Solar, battery capacity saved the Texas grid last summer; an uncertain future awaits

Solar electricity generation and utility-scale batteries within the Electric Reliability Council of Texas (ERCOT) power grid set records in summer 2024. On average, solar contributed nearly 25 percent of total power needs during mid-day hours between June 1 and Aug. 31. In critical evening hours, when load, or demand for electricity, remains elevated but solar output declines, discharge from batteries successfully filled the gap.

While these trends are positive, they also come with some caveats, as Texas residents and consumers look to this winter and beyond. Under extreme cold conditions, when peak load flips to the early morning hours, there is growing risk that the solar-battery pairing may be inadequate to meet demand, particularly if thermal (natural gas and coal) power plant outages exceed estimates.

Additionally, as ERCOT forecasts accelerated load growth due to anticipated data center construction and electrification trends, the current generation mix and market design should garner increased scrutiny.

Solar and battery installation continues to surge

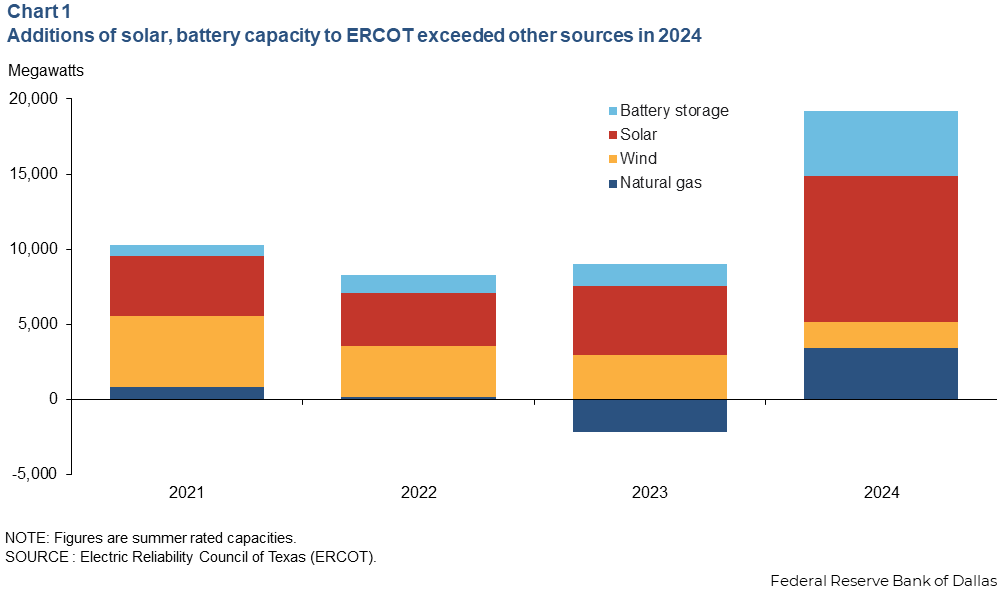

Another hot summer in Texas put the electric grid to the test, but increased capacity from solar and battery storage met the call. By a wide margin, these sources combined have led capacity growth of the ERCOT grid (Chart 1).

Between 11a.m. and 2 p.m. in summer 2024, solar output averaged nearly 17,000 megawatts (MW) compared with 12,000 MW during those hours in 2023. Between 6 p.m. and 9 p.m., discharge from battery facilities averaged 714 MW in 2024 after averaging 238 MW for those hours in 2023. However, averages fail to demonstrate the importance of batteries on certain days, such as Aug. 20, when a new load record was set. Battery discharge itself also set a record of 3,927 MW at 7:35 p.m. that evening. Solar and battery output have continued to grow since then.

Notably, ERCOT did not have to issue a conservation appeal to customers on Aug. 20 or any other day last summer as it was forced do to on 11 occasions in 2023.

Winter weather creates different challenges for grid

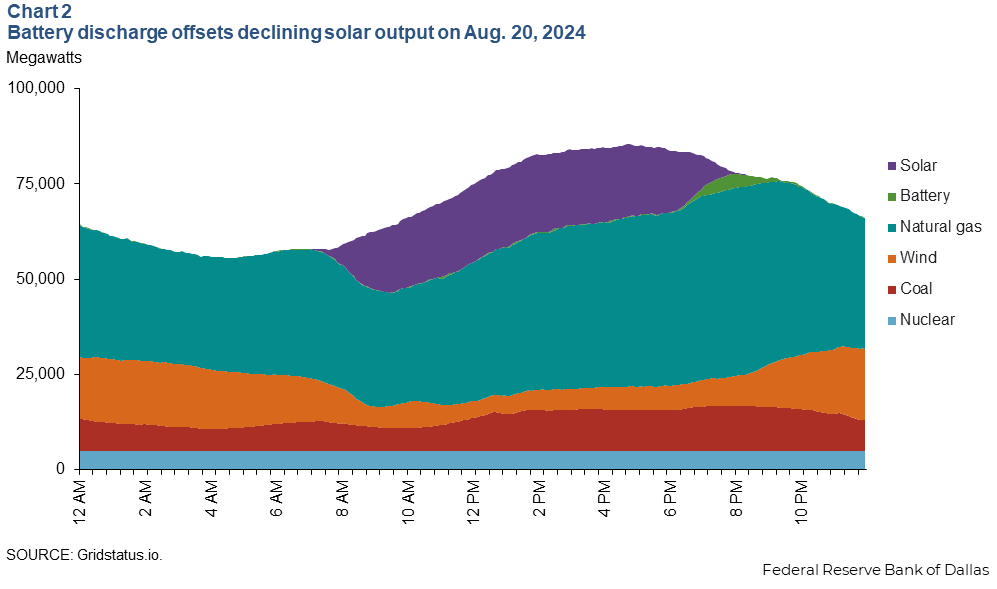

The battery-solar interplay works well in summer due to the shape of the daily load curve (Chart 2). That is, greatest daily demand tends to occur in late afternoon, when solar output is near peak levels, and batteries can discharge to meet demand as the sunshine wanes.

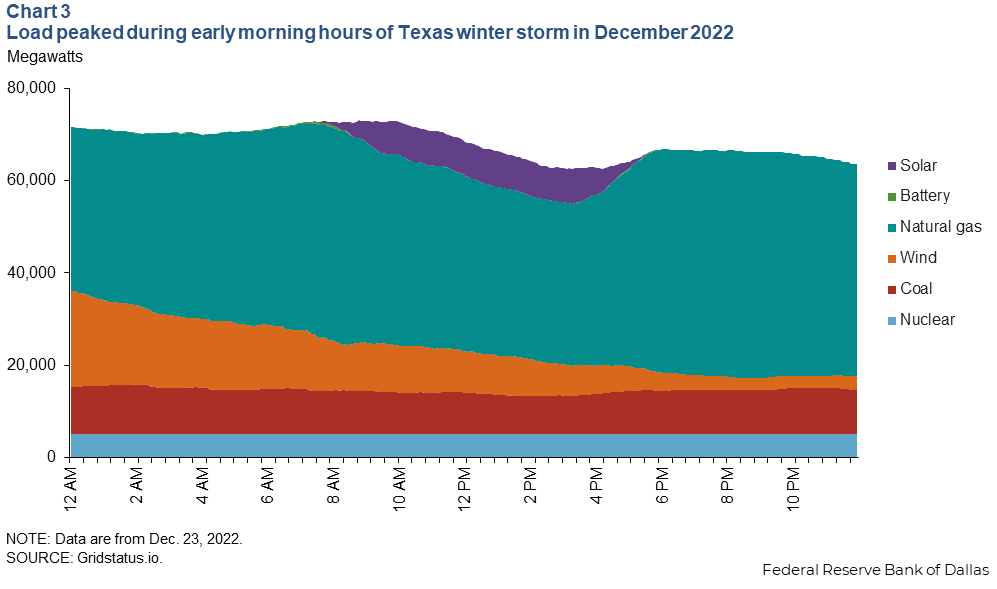

However, during bitterly cold winter days, peak load can occur early in the morning and last for a longer period (Chart 3). Not only is this before the sun rises, when solar can’t contribute any output, but it does not match as well with the typical one- to two-hour discharge capacity of the current battery storage resources within the ERCOT service area. This creates a different challenge for the grid, and this past summer’s success does not provide as clear an analog.

Thus, ERCOT forecasts a 50 percent chance of ordering rolling outages in the morning hours of a cold snap similar to a winter storm that hit the state in December 2022 and an 80 percent chance if there’s a repeat of the deep freeze that swept across Texas in February 2021. ERCOT’s analysis assumed only minor additional thermal plant outages under these conditions.

In the early morning on cold days, the grid relies primarily on the natural gas-fed generation to perform without interruption. While winterization standards and their enforcement for power plants appear to have improved since the 2021 catastrophic freeze, it is uncertain that natural gas production and transportation would be secure during extreme cold.

During recent outbreaks, natural gas output still suffered from freeze-offs and shut-ins at the wellhead. Texas natural gas production briefly fell nearly 20 percent during winter bouts in 2024 and 2022, according to Bloomberg. Power generators can compensate by switching for a short duration to fuel stored on-site, which occurred in 2024 and 2022. But under an extended, multiday spell of below-freezing temperatures, the outcome may not be as favorable.

Solving for peak load requires adequate market signals

Extreme load scenarios present challenges to a competitive, energy-only electricity market such as ERCOT, where power generators are only compensated for what they produce. There’s no guarantee of a rate of return or payments to maintain reserve capacity. In other words, market signals are required for development of adequate generating capacity to meet the highest load scenario, even if that scenario is just for one hour over the course of an entire year—or longer.

Less intense heat than in 2023 and greater generating capacity resulted in lower wholesale electricity prices in the ERCOT service area during 2024. Between June 1 and Aug. 31, 2024, real-time wholesale prices averaged just $28, compared with $97 the year before. Similarly, from 6 p.m. to 9 p.m., when battery discharge is strongest, wholesale prices averaged $80 in 2024 versus $332 in 2023.

While these prices are unquestionably better for consumers, this development has potentially negative implications for continued growth of battery storage and other forms of dispatchable generation.

Many battery storage facilities are designed to charge during periods of low wholesale prices and discharge when prices are higher in the evening hours when they fill the gap created by declining solar output. The summers of 2022 and 2023 were prime conditions for battery operators to capture this arbitrage.

However, as more batteries enter the market, they create more available supply during peak hours. All things being equal, the usual spike in wholesale electricity prices will smooth, which is essentially what started happening in summer 2024. Should the trend continue and potentially negatively impact the economics of certain projects, the expected acceleration of battery deployment within the ERCOT service area could be disrupted in the coming years.

Similarly, investors and power generating companies find it harder to justify additional thermal plant development. This follows from low average wholesale prices and fewer hours of required baseload generation during daylight hours primarily due to rising solar output. Additionally, looming federal power plant emissions standards (though subject to repeal) could make additional natural gas-fired generation cost prohibitive, which has further limited development of thermal resources in recent years. As a result, 972 MW of new thermal power plant capacity is expected to enter service within the ERCOT area by summer 2026 versus an additional 22,991 MW of new solar generation.

One variable that could change this is load growth. If load growth begins outpacing supply additions, it could push wholesale electricity prices higher and potentially incentivize baseload power additions.

Forecasts for load growth raise questions

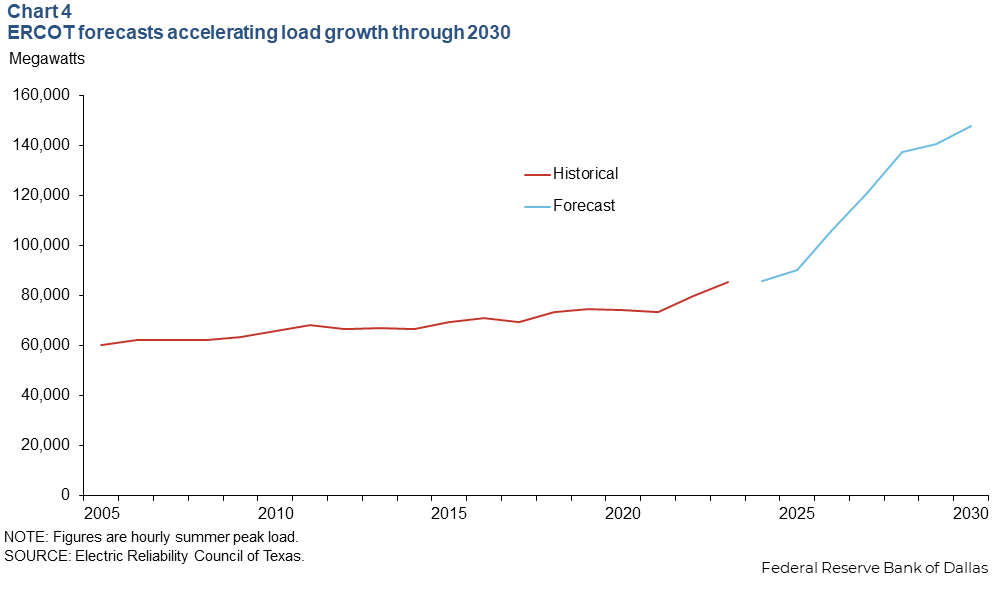

In April 2024, the ERCOT staff released an updated forecast for long-term load growth that departed from previous projections, which were based primarily on expected state gross domestic product growth and historical weather patterns.

The new forecast accounts specifically for planned and potential sources of large load, such as data centers, cryptocurrency mining operations, hydrogen electrolyzers and other major industrial users. While earlier forecasts expected peak summer load to reach 100,000 MW by 2030 (versus a peak of 85,000 MW in summer 2024), the new calculation increased that figure to 148,000 MW (Chart 4).

This suggests, on its face, that generating and transmission capacity within ERCOT will have to grow by a corresponding amount to meet this demand, plus an additional amount to account for capacity factors and reserve margins. Such growth is unlikely in such a short period of time.

At a minimum, ERCOT’s “potential” load forecast is just that. While plans are underway for a series of large and highly energy-intensive hydrogen production facilities along the Gulf Coast, construction is not assured. Similarly, all data centers and cryptocurrency mines under consideration were included in ERCOT’s forecast, but it is unlikely that every one of them will be built. Likewise, as the federal Energy Information Administration recently found, large data centers and crypto mines in ERCOT historically consume just 65 percent of their approved capacity.

Since data centers generally operate with power purchase agreements to obtain generating capacity from power companies that support their facilities, the data centers’ contribution to rising load growth will diminish if they fail to complete adequate purchase arrangements. Similarly, regulators might restrict new facilities’ access to the grid if the authorities anticipate risks to reliability and price shocks.

Additionally, rapidly improving computing efficiency within data centers and deployment of onsite behind-the-meter power generation, both of which are difficult to project, could further limit the impact of data centers on the ERCOT system. These constraints are poised to curb the extent to which load reaches the levels ERCOT and some others currently project.

As a result, while attention has been focused on the potential for electricity shortages in the coming years, futures prices for ERCOT wholesale power have been less reflexive. Though prices for 2025–28 are elevated relative to recent years, the lack of a surge reflecting current load forecasts, and mimicking price surges in other electricity markets, suggests ERCOT market participants are discounting a major supply-demand imbalance in the coming years.

Load growth and market design are not in sync

Despite the caveats on potentially explosive load growth on the ERCOT grid, it is clear that load will increase annually through a combination of a growing manufacturing base, electrification, population and economic growth, and extreme weather.

To meet that demand, more generating capacity will be required. But its development hinges on price signals and market conditions that invite more baseload and dispatchable generating capacity, including longer-duration batteries, as well as investment in power purchase agreements and other power arrangements by large-scale consumers.

ERCOT’s energy-only market design and new incentive structures such as the Texas Energy Fund do not appear adequate for the magnitude and speed of load growth likely to arrive in the coming years. While the Texas Energy Fund, created in 2023 to help finance electric generating facilities, has 10,000 MW of natural gas power plants in its queue today, deployment is several years away and comes with uncertainty. More widespread, household-focused demand response programs would also help soften extreme load peaks.

The additions also pale in comparison to even half of the load growth ERCOT envisions in its potential load forecast. As a result, ERCOT needs new market products and structures that incentivize baseload and generation from peaker plants (which handle outsized load spikes) to meet the looming challenge of load growth.

The calculus could also change, as industrial consumers and generating companies are in the early stages of a potential wave of deals to accelerate construction of power plants, some even with carbon capture and storage technologies. Additionally, while interconnection requests and transmission line construction still require years of review and approval, adoption happens faster within ERCOT than in any other grid in the country.

Rising solar and battery output in ERCOT clearly enabled a summer of triple-digit heat without the close calls of previous summers and with lower prices to boot. However, the ground is beginning to shift as load is poised for a long climb higher and expected generation installation gets pushed to its limits.