Texas shows signs of slowing; price pressures ease despite buoyant services

Texas job growth slowed in June, though it still exceeded the U.S. rate. Meanwhile, the state economy continued to expand despite the downshift in employment and weakness in manufacturing.

Businesses reported in recent Texas Business Outlook Survey (TBOS) results that they are concerned about softening demand and higher labor costs. Overall price pressures continued to ease, though price growth for services and the pace of wage increases remained high. Economic expansion in Texas is expected to continue through year-end but likely at a slower pace than in the first half of 2023.

Job growth robust, though slowing

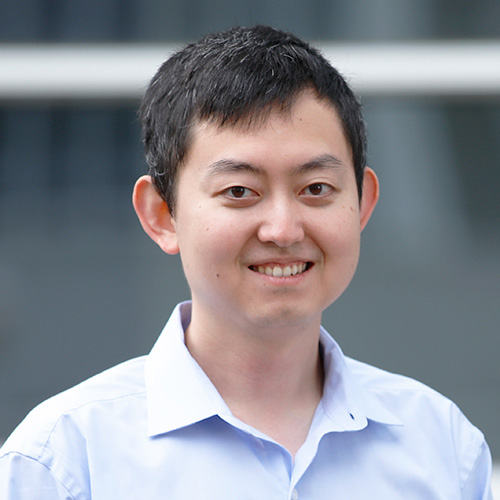

Texas employment grew an annualized 2.1 percent in June, down from May. During the first half of the year, employment rose at an annualized 3.2 percent rate, compared with 2.2 percent for the U.S. (Chart 1). Texas job growth has been robust across sectors outside of leisure and hospitality and manufacturing.

Slowing manufacturing employment is consistent with declining manufacturing activity. Leisure and hospitality softness reflects weakness in the recreation industry (principally amusement parks) and the hotel industry during May and June, which were unusually hot months that may have deterred family outings.

Despite overall healthy job growth, the state unemployment rate remained at 4.1 percent in June, compared with 3.6 percent nationally. Texas’ higher labor market slack is largely attributable to a relatively higher labor force participation rate and faster-growing labor force.

Weakening demand a concern despite services strength

On the strength of the service sector, economic growth in Texas rebounded in July from a slower June, according to TBOS respondents. The service sector revenue index jumped to 12.9 in July from 3.6 in June, indicating that the rate of expansion picked up. Meanwhile, the manufacturing production index fell further into contractionary territory.

While manufacturers grew more pessimistic, the outlook among service sector firms turned positive for the first time since May 2022.

The indexes are calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase, with positive numbers showing growth and negative ones signaling contraction.

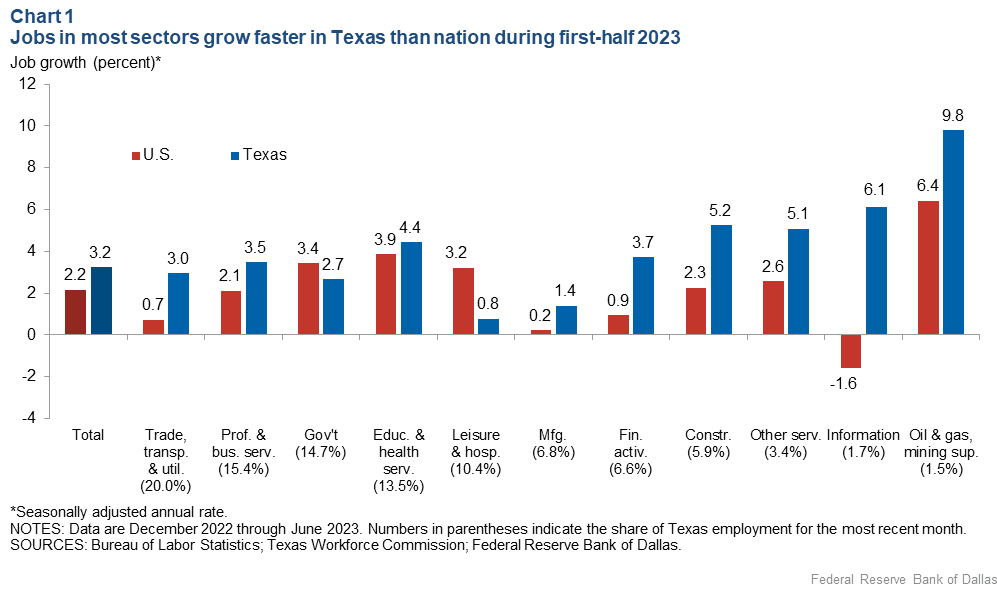

In June, TBOS participants were asked about their top concerns surrounding their business outlooks. Weakening demand/potential recession was cited most, mirroring results three months earlier (Chart 2).

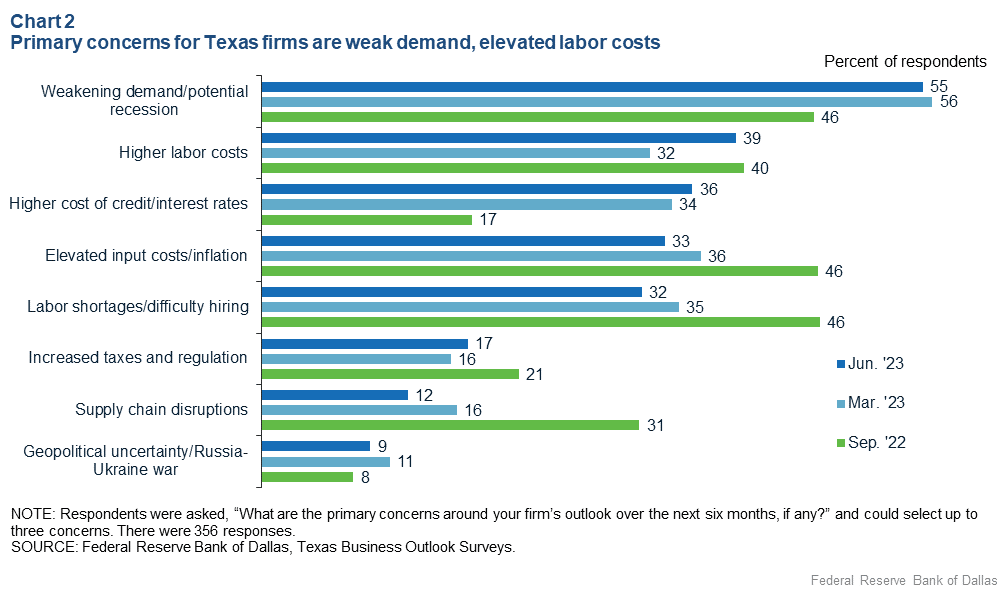

Increasing labor costs were another principal concern, while supply-chain disruptions, inflation and hiring difficulties have retreated since last year. In July, more businesses reported improved job applicant availability than worsening availability (Chart 3).

Nonetheless, more than half of the responding firms in June noted some degree of understaffing. The number of firms reporting that they were overstaffed also increased, but a sizable share of overstaffed firms said they would not lay off workers, indicative of expectations that weakening demand may be short-lived. Special questions posed in July suggest difficulties filling low- and mid-skill positions.

Services prices continue rising; wage growth remains high

Overall price pressures have eased this year, though the cost of raw materials rose from June to July, TBOS respondents indicated. Service sector firms continued to see increases in input and selling prices through July. Wage increases have slowed but remain well above the historical average.

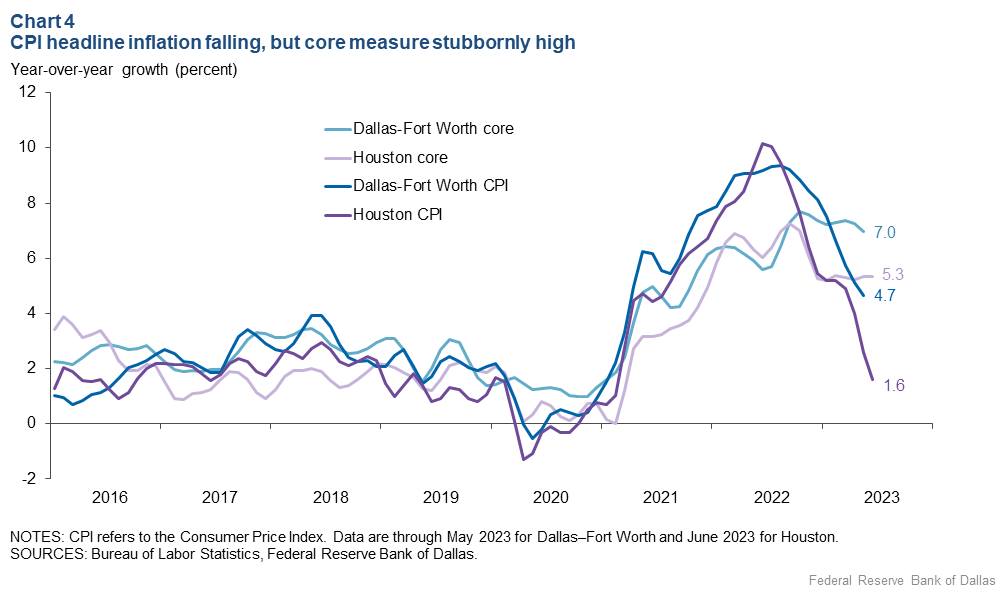

Official inflation data for Texas metros tell a similar story. Although the 12-month Consumer Price Index (CPI) for Houston declined to 1.6 percent in June, core CPI (all items except food and energy) remained at 5.3 percent (Chart 4). Headline and core CPI growth rates in Dallas–Fort Worth exhibited a similar pattern in May.

Steeply declining energy prices account for the gap between overall and core CPI rates in recent months. Relatively high core CPI indicates that, energy prices aside, strong upward price pressures continue in the region.

House prices rebound; inventory levels improve

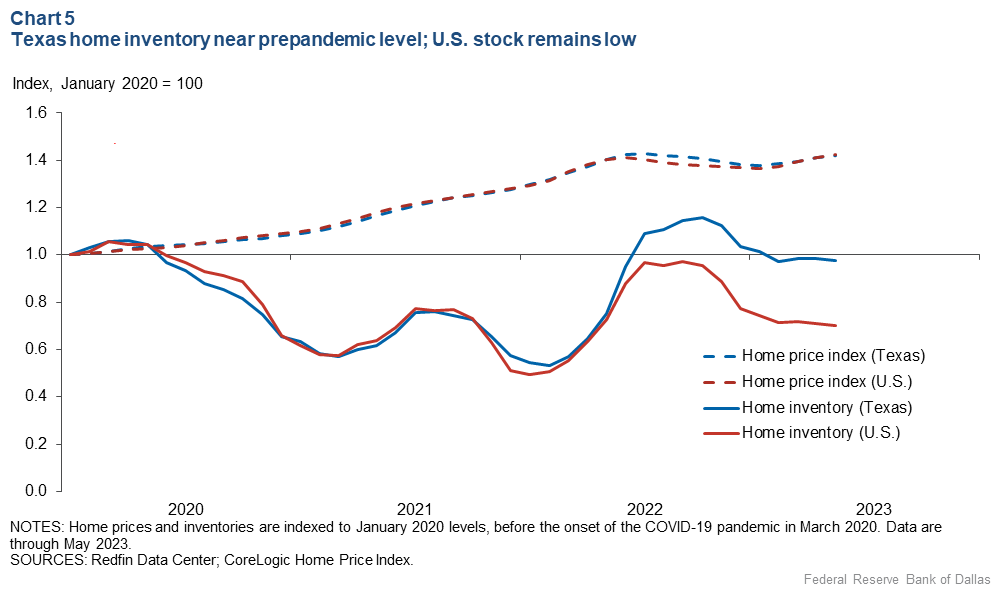

Residential real estate lending has been stabilizing in the region. Additionally, Texas home prices have rebounded since January 2023 after declining in 2022, according to CoreLogic data (Chart 5).

Housing inventories in Texas have grown significantly above the lows of 2021 and 2022—approaching prepandemic levels—which may reduce some of the price pressure. The rise in inventory levels since early last year contrasts with the nation, where inventories remain near historic lows.

Austin has the highest level of inventory, while Houston, San Antonio and Dallas–Fort Worth inventories remain below prepandemic levels.

Apartment rents have increased slowly this year after declining in the second half of 2022. Vacancy rates in Texas and the U.S. have reached prepandemic levels, which may exert downward pressure on future rent growth.

Office vacancies in Texas remain high, with a 25 percent vacancy rate in Houston and a 23 percent rate in Dallas–Fort Worth versus 18 percent nationally.

Texas economy likely to expand further but more slowly

Texas economic growth will likely continue through year-end, although evidence points to slower expansion relative to the first half. That said, the likelihood of a contraction remains low.

Texas employment (December to December) is forecast to rise 2.5 percent this year, down from the 2.8 percent estimate a month ago. The July figure implies moderating job growth—a 1.8 percent annualized rate for the rest of the year.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.