Threat of global housing slide looms amid rising rates

Housing froth has reemerged since 2020, with signs of a pandemic housing boom extending beyond the U.S. to other, mostly advanced, economies. While house-price growth has recently begun to moderate—or, in some countries, to decline—the risk of a deep global housing slide persists.

Specifically, the perils detected in the U.S. and German housing markets pose a vulnerability to the global outlook because of the size of those nations’ economies and significant cross-border financial spillovers.

Global housing cycles markedly changed in the 1970s

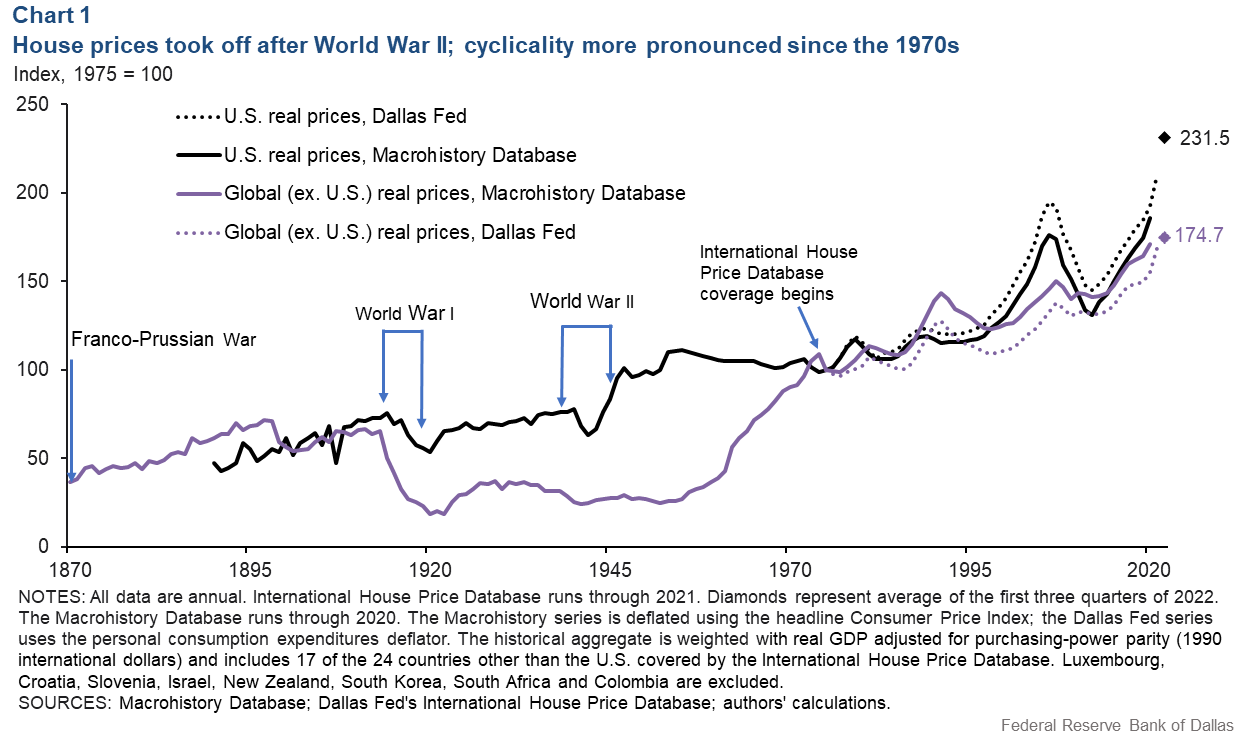

Chart 1 puts in historical perspective the evolution of U.S. and global house prices, adjusted for inflation. The depiction is partly based on data from the Dallas Fed’s International House Price Database, which dates back to 1975. Despite some methodological differences, available historical sources for the U.S. and a subset of 17 of the 24 countries in our sample can be used to construct consistent annual measures of U.S. and global (excluding U.S.) real house prices dating back to the Franco-Prussian War of 1870.

Chart 1 illustrates how, after experiencing a significant depression in real prices following World War I, advanced economies outside of the U.S. bounced back in the late 1950s, rebuilding on the heels of the U.S. post-World War II boom and catching up with the U.S. through the 1960s.

Starting in the 1970s, real house prices displayed a broad upward trend, including in the U.S. The ratio of mortgage credit to GDP—an indicator of financial intermediary participation in housing—similarly grew. Credit-fueled booms tend to be followed by more-severe corrections. Housing cycles also became increasingly longer and larger after the 1970s, with phases of appreciation particularly stark in the late 1980s, 2000s and around the pandemic, beginning in early 2020.

Housing booms give way to affordability crises

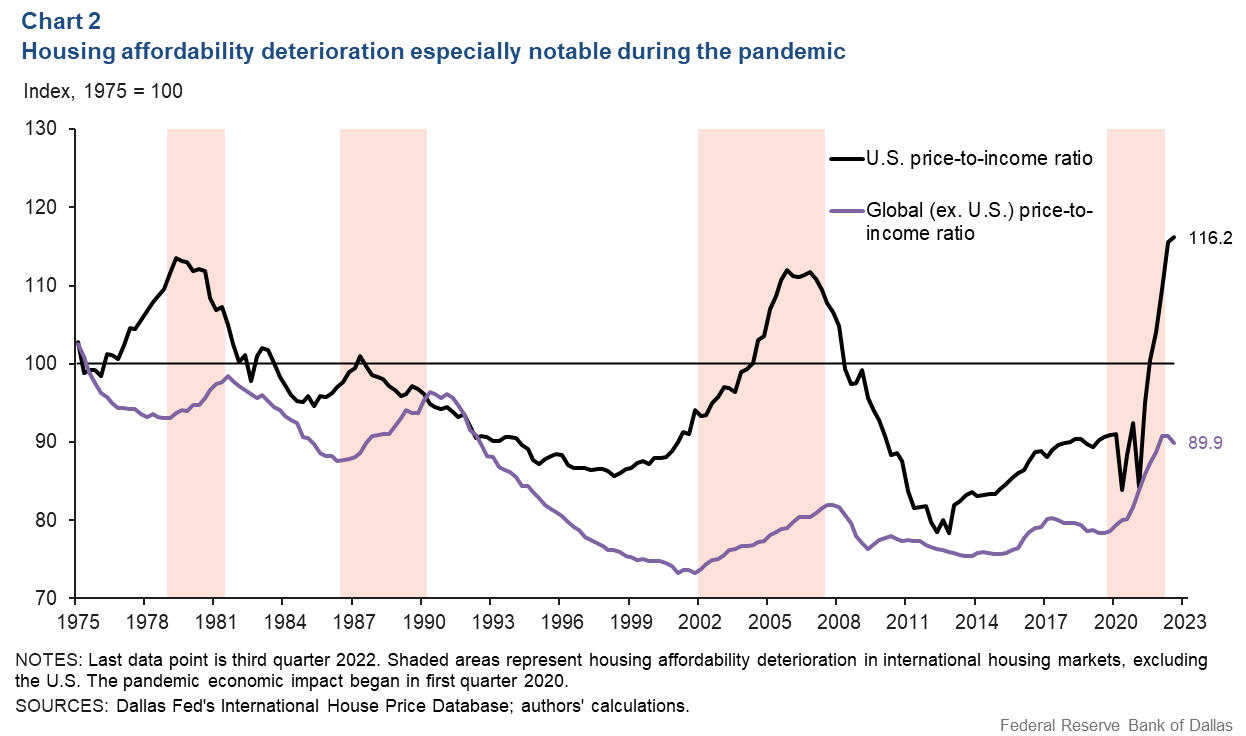

The price-to-income ratio is a conventional measure of consumer housing affordability, with higher readings indicating greater challenges for buyers (Chart 2). Evidence shows that affordability crises often accompany housing booms.

Signs of diminished affordability in the U.S. have usually preceded global deterioration. However, during the pandemic boom, the U.S. and the world largely aligned. The U.S. price-to-income ratio reached a peak not seen since 1975, while the global price-to-income ratio increased at its fastest rate and by its largest amount. Signs of moderation emerged globally in second quarter 2022.

Global housing booms increasingly frothy

Rapidly deteriorating affordability—even as remarkable as during the pandemic—does not necessarily imply bubbly behavior. A housing boom becomes frothy and out of sync with fundamentals when driven by fear of missing out (FOMO), based on the wide acceptance of the belief that today’s strong price appreciation will continue unabated in the future, leaving behind prospective purchasers.

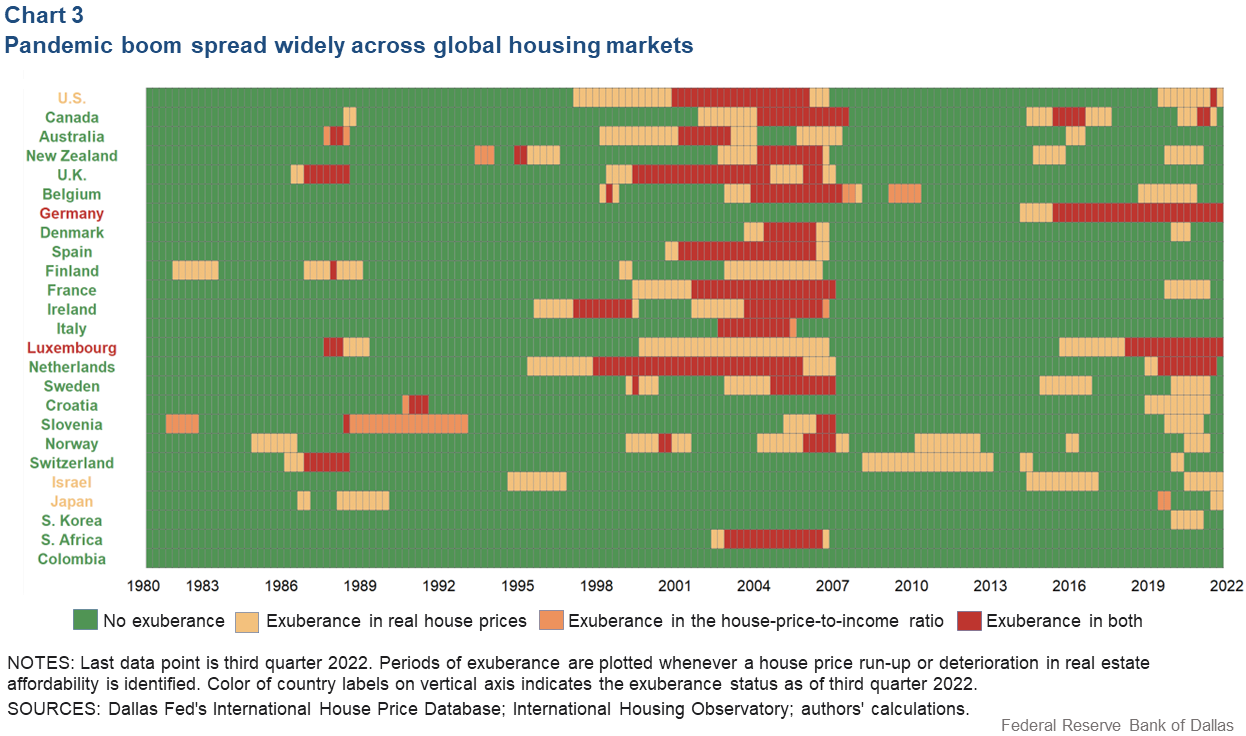

Exponential growth in key housing market indicators—such as real house prices and the price-to-income ratio—are a symptom of exuberance during a FOMO-driven housing bubble. Using statistical tools to identify such excesses, we find that booms have become longer and more concordant since the 1990s (Chart 3).

Affordability crises arise often from unsustainable and widespread exuberant behavior, data suggest. Particularly concerning, housing has become more prone to excesses spreading across borders, resulting in major misallocation of resources and efficiency losses. This can have sizeable global macroeconomic and financial consequences.

The period from the 1970s onward is characterized by financial deepening and a rapid expansion of mortgage credit. The “Nixon shock” in 1971 (the decoupling of the U.S. dollar from gold) effectively ended the Bretton Woods system—the international agreement to fix various countries’ currencies to the U.S. dollar, which itself was pegged to gold. As a result, a new regime based on floating fiat currencies and free international capital movement progressively emerged.

The greater international capital mobility since the 1990s allowed investors to search for yield beyond their nearest housing markets and boosted mortgage credit availability. This played an important role—together with migration flows—in propagating froth across countries and sustaining housing booms for prolonged periods.

Perils of pandemic housing froth

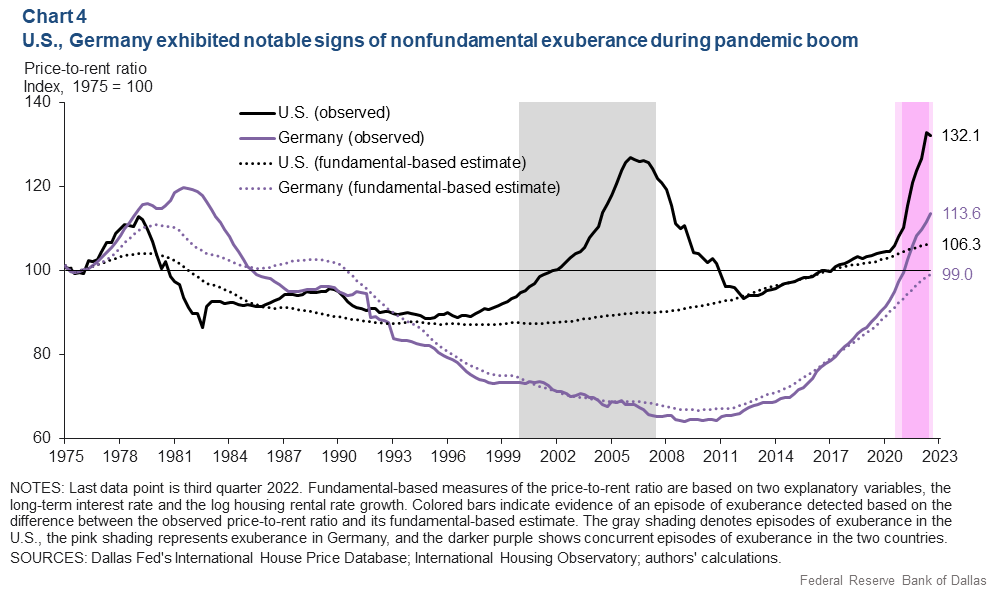

The U.S. and Germany, because of the size of their economies, pose a substantial risk to global housing. Focusing on these two countries, our analysis goes a step further, looking at complementary evidence extracted from house-price-to-rent ratio data. This ratio—a natural counterpart to the price-to-earnings ratio for stocks—measures the profitability of housing as an investment opportunity.

Using data from the International Housing Observatory, we detect periods of exuberance after accounting for those conventional fundamentals of the price-to-rent ratio.

Specifically, if the observed price-to-rent ratio grows at an explosive rate relative to its fundamental-based ratio estimated with long-term interest rate and rent growth data, the bubble hypothesis merits attention. Chart 4 shows episodes of exuberance for the U.S. and Germany.

Comparing Germany’s actual price-to-rent ratio with its estimated price-to-rent ratio, evidence of exuberance is apparent since the start of the pandemic. To return to its fundamental-based level, the German price-to-rent ratio would need to fall by 12.8 percent.

The comparative gap between the U.S. price-to-rent ratio and its estimated fundamental ratio signals exuberance in the early 2000s as well as during the pandemic. The correction needed to bring the U.S. in line with its fundamentals—a 19.5 percent decline—is less sizeable than at the peak of the previous boom but larger than that for Germany.

There is evidence that the U.S. price-to-rent ratio began to fall in third quarter 2022 as prices moderated more so than rents, unlike what the German data show for the same quarter.

Confluence of risk factors

Warning signs of froth in international housing have been apparent since 2021. Germany’s housing market, much like the U.S.’, is at a crossroads.

An energy crisis stemming from the war in Ukraine and a rapid increase in import prices deteriorated the terms of trade of energy-importing economies such as Germany. The challenges are considerable because the tighter monetary policy needed to combat rising inflation hits interest-rate-sensitive sectors like housing.

Germany, like the U.S., has a small proportion of variable-rate mortgages, which helps mitigate the direct effects of rising interest rates. Central bank policy rates in Europe also lag those of the U.S. However, while a modest housing correction remains the baseline scenario, the risk that a tighter-than-expected monetary policy may trigger a more-severe price correction in Germany (and the U.S.) cannot be ignored.

Even countries such as Spain and Italy—which did not boom during the pandemic—are exposed through euro-area linkages to negative shocks originating in Germany. The two countries were already weakened after failing to fully recover after the housing bust of 2008.

The possibility of a domino effect, where investors pull out of international housing seeking safety and liquidity elsewhere, also raises concerns of spillovers beyond Germany or the U.S. to the global economy.

Additionally, the fragile Chinese housing market poses its own set of issues. It suffers from overbuilding in some areas and simultaneously some overpricing in top-tier cities that could pose a major domestic risk as well as one for the global economy.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.