Russia’s war on Ukraine will leave scars on U.S., world economies

Russia’s invasion of Ukraine has dealt a blow to the global economy—weakening the postpandemic recovery and aggravating already-high inflation. Even if the worst fears of rising geopolitical tensions and larger economic disruptions do not materialize, private forecasters anticipate an inflationary slump for the world economy.

In this context, the U.S. economy faces significant headwinds from higher food, energy and raw material prices.

Private forecasters do not anticipate a fiscal/monetary policy mix robust enough to quell surging prices through 2023, raising concerns that above-target inflation could become entrenched. The war’s economic damage will partly depend on the persistence of high inflation and economic “scarring” over the medium to long term.

Global outlook takes a turn for the worse

We assess the global outlook through 2023 using Consensus Economics daily forecasts for the U.S. and 36 of its largest trading partners as tracked in the Dallas Fed’s Database of Global Economic Indicators. These countries encompass 83 percent of 2021 global GDP in purchasing-power-parity terms. Purchasing power parity provides a common basis for valuing output across countries.

The daily forecasts correspond to the moving average of private forecasters’ latest projections for annual GDP growth and Consumer Price Index (CPI) inflation for each country. We construct global aggregates, weighting each country’s forecasts according to its share of purchasing-power-parity-adjusted global output. These aggregates reflect private forecasters’ base scenario for the global economy and, implicitly, also capture their central view about the effects of the likely monetary and fiscal policy paths.

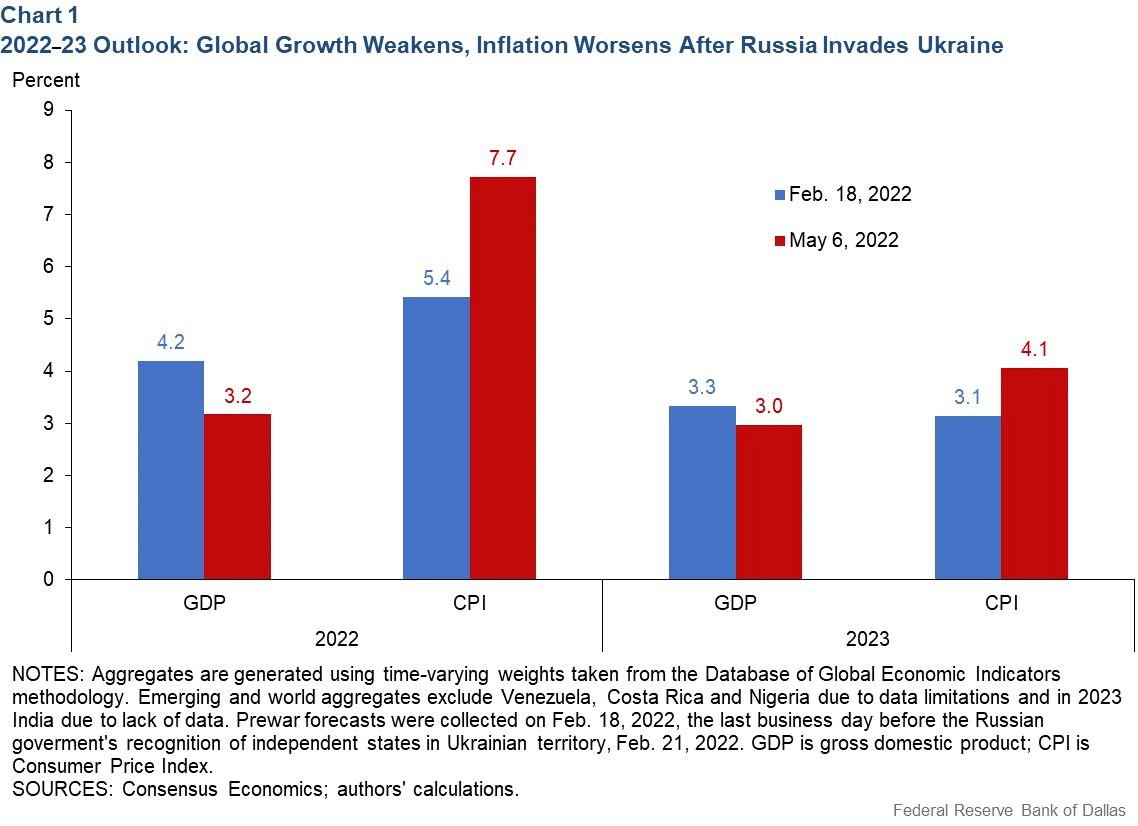

Global growth projections have eroded since the beginning of the war (Chart 1). These forecasts have fallen by 1.0 percentage points for 2022 and by 0.4 percentage points for 2023 since Feb. 18, just before Russia’s recognition of two independent republics inside Ukraine that preceded the start of the war. Over the same period, global CPI inflation forecasts also jumped about 2.3 percentage points for 2022 and 0.9 percentage points for 2023.

Global growth projections have fallen below the 3.6 percent prepandemic (2010–19) average, with global inflation exceeding the prepandemic (2010–19) average of 3.1 percent. The deterioration of the global outlook beyond 2022, although still modest, is consistent with a growing recognition that the scarring effects of the war could be longer-lasting.

Reaction to Russia’s actions drives diminished expectations

Revisions to the private forecasters’ prewar scenario in Chart 1 are the result of major vulnerabilities and sizeable spillovers from the conflict. The global economy is exposed—neighboring countries, in particular—to supply-chain and trade-war-caused disruptions along with voluntary or legal requirements to disengage from Russia. These include some Russian banks’ removal from the global SWIFT financial institution payment system, other financial and trade sanctions plus the displacement of nearly 6 million Ukrainian refugees.

Amplified geopolitical risks likely weigh on business confidence and asset prices and could spur heightened volatility and capital outflows in some markets. Governments may also face fiscal pressures from costly measures arising from boycotts of Russian trade and financial exchanges—primarily involving energy sources—and support for Ukraine, including, in some cases, higher defense budgets.

Since Russia and Ukraine are major commodity producers, global energy and food prices have also jumped—notably oil, natural gas, nitrogen fertilizers, wheat and other grains, and a variety of other raw materials and metals. War-related energy and food price hikes have some parallels with previous crises, such as the oil shocks of the 1970s.

A return to the 1970s?

Experiences such as those of the 1970s suggest that large price increases of production inputs that are not easily substitutable—also known as cost-push shocks—can lead to higher prices and lower aggregate supply. The deeper lesson from the 1970s is that high inflation and sluggish economic activity can follow from a large cost spike if increased prices feed into expectations of higher inflation and rising wages.

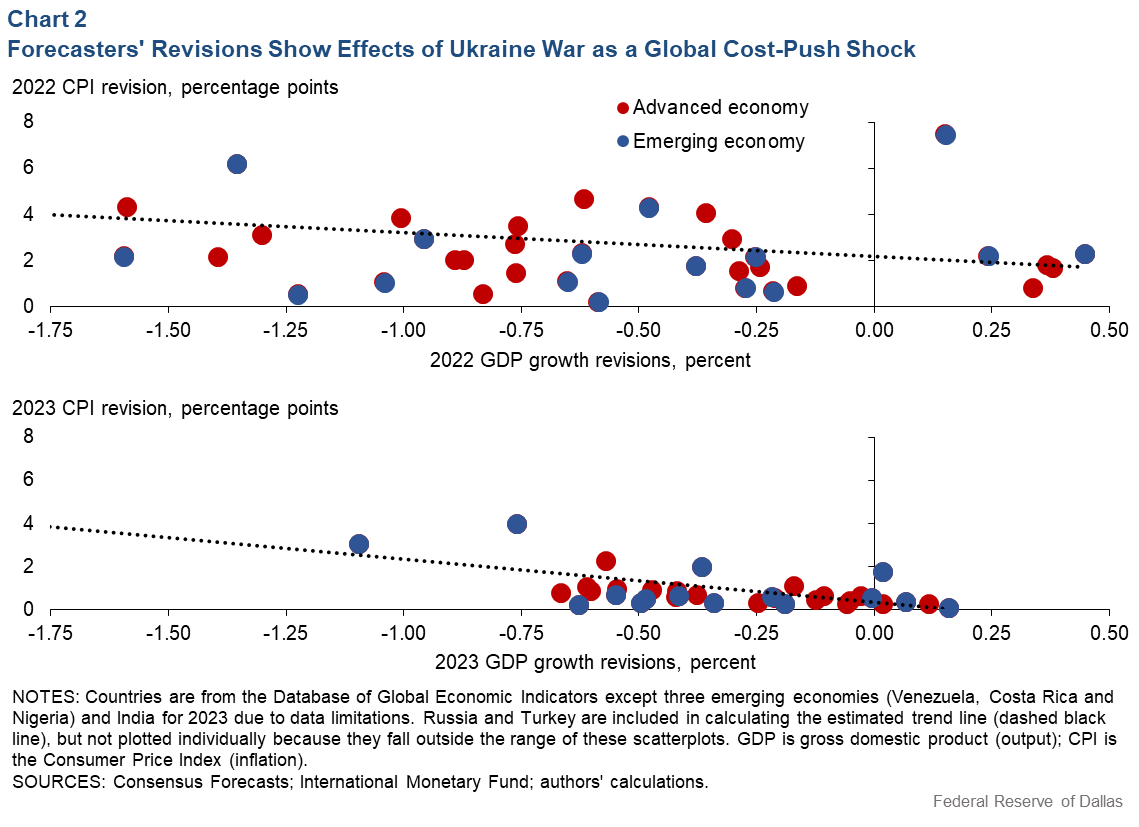

Private forecasters’ view of the war is consistent with the consequences of a cost-push shock given that, since the start of the conflict, a pattern of declining growth and increasing inflation forecasts has become widespread in most countries (Chart 2).

These impacts for now are less sizeable than those of the 1970s’ oil shocks and more similar in magnitude to the 1990 oil shock during the Gulf War or the 2007–08 oil and commodity price shock. In part, this reflects improved energy efficiency since the 1970s. However, in the current context, the dependence on Russian energy imports constitutes a major risk factor for neighboring countries.

Complicating matters, the war has worsened what for many economies was already their largest bout of inflation since the 1980s and 1990s. Private forecasters also anticipate these impacts will persist at least into 2023. Bringing inflation down more quickly and preventing inflation expectations from becoming unmoored may require a more-robust policy tightening than forecasters anticipate in their latest base case scenario for the global outlook.

Headwinds for the U.S. economy

The short-term economic impacts of the war are likely limited for the U.S. since its trade ties with Ukraine and Russia are modest, although the commodity prices surge is pressuring inflation higher.

Unlike most other countries, the U.S. can increase domestic energy production and, to some extent, also agricultural output to partly offset shortfalls and restrain price hikes. However, the ability of U.S. producers to boost production quickly and significantly is not unrestrained due to supply-chain bottlenecks, shortages and various regulatory, financial and technological hurdles to profitability.

U.S. inflation was already at historically high levels after a period of fiscal expansion and monetary accommodation following the COVID-19 economic shock. The onset of the war has exacerbated the problem globally, prompting the Federal Reserve to begin tightening.

Given the potential for escalation of the Ukraine conflict, the balance of risks on U.S. inflation over the short to medium term appears tilted to the upside. This might require a more front-loaded and rapid reaction to reduce the likelihood of inflation climbing further and to prevent those tail risks from materializing.

This high inflation risk coincides with increasing signs of buoyant asset markets, notably housing. In parts of the U.S. particularly dependent on the oil and natural gas industry, booming energy prices can add pressure to already-elevated housing prices.

Housing market exuberance complicates monetary policy, as higher rates can trigger a downward asset price correction and a negative wealth effect—since housing is often the largest part of household wealth. In the extreme, a correction prompts financial stability concerns as well. High indebtedness—a global trend—poses its own risks and can curtail the fiscal space needed should another crisis unfold.

In the longer term, the economic scars for the U.S. and globally will depend on the war. The conflict may alter the global economic and geopolitical order, leading to a new era of deglobalization as trade, energy and supply chains reconfigure or decouple, payment and financial networks fragment, reserve currency holdings shift, capital flight problems emerge and defense alliances reshuffle.

The extent of the impact will also depend on how long elevated price pressures last and on how policymakers respond to anchor long-run inflation expectations.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.