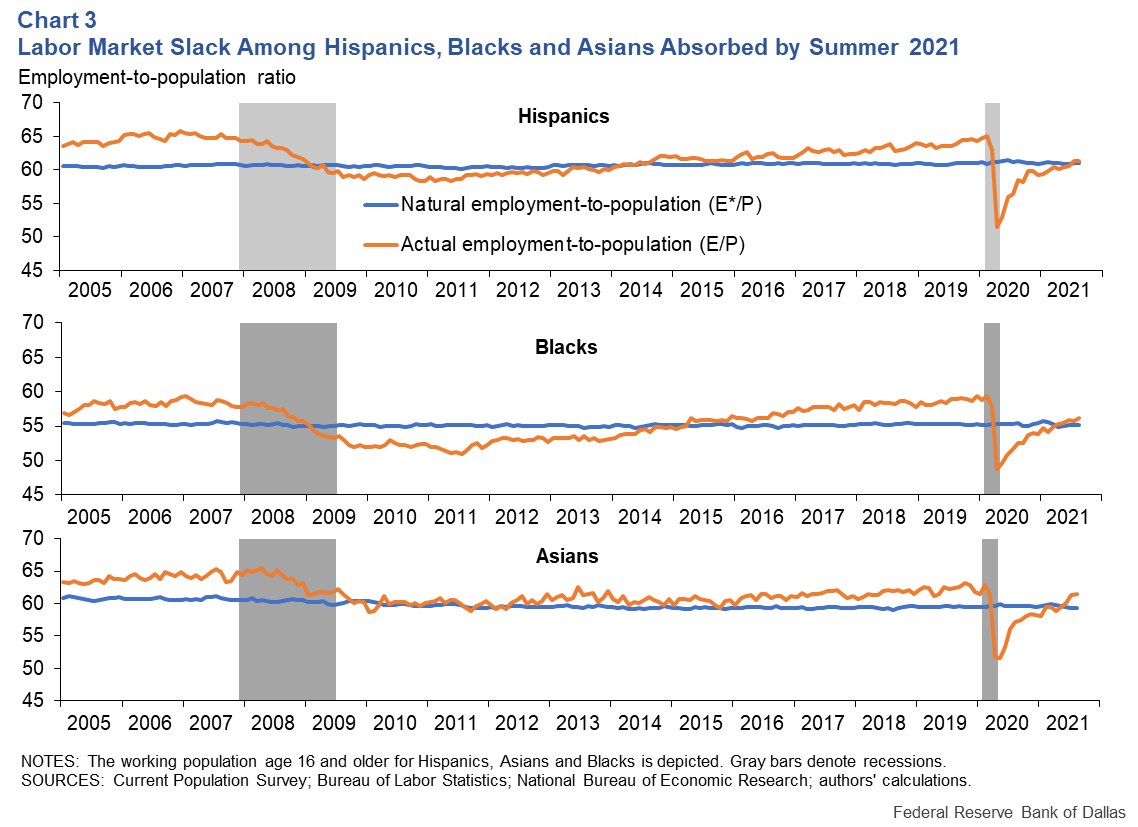

The pace of economic recovery among various subgroups is often uneven. For example, the aggregate employment rate of Hispanics dropped 13.6 percentage points, while it fell 11.3 percentage points for Asians and 10.5 percentage points for Blacks.

Our analysis shows that, in terms of labor market slack, the economic recovery has removed the slack for Asians, Blacks and Hispanics in addition to whites (Chart 3). The current E/P ratios exceed the natural-rate ratios for Asians (by 2.1 percentage points), Blacks (1.0 percentage points) and Hispanics (0.4 percentage points).

Various measures suggest tighter labor market

The weaker-than-expected August labor market report should not obscure the labor market’s ongoing and significant progress while recovering from the COVID-19 pandemic. Our analysis shows both overall and among major subgroups, the unprecedented labor market slack created in 2020 has been absorbed.

This is consistent with other signals from the labor market such as the high quit rate reported in the Job Openings and Labor Turnover Survey—known as the “JOLTS Report”—and a faster pace of wage growth.

Importantly, and as we have argued previously, the 5.3 million “shortfall” of employment from February 2020 levels is not a proper measure of labor market slack relative to a neutral labor market.