What the trimmed mean says about future inflation: broadening price pressures ahead

While headline measures of inflation have jumped to multiyear highs, the Dallas Fed's Trimmed Mean Personal Consumption Expenditures (PCE) inflation rate remains below its prepandemic level. What should we conclude from these readings?

Does the current low trimmed mean reading suggest that all-items inflation will fall back below the Federal Open Market Committee’s 2 percent longer-run target? Our analysis suggests that, while some of the recent inflation surge will dissipate, some price pressures will persist and others likely will emerge. In fact, our forecast for both headline and trimmed mean PCE inflation for year-end 2022 is approximately 2.4 percent, albeit with upside risk and a significant amount of uncertainty.

In this post, we review how the Dallas Fed trimmed mean inflation rate is calculated, why it is useful for assessing inflation trends and what it tells us about the current inflation outlook.

Dallas’ trimmed mean explained

The annual change in the PCE price index—“headline” inflation—is the Federal Reserve’s preferred measure of overall inflation. An alternative inflation measure, the Dallas Fed Trimmed Mean PCE, excludes the most extreme upside and downside price changes in each month’s disaggregated inflation data. The motivation for the trimming is that extreme price changes are often due to one-off special factors not indicative of underlying inflation trends.

Our empirical analysis indicates that the trimmed mean successfully filters out much of the “static” or “noise” that can make it difficult to discern near-term inflation trends. Because the trimmed mean is a cleaner measure of inflation, it is also more strongly and reliably related to labor-market slack and other variables that might influence inflation’s path over the business cycle. And because trimmed mean inflation excludes noisy extreme movements, forecasts of the trimmed mean do a good job in predicting headline inflation at the horizons relevant for monetary policy (four quarters and beyond).

We believe that ex-food-and-energy inflation readings—commonly known as “core” inflation—tend to exclude too much signal and leave in too much noise compared with the trimmed mean measure of inflation.

Trimmed mean since the start of the pandemic

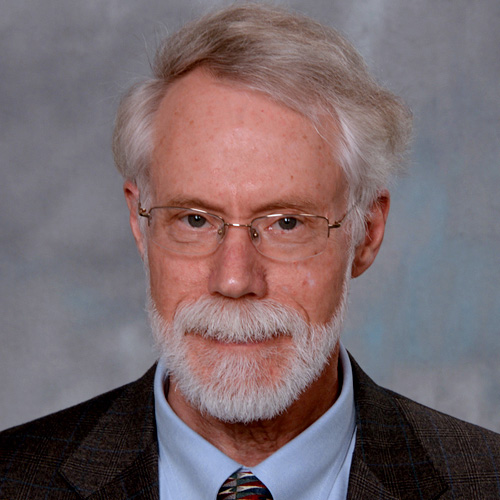

Chart 1 shows trimmed mean inflation from 2007 through May 2021 and the forecast through mid-2023.

The 12-month trimmed mean PCE inflation rate stood at 2.1 percent in February 2020, prior to the economic impact of COVID-19, versus headline PCE inflation of 1.8 percent. Over the course of the pandemic, while headline PCE inflation initially plummeted and then rebounded sharply, the trimmed mean gradually decelerated, reaching a low of 1.6 percent in January 2021. It has since firmed to 1.9 percent in May.

The current 12-month trimmed mean reading of 1.9 percent contrasts with a headline PCE inflation rate of 3.9 percent. The divergence in the readings of these two measures in recent months is indicative of the fact that the bulk of large price increases driving recent headline inflation are narrowly based. Because the trimmed mean excludes those extreme moves, it focuses attention on the middle of the distribution, which has not shifted significantly.

However, as we look ahead to the rest of this year and into 2022, we expect that even as some of the extreme price increases responsible for the recent surge in headline inflation fade, a broader swath of goods and services will show meaningful price increases. As a result, we expect trimmed mean inflation will pick up.

Convergence between trimmed mean and headline PCE

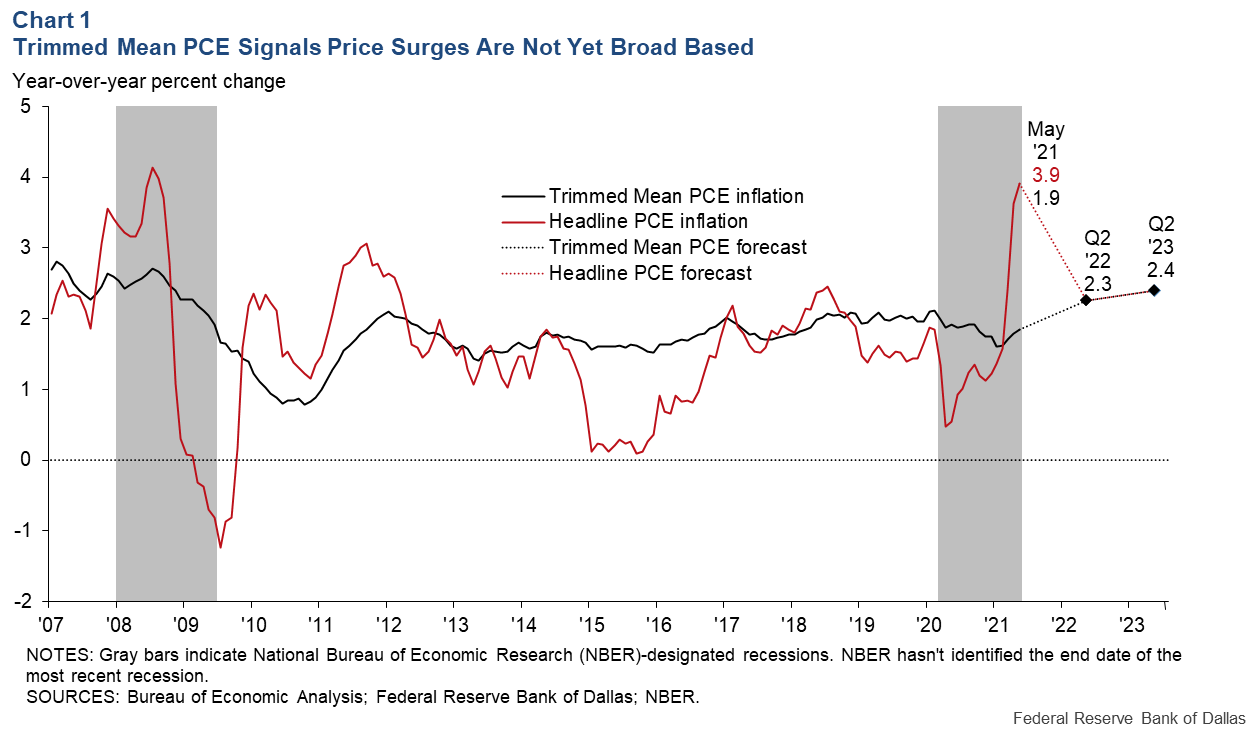

Gaps between headline and trimmed mean inflation typically close fairly quickly, usually within one year. They mostly close through headline inflation gravitating toward trimmed mean inflation, which is the less-volatile inflation measure. However, trimmed mean inflation also responds to its deviations from headline inflation.

Chart 2 illustrates that phenomenon—the red line is 12-month trimmed mean inflation and the black line is the gap between headline and trimmed mean inflation 12 months earlier. When headline inflation has run below trimmed mean, trimmed mean has typically been somewhat lower over the following year than would otherwise be expected. Conversely, headline inflation running well above the trimmed mean, like the current situation, tends to predict a pickup of trimmed mean inflation down the road.

Burst of higher prices leads to a broadening

Why do gaps between headline and trimmed mean inflation predict future shifts in trimmed mean inflation? Our interpretation of this relationship is that narrowly based, extreme price surges often reflect supply/demand imbalances that can potentially affect prices for a broader range of goods and services. While these imbalances initially show up in PCE components with more flexible, faster-moving prices, they eventually bleed into more-moderate increases in a broader range of slower-moving prices.

A typical example would be a sharp increase in the price of petroleum that initially shows up as a jump in gasoline prices, impacting headline inflation but having little or no impact on the trimmed mean. Eventually, though, the higher oil price leads to increases in slower-moving prices for car fares, airline tickets and goods (due to higher production and shipping costs).

Indeed, oil prices and, as a result, gasoline prices have risen sharply over the past year (56.7 percent for the 12 months ended in May), contributing significantly to headline PCE inflation, but negligibly impacting trimmed mean inflation. Eventually, we expect the run-up in energy prices to percolate through the prices of a broader range of goods and services.

But energy prices are likely far from the whole story in the economy’s current circumstances. A number of other imbalances have pushed up headline inflation, with the potential to bleed into prices for a broader range of goods and services.

A shortage of semiconductors has limited production of new motor vehicles. As a result, used vehicle prices have risen 38 percent during the 12 months ended in May. Beyond these immediate impacts, over the coming months, we believe it is likely that these semiconductor shortages will lead to a much broader range of price increases in consumer goods.

Supply/demand imbalances for construction materials such as lumber have impacted headline PCE inflation through components such as furniture (up 8.6 percent during the 12 months ended in May) and have contributed to rapidly rising house prices, which don’t show up directly in PCE. Over the coming months, though, we would expect increased house prices to lead to a pickup in rents and imputed rents, among the largest expenditure categories in PCE.

And, over the past few months, food prices have also risen noticeably, led by prices for less-processed food items, which tend to respond rapidly to supply/demand imbalances and higher input costs. Over time, these imbalances may lead to increased prices for more-processed grocery items as well as for food consumption away from home.

In all these cases, imbalances that initially manifest in a small set of PCE items have the potential to seep into a broader range of goods, representing a larger share of expenditures. Though the ultimate price increases may be more moderate than the initial signals, the breadth of the affected components can lead to an upward move in the middle of the distribution of PCE price changes and, with it, the trimmed mean. And indeed, over the four months through May, trimmed mean inflation has averaged an annualized 2.4 percent.

Other inflationary forces

Dallas Fed contacts report that shortages in semiconductors and a wide range of raw materials are broadening the extent to which supply-chain bottlenecks are putting upward pressure on the prices of goods and services. Some of this relates to reopening and some to other secular trends in the U.S. and global economies. Many of our contacts expect that these shortages will be exacerbated by substantial demand for chips in solar panels, electrification of the automobile grid and increased production of energy-efficient consumer products relating to the ongoing transition to cleaner energy.

We do not believe labor market slack will restrain inflationary pressures as in the aftermath of the Great Recession. Despite the elevated unemployment rate and low level of employment relative to February 2020, a broad range of labor market indicators suggest tight labor market conditions and strong wage growth. Consistent with this argument, our contacts report labor supply/demand imbalances rippling through to price increases in a range of goods and services. Price increases driven by these forces tend to be persistent.

We are also seeing a trend toward displacement of more expensive items by greater demand for relatively cheaper ones, in turn raising those prices.

Inflation forecast

Our estimates put the “bleed-through” to future inflation at about 0.25 percentage points for each full percentage point that headline inflation currently exceeds trimmed mean inflation (as described in Koenig and Armen 2015). With trimmed mean inflation now running at 1.9 percent, and headline inflation 2.0 percentage points above that, the average historical bleed-through effect on its own implies a trimmed mean inflation forecast 0.5 percentage points higher than if headline inflation had not exceeded trimmed mean.

Of course, there are other factors that influence the inflation outlook, such as labor market slack, structural changes in the U.S. and global economies, and longer-run inflation expectations. Factoring in those influences, our forecast for four-quarter trimmed mean inflation in the second quarter of 2022 is 2.3 percent, as shown in Chart 1.

Based on our expectation of labor market conditions continuing to tighten, trimmed mean PCE inflation should increase to 2.4 percent by year-end 2022 and remain at that level through mid-2023. This also implies a headline PCE inflation rate of 2.4 percent by year-end 2022. Given the unusual nature of this business cycle, there is significant uncertainty around this forecast.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.