Mounting signs point to a Texas economic slowdown

There are increasing signs that the Texas economy is slowing. The most recent jobs report showed state employment was flat in August. The unemployment rate rose slightly to 4.1 percent (from 4.0 percent in July), and labor force and wage growth also eased.

Real-time measures of economic activity, from the Dallas Fed’s Texas Business Outlook Surveys (TBOS), point to below-average growth in manufacturing production and service sector revenue and to lessening price pressures.

Labor markets show indications of softening

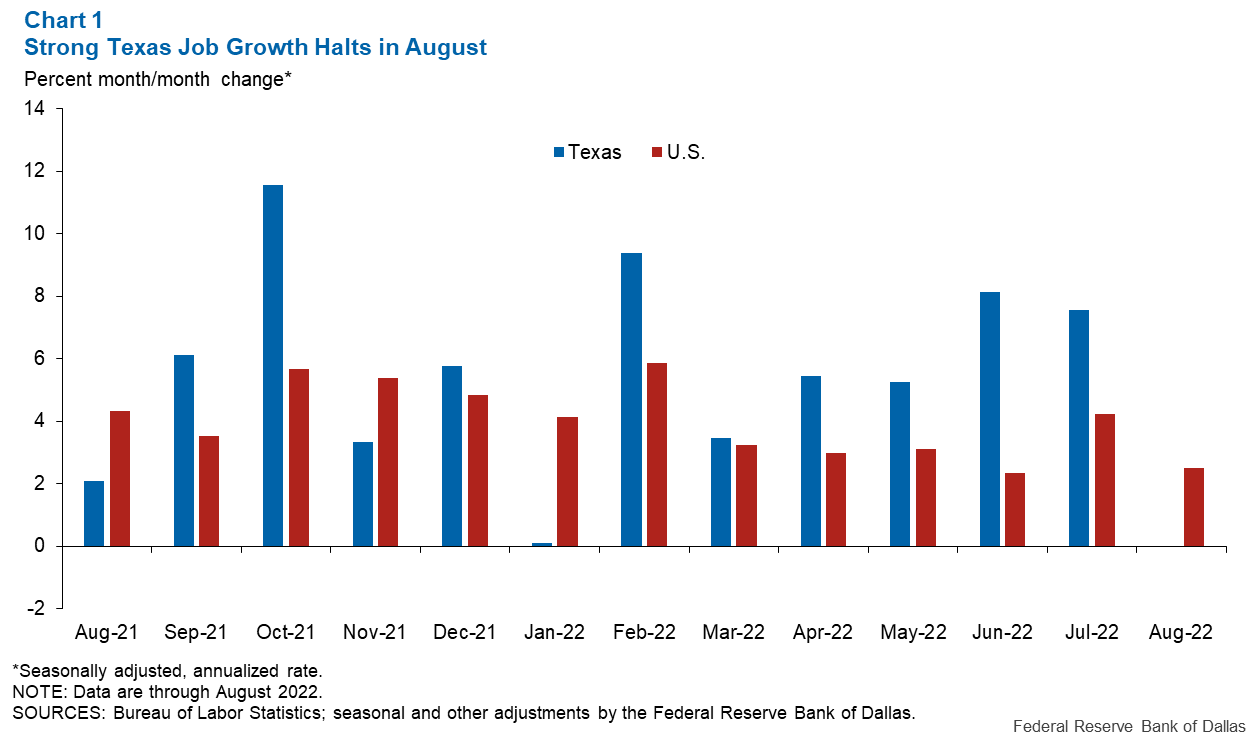

After the number of jobs grew at a torrid 5.6 percent annual rate during the first seven months of 2022, the expansion ground to a halt in August (Chart 1). On a month-over-month basis, job growth dropped from 7.6 percent in July to 0 percent in August.

Notably, the latest results represent a single month and are subject to revision. Nevertheless, other data sources also point to a sharp slowing in late summer. Household survey employment, for example, grew only 0.5 percent. Payroll hourly wage growth slid from 4.4 percent year over year in July to 2.8 percent in August. The labor force increased by just 1 percent on an annualized basis during the period.

Notwithstanding the recent slowing, Texas employment has expanded 4.9 percent this year, significantly faster than the national rate of 3.5 percent.

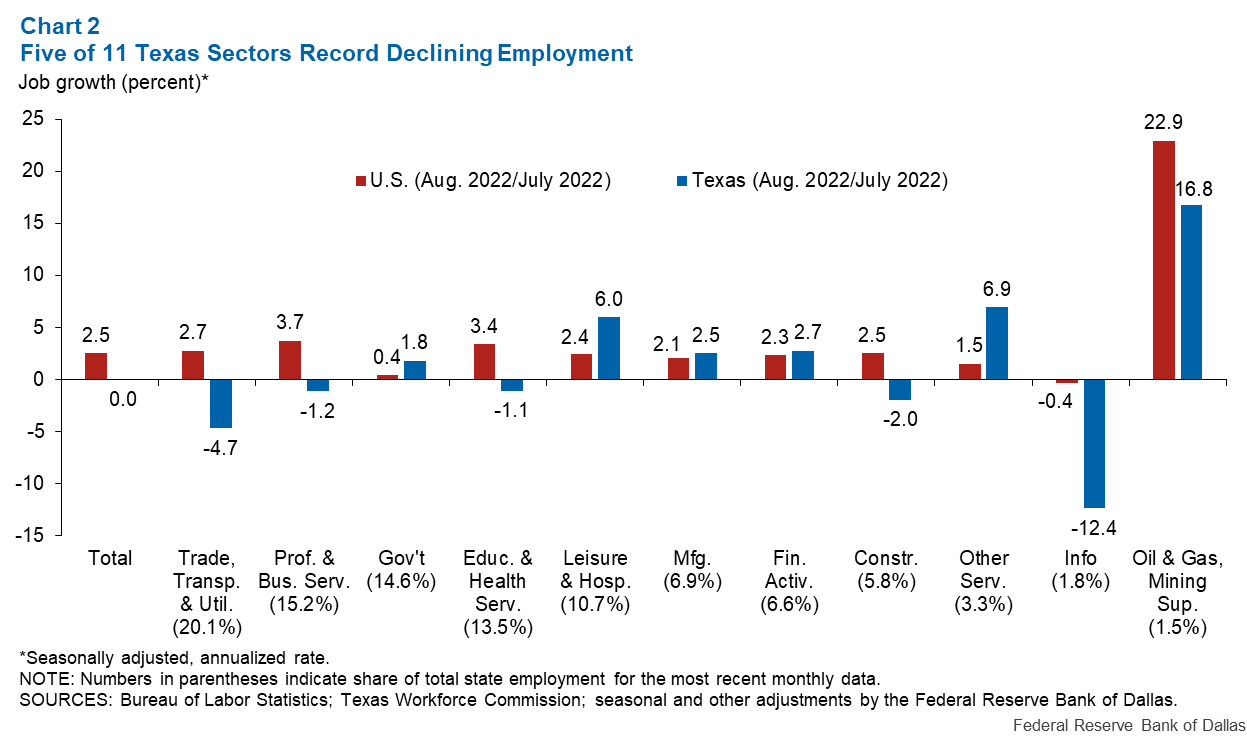

The slowing momentum is visible across a broad range of Texas industries. Trade, transportation and utilities, professional and business services, education and health, construction and information sectors all experienced declining employment month over month in August (Chart 2).

Meanwhile, the oil and gas sector continued to lead Texas job growth, with energy sector jobs rising an annualized 16.8 percent. Leisure and hospitality, manufacturing, financial activities, government and other services also improved.

Following the late-summer hiring pause, labor shortages and difficulty hiring remain primary concerns among Texas firms when asked about their company’s outlook, with a TBOS contact quipping that “the labor pool here is a labor puddle.” High input costs/inflation and weakening demand/potential recession were second and third on the list of survey respondent worries.

Slowing economic activity apparent in past year

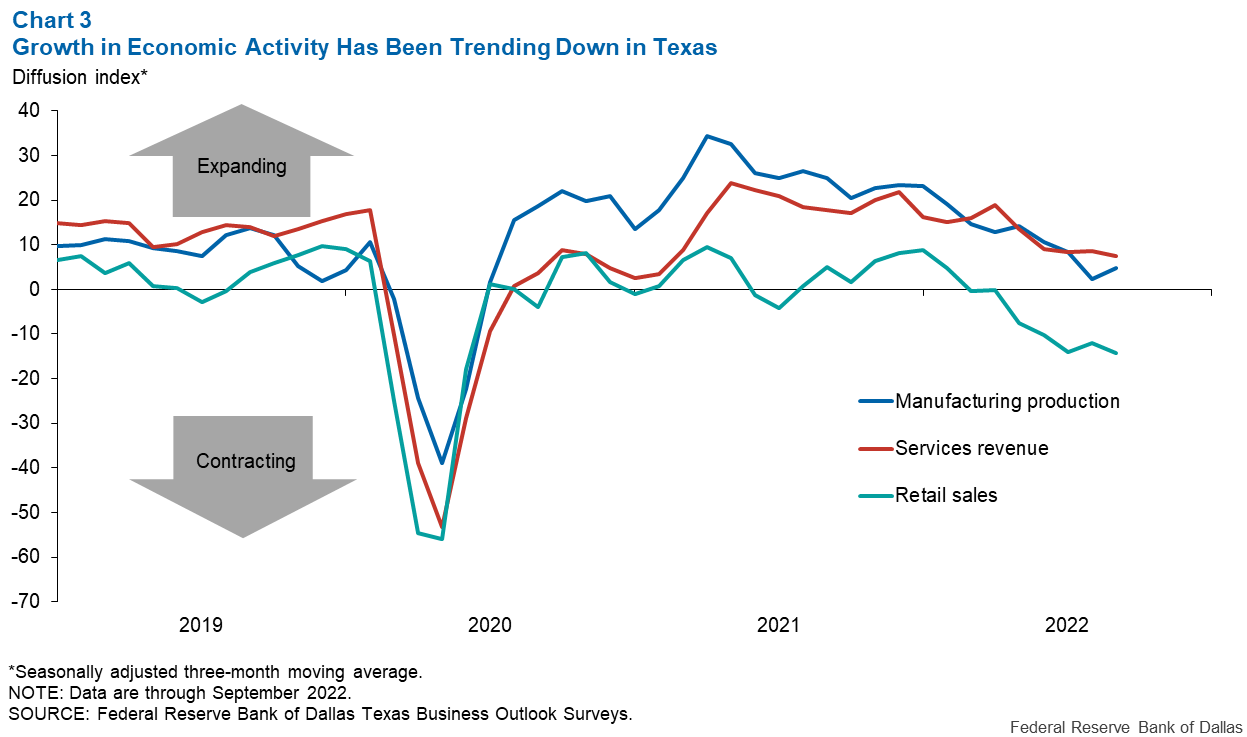

TBOS headline indexes have pointed to slowing growth for more than a year. Smoothed headline indexes show that the growth rate of activity in the state has been declining since spring 2021 when it was unusually high.

Even as growth eased, however, the pace of expansion remained well above the average rate. Slowing was not a reflection of weakening demand as much as a normalization after the pandemic recession. That’s no longer the case in 2022. Growth in service sector revenue slipped beneath its historical average in April, followed by manufacturing production in May (Chart 3).

Official data such as inflation-adjusted state GDP are very lagged, but they also point to dramatically softening economic activity at the beginning of the year. Annualized GDP fell from a 10.1 percent quarter-over-quarter increase in fourth quarter 2021 to a 2.3 percent decline in first quarter 2022.

Supply-chain disruptions apparently lessening

Supply-chain disruptions may finally be easing. In August, 58 percent of TBOS respondents reported experiencing supply-chain disruptions, down from 65 percent in May. The timeline for supply-chain normalization also improved, dropping after rising steadily during the prior year. Respondents experiencing supply-chain disruptions now expect normalization to occur in 9.1 months, down from a peak of 9.6 months in May.

One silver lining of the economic slowdown, as well as easing supply chains, is that manufacturers have been able to work down order backlogs that were prevalent in 2021. Shipments and inventories have risen, and unfilled orders are down.

Price pressures easing from record high

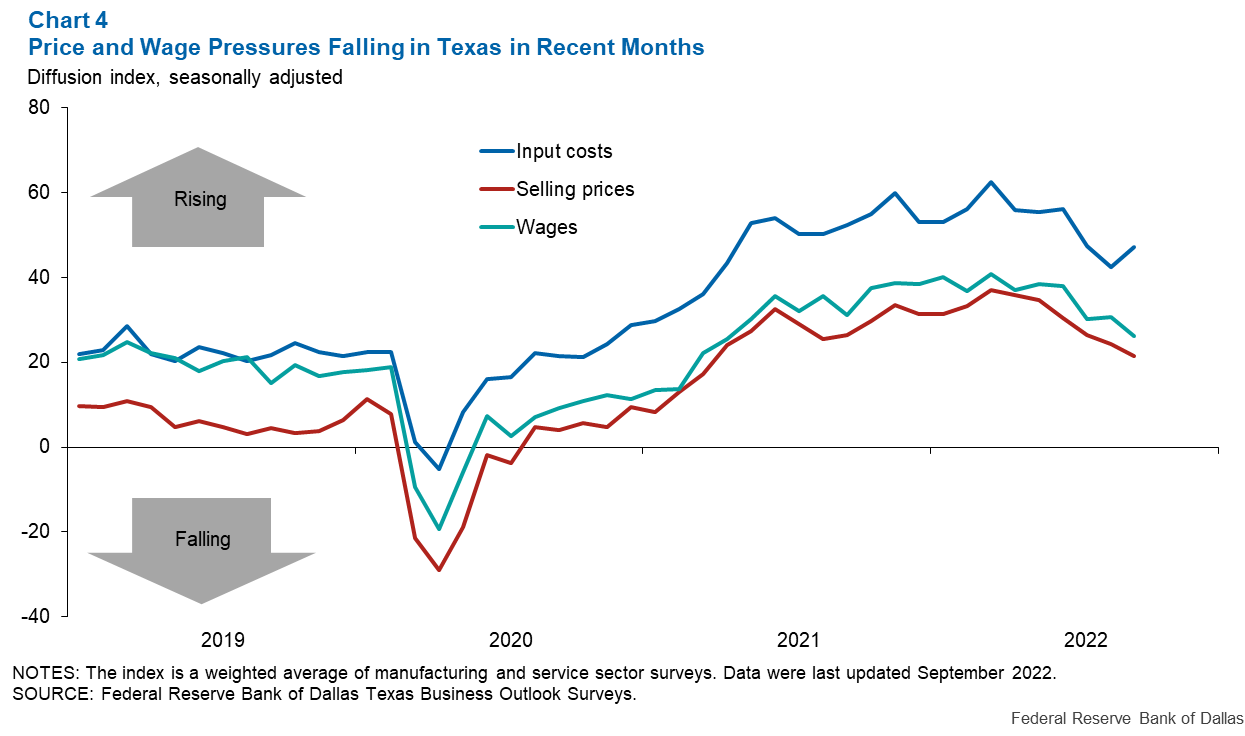

The rate of increase in selling prices, input costs and wages reached a survey high earlier this year but has since fallen, TBOS surveys show (Chart 4). The decline is rapid, suggesting price pressures are approaching where they were more than a year ago.

Most businesses reported no change in selling prices or wages in September, which is not unusual. But the share of firms reporting increasing prices dropped in both the manufacturing and service sector surveys. The share of manufacturing firms reporting a month-over-month increase in selling prices was 24 percent, the lowest it has been since January 2021, and only 28 percent of service sector firms similarly noted raising prices—the lowest since October 2021.

Wage pressures also eased, with 38 percent of manufacturing firms and 29 percent of service firms boosting wages, the lowest shares since March and April 2021, respectively.

Survey respondents were mixed on how much of the price and cost increases they passed on to customers. In August, 26 percent of firms reported passing on most or all costs, while another 26 percent reported passing none along. Firms were apparently absorbing fewer cost increases than in May 2022 but more than in December 2021 when respondents reported the greatest pass-through since the pandemic began.

Employment forecast still points to above-trend growth

Despite weakness in recent jobs data, the Dallas Fed still forecasts job growth to exceed 4 percent in Texas this year. Year to date, job growth is 4.9 percent. To meet the forecast, the remaining months of 2022 should average about 3 percent job growth. Though slightly lower than the August projection, that would still exceed Texas’ historical average of about 2 percent growth.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.