Texas expansion moderates; labor market, price expectations normalize

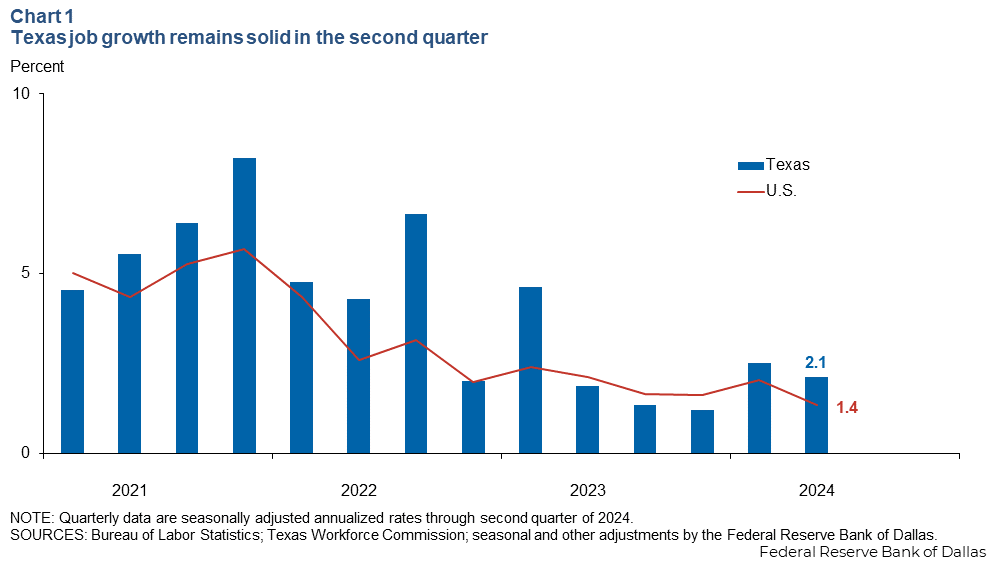

The Texas labor market cooled in June, with employment flat compared with the prior month. However, job growth in the first half of the year was solid, surpassing the national average. Texas Business Outlook Surveys (TBOS) indicate a modest pace of expansion led by services and a stabilization of price and wage growth expectations.

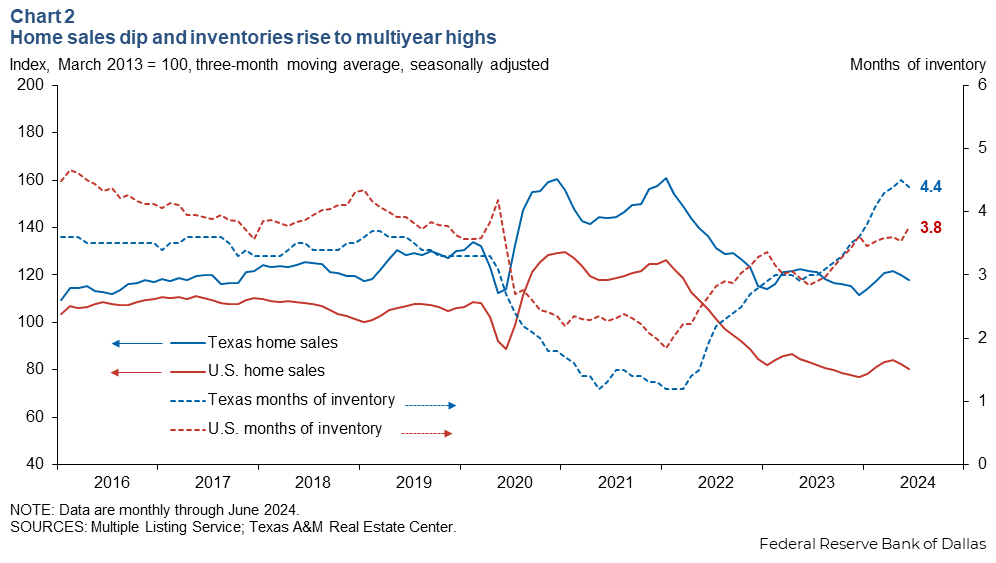

The housing market slowed, with sales down and inventories rising. Data reflecting strain among small businesses and low- and moderate-income households appeared mixed. Some data point to rising stress, while others suggest resilience.

Job growth eases in June

Texas job growth slowed significantly in June. Payrolls declined an annualized 0.2 percent (1,900 jobs), partly due to the widespread storms in May that disrupted economic activity and hiring. Employment declined broadly across major sectors with only construction, manufacturing, education and health services, and government payrolls experiencing gains.

Despite the slowing, second-quarter job growth was a solid 2.1 percent—in-line with the state’s historical average annual growth (Chart 1). The Texas unemployment rate was stable at 4.0 percent.

The labor market is coming into better balance, with Texas businesses expressing less apprehension about rising labor costs and worker shortages. Among TBOS respondents who intend to hire, 41 percent noted applicant availability was an impediment to hiring in July, down from 49 percent in January. Further, 39 percent cited applicant pay expectation as an impediment, a decline from 43 percent in January.

Manufacturing struggles to grow; wages, prices stabilize

TBOS indicated a modest pace of expansion supported by services. Revenue growth picked up in the service sector in July but remained slightly below trend. Manufacturing production continued largely flat in recent months, and demand pulled back in July.

TBOS also suggested stable inflation expectations among Texas businesses. In June, TBOS respondents anticipated wage growth of 3.5 percent in 12 months, little changed from 3.6 percent in March, but down notably from 4.3 percent in December 2023.

Selling-price growth expectations over the upcoming 12 months were stable from March (2.9 percent anticipated growth) to June (2.8 percent), though lower than in December 2023 (3.5 percent). If current expectations are realized, wage and price growth this year will be close to 2018–19 averages.

Housing market softens

Texas existing-home sales fell in June for a second straight month (Chart 2).

Sales dipped in most major metropolitan areas, too. Inventories ticked down from 4.5 months of supply to 4.4 in June but remain near levels last seen in early 2013. Inventories in Texas have risen rapidly since mid-2022 and are currently well above the U.S. average (3.8 months) due in part to stronger homebuilding activity in the state. Prices are holding up, down just 0.9 percent year over year in June.

Financial conditions tighten somewhat for small businesses

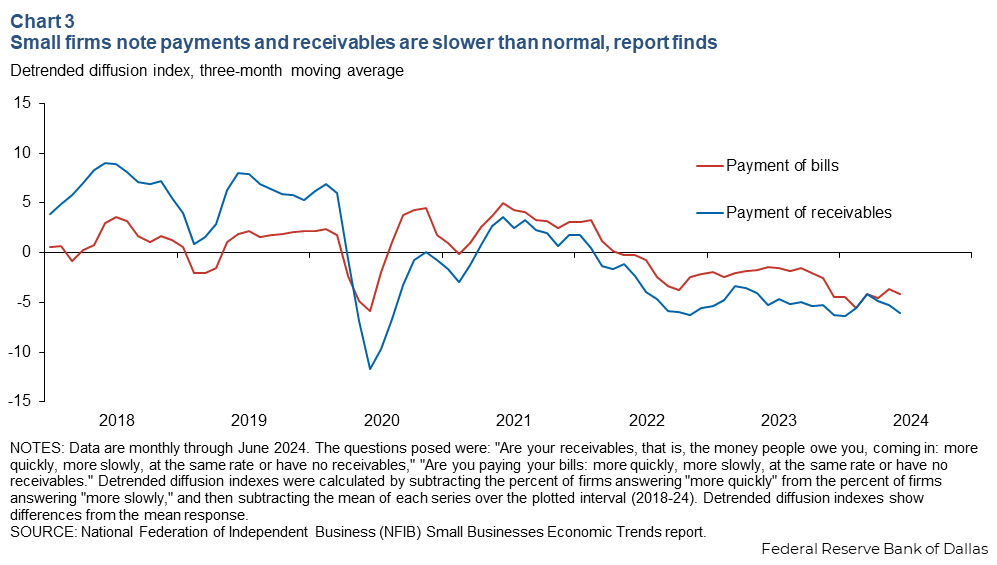

Small business appears to be experiencing slight financial strain, but no more so now than at the beginning of 2024. The rate of payment of bills and receipt of receivables for small firms weakened in mid-2022 as interest rates began rising, according to the National Federation of Independent Business (NFIB) Small Business Economic Trends report (Chart 3).

In June, the pace of payables and receivables was roughly the same as in January. Firms were also asked to compare their earnings in the last three months to the three months prior, leading to a dismal reading of -29 in June. The data point indicates 29 percent more firms noted lower earnings than those citing increases. This diffusion index has hovered around this level for a year, indicating some small firms face economic stress, though their challenges have not necessarily intensified in recent months.

July TBOS data corroborated the NFIB survey findings. Nearly one-third of Texas firms reported a slowdown in the pace of receivables over the past three months. Conversely, 10 percent reported paying their own bills more slowly over the past three months.

The TBOS data show activity by firm size. Overall, they indicated similar output and employment growth trends among small firms (fewer than 50 employees) and large enterprises (50 or more employees). Both small and large manufacturers cited flat to down activity on net, while revenue growth among small service firms actually outpaced that of large ones in recent months.

Consumption remains resilient despite rising credit card delinquencies

Texas inflation-adjusted retail sales tax collections (a proxy for spending on goods) show a continuing healthy level of spending albeit not much growth. While real retail sales tax collections were flat year over year in June, collections were 7.9 percent above January 2020 levels.

Though spending is holding up, delinquencies indicated some financial strain on households. Credit card delinquencies (90 or more days late) have risen broadly in Texas since 2022, according to data from the New York Fed Consumer Credit Panel. Consumers living in low- and moderate-income neighborhoods have experienced more rapid increases.

The rising delinquencies partly reflect expansion of credit to non-prime borrowers during the pandemic and normalization of credit portfolios at the current higher level of interest rates.

Data from the Eviction Lab at Princeton University show elevated eviction filings in Austin, Houston and Fort Worth relative to prepandemic averages. Evictions over the past three months through June on average were 33 percent higher in Houston, 20 percent higher in Fort Worth and 23 percent higher in Austin than prepandemic averages, but 6 percent lower in Dallas.

High rents have increased the burden on low-income households. However, business contacts report the elevated level of filings is partly due to delayed post-COVID eviction notices working through the system.

Outlook positive, but headwinds prevail

Texas firms are optimistic about future business activity, with services slightly stronger than manufacturing. However, the effects of Hurricane Beryl in early July have not fully appeared in the employment data. Unemployment claims spiked in Houston in mid-to-late July.

The Texas Leading Index declined for the fourth straight month in June, suggesting slower growth ahead. The Dallas Fed’s Texas Employment Forecast was revised down from 2.4 percent to 1.9 percent growth (December over December), indicating trend job growth for 2024 after three years of robust expansion.

About the authors