Wage growth still exceeds 3 percent despite slowing in business survey measures

Fed policymakers working to reduce inflation have closely monitored how fast wages have risen.

The rate of wage growth exceeded 5 percent in 2022 amid a rapid recovery from the COVID-19 pandemic and extremely tight labor market conditions. Wage growth seems to be cooling this year but remains well above the 3 percent pace of 2019. If trend productivity growth is still around 1 percent, wage growth will eventually need to slow to around 3 percent to be consistent with 2 percent inflation in the long run.

National estimates put recent 12-month wage inflation at around 4–5 percent, though these measures can lag other indicators of labor market conditions. More timely wage data can be found from the five regional Federal Reserve Banks that conduct business surveys.

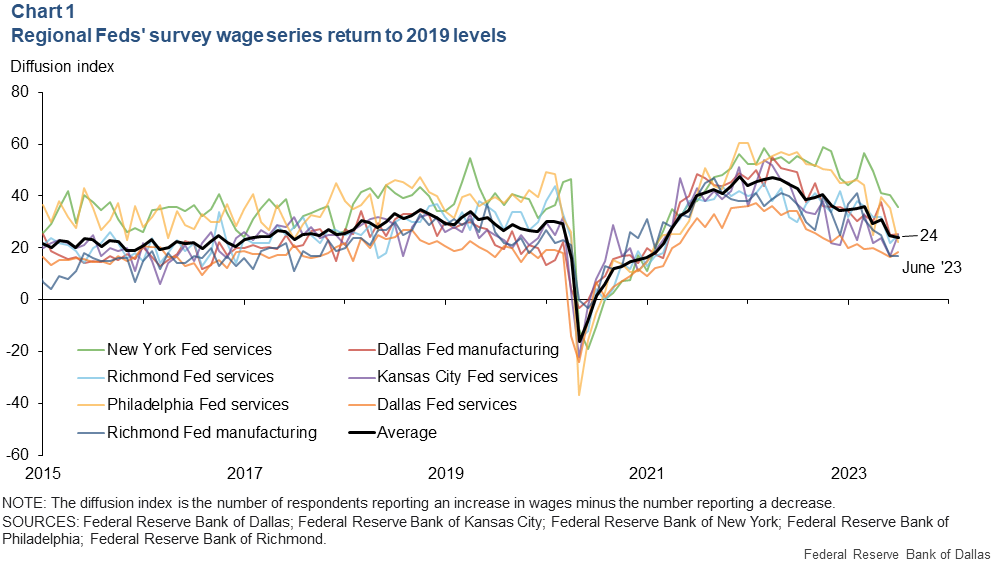

These surveys ask executives whether their firm’s wages increased, decreased or remained unchanged over the prior month. Diffusion indexes (the share reporting an increase minus the share reporting a decrease) constructed from this question have returned to 2019 values (Chart 1)

However, as promising as this development appears, it does not indicate that wage growth has slowed to near 3 percent. Diffusion indexes don’t explicitly measure the magnitude of a change, just the net share of firms raising wages. Firms reported that they expect to raise wages at a pace markedly greater than 3 percent over the rest of the year.

Diffusion indexes provide different insight than growth rates

Diffusion indexes from regional Fed surveys provide timely and reliable insights into economic conditions and help fill gaps in regional data. But the indexes may not always have a stable relationship with corresponding growth rates, particularly during unusual circumstances.

The immediate recovery from the onset of the pandemic in 2020 is one example—historically rapid employment growth was accompanied by survey employment diffusion indexes only modestly higher than 2019 values. The similarity of the current wage growth environment relative to the prepandemic pace is another instance where caution is needed when interpreting diffusion indexes. The diffusion indexes don’t provide a full view needed to accurately infer wage growth rates.

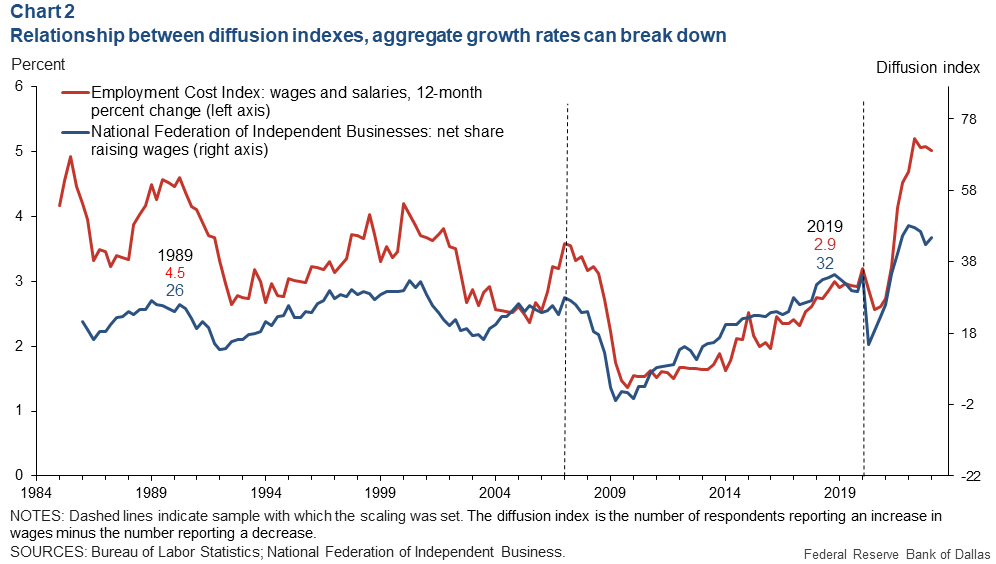

The National Federation of Independent Business survey offers a good example of why caution is needed when considering the implications of a given diffusion index reading. The federation’s survey goes back to the mid-1980s and demonstrates the unstable relationship between its wage diffusion index and a measure of actual wage growth, the Employment Cost Index (ECI) (Chart 2).

The two scales—the left and right vertical axes—are set so that the series line up over the previous business cycle, 2007–19, when they closely tracked one another.

However, outside of this period, the relationship breaks down. In 1989 and again in 2019, on net about 30 percent of small businesses reported raising wages, despite ECI wage growth of 4.5 percent in 1989 and 2.9 percent in 2019. While near-equal shares of businesses were raising wages in both periods, the magnitude of pay raises was clearly different.

Although a higher diffusion index generally corresponds with a greater rate of change—because the surveys don’t explicitly measure the magnitude of change—a given diffusion index reading can be consistent with multiple growth rates.

Direct measures of firms’ wage growth rates

Rather than trying to infer a wage growth rate from a diffusion index, it’s better to directly ask businesses how much they raised wages in the past year and what they anticipate in the year ahead.

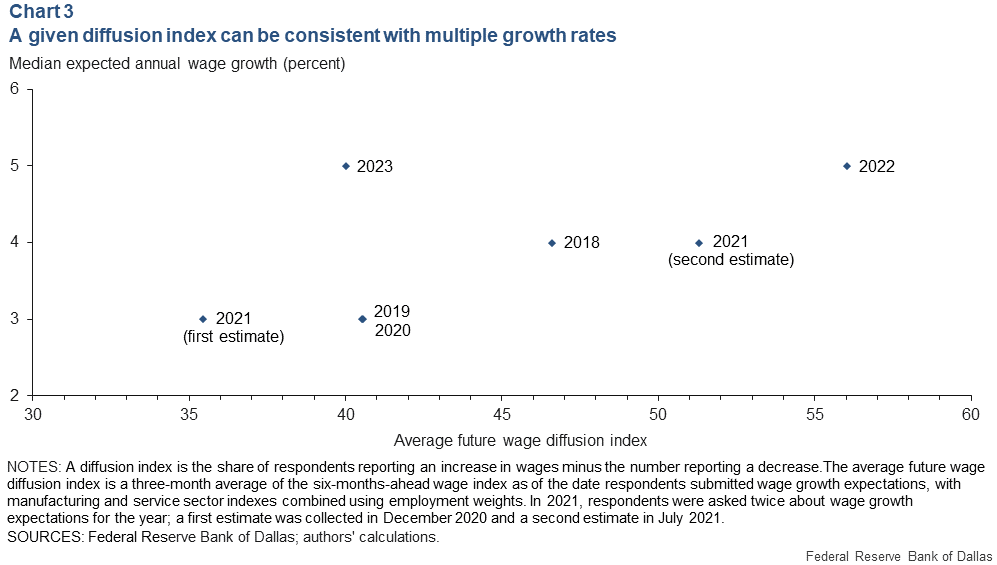

The Dallas Fed’s Texas Business Outlook Surveys’ special questions have done this at least annually since 2018. Chart 3 shows the relationship between the future wage diffusion index on the horizontal axis and the average expected annual wage growth on the vertical axis.

While there is a clear upward sloping relationship, we again see evidence that multiple values of wage growth can be consistent with a given diffusion index. Texas businesses surveyed still expect wage growth exceeding 5 percent this year as of the Dallas Fed’s May 2023 survey, despite the future wage diffusion index returning to 2019 levels.

Expected wage growth still elevated

Other regional Fed surveys that directly ask about expected wage growth provide additional insight (Table 1). The CFO Survey—a poll of nationwide business leaders conducted by the Atlanta and Richmond Federal Reserve Banks in partnership with the Fuqua School of Business at Duke University—indicates average expected wage growth for 2023 of around 5 percent. The Federal Reserve Bank of Philadelphia business outlook surveys ask for expected wage growth over the upcoming 12 months. Responses averaged 4 percent in May, compared with a 3 percent expectation for 2019.

| Table 1: Businesses expect 4–5 percent wage growth in 2023 | ||

| Survey | Latest value (percent) |

2019 value (percent) |

| Dallas Fed | 5.0 | 3.0 |

| CFO | 5.0 | – |

| Philadelphia Fed* | 4.0 | 3.0 |

| *Latest value is 12 months ahead wage growth expectation, while the others are for calendar year 2023. NOTES: Median readings are shown. Latest values are as of May for the Dallas Fed and Philadelphia Fed, and as of second quarter for the CFO Survey. SOURCES: Federal Reserve Bank of Dallas; Federal Reserve Bank of Philadelphia; Federal Reserve Bank of Richmond; authors' calculations. |

||

Like many other indicators of the labor market, regional Fed survey responses about wage growth have pointed to a gradual easing of historically tight labor conditions over the past year.

However, the return of these surveys’ wage diffusion indexes to prepandemic levels doesn’t necessarily imply wage growth will quickly slow to near 3 percent, the level experienced in 2019 and likely consistent in the long run with the Fed’s 2 percent inflation goal.

A broad sampling of firms across several Federal Reserve surveys reported that they expect to raise wages 4–5 percent this year.

About the authors