With few firms advising life insurers, is financial stability at risk?

Concerns about financial stability have accompanied the asset management industry’s growing influence on multiple institutional clients’ behaviors.

Institutional investors, such as insurance companies and pension funds, often allocate their portfolios according to strategies designed or advised by a handful of asset management firms.

As strategies are applied on behalf of multiple institutions, portfolios might become too similar. In a financial downturn, this similarity theoretically could deepen insurer losses and magnify shocks to asset values through coordinated sell-offs of holdings.

However, despite asset managers playing an increasingly pivotal role in investment decisions—leading to more similar portfolios—analysis of life insurance firms and their advisers reveals a relatively small threat to financial stability.

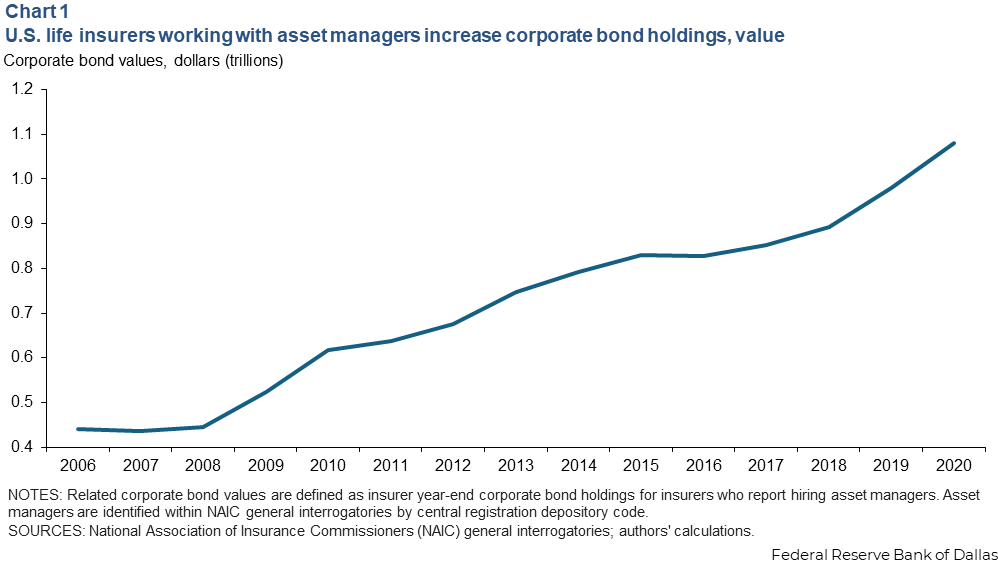

Life insurers have attracted particular attention among institutions because of their increased reliance on external asset managers over the past decade. Notably, the value of U.S. life insurer corporate bond holdings associated with asset managers more than doubled from 2010 to 2020, now exceeding $1 trillion (Chart 1).

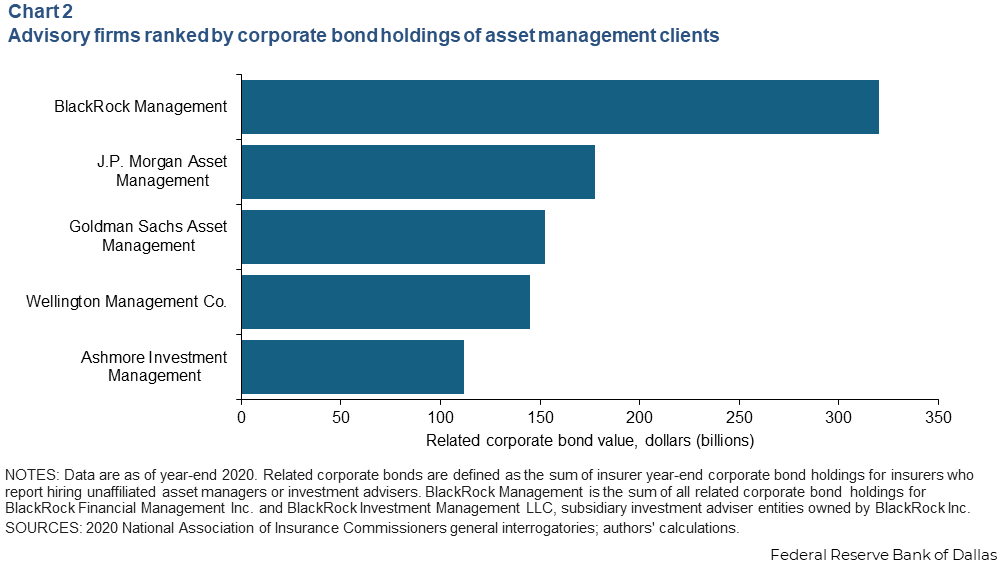

Despite large growth in managed assets, a relatively small number of asset managers control a majority of holdings. Just five companies oversaw 53 percent of managed life insurer corporate bonds as of 2020 (Chart 2).

Regulatory proposals related to financial stability previously focused on individual institutional investors. However, asset manager concentration among insurance companies raises a key question: If many insurers hire the same asset managers, do the insurers end up with similar investment portfolios and trading behaviors?

Our recent working paper “Asset Manager Commonality and Portfolio Similarity” investigates this question. It combines insurance company portfolio holdings data from the National Association of Insurance Commissioners with previously untapped disclosures identifying the asset managers of insurers. We measure how closely aligned insurers’ portfolios are and find more similar portfolios and trades among life insurers sharing a common asset manager.

Nevertheless, related financial stability concerns appear alleviated because the heightened similarity is driven primarily by coordinated asset purchases rather than sales. The resulting impact on correlation of portfolio returns across insurers is small, mitigating concerns regarding correlated investment losses across insurers.

Quantifying the similarity of insurers’ portfolios

We measure life insurer portfolio overlaps through a method known as cosine similarity. A popular measure in computer science, cosine similarity has recently been applied to financial research as well. Cosine similarity provides a way to quantify the resemblance between insurers’ portfolios, capturing how closely aligned weights of various assets in the two insurers’ portfolios are. An individual entry corresponds to the share of a portfolio invested in a particular issuer’s bonds.

Cosine similarity of 1 indicates portfolio weights are identical. Cosine similarity of 0 indicates no overlap, meaning portfolio weights are completely different with no common investments.

By calculating the cosine similarity for all potential pairs of life insurers, we quantify the degree of portfolio overlap across the industry, and most importantly, whether sharing the same asset manager drives any of this overlap.

Discerning shared asset managers

Asset manager disclosures were obtained from National Association of Insurance Commissioners general interrogatories. These entities are identified by name and a unique central registration depository code. An insurer-pair shares the same manager if the companies report at least one common code.

Combining our insurer investment and asset manager datasets, we can view the asset manager rosters for the universe of life insurance pairs and each pair’s portfolio similarity. The sampling period runs from 2006 to 2020 on an annual basis.

We find that sharing the same asset manager increases portfolio similarity. Specifically, insurer pairs that share at least one asset manager have portfolios that are 20 percent more similar on average than those who don’t. This result is obtained after controlling for a variety of confounding factors. They include belonging to the same insurance group or being subject to time trends that may drive manager choice and portfolio decisions simultaneously.

Beyond increasing portfolio similarity, common asset management also increases the trade similarity of insurer pairs 50 percent on average when compared with those that do not share an asset manager. This suggests asset managers not only shape the long-term portfolio strategy of life insurers but also actively influence their trading decisions.

Assessing differing asset manager relationships

Asset managers notably create greater portfolio and trade similarity through two mechanisms.

First, asset managers that actively manage insurer assets (as opposed to merely providing investment advice) primarily drive similarities.

The results show that if an insurer pair shares a manager that directly controls the majority of the assets of both insurers, the two will exhibit greater portfolio and trade similarity. When an insurer pair shares a manager who simply advises, the portfolio similarity increases, albeit to a lesser degree. Despite not actively executing investment decisions, advisers may tangibly influence insurance companies, which translates into similar decisions.

Second, the longer two insurers share a manager, the more similar their portfolios become. Notably, the effect of sharing a manager doubles after 10 years.

This gradual deepening of investment coordination over time helps us rule out an alternative explanation that insurers driven by similar investment motives may simply be selecting the same managers. Were that the case, trade similarity would immediately spike. To support the robustness of our findings, we examine instances of asset manager closures, which naturally alter the overlap in managers across insurers independently of our main variables. Our results remain consistent in these cases.

Financial stability doesn’t appear at immediate risk

If overlapping asset managers among insurers causes increasingly similar investment patterns, could that lead to correlated sales or correlated losses and, thereby, pose a threat to financial stability?

It appears that sharing the same asset manager has a greater impact on insurers buying bonds at the same time, as opposed to simultaneously selling them. This distinction is important because while there may be coordination in buy-side trades, there is less evidence of mass synchronized selling that is the main financial stability concern.

To study correlated losses, we examine whether an asset manager creating similar investment portfolios for insurers also generates similar returns for them. We find that while common asset management leads to greater return correlations for a given insurer pair, the effect is small, a roughly 1.4 percent increase in correlation on average. Thus, a large increase in portfolio similarity through shared asset management does not automatically translate to systemic risk to the broader financial system.

About the authors