Texas economy strongly expands despite supply-chain disruptions, hiring challenges

Economic activity continued to expand at a robust pace in July, though growth was constrained by continued supply-chain disruptions and hiring difficulties. Texas employment rose at a healthy pace in June, and the unemployment rate inched down.

The labor market remained tight despite the rollback of supplemental federal unemployment benefits in late June. There has been strong upward pressure on prices and wages, though there were some signs of easing in July. The hot housing market continued to push up apartment rents, housing prices and construction.

Economic activity expands at strong pace

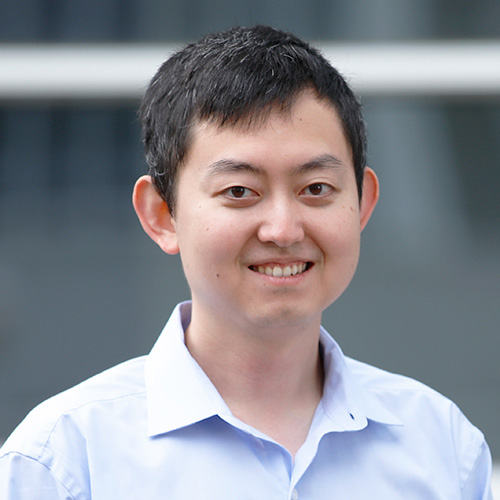

The Texas Business Outlook Surveys (TBOS) for July point to strong output expansion. The manufacturing sector exhibited solid growth, with the production index increasing from 29.4 in June to 31.0 in July (Chart 1). The TBOS diffusion indexes measure the difference between the percentage of firms reporting increases and those reporting decreases, so large positive numbers are indicative of rising activity levels.

Growth in the service sector picked up as well; the revenue index climbed from 16.7 to 21.7 in July. Retail activity also improved but remained weak, with the sales index coming in at near zero in July. Retail businesses, such as auto dealerships, face challenges making sales because they have low inventories and disrupted supply chains.

Supply and labor constraints abound

Economic growth is stymied by supply-chain disruptions and hiring difficulties. On the labor front, there are too few job applicants and a high quit rate. Even as businesses raise wages and the expanded federal unemployment benefits expired in Texas in June, TBOS respondents cited the lack of applicants and material shortages as obstacles to growing business operations in July. However, respondents expect the disruption to the supply chain to moderate significantly over the next six months.

Price and wage pressures were near record levels in July, and expected price increases for the year were up markedly from the December 2020 survey. In July, businesses expected input price growth for 2021 of 6.7 percent, up from 3.7 percent in December 2020; they expected wage growth of 5.1 percent, up from 4.3 in December, and selling price growth of 5.3 percent, up from 3.4 percent. Survey respondents anticipate that price and wage growth will slow in 2022 from the breakneck pace of 2021, although the rate of increase will remain above average.

Texas employment continues to grow

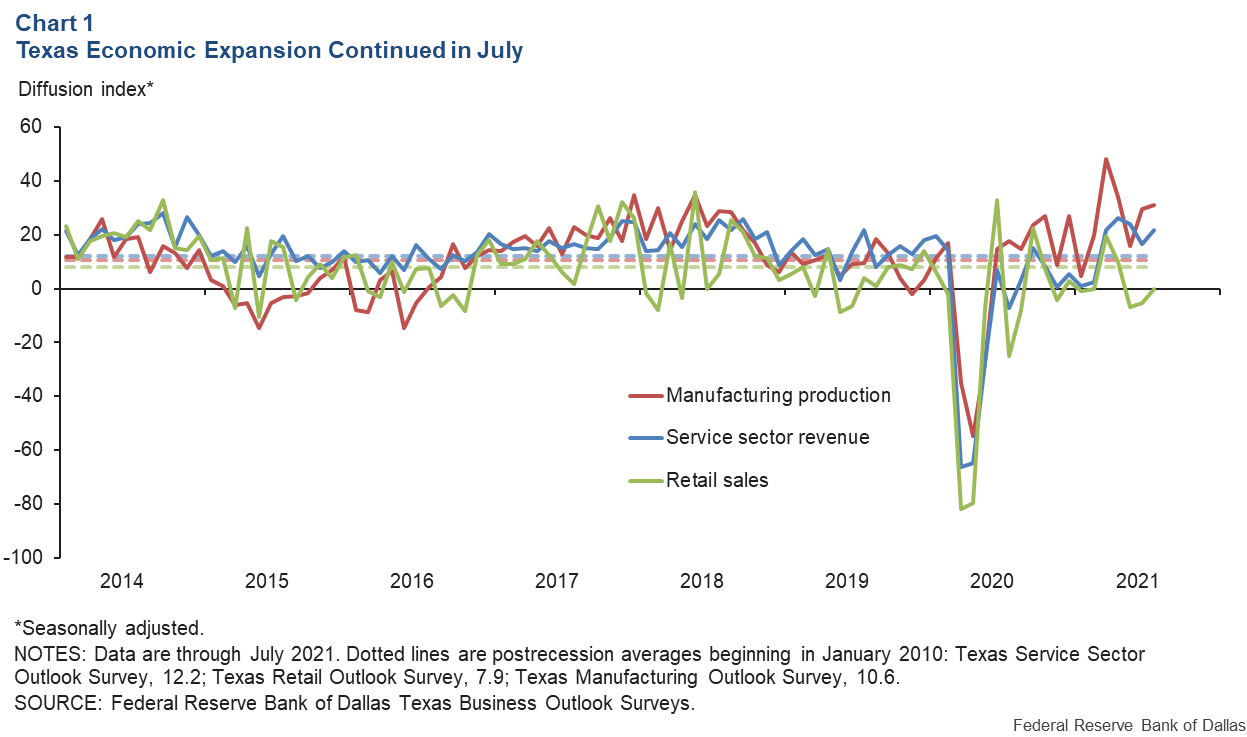

Texas employment grew an annualized 4.3 percent month over month in June, similar to the 4.4 percent growth posted in May. In the first half of the year, Texas payrolls expanded an annualized 4.4 percent—a pace that slightly trailed national job growth of 4.6 percent. The Dallas Fed’s 2021 Texas employment forecast is 5.6 percent for the year (December/December). If statewide payrolls grow as predicted, Texas employment will reach prepandemic (February 2020) levels by year-end (Chart 2).

Texas unemployment edges down in June

The Texas unemployment rate fell by 0.1 percentage points to 6.5 percent in June, its lowest level since March 2020. Despite this decline, the statewide measure remains higher than the national rate, which was 5.9 percent in June.

Even though the unemployment rate is higher in Texas than in the U.S., other indicators suggest there is not much labor market slack. For example, the June employment-to-population ratio of 59.7 in Texas was on par with the nation’s 59.0 percent. The Texas unemployment rate in recent months has been higher than the nation in part because the Texas labor force participation rate is higher than the nation’s.

The employment situation has improved for minority groups in Texas in recent months. While the unemployment rates for Hispanic and non-Hispanic Black Texans remain higher than those of non-Hispanic whites, they have declined far more rapidly. In addition, the employment-to-population ratio for non-Hispanic Blacks in Texas has surged since April and surpassed that of both Hispanics and non-Hispanic whites as of June. The employment-to-population ratio for Hispanics is similar to that of non-Hispanic whites in Texas. It bears noting that the estimates for Texas may be slightly less reliable than the national estimates due to a smaller household survey sample size.

Texas housing market heats up further

The housing market in Texas continues to be hot. With the continued in-migration of residents from other states and the surging demand for homes, home-price growth in Texas has largely been on par with national home-price growth since the beginning of last year.

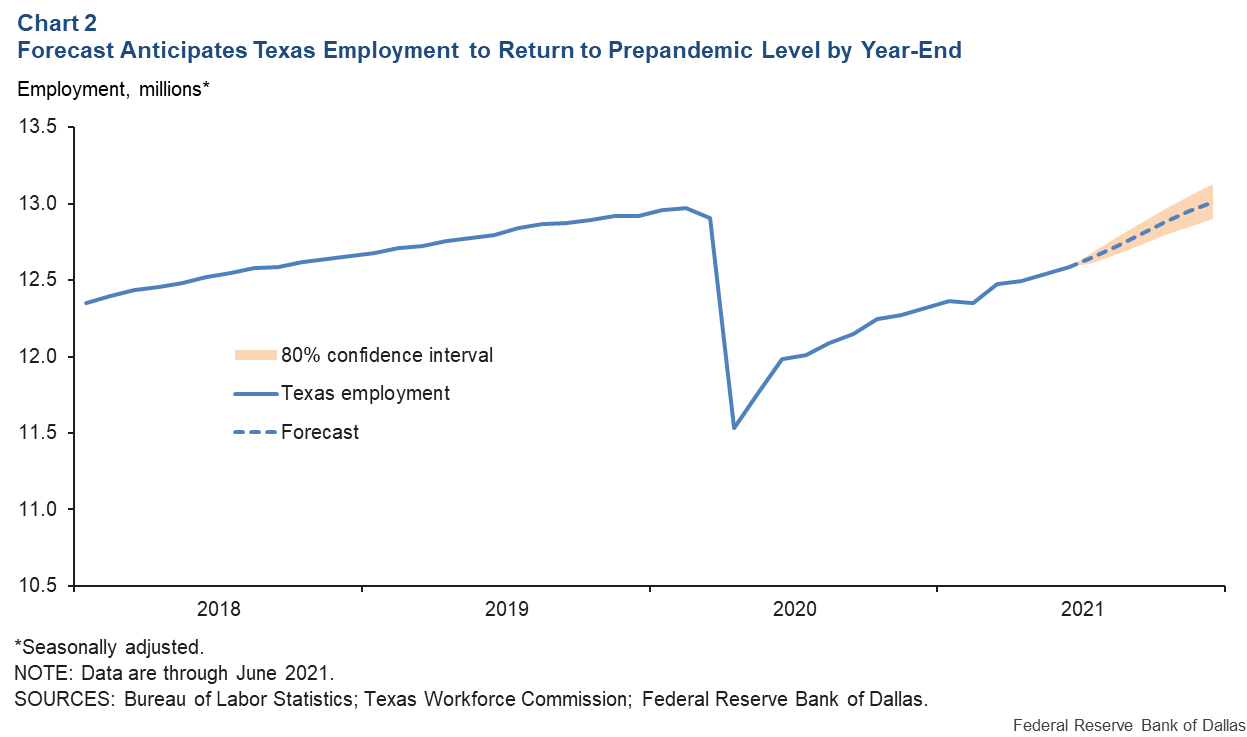

Multifamily markets are also heating up. Texas apartment rents surged in second quarter 2021 after declining throughout the pandemic until early this year. Consistent with rising rents, apartment occupancy rates also increased markedly across Texas metros in the second quarter (Chart 3).

Office occupancy in Texas major metros declined in second quarter 2021 for the sixth quarter in a row. The drop was sharpest in Austin, where a large portion of workers are able to work from home. With the high demand from many white-collar workers to work remotely and the recent increase in COVID cases due to the spread of the Delta variant, the timeline for businesses bringing their workforce back into the office is unclear.

Economic outlook broadly optimistic

The increase in new COVID-19 cases and the spread of the Delta variant pose downside risks to the Texas growth outlook. The Texas vaccination rate lags behind the nation with only 55 percent of Texans age 18 or older fully vaccinated as of July 27, compared with 60 percent nationwide. Notwithstanding the elevated COVID-19 risks and continued challenges in the supply chain and labor market, Texas business respondents remained positive in July. Company outlooks remained far above average, reflecting broad optimism and high growth expectations for the fall.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.