Texas’ economic outlook deteriorates as tariff-related uncertainty builds

While lagging indicators reflect resilient growth for the Texas economy, more recent survey data suggest diminished momentum amid elevated uncertainty about the outlook.

Job growth was solid in the first quarter. However, the Dallas Fed’s Texas Business Outlook Surveys (TBOS), which are timelier than government jobs data, point to broad-based weakening in business activity.

Texas firms report that the impact of higher tariffs has considerably dimmed business outlooks, with weakening demand, policy uncertainty and inflation among the primary concerns.

Business outlook surveys point to broad-based deceleration

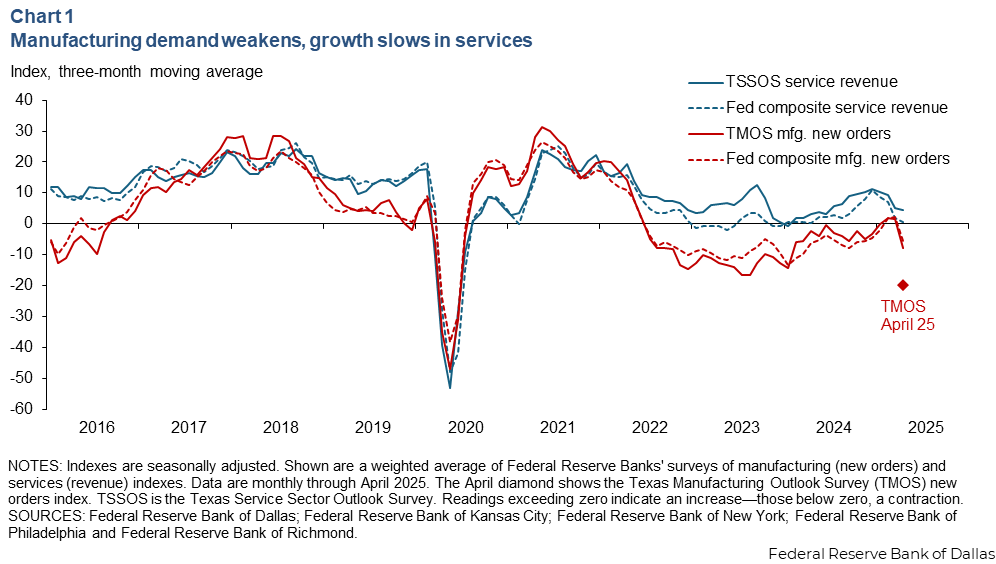

During the first quarter, the Dallas Fed’s monthly manufacturing outlook survey showed that manufacturing demand (new orders) grew modestly in Texas and that trend was evident in other regional Fed surveys, marking a rebound after more than two years of contraction (Chart 1). This initial pickup was partly attributed to firms pulling orders forward ahead of the new tariffs.

Subsequently, the uptick appears short-lived, as the Texas Manufacturing Outlook Survey (TMOS) and Fed composite manufacturing new orders indexes turned negative in April. Diffusion indexes indicate the change in the underlying variable; positive/negative values represent expansion/contraction.

National and state data collectively suggest that the service sector is also experiencing a deceleration. TBOS and various regional Federal Reserve service sector surveys indicate slowing services activity. If sustained, this directional change in service sector revenue growth is concerning, as the service sector accounts for the majority of the economy and is less volatile than manufacturing.

Sentiment indicators turn negative with rising outlook uncertainty

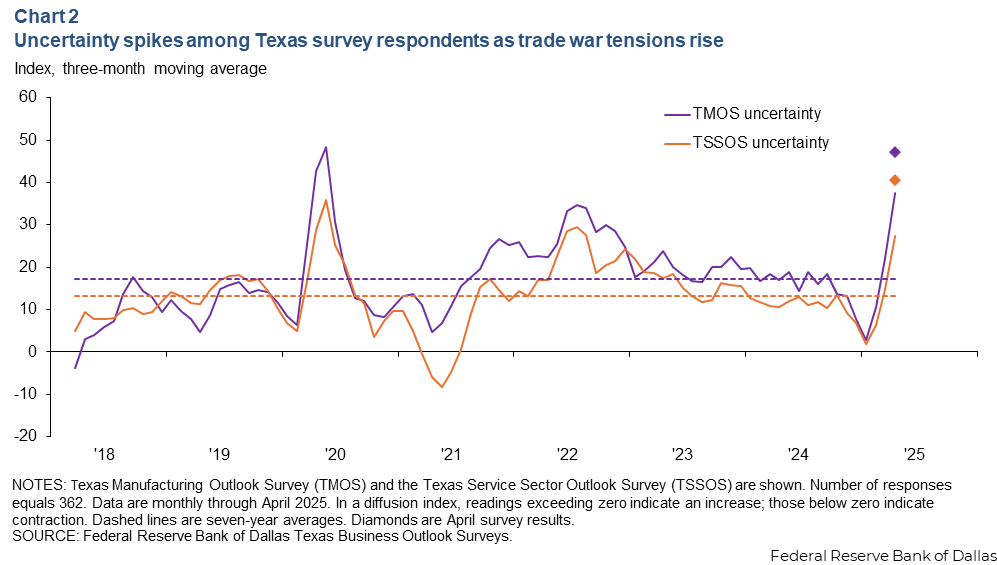

Uncertainty among Texas businesses rose to multiyear highs in April (Chart 2). A larger share of manufacturing firms noted greater outlook uncertainty relative to service sector firms, likely due to a disproportionate tariff impact. This increase is reflective of a nationwide rise in uncertainty among businesses amid shifting federal trade policies.

Uncertainty can adversely affect economic activity, as firms tend to delay capital investments, hiring and other business decisions. Commentary from the April TBOS indicates that firms are broadly taking a wait-and-see approach on business planning and investment until there is greater clarity surrounding tariff policies. A 2020 Federal Reserve Board staff research paper estimated that U.S. business investment fell 1.5 percent as a result of trade policy uncertainty in 2018.

Forward-looking sentiment indexes in TBOS and other Federal Reserve surveys have also tumbled from their peaks in January. In the postpandemic period, sentiment indicators frequently diverged from real economic activity, showing persistent weakness even as growth was robust. Several factors, including elevated inflation and interest rates as well as compressed margins, likely contributed to this negative bias. However, the recent broad-based decline in sentiment appears to be aligned with fundamentals, suggesting it may be a leading signal rather than noise disconnected from fundamentals.

In the April TBOS, for example, 59 percent of firms said increasing tariffs negatively affected them, a rise from September 2018 when just over a third of firms noted a negative impact.

Tariffs affecting more firms than before

A broader set of firms reported more-pronounced anticipated effects from tariff policies than was the case during the 2018–19 tariff rounds, responses to survey special questions suggest (Table 1).

| Sept. '18 (percent) | June '19 (percent) |

April '25 (percent) |

|

| Increase in input costs | 44 | 36 | 67 |

| Increase in selling prices | 28 | 22 | 47 |

| Decrease in profit margins | NA | 29 | 58 |

| Increase in supplier delivery time | 20 | 18 | 30 |

| Decrease in production/revenue | 19 | 17 | 41 |

| Decrease in employment | 8 | 10 | 31 |

| Decrease in capital spending | 14 | 18 | 40 |

| Decrease in company outlook | 20 | 28 | 60 |

| NOTES: Number of responses equals 271 in April 2025 survey. Most recent survey collection period was April 15–23. The April 2025 question was “What net impact do you expect higher tariffs to have on the following aspects of your firm's business this year?” The question in 2018–19 asked about the realized impact. SOURCE: Federal Reserve Bank of Dallas Texas Business Outlook Surveys. |

|||

In April, two-thirds of Texas firms expected higher input costs due to tariffs, a more widespread response than the 44 percent that reported input cost impact in 2018. Nearly half of the firms in April anticipated an increase in selling prices, up from 28 percent in 2018. About 40 percent of firms expect reduced output and/or capital spending—triple the share reporting in 2018.

Firms take various responses to tariffs

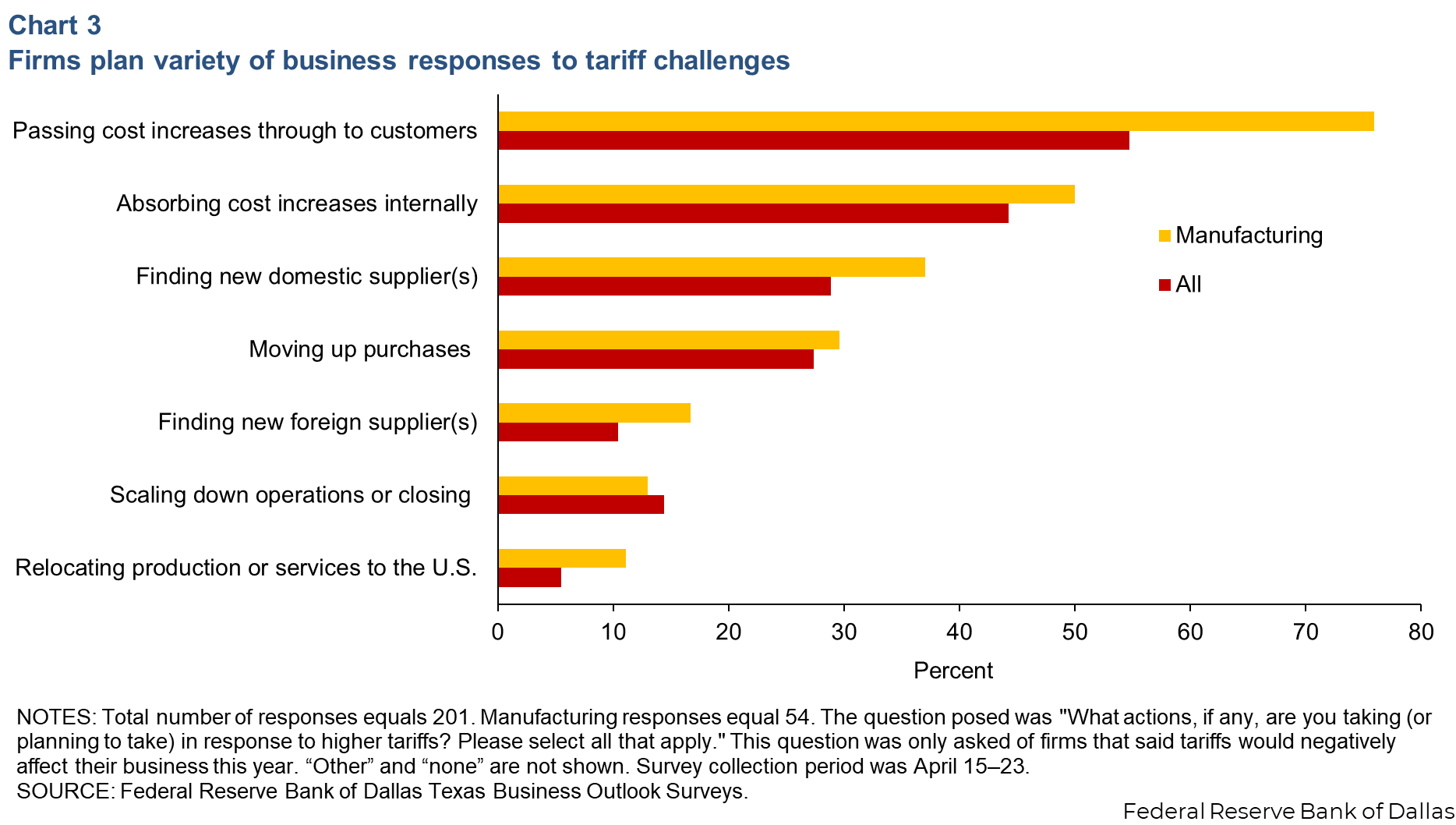

Texas firms are taking multiple actions in response to higher tariffs (Chart 3). Among firms negatively affected, most are passing cost increases through to customers (55 percent) or absorbing costs internally (44 percent). Manufacturers and retailers are especially likely to act on prices, with 76 percent of manufacturing and retail firms impacted noting plans to pass on higher costs to customers.

Other actions include finding new domestic suppliers (29 percent) and moving up purchases (27 percent). Firms more exposed to tariffs were more likely to raise prices and accelerate purchases ahead of the tariffs. Among firms sourcing more than half their inputs from abroad, 45 percent noted pulling forward purchases, and 83 percent were raising prices, much higher shares than firms with little or no foreign reliance.

Only 5 percent of firms indicated they were relocating production, generally because of either low reliance on foreign inputs or challenges reshoring manufacturing production. Sixty-three percent of firms reported sourcing 10 percent or less of their inputs from abroad. Additionally, one survey contact noted that relocating production would take several years: “A major facility is five years minimum. Smaller facilities may only take three years.”

Tariff cost pass-through will be partial but swift

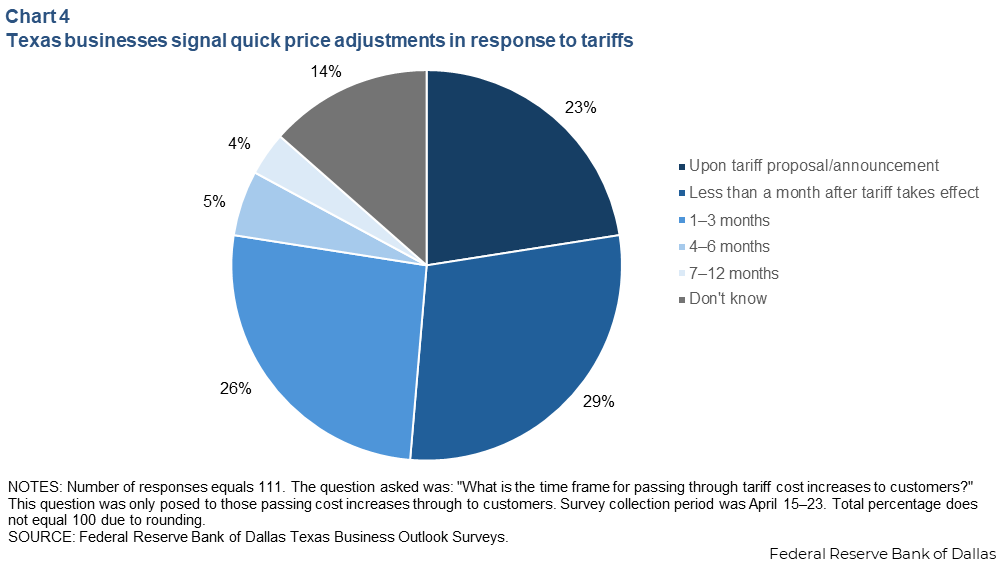

Tariff-related price adjustments are expected to be swift, but pass-through appears to be mixed, partly due to a weaker economic outlook. Among TBOS firms anticipating passing on cost increases, 26 percent noted plans to pass through all the increase, another 26 percent noted plans to pass through most of the higher costs, and 41 percent noted some pass-through. Cost pass-through is higher among retailers, with nearly two-thirds indicating plans to pass through all or most of the increase.

Among firms with no reliance on foreign inputs, 30 percent say they will pass on cost increases to customers. This suggests tariff spillover to sectors that are indirectly affected. This is consistent with research that illustrates that domestic firms that do not import goods or services often also raise prices in response to tariffs. This occurs because tariffs increase costs throughout the supply chain and reduce foreign competition, giving domestic firms pricing power.

Among TBOS firms passing cost increases through to customers, 52 percent said they would pass through the increase upon announcement of a tariff or within one month of tariffs taking effect, 26 percent said within one to three months after tariffs take effect, and 9 percent said between four and 12 months (Chart 4).

The results from the April TBOS special questions are consistent with recent research that finds that prices responded quickly to tariffs, though the magnitude of price increases is modest relative to the size of the tariffs.

Dual headwinds: Weaker growth and rising inflation

Due to lags in publishing official inflation data, timely price measures from business surveys such as TBOS are invaluable to quickly forecast inflation, especially during periods of price volatility. The TBOS current and future selling prices indexes rose notably in March and/or April and are above their series averages. The Federal Reserve Bank of Richmond survey, which tracks the Consumer Price Index, exhibited a similar spike in expected selling-price growth, particularly in manufacturing. This suggests that inflation will rise in coming months, driven by tariff-induced price increases.

The Dallas Fed forecasts below-average job growth in 2025, with risks tilted to the downside. Moreover, the TBOS service sector employment index—a leading indicator of Texas job growth—turned negative in April, falling to levels last seen during the pandemic and portending potential weakness in employment growth ahead.

While tariffs can drive up prices and reduce employment, uncertainty around the timing and scope weighs most heavily on the economic outlook. As one survey contact said, “We need to make decisions, but the ball is constantly moving.”

About the authors