Texas economic activity, job growth weaken as 2023 closes

Texas economic growth slowed in the fourth quarter, with job growth falling sharply in October and business activity contracting slightly in November.

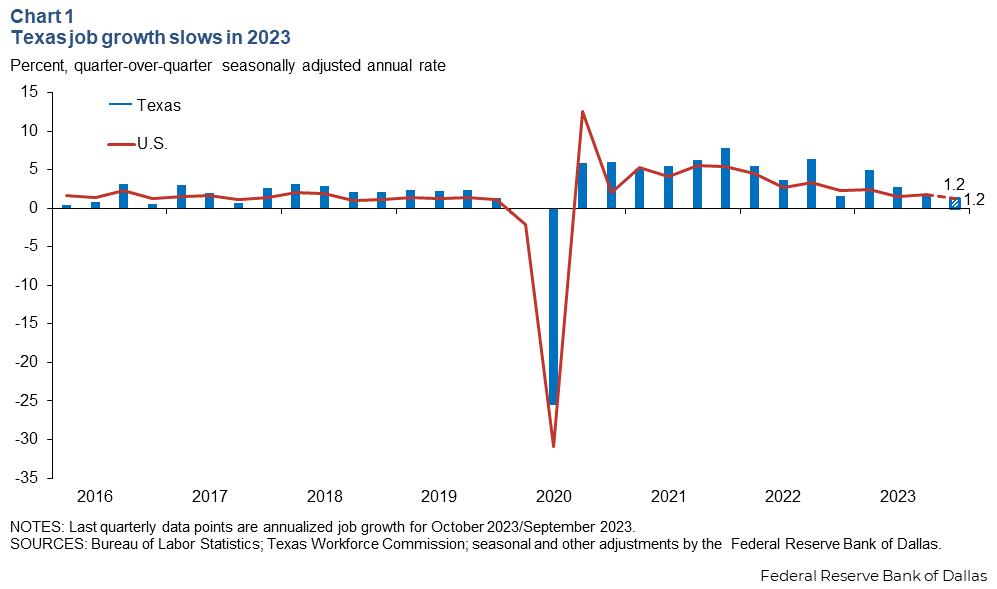

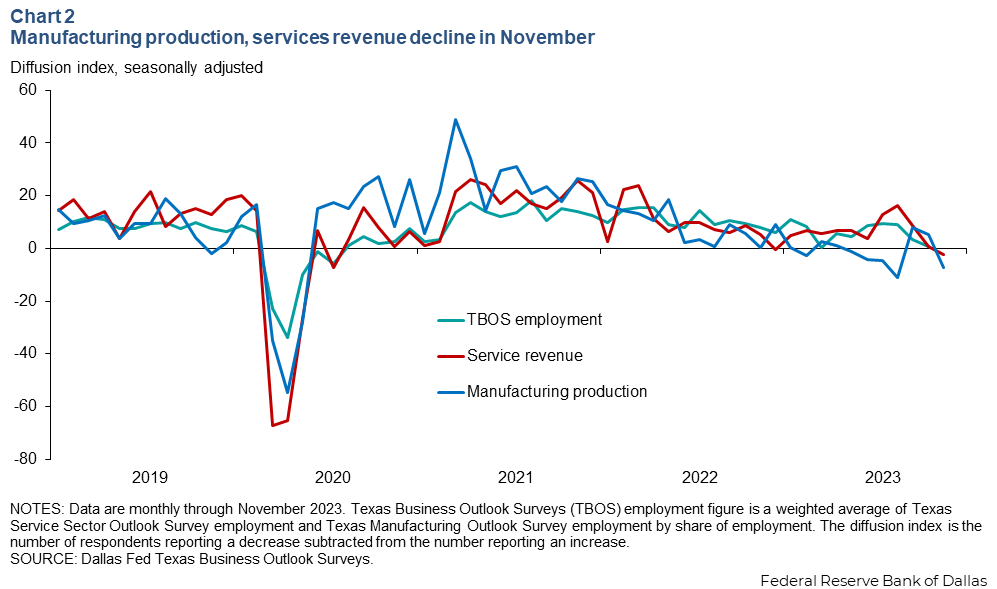

Job growth decelerated sharply to start the quarter, falling to 1.2 percent in October from 5.8 percent in September. The Dallas Fed Texas Business Outlook Surveys (TBOS) similarly indicated notable slowing in employment growth. In November, TBOS manufacturing production and service sector revenue indexes turned negative.

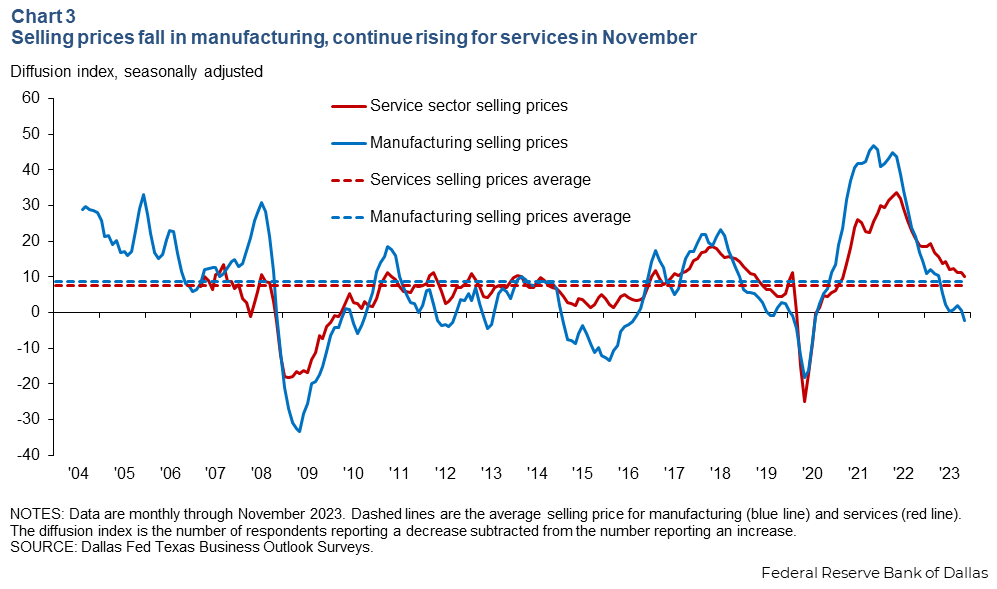

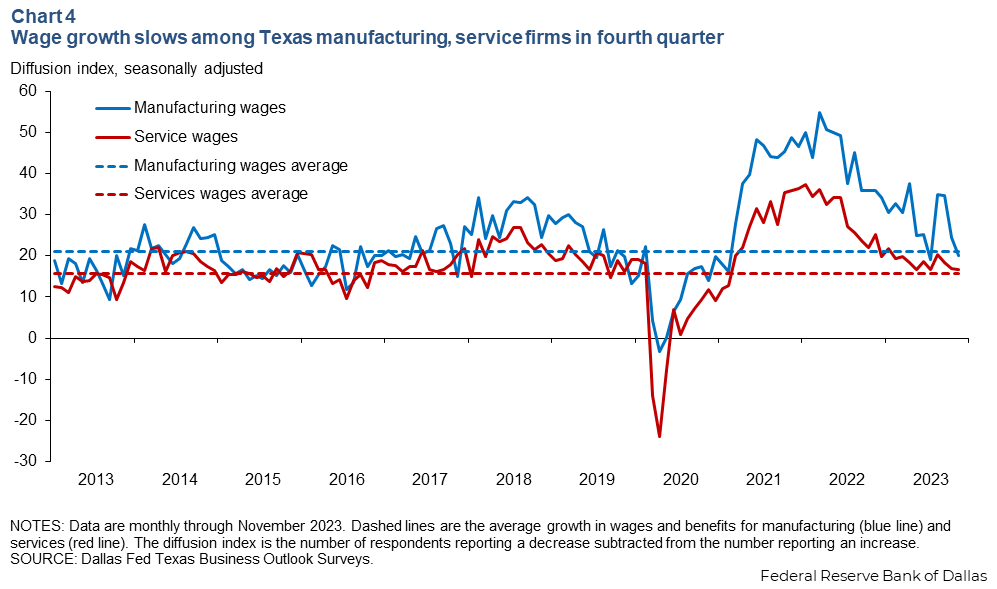

TBOS respondents also reported falling prices in manufacturing, while service sector contacts noted stable price pressures. Wage pressures stabilized broadly.

Texas employment growth matches U.S. in October

Texas employment grew at the same pace as the nation in October, a 1.2 percent annualized rate (Chart 1). However, the state’s year-to-date job growth (3.2 percent) remains ahead of the U.S. (1.8 percent) in total and across all industries.

Despite the slowing, Texas employment growth during the fourth quarter remained broad based as top sectors such as trade, transportation and utilities; professional and business services and education and health services notably advanced. In contrast, U.S job growth was concentrated in particular industries, such as health care and hospitality.

Pessimism among the Texas Service Sector Outlook Survey respondents in November reflected slowing Texas activity. One utilities contact reported the company’s leadership felt “that we are headed for a recession.” Similarly, a Texas Manufacturing Outlook Survey respondent engaged in transportation equipment manufacturing noted “there is nothing encouraging on the horizon.”The second quarter Texas employment benchmark, a statistical adjustment to early data releases, produced a 0.3 percent reduction of payrolls. Because of that slight overstatement in the early data, it appears employment has been growing at a lower rate than previously reported.

The Dallas Fed’s 2023 Texas Employment Forecast fell from 3.3 percent to 3.2 percent (December to December).

Economic activity contracted slightly in November

Manufacturing production and service sector revenue declined in November, according to the TBOS surveys. The Texas Service Sector Outloook Survey (TSSOS) revenue index turned negative for the first time since December 2022 (Chart 2). The last time both production and revenue declined in the same month was May 2020, at the height of the pandemic economic downturn.

Price pressures mixed, wage pressures stabilize

TMOS manufacturing contacts reported falling selling prices in November, while service sector contacts noted continued price growth (Chart 3). Input cost growth declined further for both manufacturing and services.

Anecdotally, a computer and electronics product manufacturer mentioned the company was “seeing a lot of price and lead-time increases,” while a contact in food manufacturing indicated “raw materials (prices) decreased, leading to improved profit margins.” Texas Consumer Price Index headline inflation was 5.2 percent on an annualized basis in October. Year over year, headline inflation was 4.2 percent and core inflation (excluding food and energy) was 5.1 percent. The U.S. year-over-year rates were lower, 3.2 percent headline and 4.0 percent core.

Meanwhile, TBOS manufacturing and service sector contacts noted stabilizing wage pressures (Chart 4). According to payroll data, as of October, the year-over-year percent change in Texas wages for manufacturing was 7.3 percent and 4.4 percent for services. Overall, Texas wages outpaced the nation, growing 5.2 percent compared with 4.0 percent for the U.S.

Despite wage pressures stabilizing, recent gains have been substantial. A food services and drinking places contact said, “The pressure to increase wages and salary continues to be a struggle.”

Overall, these developments point toward easing economic activity heading into 2024. While prospects for a slowdown also appeared substantial a year ago, toward the end of 2022, the underlying conditions then proved to be transitory.

The current situation is more likely to persist because of elevated interest rates, tighter financial conditions and waning consumption growth. Notably, the average 30-year mortgage rate increased from 5.6 percent in 2022 to about 7.3 percent through most of 2023. Regional banks in the Eleventh District reported tighter financial conditions in November, while consumption as measured by Texas retail sales tax revenue declined 0.7 percent year over year in November.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.