Fed’s mortgage-backed securities purchases sought calm, accommodation during pandemic

The Federal Reserve quickly responded to significant financial market disruption at the onset of the COVID-19 pandemic in March 2020, providing stability in a variety of ways. This included large-scale purchases of U.S. Treasuries and agency mortgage-backed securities (MBS).

While market functioning improved in the subsequent months, the central bank has continued purchasing these assets to maintain smooth functioning as well as to help foster accommodative financial conditions. We explore the Federal Reserve’s purchases of agency MBS—mortgage bonds guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac—and related market dynamics during the pandemic, including why mortgage rates fell to historic lows.

Agency MBS and mortgage prepayment

The market for agency MBS is among the largest fixed-income markets in the world ($7.6 trillion) and acts as the benchmark for pricing fixed-rate home mortgages eligible for agency guarantees.

These securities distribute monthly principal and interest payments due on underlying mortgages to investors. While agency MBS investors are shielded from credit risk by government guarantees, they do face prepayment risk.

Homeowners with fixed-rate mortgages make principal and interest payments each month based on a predetermined amortization schedule. However, the borrower has the option to pay down additional mortgage principal at any time. (This usually occurs when the borrower refinances the loan or sells the home.) The initial value of this prepayment option is reflected in the borrowers’ mortgage interest rate and is passed through to the agency MBS investor.

Large declines in mortgage rates can result in a sizeable swath of fixed-rate mortgage borrowers with refinancing options “in-the-money.” When this happens, there is an expectation of a rapid decline in existing higher coupon-rate agency MBS balances due to prepayments and a corresponding increase in the issuance of new securities with lower coupon rates.

Evolution of Federal Reserve policy and purchases

As the pandemic’s economic impact unfolded, the Federal Open Market Committee (FOMC) announced on March 15, 2020, it would increase agency MBS holdings by at least $200 billion, plus reinvest all principal payments received. This directive was amended a week later to uncap purchases.

The FOMC modified its approach at its June 2020 meeting, increasing agency MBS holdings to around $40 billion per month plus reinvestments, a policy that remains in place. (More information on FOMC directives during 2020 is summarized in the Federal Reserve Bank of New York’s Annual Report on Open Market Operations.) From March 2020 through June 2021, the Federal Reserve increased its agency MBS holdings from $1.4 trillion to $2.3 trillion.

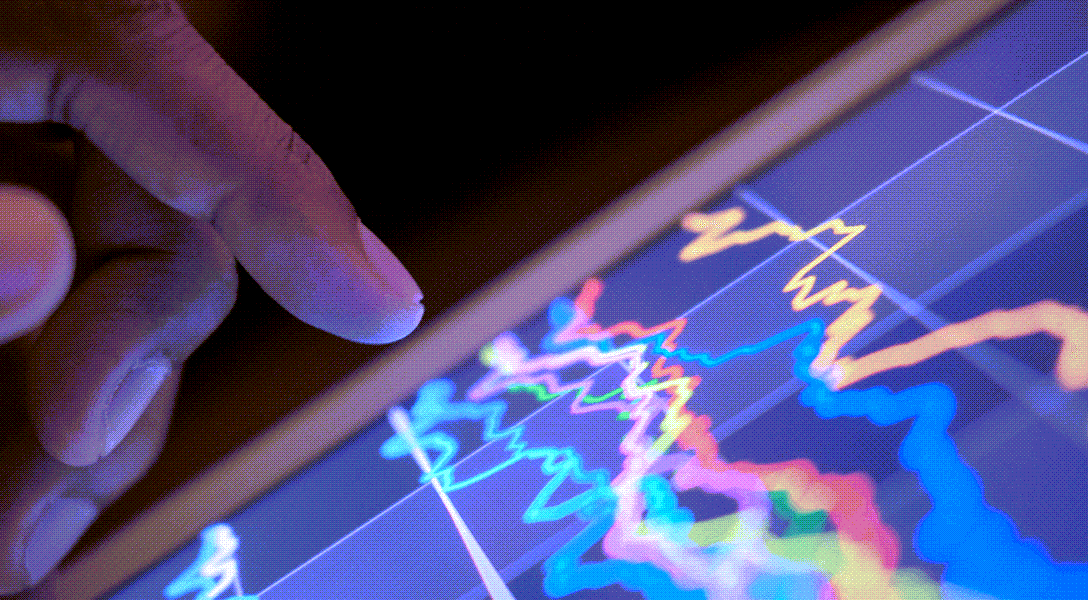

Chart 1 presents the Federal Reserve’s monthly gross purchases of agency MBS over the past decade and the MBS current coupon spread, or the yield consistent with a par value security, less the average of the five-year and 10-year Treasury yields.

The central bank purchased a total $580 billion in agency MBS during the two-month period of March–April 2020, and since has averaged about $114 billion per month including reinvestment of principal payments. During this time, the current coupon spread has steadily narrowed to its tightest levels in almost a decade (62 basis points, or 0.62 percentage points, in May 2021). Primary mortgage rates have similarly fallen during this time, according to Freddie Mac survey data.

Chart 1 also includes a metric known as the current coupon option-adjusted spread (OAS), which includes the likelihood of homeowners prepaying mortgages due to changes in interest rates. The OAS is a derived risk premium that equates model-based agency MBS values (using simulations of future interest rate paths) to prices observed in the market. By accounting for interest rate variability, OAS reflects the residual compensation earned by agency MBS holders arising from noninterest-rate factors, such as the characteristics of the underlying mortgages.

While OAS is typically positive, the measure shown here—produced by Bloomberg for a hypothetical MBS priced at par—has declined steadily since March 2020 and turned negative for the first time since 2013, the only other time in the series history that this has occurred.

Taken together, the data in Chart 1 suggest that the Federal Reserve’s recent large-scale purchases of agency MBS have contributed to historically tight spreads in the secondary market.

Federal Reserve purchases agency MBS in forward market

The Federal Reserve purchases agency MBS in the to-be-announced (TBA) market, a large and liquid forward market with contracts that settle once per month based on a calendar set by the Securities Industry and Financial Market Association. The central bank typically targets its purchases on the most widely traded coupons for settlement in the following month. This is done through prescheduled auctions conducted throughout the month.

Given the forward-settling nature of the market, the volume of TBA contracts sold for a particular settlement month may not match supply available for delivery when the settlement date arrives.

To manage this mismatch and to avoid delivery failures, market participants engage in “dollar roll” transactions. A dollar roll involves the simultaneous sale (purchase) of a TBA contract for one settlement month and purchase (sale) of a TBA contract for an adjacent month. In this way, a dollar roll allows market participants to delay (bring forward) settlement of TBA contracts. The cost of this trade is reflected by the price difference between TBA contracts settling in adjacent months.

When the price of the front-month TBA becomes greater than the fair value of holding that security over the next month, it is said to be trading “special.” This may be an indication of an expected collateral shortage for the month's settlement. Dollar roll specialness can subside if the price signal entices market participants to deliver additional collateral into the TBA market for delivery.

Federal Reserve’s dollar roll sales activity

The Federal Reserve conducts dollar rolls to aid settlement of its TBA purchases if there is a notable level of specialness. The timing and volume of these transactions depend on an internal assessment of market conditions and movements in implied financing rates.

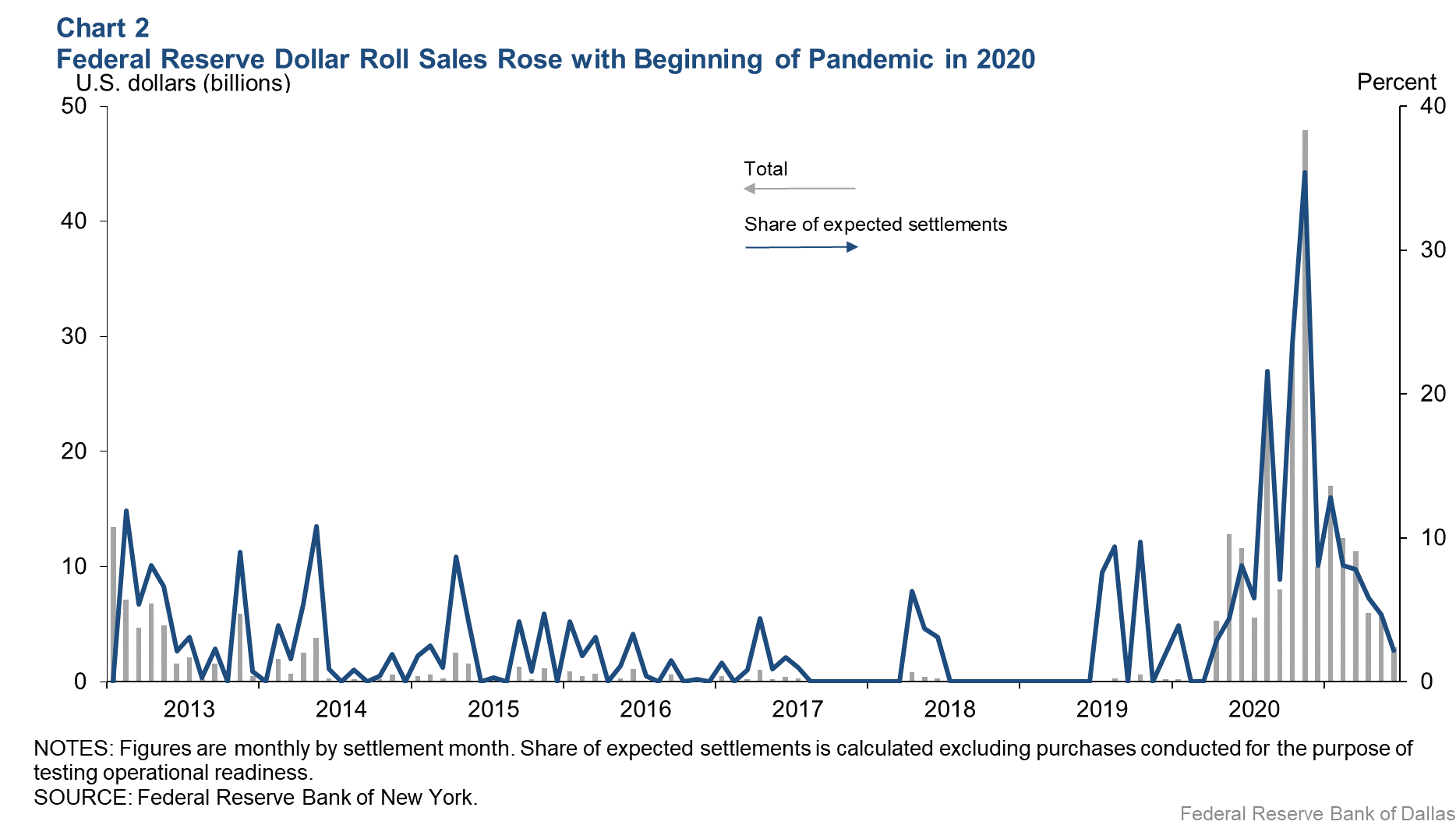

Chart 2 shows the Federal Reserve’s monthly dollar roll sales since the start of 2013 and their share of the month’s expected settlements. Expected settlements are the sum of the regular, planned purchase ($40 billion), principal reinvestments from the prior months’ paydowns and TBA contracts already held for that month’s settlement from previous dollar rolls. The central bank has consistently engaged in dollar roll transactions since April 2020, reaching a peak of $48 billion in November 2020.

The Chart 2 data beg the question of why the Federal Reserve conducted so many dollar roll sales. There are a few explanations.

First, the FOMC’s directive for monthly agency MBS purchases resulted in the central bank acquiring almost 40 percent of newly issued securities since May 2020. Moreover, the Federal Reserve’s TBA purchases were for settlement in the near month, although mortgage originators were often selling TBAs into back months. This created a timing mismatch. In response, the central bank purchased near-month TBAs from dealers, which were then often rolled for back-month settlement.

Second, commercial banks represent the only other investor base that increased its agency MBS holdings during 2020 and through first quarter 2021 ($580 billion). But banks tend not to conduct dollar roll transactions to delay settlement, owing to the nature of their business operations and accounting considerations.

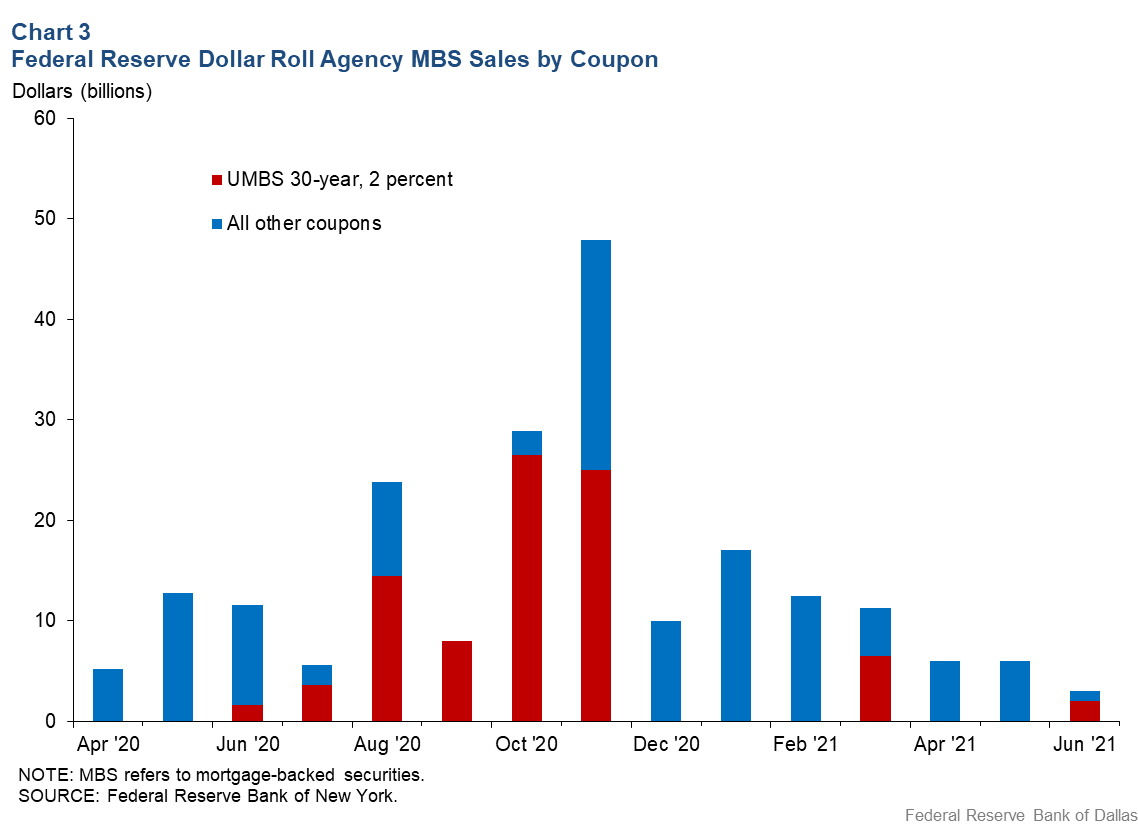

Third, the sharp decline in mortgage rates led to periods of collateral scarcity for lower coupon securities. The Fannie Mae or Freddie Mac Uniform MBS (UMBS) 30-year, 2 percent coupon provides a useful example. During the summer of 2020, mortgage originators sold the majority of TBAs forward into these securities. However, the outstanding stock of UMBS 30-year, 2 percent coupons was modest, thus limiting the ability of existing securities to be delivered for settlement. As the outstanding stock of UMBS 30-year, 2 percent securities increased, the Federal Reserve’s roll activity in the coupon declined commensurately.

Aside from the UMBS 30-year, 2 percent coupon, the Federal Reserve conducted dollar roll sales in eight other securities. This indicates that specialness was more widespread at times, although the rolling of these other coupons was more sporadic. Chart 3 presents the volume of Federal Reserve dollar roll sales for the UMBS 30-year, 2 percent coupon relative to all other TBA contracts.

The Federal Reserve’s large-scale purchases of agency MBS have likely contributed to dollar roll specialness over the course of the current purchase program. The central bank has responded by using dollar roll sales to extend the settlement of some of its TBA purchases into the future.

Tight spreads, low mortgage rates

In response to the pandemic, the Federal Reserve restarted its large-scale purchases of agency MBS and now holds more than $2.3 trillion, representing almost 30 percent of outstanding bonds. These purchases have been associated with historically tight spreads in that market, which have translated into historically low mortgage rates.

Because of periodic supply shortages, the Federal Reserve has smoothed purchases using dollar roll sales that extend settlement into the future and aid market functioning.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.