Higher interest rates transform housing market, Texas real estate workforce

The real estate market in Texas has experienced enormous changes in the five years since the pandemic began, including an unprecedented increase in new real estate sales licenses.

The extent of the shift can be evaluated using a unique data set of all licensed salespeople and brokers from the Texas Real Estate Commission in conjunction with a database of statewide home listings and sales from the Multiple Listing Service (via the CoreLogic (Cotality) Matrix platform).

This unique combination allows researchers to follow individual salespeople over time, tracking the changing relationships among salespeople, brokers and the brokerage firms serving as their employers. The data also allow measurement of productivity and the value of the transactions brokers execute quarterly.

Real estate agent labor market provides market indicator

An unprecedented surge in residential sales activity in the wake of the 2020 pandemic—a period of relatively low interest rates and rising house prices—attracted a record number of new real estate agents. The labor market for real estate agents and brokers markedly contracted in late 2022.

Despite subsequent near-record high house prices that would typically induce agents into the market, rapidly rising interest rates and falling sales curbed growth in the Texas agent labor market. These adaptive movements illustrate the economic importance of low barriers to entry and fast-adapting labor supply to meet large changes in demand.

Nationally, 90 percent of homebuyers and sellers use salespeople or brokers in residential sales, notwithstanding the growth of low-cost online platforms and flat-fee Multiple Listing Service arrangements. The National Association of Realtors says agent-assisted sales as a share of purchases have likely increased, based on a survey of transactions between July 2024 and June 2025.

Home ownership represents Americans’ main source of wealth. Home equity accounts for 45 percent of the median American homeowner’s net worth. The real estate labor market is also significant, with about 2 million real estate agents nationwide. Approximately 210,000 licenses were in effect in Texas as of November 2025, corresponding to 1.1 percent of the age 18 to 64 population of approximately 19.3 million.

Real estate gold rush develops

The pandemic and subsequent years represent one of the most dynamic real estate boom-bust cycles in recent Texas history. Demand for housing skyrocketed following federal stimulus payments to taxpayers, high rates of migration to Texas, the proliferation of remote work and falling mortgage interest rates.

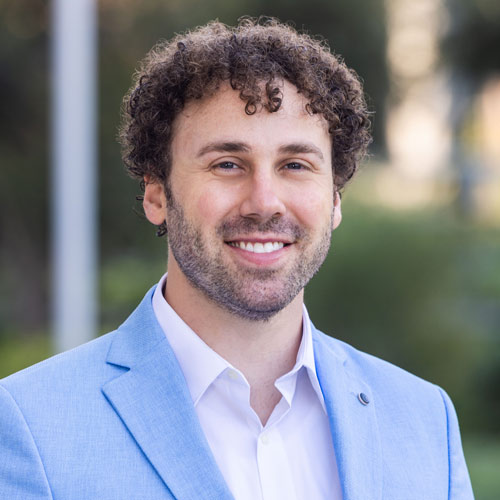

Texas home sales quickly accelerated from approximately 90,000 per quarter at year-end 2019 to 110,000 per quarter (a 22 percent increase) in mid-2020, while home prices increased 40 percent from the beginning of 2020 to 2022 (Chart 1).

Real estate agents facilitated this rapid increase in the speed and price of home buying and selling. There are two types of agents: salespeople and brokers. Becoming a salesperson in Texas is straightforward: Candidates must take classes online or in person and pass two exams. A salesperson must work under the supervision of a licensed broker and cannot facilitate a transaction on a home without a broker sponsor.

A broker can act independently, set up an independent firm or work for another brokerage and manage teams of salespeople.

To become a broker in Texas, a salesperson must hold a sales license for at least four years (up from a two-year requirement in 2012), take 270 to 900 course-hours of education specific to brokers (the exact number depends on whether a candidate has a four-year college degree) and pass another set of licensing exams. An applicant also must have closed at least 12 property transactions (and at least one per year) during their four-year tenure as a salesperson.

Thus, the barriers to entry for brokers are substantial and demand longer-run commitments to the industry than for salespeople in order to enjoy unrestricted market access. The rate at which salespeople upgrade to broker licenses may, therefore, serve as an indicator of salespeople’s medium-run expectations for the industry.

Number of real estate professionals jumps

Salespeople and brokers are most commonly paid a percentage of a home’s sales price as commission (typically 2.5 percent to 3 percent); salespeople and their brokers usually split those commissions. Higher house prices translate into larger commissions, while a higher frequency of transactions holds the prospect of more paydays.

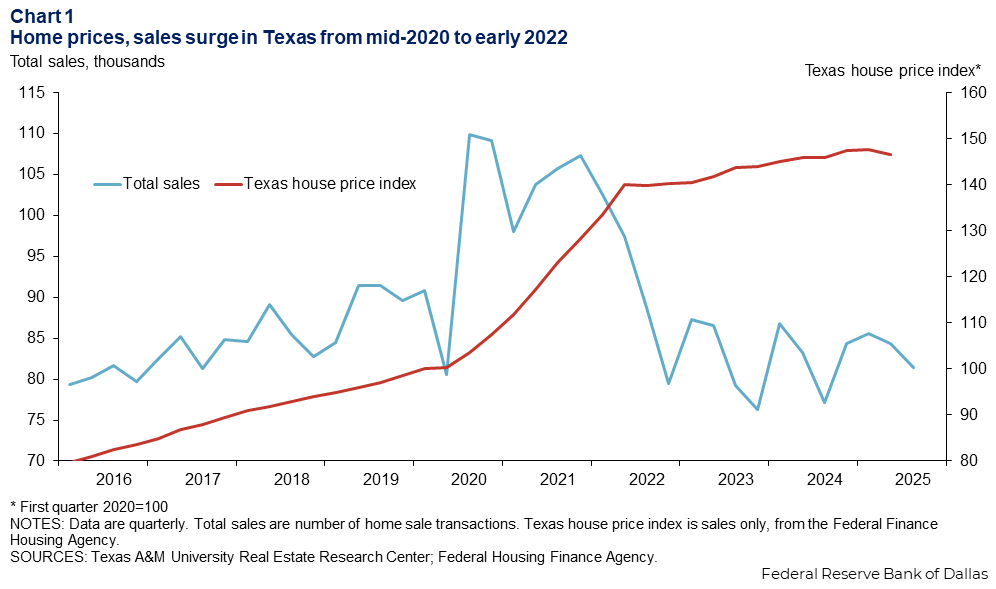

Mortgage interest rates dropped in the second quarter of 2020 below 3 percent, among the lowest mortgage rates in U.S. history (Chart 2). This fueled housing demand. As this demand accelerated, the rate at which newly licensed salespeople entered the market in Texas surged from around 4,000 per quarter in early 2020 to approximately 6,500 per quarter in 2021 through early 2022—a 60 percent increase over just two years.

The prospect of low interest rates, higher home prices and more frequent sales made real estate a promising career or part-time job. Interestingly, the surge in new licenses for salespeople followed the volume of sales closely, while price increases were a lagging indicator.

In other words, new agents entered with the expectation of future increases in sales volume from lower mortgage borrowing costs rather than realized changes in house prices. The increase in total agents in Texas exceeded that of almost every other state , even though, by some metrics, Texas has more stringent training requirements than most states.

Women lead the rise in real estate salespeople

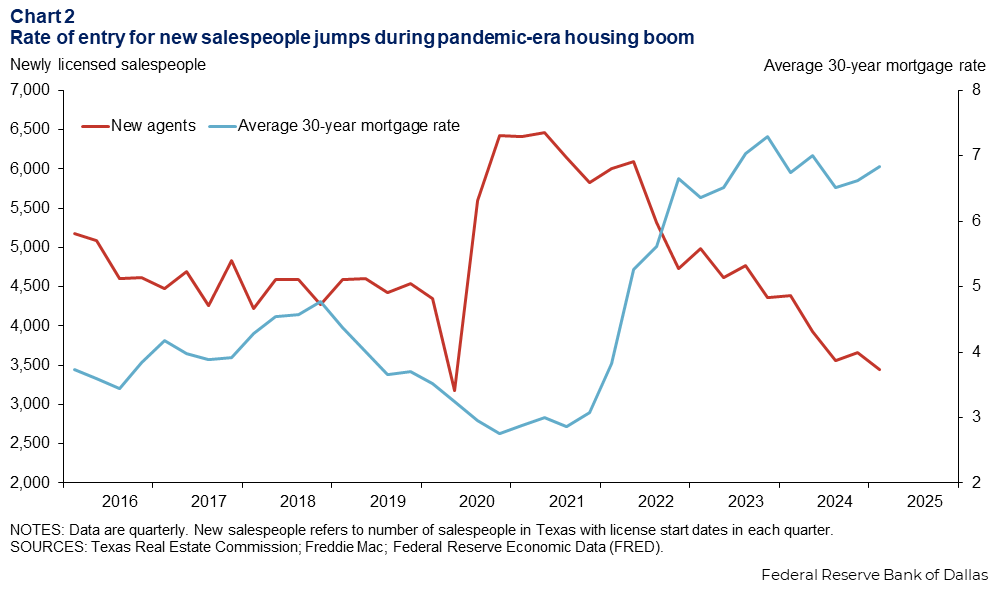

This exponential rise in the rate of new salespeople was driven primarily by women, who were disproportionately hurt by pandemic-era job losses and subsequently interested in part-time or flexible work. Women became licensed salespeople at a rate of 2,500 per quarter in 2019 compared with fewer than 2,000 per quarter for men.

This phenomenon is consistent with economic research showing that women’s labor supply is more elastic than men’s. That is, women, on average, increase their participation and hours in response to wage increases more than men do. Nobel laureate Claudia Goldin has shown that women, on average, greatly value flexibility in the labor market.

When interest rates reversed course in 2022, the sales rush quickly halted. Mortgage rates rose above 7 percent for the first time since 2001. The rate at which new salespeople entered the market fell dramatically, declining 50 percent by year-end 2024 from the 2021–22 peak. Like the boom, the bust in new salespeople entering the market was mostly driven by female licensees.

Importantly, the slump in expected returns for salespeople appears to be behind the decline—not changing barriers to entry. As new salespeople entered the market during the boom, the rate at which the typical licensed salesperson closed sales (as a seller’s or a buyer’s agent) did not dramatically shift, but the value of closed sales increased by approximately one-third.

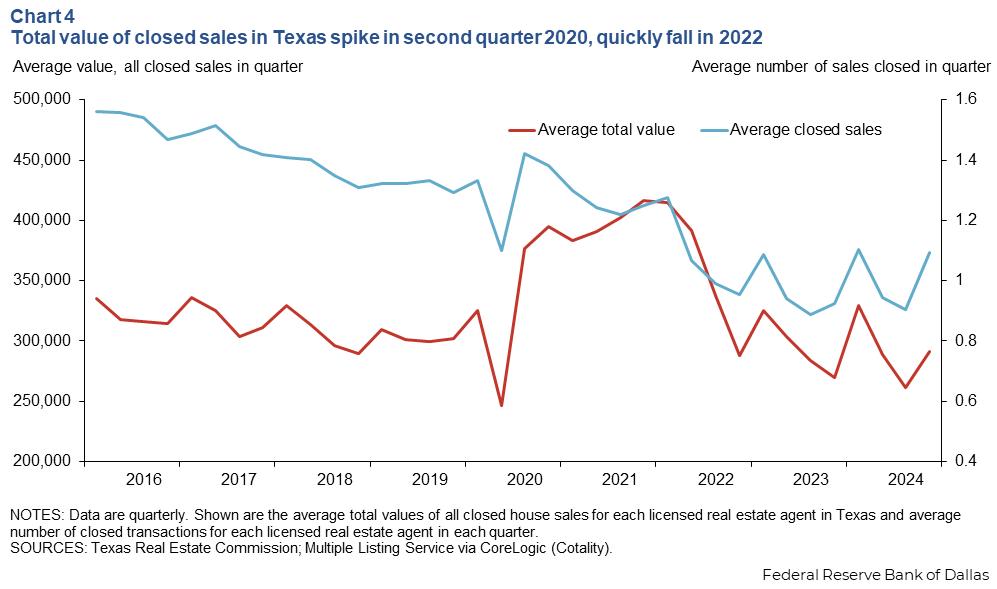

Among those agents who had previously closed sales in their careers, the typical licensee closed approximately 1.3 sales per quarter before the pandemic in 2019. Despite the low interest rates, the speed at which agents subsequently closed transactions did not significantly rise. By year-end 2021, agents closed fewer transactions than at year-end 2019 (Chart 4). New sales agents met much of the demand for new housing transactions; existing salespeople didn’t take on more work.

However, the value of the transactions the average agent oversaw increased from $300,000 per quarter to more than $400,000. Assuming that commissions rose proportionally, the gain implies a 30 percent spike in take-home pay for a similar number of transactions, implying significantly higher hourly earnings.

That pay increase was short lived. As rising interest rates slowed real estate transactions in 2022, the total value of transacted home sales for a typical agent fell to 2019 levels, while the average number of closed transactions declined to approximately one per quarter, the lowest level in at least eight years.

With relatively high inflation during the 2021–22 period—the Consumer Price Index rose approximately 8 percent in 2022—inflation-adjusted earnings for the typical licensed agent have likely declined and not recovered since 2022.

As the labor market for real estate salespeople weakened, so did that for brokers.

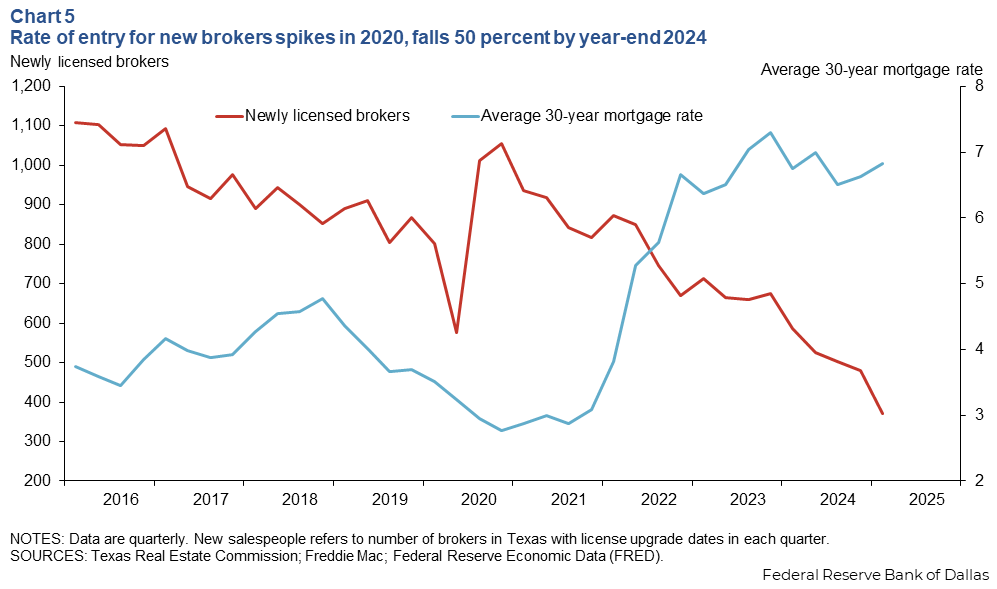

The rate at which salespeople upgraded their licenses to broker status steadily declined from 2016 through 2019 (Chart 5). Along with the surge in newly licensed salespeople, the number of broker license upgrades also jumped in 2021. The upgrade rate stabilized by year-end 2022 at near 2019 levels.

However, as interest rates climbed, the rate of salespeople upgrading to broker fell from its 2022 peak of 800 brokers per quarter to fewer than 400 per quarter at the beginning of 2025. The 50 percent decline signaled that some real estate professionals were leaving the profession.

The movement of brokers is important because upgrading to a broker license represents a more enduring investment of human capital into the real estate industry than remaining a salesperson. Because brokers typically can form small businesses or become employers and managers, significant, sustained declines in new brokers represent consequential changes for the future.

Real estate transactions cannot move forward without brokers. Fewer new salespeople entering the profession means fewer potential brokers. The entry requirements for a new broker are tied to time (at least four years of experience as a salesperson) and performance (at least 12 transactions over four years and one every year for four years). If both the entry rate of salespeople and the performance prospects of salespeople decline significantly today, notable bottlenecks could result if real estate activity suddenly picks up.

Impact uneven across Texas

The surge in home prices did not affect Texas regions equally from 2020 to 2024.

In the postpandemic surge, home price growth was significantly higher and the surge was disproportionately felt in outer suburban counties, especially around Austin, San Antonio and Dallas–Fort Worth.

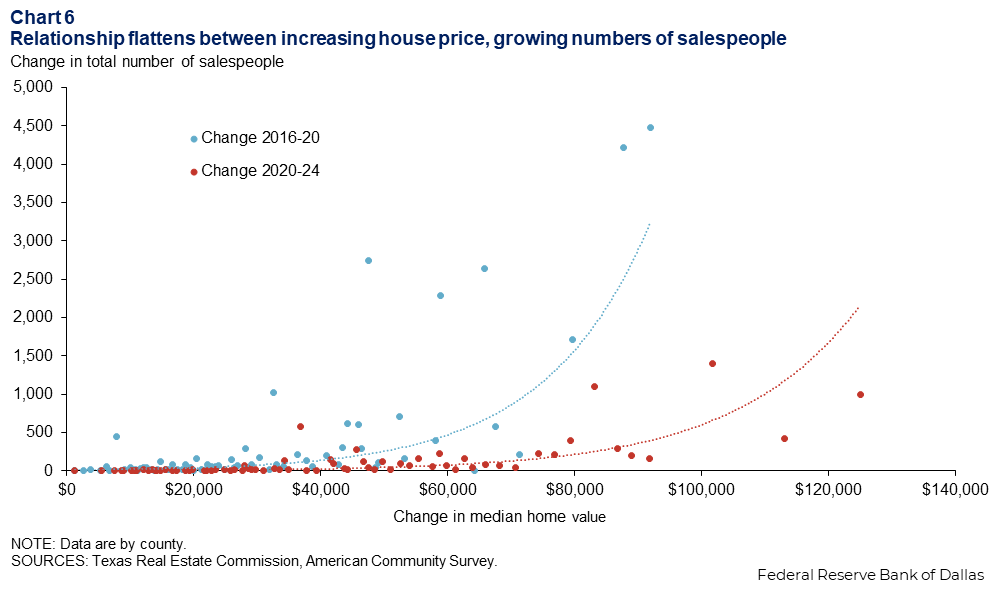

We might similarly expect the stock of real estate agents to rise most in areas that experienced greater house price growth. Strikingly, this was true before the pandemic but not during the pandemic-era real estate boom (Chart 6).

In the prepandemic period, counties with larger home price increases experienced greater salesperson counts. Prospective salespeople followed the money, and rising prices signaled opportunity. By the time median home prices in a county appreciated by approximately $50,000, salesperson counts in those counties had meaningfully increased.

At the common commission rate of 3 percent, a $50,000 increase in median home prices implies an increase in commission payouts of approximately $6,000–$7,500 annually for agents transacting an average rate of 1.0 to 1.2 homes per quarter. Prospective salespeople responded to these incentives.

There was a significant shift after the pandemic. The relationship between price appreciation and agent growth essentially disappeared. Many counties experienced substantial price increases but relatively modest salespeople growth.

This disconnect reveals something important about the nature of the pandemic-era boom. As it unfolded, a rational assessment of overall market conditions—the expectation that low rates would make real estate more appealing—drove an increase in sales personnel.

However, this assessment did not appear to be strongly based on local price conditions. Newly minted agents bet on continued acceleration in the speed of home sales regardless of local prices.

Real estate professionals have cause for concern

These significant changes in the pandemic-era boom and bust suggest that Texas real estate has shifted from a growth phase to a mature one. From 2022 to 2024, the average agent closed fewer transactions than at any point in the past decade, with home prices notably above prepandemic levels.

Thousands of Texans who made career bets on real estate during the pandemic era face uncertain prospects. Some will transition to other industries, but not without some economic pain. Because of the central role of brokers in facilitating transactions and the high barriers to entry, waning broker entry rates may have implications for future industry expectations. Taken together, these trends imply that prospective real estate professionals do not see an imminent upswing in the Texas market.

More competition benefits buyers, sellers

For consumers, intense competition among agents might lead to better service, more aggressive marketing and lower commission rates. These broader developments occur as the real estate sales trade organization, the National Association of Realtors, reached a settlement with class-action plaintiffs who had alleged anticompetitive commission rate setting.

The deal could change commission practices and prices, and it comes at a time of digital innovation and vertical integration of real estate brokerages. Commission rates tend to be negatively correlated with house prices. Recent analyses suggest commission rates were trending lower before the settlement.

Texas has been one of the nation's fastest-growing states, attracting businesses and residents from across the country. The real estate sector both benefitted from and enabled this growth. The changing financial prospects of real estate sales personnel could affect that.

About the authors