Investment in Mexico falls despite rise in remittances

Mexico has grown more dependent on foreign direct investment and remittances after total investment declined sharply for a fourth consecutive year in 2020.

The pandemic likely played a significant role in 2020, with investment dropping to 19 percent of gross domestic product (GDP) in 2020—from 21 percent in 2019 and 23 percent in 2018.

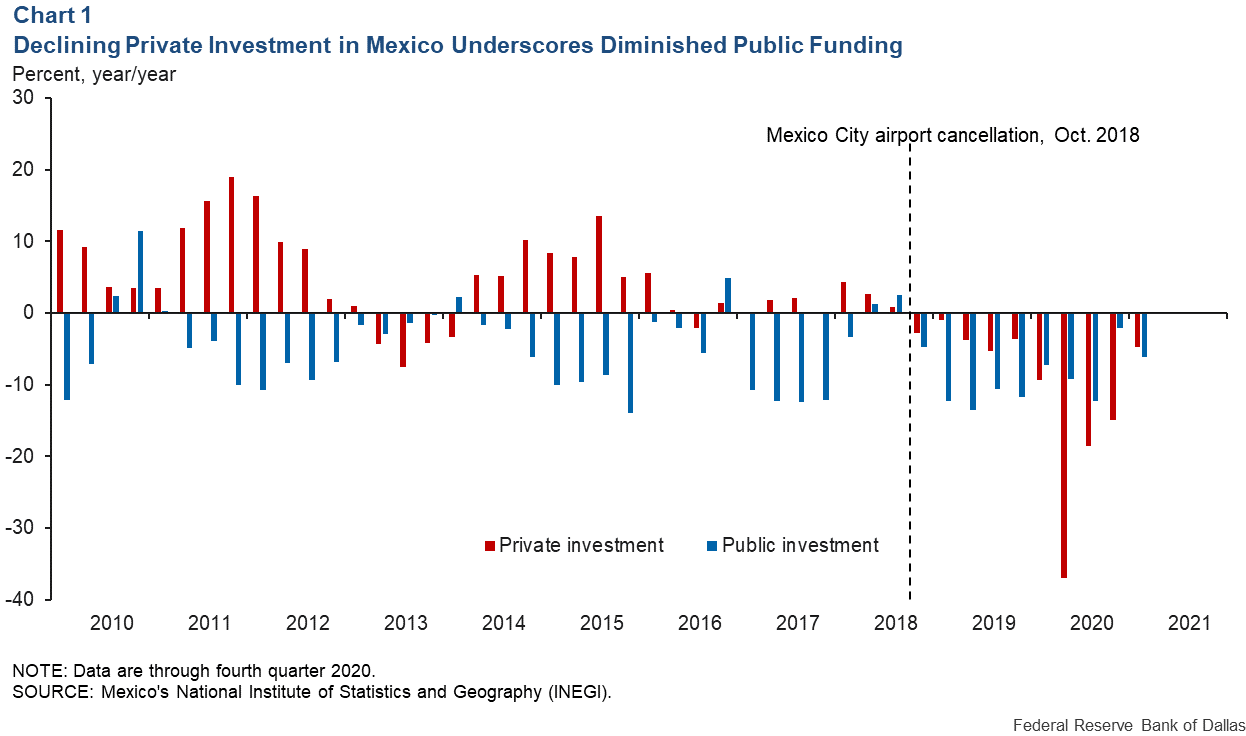

The country had relied on private sources to make up for lagging public investment, which includes government spending on physical infrastructure and research and development. However, such private investment started declining in 2018 (Chart 1).

Public investment supports private sector productivity

Normally, public investment plays an important role in a country’s long-term growth. Infrastructure such as highways, mass transit, airports, and sea and rail port facilities have a positive effect on private sector output and productivity growth.

Such positive effects come from the availability of infrastructure to support private sector production. For example, by assembling the necessary infrastructure—roads, electricity and telecommunications—public sector investment can strongly influence the productivity of private capital investment in buildings, vehicles, machinery and equipment.

Mexico’s public investment has dropped at an average annual rate of 6 percent since 2010; private investment initially offset some of that. Recent declines in private investment coincided with the 2018 cancellation of construction of a new $13 billion Mexico City airport by the incoming Andrés Manuel López Obrador (AMLO) administration after $2 billion had already been spent.

Pausing oil and gas lease auctions

The new government also curtailed energy investment. The AMLO administration installed a moratorium on lease auctions for oil exploration after saying it wanted to see production results from auctions that had occurred during the previous administration of Enrique Peña Nieto. Typically, it takes four to five years to go from exploration to production in a new area.

The government also proposed policy changes that would favor Mexico’s state-owned Federal Electricity Commission (Comisión Federal de Electricidad (CFE)). The resolution favors pollution-producing fossil fuel power plants—such as CFE’s facilities—over renewables and private sources. The measure could affect more than 150 renewable energy projects under development, representing a $40 billion investment, industry analysts estimate.

Role of public investment in aiding economic growth

Public investment plays an important role in a country’s long-term growth. Conversely, inadequate public infrastructure is often an impediment to economic growth and development in low- and middle-income countries. Mexico has attempted to attract private investment given the paucity of public funding. It has also leaned on expatriates’ remittances to family members to alleviate poverty.

Such a strategy carries a risk: Investors’ perceptions about the economy can suddenly turn pessimistic because of changing public policy—such as the airport cancellation or restrictions on investment. Additionally, remittances are subject to external shocks and international policy changes.

Remittances increase despite pandemic

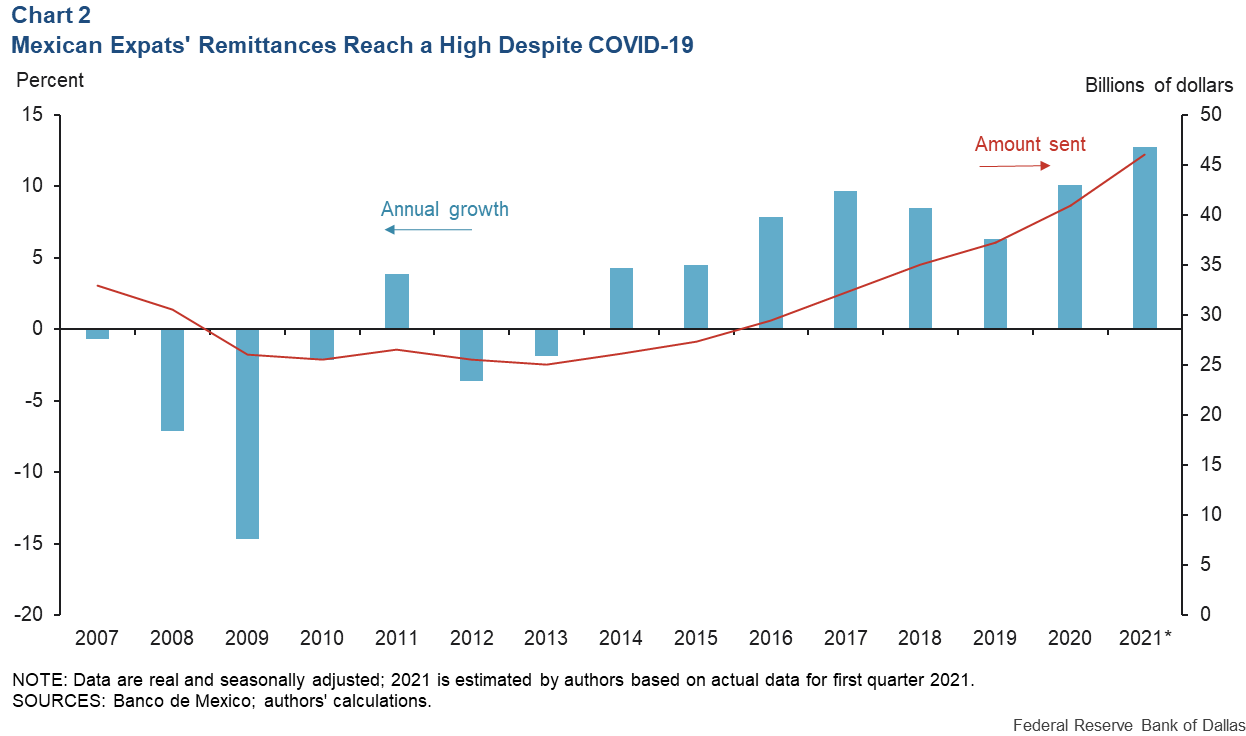

Mexico’s economy benefited when workers’ remittances continued flowing, reaching a high of $41 billion in 2020 despite the pandemic. Assuming the quarterly growth observed from January through March 2021, remittances could reach $46 billion by year-end. (Chart 2).

Depreciation of the peso between February and April—it fell 22 percent against the dollar—may be one reason for the climbing remittance total. Expats, knowing that their dollars can buy more pesos, have historically used the opportunity to increase remittances. The Mexican currency has subsequently regained ground, approaching 21 pesos per dollar in June.

The level of remittances may also be responding to the COVID-19 situation in Mexico, which at times was particularly acute, leading to harsh economic conditions that some expats sought to ease for family members.

And while the pandemic recession particularly affected workers in the U.S. service sector, many legal and unauthorized immigrants tend to work in industries that were designated as essential. For example, these workers represent 29 percent of jobs in agriculture and 25 percent of those in construction.

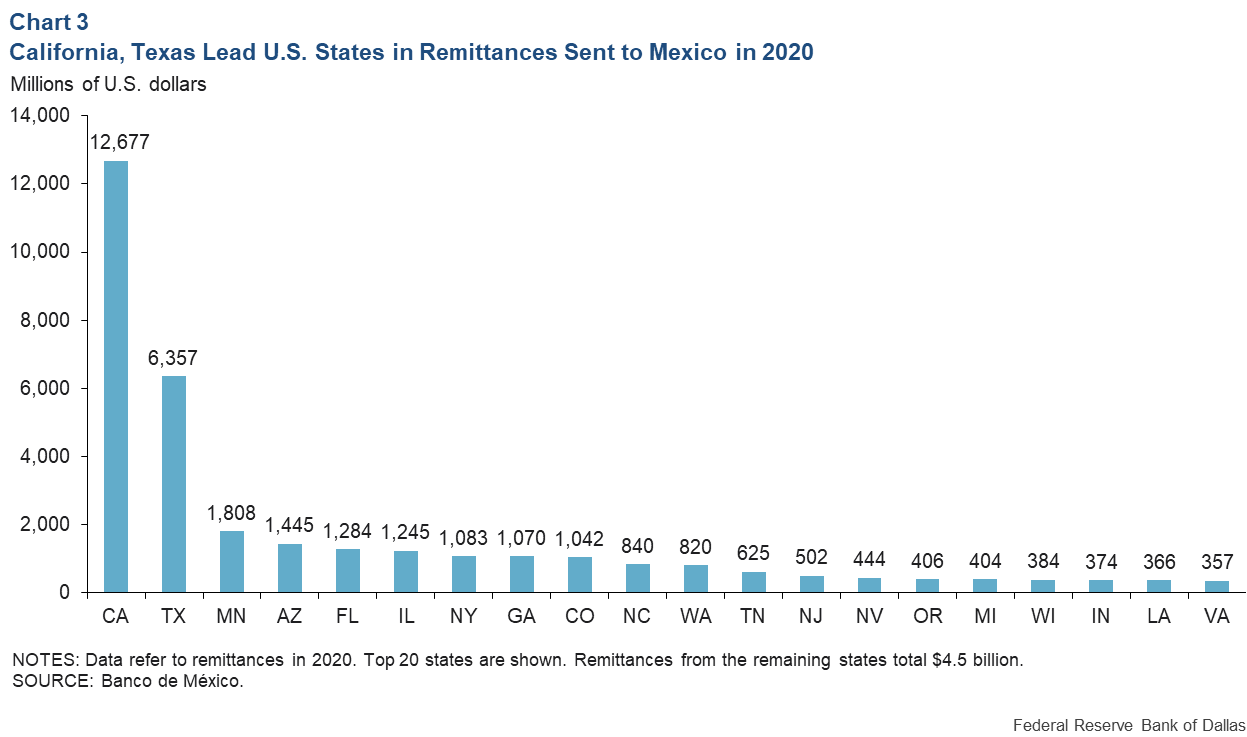

California, Texas and Minnesota were the top three states from which remittances were sent to Mexico in 2020, totaling a combined $21 billion (Chart 3 ).

Also, some of the cash sent to Mexico may have been funds that U.S. residents collected from the American government’s COVID-19 economic stimulus payments.

Evidence regarding the impact of the remittances on economic growth is inconclusive. However, there is consensus that the funds alleviate poverty and smooth consumption among recipient households. In Mexico, most of such funds are used to buy food or cover basic expenses, such as rent or health care. About 17 percent of Mexican remittance recipients use some of the money for savings, investing or education.

Most likely, remittances have provided economic relief to the most vulnerable sectors of the Mexican population during the pandemic. The money is also filling some of the void left by the federal government’s scant fiscal support for the economy.

Foreign direct investment resilient

Foreign direct investment (FDI) occurs when an investor from outside a target country establishes a lasting interest in an enterprise. FDI is an important channel for technology transfer between nations and promotes international trade through access to foreign markets. In addition to financing investment in the target country, FDI can be an important vehicle for economic development.

FDI in Mexico has remained stable since 2015, averaging about $8.7 billion of new investment per quarter. The U.S. is the No. 1 source of FDI in Mexico, accounting for 38 percent of the total. Close to 50 percent of FDI in Mexico goes to the manufacturing sector, reflecting the importance of production integration in the U.S.–Mexico commercial relationship.

Mexico will likely remain a prime U.S. investment destination, given that U.S. trade competitiveness depends partly on access to exports from Mexico. Moreover, the United States–Mexico–Canada Agreement took effect July 1, 2020, codifying the nations’ trade relationships and bringing new clarity for FDI investors.

Public investment key to attracting private funds

Remittances have aided Mexico’s poorest, while FDI has contributed to Mexico’s main engine of growth, manufacturing. Together they have cushioned the blow of declining private and public investment.

Longer term, Mexico should take advantage of the relatively low interest rate cost for financing public investments in the current environment and the nation’s low debt-to-GDP ratio to invest in projects that will ultimately complement private sector efforts. This also requires public policies designed to boost attractiveness for investors and, thus, maximize output growth.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.