Texas economic sentiment upbeat amid price pressures, uncertainty

Texas companies reported rising service sector revenue and a resumption of production growth in the manufacturing sector after weakness in 2023 and much of 2024, according to the Dallas Fed’s Texas Business Outlook Surveys (TBOS). Additionally, expected changes in the tax and regulatory environment following the election have boosted company outlooks.

Texas businesses also raised their expectations for wage and price increases in 2025. They cited rising insurance costs and higher input prices, including potential tariff-related increases, among other factors, as contributing to those expected increases.

The mixed expectations follow slightly below-average job growth in 2024. Employment was volatile last year following summer storms and a pullback in high-tech, consulting services and government hiring.

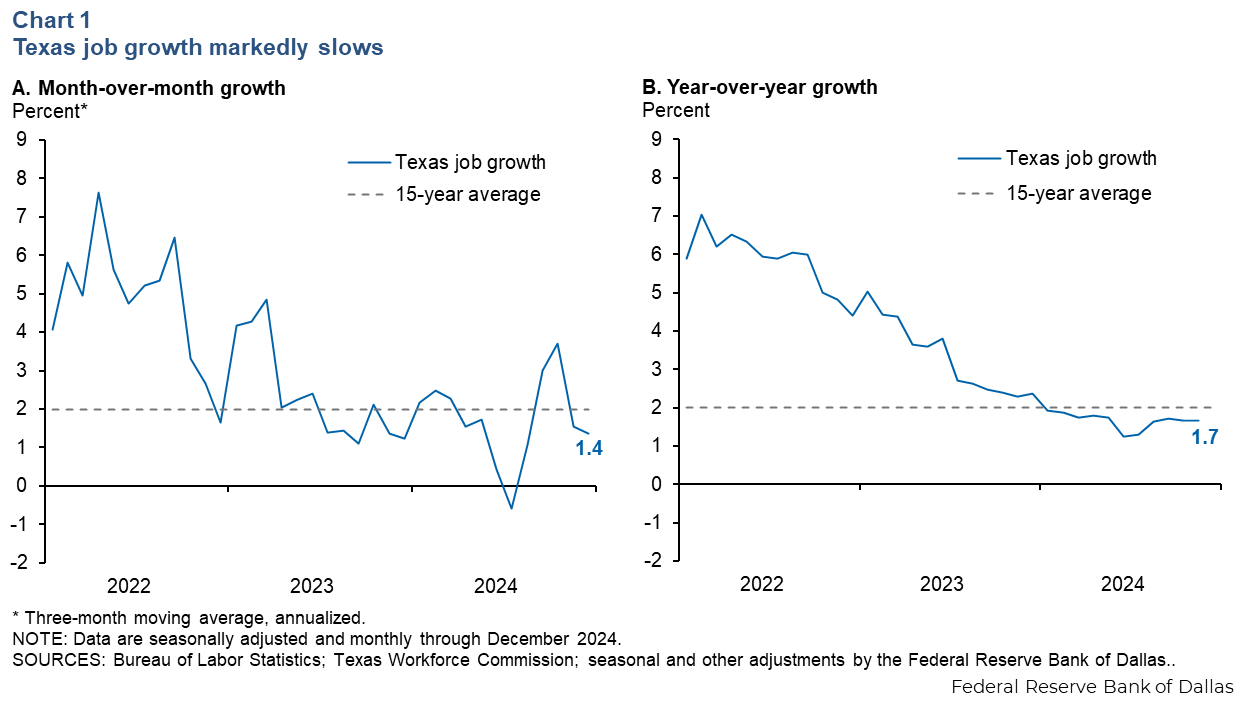

Texas job growth slows at year-end 2024

Texas job growth decelerated notably after spiking in third quarter 2024, falling to an annualized three-month moving average of 1.4 percent in December (Chart 1). State payroll data have been volatile since the pandemic. Viewing year-over-year growth as a smoother measure indicates job gains of 1.7 percent (December over December). The annual reading fell below Texas’ long-run average job growth rate of about 2.0 percent and 2023’s rate of 2.4 percent.

Weakness in professional and business employment is a key factor driving slower growth. The slowdown may be a correction after overhiring following the pandemic. This is most notable in employment services, high-tech services and management consulting. In addition, government employment growth at the state and local level, including in public education, abated in the second half of 2024.

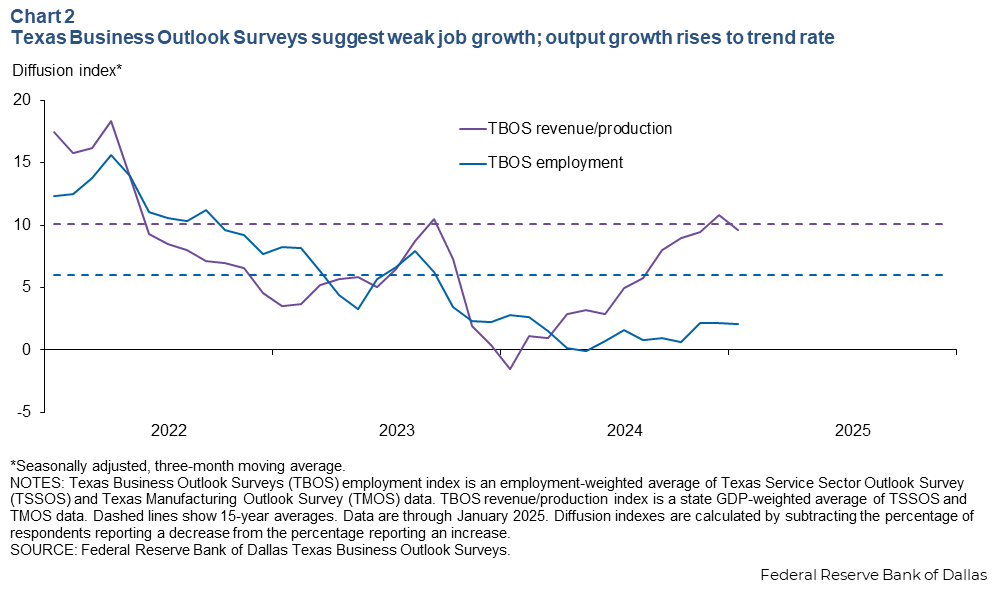

While weaker-than-normal job growth is echoed in the TBOS employment index, output growth rose notably in the fourth quarter, as evidenced by TBOS diffusion revenue/production indexes (Chart 2). Diffusion indexes are calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. A positive value indicates expansion, while a negative value indicates contraction.

Manufacturing production—flat through most of 2024—resumed modest growth in the fourth quarter.

Texas firms expect business conditions to improve

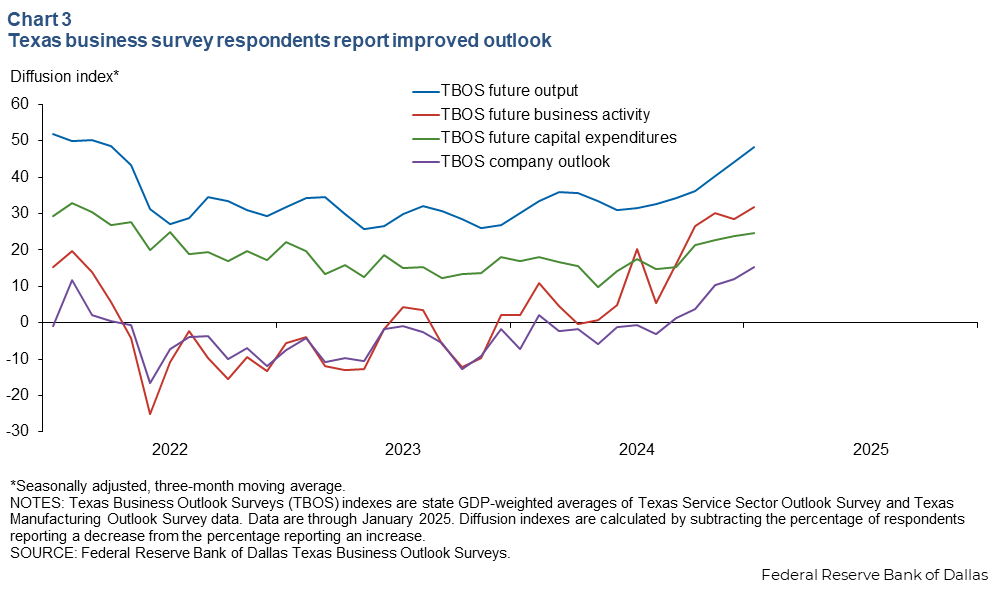

Positive sentiment increased in forward-looking TBOS indexes in January. It markedly rose after the November election (Chart 3). Some uncertainty has been resolved, and many survey respondents believe the new administration will seek less regulation and more favorable tax policy.

Firms anticipate more available time and resources for their businesses with fewer regulations. A repair and maintenance company reported, “Government regulations are a huge burden, requiring extra unbilled staff to try to stay in compliance.”

Banks were upbeat in their assessment of growth prospects this year. More generally, businesses surveyed anticipated that renewal of the Tax Cuts and Jobs Act of 2017 could provide an additional tailwind for Texas businesses, as the law contains favorable deductions on capital expenditures.

A smaller share of businesses cited domestic policy uncertainty, demand, taxes and regulation as primary outlook concerns in December, according to a TBOS special question.

Despite improving outlooks, not all concerns abate

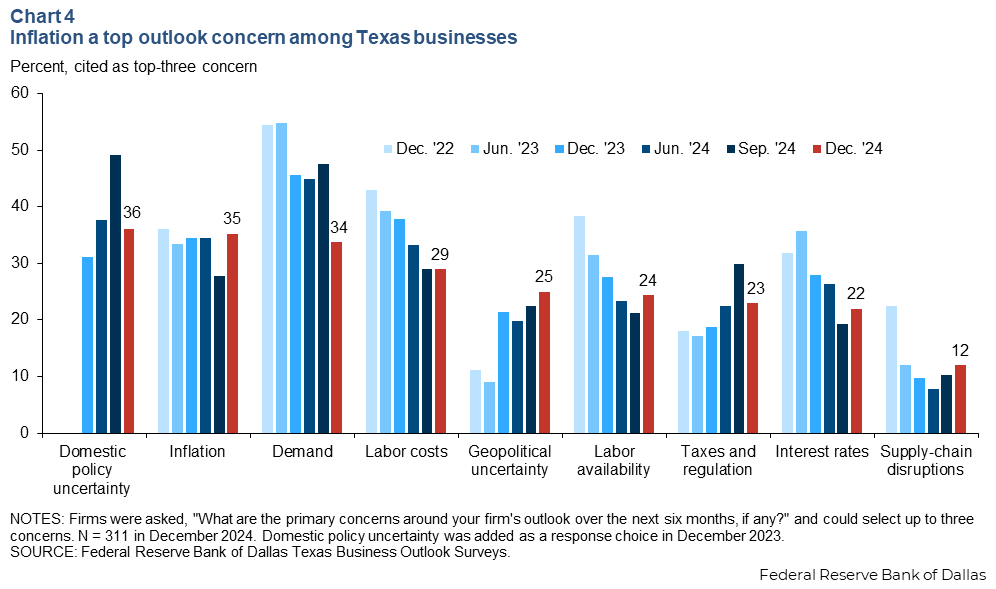

While some concerns have retreated, Texas firms have grown more concerned about rising prices and the impact of tariffs. Inflation was the second-highest-ranked outlook concern among Texas businesses in December (Chart 4).

Growing concern over inflation coincided with rising selling price expectations in December, a change from the downward trend since December 2022, according to TBOS. In special questions asked in December 2024, Texas businesses expected selling prices to increase on average 3.1 percent over the upcoming 12 months. This exceeded the 2.7 percent average expected increase reported in September 2024. Increases were more pronounced in the manufacturing sector than in services.

Partly fueling those expectations are higher anticipated wage and input cost growth over the upcoming 12 months. In December 2024, Texas businesses expected, on average, growth of 3.9 percent for wages and 3.6 percent for input costs during the next 12-month period.

Service sector firms expected wage growth to rise further, while manufacturers anticipated input costs to increase by a larger amount. Contacts identified higher wage, insurance and raw material costs as price drivers, and reiterated that they can no longer absorb higher costs. A rental and leasing services firm commented, “Labor costs for hourly workers have increased for four years now and have still not kept up with inflation. We anticipate wage pressure to continue.”

Additionally, businesses see current demand as resilient, enabling them to pass along higher prices and avoid significant margin compression. In September 2024, respondents expected wage growth of 3.7 percent and input costs to climb 3.2 percent.

Potential impact from tariffs partly fueled the rising price expectations. Many businesses that expect to be directly affected by tariffs intend to act swiftly in response by raising prices—especially in the manufacturing sector. A computer and electronics product manufacturer said in December, “Widespread tariffs will increase our input costs, and we will have to pass this along to customers.”

Some TBOS respondents noted they were already raising prices, increasing purchases of inventory or exploring new domestic or international suppliers. A food manufacturer said, “Our company has been contacted by several potential new customers over the past month looking for us to be a supplier due to their fear of new tariff costs placed on their current supply-chain partners in Mexico.”

Some firms do not have the ability to absorb further cost increases. Additionally, while demand is currently hearty, some believe it is likely not strong enough to tolerate full pass-through of tariff cost increases. Thus, partial pass-throughs may be more common than zero or full tariff cost increases.

Several companies unlikely to be directly affected by new tariffs said they were concerned that blanket tariffs will affect their customers and vendors and may have wide-ranging effects throughout the economy, including supply-chain disruptions and higher costs.

Outlooks lean positive but uncertainty remains

The Texas economy grew slightly below its long-run trend in 2024 amid tighter monetary policy, a correction in service sector overhiring, weather disruptions and uncertainty surrounding the national election. The state economy is expected to expand at a pace similar to 2024 with employment forecast to grow between 1.5 percent and 2.0 percent this year.

The outlook is brightened by rising output from both manufacturing and services as well as increased business optimism spurred by anticipated easing of regulatory and tax policy. However, inflation concerns have risen as companies see tariffs, insurance and wages pressuring prices higher.

About the authors